The Federal Reserve Bank of New York has made its decision. On June 18 of this year John Williams, currently serving as the President of the Federal Reserve Bank of San Francisco, will succeed William Dudley as New York Fed President. This decision will have many ramifications in the years to come, but several key points immediately stand out.

It means that Jerome Powell, the newly minted chair of the Fed, who is a lawyer not an economist, will have someone steeped in monetary policy by his side on the Federal Open Market Committee (FOMC) — the NY Fed President serves as the vice chair of the FOMC and is a permanent voter.

Williams has spent nearly his entire career within the Federal Reserve System. A student of John Taylor, Williams earned his PhD in 1994 at Stanford and immediately went to work at the Board of Governors. He stayed at the Board until 2002 when he moved to the San Francisco Fed. In 2011, Williams succeeded Janet Yellen as president there, having served as her research director.

The move to NY continues Williams’ ascension through the ranks of the Fed. While the NY Fed is one of a dozen regional banks, it is far and away the most important.

As president of the San Francisco Fed, Williams was already a voter on this year’s FOMC, but leading the NY Fed gives him a vote every year — the San Francisco Fed President votes only once every three years.

With the trading desk housed at the NY Fed, it is responsible for executing the monetary policy decisions of the FOMC. The NY Fed’s special placement makes its president one of the top three officials within the Federal Reserve System — along with the Vice Chair of the Board and, of course, the Fed Chair.

While Williams has never worked directly in financial markets, that fact should not be seen as a criticism. His career in monetary policy complements Chair Powell’s business background, which is important as long as the Vice Chair of the Board remains a vacant seat. Furthermore, and perhaps because he has not worked directly in markets, Williams understands that monetary policy should not overreact to short term data, particularly drops in financial markets. In his most recent speech, he said that there is no reason to expect a “knee-jerk reaction” from the Fed in response to recent events.

Williams’ specific monetary policy expertise is important in additional ways.

For nearly twenty years Williams has been discussing ways to measure the natural rate of interest (r*), which is a key input into many monetary policy rules, including the Taylor Rule. Though r* had been declining shortly before the Great Recession, it fell sharply during the financial crisis and has not recovered. This line of research has led Williams to the conclusion that the Fed is quite likely to be at the Zero Lower Bound again during future downturns. Because of this, Williams has become one of the most prominent advocates inside the Fed for finding an alternative target for conducting monetary policy. His preferred alternative to the Fed’s current inflation rate target is price-level targeting.

Targeting the inflation rate means that policy errors are ignored going forward. When the Fed undershoots its inflation rate, as it has almost without exception since adopting it in 2012, it doesn’t take corrective action to atone for those errors. Price level targeting, on the other hand, does correct for these mistakes by returning the price level to its overall trend. Level targeting offers a stability that inflation rate targeting cannot.

While Williams should be commended for his willingness to rethink the central bank’s inflation target from within the Fed, a price level target is not the answer.

Level targeting is certainly preferable to targeting the growth rate of a nominal variable, like the inflation rate, because level targeting obliges a central bank to make up for past policy errors. But price level targeting can sometimes contribute to the business cycle.

For example, when there is a negative real shock to the economy, like a decline in the output of oil, the price level will naturally tend to rise. Yet Fed tightening under these circumstances would only cause output to fall still further. (Williams, to his credit, admitted that adverse supply shocks would pose a challenge to a price level targeting central bank when I asked him about this at a recent Shadow Open Market Committee event).

A central bank that keeps the price level stable despite rapid productivity growth may, on the other hand, overheat the economy. Partly for these reasons, there is little reason to believe that price level targeting would have improved the Fed’s performance during the financial crisis and Great Recession, even if it might have improved upon the Fed’s actual policies at other times.

That said, John Williams is a monetary policy expert steeped in decades of research that shows evolution in his thinking — which, over the years, has earned him a reputation as a data-driven Fed official. As more economists call for a new target, we can hope he joins them in seeing the benefits of a nominal GDP level target over a price level target.

