The all-day affair featured four panels of distinguished speakers — including Stanford economist John B. Taylor, former Federal Reserve Board governor Kevin Warsh, and Charles Calomiris of Columbia Business School. We were honored to have two esteemed keynotes — Loretta Mester, president and CEO of the Federal Reserve Bank of Cleveland, and Rep. Andy Barr, chairman of the House Subcommittee on Monetary Policy and Trade — who circumstances brought to the stage in quick succession. Topics ranged from the potential for a rules-based international monetary system and monetary policy normalization to the future of cash and China’s role in the global monetary system.

In his introductory remarks, Cato president Peter Goettler framed the day’s discussion by challenging attendees to think of a policy area more crucial to an individual’s freedom than monetary policy — remarking with incredulity upon the delegation of discretionary authority over such an important aspect of our society to a few unelected officials. He was also the first of many speakers to acknowledge the leadership of Cato’s vice president for monetary studies, Jim Dorn, who founded the monetary conference 35 years ago and has presided over it ever since — keeping debate on monetary policy alive in DC.

If you missed the live event, here’s a synopsis.

Keynote Address: Loretta J. Mester, President, Federal Reserve Bank of Cleveland

Mester began the conference with a speech about the effects of demographic changes on the economy and the implications of such changes for monetary policy. She commented that there is a strong tradition of studying demography as part of economics. As the world’s economy moves on from a post-financial crisis mindset to one of “normalization,” changes in demographics play a large role in figuring out just what is normal. An aging population — the primary demographic change at present — has deep structural effects on the economy and the data we use to gauge its relative health; for example, long-run unemployment, productivity, and the real natural rate of interest. With specific regard to monetary policy, an aging population effects the monetary transmission mechanism as wealth effects become stronger relative to income effects, savings rates change, and the equilibrium long-term interest rate falls.

Double-Header Keynote Address: Hon. Andy Barr, Chairman, House Subcommittee on Monetary Policy and Trade

While policy discussions are certainly a fruitful use of time, actual governance takes precedent in Washington. As such, Rep. Andy Barr’s luncheon address got bumped by a House vote on tax reform. Fortunately, his speech simply became a double-header keynote, following Mester’s. Barr’s remarks focused on legislative efforts to reform monetary policy, namely the Fed Oversight Reform and Modernization (FORM) Act and updates to it. In particular, he highlighted plans to improve communication from the Fed, create greater transparency as to how the Fed will make their decisions, and force the Fed to participate in an “Annual Adoption of Strategy” in which they would publicly choose reference rules to use in the formulation of monetary policy. Barr lamented the distortions in asset prices caused by the Fed’s balance sheet expansion and criticized its role in the “business of credit allocation.”

Panel 1: Toward a Rules-Based International Monetary System

The first panel of the day was moderated by the Wall Street Journal’s Josh Zumbrun. In addition to John Taylor, it featured George Tavlas of the Bank of Greece, Judy Shelton, author of Money Meltdown: Restoring Order to the Global Currency System, and Charles Plosser, former president of the Philadelphia Fed. Taylor’s presentation established that one way towards a rules-based international monetary system is each country acting in their own interest. He argued that simultaneous implementation of domestic rules-based monetary systems would contribute to global stability. Tavlas discussed three historical periods of rules-based international monetary systems. Of the possible types of international rules-based systems, he speculated that Milton Friedman would opt for a flexible exchange rate system with legislated domestic monetary rules (such as the Taylor rule) that aim at price stability, rather than a system based on international coordination of exchange rates or commodity standards. Shelton, who served as an economic adviser to President Trump’s transition team and was recently nominated to be US director of the European Bank for Reconstruction and Economic Development, lamented the lack of progress toward a rules-based framework for monetary policy that would align currencies and prevent competitive devaluations from distorting global trade balances. Nevertheless, she expressed hope for the future as she urged those in the room to keep trying along with her. The final panelist, Charles Plosser, echoed the views of other panelists, arguing that the difficulty of international rules-based systems is finding the right set of incentives for cooperation between sovereign nations, each of which is primarily concerned with domestic economic performance.

