Venezuela has the largest oil reserves in the world. Crude exports earn the country 95 per cent of its foreign exchange. That figure used to be lower, but relentless nationalization and the government’s insistence on controlling prices and exchange rates have made other exports unviable. Not that productive activity has reoriented inward: the IMF expects Venezuelan GDP to have dropped by 15 per cent in real terms each year in 2016 and 2017, and to do so again in 2018. This is a country in freefall.

Nor have price controls helped to sustain Venezuela’s currency. The bolivar, dubbed with cruel irony ‘strong’ because it replaced the old, weaker, bolivar at a 1:1,000 rate, has itself lost 99.9 per cent of its value against the U.S. dollar since March 2016. Shortages induced by controls, inept state management of nationalized companies, and capital flight have joined unlimited central bank money-printing to extinguish the purchasing power of Venezuelan money.

Rational policymakers would react to such a catastrophic state of affairs by enacting a dramatic U‑turn and committing to it. Previous episodes of hyperinflation in Latin America were most effectively quelled by dollarization and the subsequent liberalization of goods and capital markets. But the extreme form of socialism that is the ruling regime’s ideology makes the leadership unwilling to countenance change.

Instead, they regale the population with a mixture of repression and gimmicks. The launch of the Petro, a state-sponsored cryptocurrency announced late last year, belongs in the latter category.

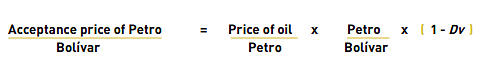

The Petro, which according to the Venezuelan government’s clumsy white paper is available for purchase as of yesterday, is supposed to be linked to the price of Venezuelan oil. From the white paper:

In words: the government vows to accept Petros in payment for taxes and government fees at a rate determined by the previous day’s price of Venezuelan oil. Dv is a discount rate.

Because the quantity of Petros in circulation is fixed and governance of the cryptocurrency is technically decentralized, the government argues that future manipulation of the Petro’s value is outside its control.

The reality, unsurprisingly, is more complicated. The Petro will run on the NEM blockchain, where transactions are validated differently from most cryptocurrencies. Bitcoin, for example, relies on a proof-of-work consensus algorithm, where computing power determines which transactions are validated. NEM, on the other hand, uses a proof-of-importance system where transactions are confirmed by the most important nodes, with importance defined as the number of coins owned and the frequency of transactions.

The Petro will ostensibly be accepted for payment of Venezuelan taxes and government fees, but little else. Moreover, the government has issued 100 million tokens but only 82.4 million are available for sale. Venezuelan authorities will presumably retain the remainder, so they will play an outsize role in the governance of the cryptocurrency under the POI system, despite the nominally decentralized blockchain.

Second, the supposed “backing” of the Petro by oil reserves is nothing of the kind. There is a link between the market price of Venezuelan oil and the Petro’s bolivar exchange rate, but ownership of the cryptocurrency gives its owner no claim on sovereign oil assets. By buying Petros, one is giving the country’s socialist government full faith and credit that it will fulfill its promise to redeem liabilities at the prevailing oil price. Given recent experience and Venezuela’s multiple oil commitments to sovereign creditors such as Russia and China, that would be a lot of faith indeed.

The Petro might offer Venezuelan citizens a distraction from their nation’s dire problems; it may even allow the Venezuelan dictatorship to evade some U.S. sanctions, despite President Trump’s decision to ban U.S. citizens from buying Petros. But as a cryptocurrency, it is doomed to fail.

A true crypto-asset might instead represent claims on real barrels of oil, which could be traded in a decentralized market through transactions recorded on the blockchain. It’s unclear how much of an improvement this would yield over futures trading on an exchange, although it’s probably cheaper for some market participants to transact on the blockchain. But the Petro offers no true claim on anything, so its utility is dubious given the likelihood that the Petro’s state sponsor will default on its promises.

If you needed another reason not to buy any currency, digital or otherwise, issued by the Venezuelan government, then this is it.