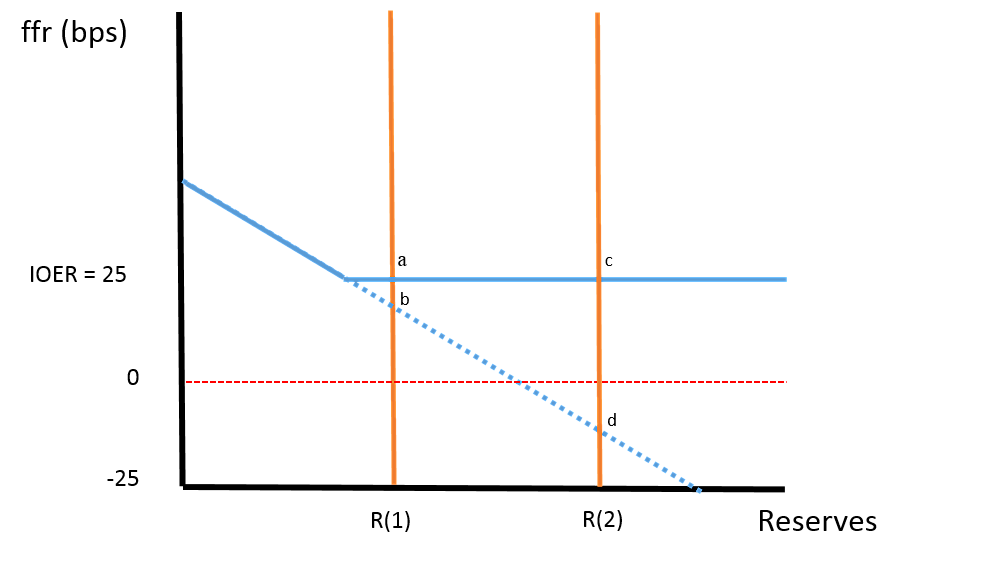

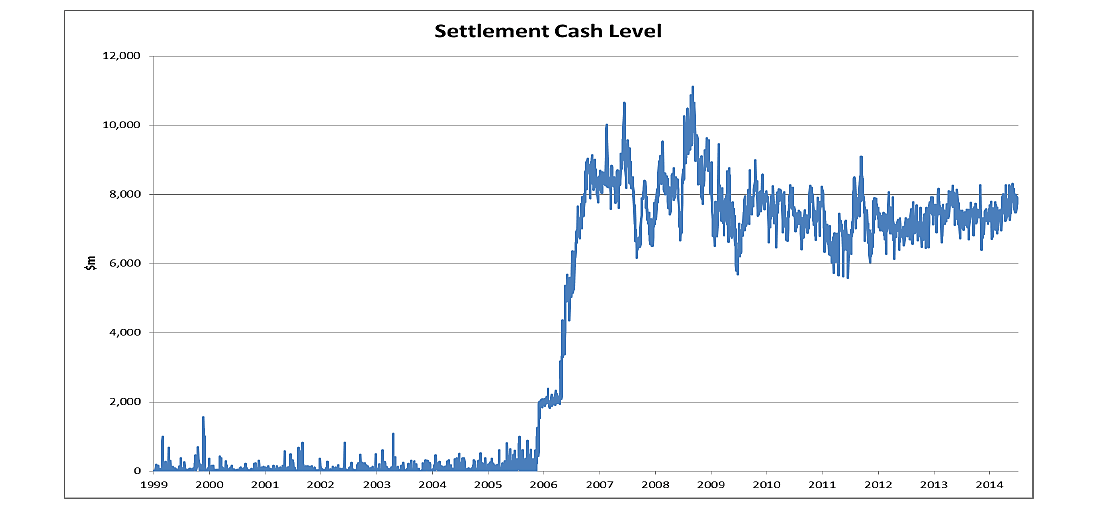

And critically important, at the NY Fed he will see the new operating framework up close and speak to those in charge of executing it on a daily basis. Janet Yellen called the new operating framework, particularly the interest rate paid on banks’ reserves, the key tool for monetary policy. Powell at his first press conference said there was essentially no decision made or forthcoming on whether the Fed will return to the corridor system used before the crisis.

Let us hope that Williams uses his expertise to critically examine the new operating framework during his leadership of the NY Fed — particularly the role this operating system may be playing in the Fed’s inability to reach its inflation target for years.

There are of course still many open questions regarding the future conduct of monetary policy, including how much the balance sheet will shrink, and whether the Fed will ever return to its pre-crisis operating framework based upon a market-determined federal funds rate. The New York Fed will play a lead role in deciding how such questions will be answered. Williams’ openness to new ideas and in engaging his colleagues, scholars, and the public on monetary policy issues is a good sign for those interested in the debate about how the Fed should conduct monetary policy.