Panel 2: Normalizing Monetary Policy

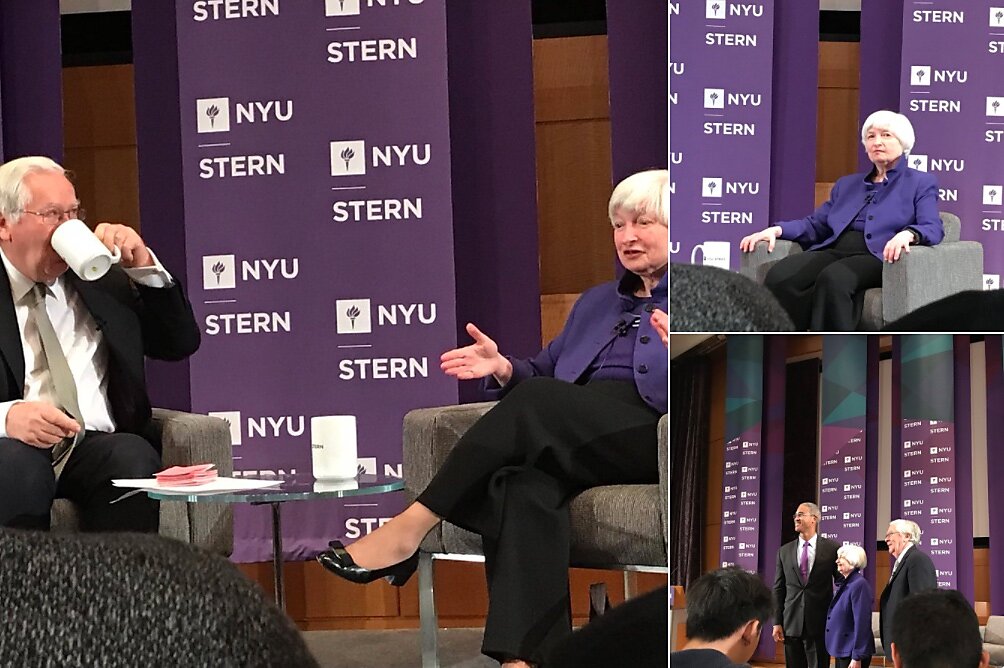

After nearly a decade of unconventional monetary policy by the world’s major central banks, the second panel was a must-see. Moderated by Mickey Levy of Berenberg Capital Markets, panelists included Martin Feldstein of Harvard University, Kevin Warsh of the Hoover Institution, Hu McCulloch of New York University, and Gunther Schnabl of Leipzig University. Feldstein kicked things off by decrying the Fed’s balance sheet reduction plan as “too little and too late,” commenting that he thought the Fed should have started the process in 2013. Per Feldstein, excessively easy money has inflated asset prices and created an environment for financial instability. Kevin Warsh, drawing from his experience at the Fed during the 2008 financial crisis, spoke about the “false precision” of the Fed’s 2% core PCE inflation target that monetary policy formulation is based on today. He criticized the “caricatured and confused commentary of hawks and doves,” while commenting that “we know far less than we purport about the price formation process” and other key economic concepts. We should therefore reevaluate our standard deliberations about monetary policy. Hu McCulloch presented a six-point plan to normalize monetary policy, the first part of which was to stop paying interest on excess reserves (a topic McCulloch has written about for Alt‑M). Schnabl spoke of the “low interest rate and high debt trap” created by the past decade of unconventional monetary policy, which has resulted in low growth and a variety of redistribution effects: from the private sector to the public sector via financial repression; from the enterprise sector to the financial sector via rising asset prices and sluggish consumption; from the poor to the rich via asset price inflation and financial repression; from young to old via nominal wage repression and reduced future pension claims; and from small and medium enterprise to large enterprise via capital markets–based financing instead of bank-based financing.

Panel 3: The Future of Currency

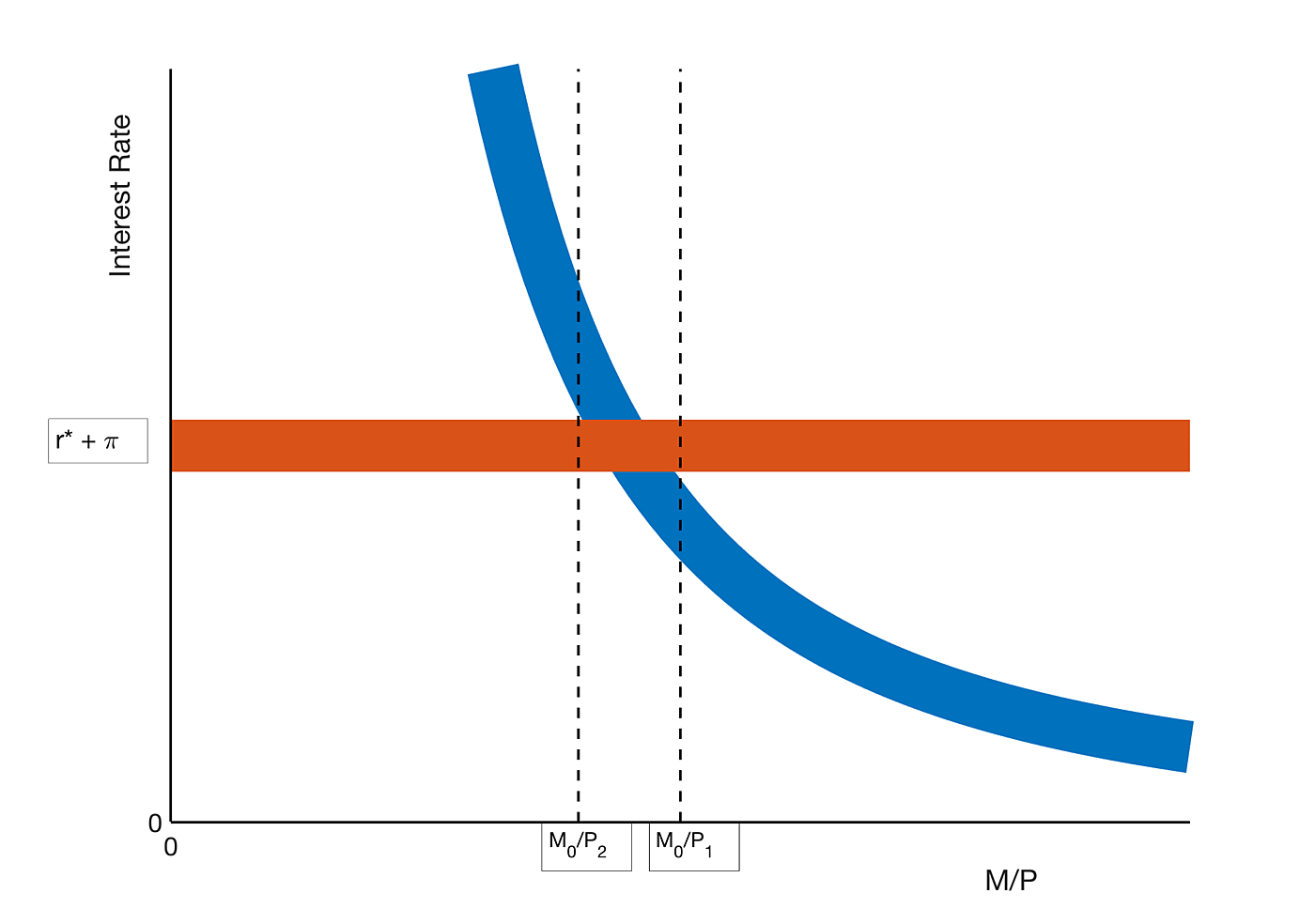

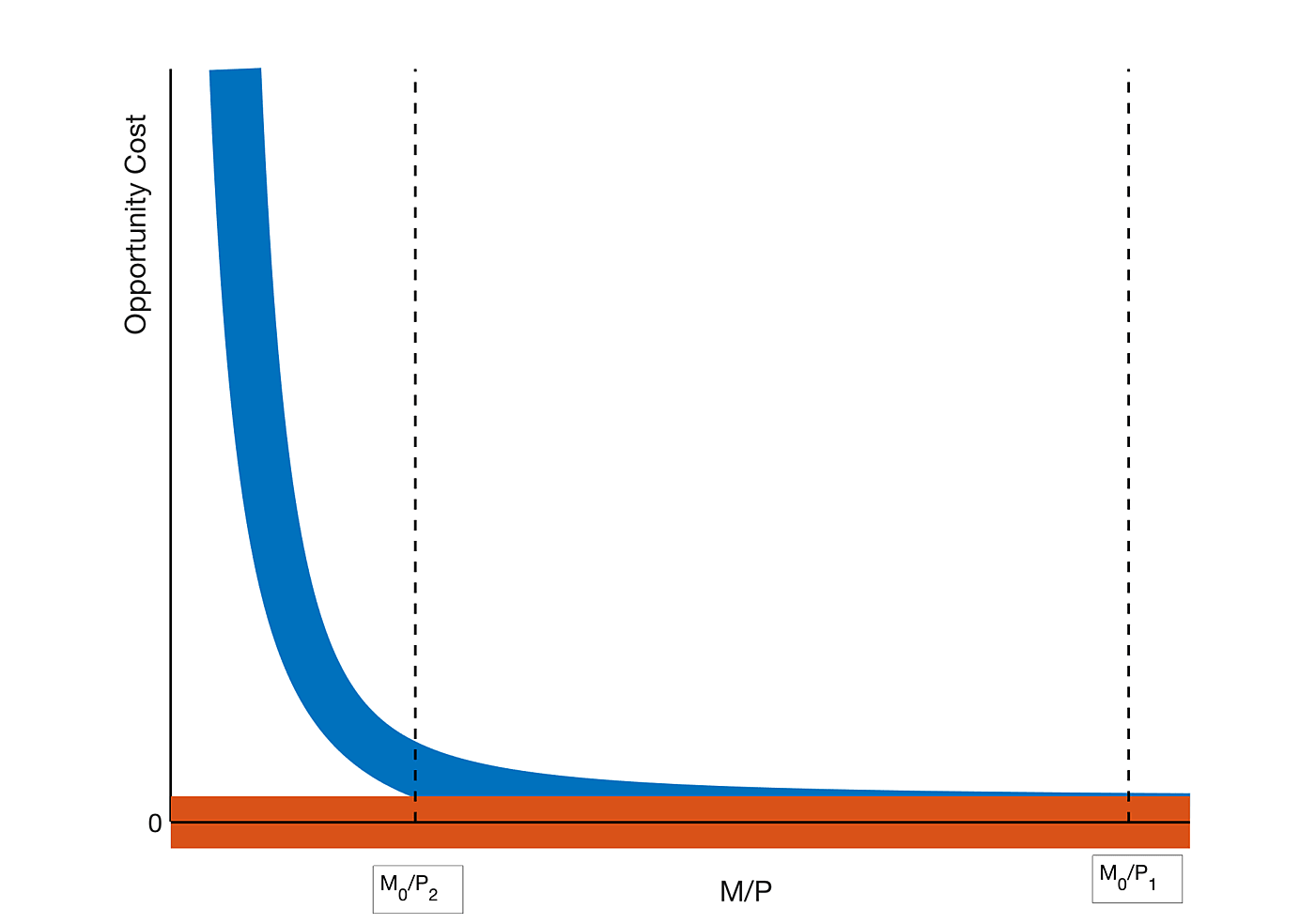

The third panel was moderated by CMFA’s director, George Selgin, who focused the discussion around whether the “War on Cash” would achieve its stated objectives — increasing tax revenue and decreasing illicit activities — and at what cost. Lawrence H. White of George Mason University, Norbert Michel of the Heritage Foundation, and William Lastrapes of the University of Georgia comprised the panel. White spoke first about the aims of the “War on Cash” that are not openly discussed, such as raising the cost of storing cash so as to enable negative interest rates. He remarked playfully that concerns that banning cash would cut into consumer surplus are futile because those advocating the ban do so from the perspective of the tax collector not the consumer. Michel began his speech with a reminder that although there are more payment options available to consumers than ever before, approximately 40% of transactions by volume are still done in cash. His speech featured several interesting examples of the interest groups and unintended consequences at the heart of this issue. Finally, Lastrapes presented his general-equilibrium model to evaluate the costs and benefits of eliminating or suppressing currency in an economy. He found that eliminating cash would act as an increase in the effective tax rate in his modeled economy.

Panel 4: The Future of China in the Global Monetary System

Jim Dorn moderated the final panel of the day. Eswar Prasad of Cornell University spoke first and gave a succinct rundown of China’s contributions to the history of money, highlighting the use of paper money in the 7th century Tang Dynasty, and the coercive establishment of legal tender under the rule of Kublai Khan. Prasad said that although the renminbi was recently included in the International Monetary Fund’s SDR basket of currencies — an honor usually restricted to reserve currencies — only the market can really elevate it to such a status. Currently, only 2% of global transactions are settled in renminbi. Charles Calomiris talked about the geopolitical struggle between China and the United States. He applauded the changing perspective on China as a currency manipulator, arguing that productivity growth was the source of China’s economic boom — not an unfairly engineered exchange rate. He also observed that although the renminbi may need depreciation going forward, such an event would have primarily domestic repercussions rather than international ones. David Dollar of the Brookings Institution agreed with Calomiris’s assessment of depreciation risk in China. Drawing on his experience of living and working in China for nearly a decade, Dollar argued that institutional weakness is still a long-term impediment to the renminbi as a reserve currency.

Video:

Check out full video coverage of each panel, along with more information about the conference and speakers, here. Papers presented at the conference will be published in the Spring/Summer 2018 edition of the Cato Journal.