Fed economists defending interest on reserves have recently called on an unexpected quarter by reviving interest in Milton Friedman’s 1969 essay, “The Optimum Quantity of Money.”[1] As Ben Bernanke and Don Kohn put it, “Before the Fed paid interest on reserves, banks engaged in wasteful and inefficient efforts to avoid holding non-interest-bearing reserves instead of interest-bearing assets, such as loans.”[2] Laura Lipscomb, Antoine Martin and Heather Wiggens make explicit reference to Friedman’s paper in their recent post defending interest on reserves on the New York Fed’s Liberty Street blog.[3]

This discussion takes me back to my graduate student days at Chicago, when Friedman’s essay had just come out, and one witty student had nicknamed it the “Optiquan Model.” “Optiquan” came out shortly after Friedman’s important 1967 AEA presidential address, “The Role of Monetary Policy,”[4] in which he refuted the notion, popularized by the Keynesians Paul Samuelson and Robert Solow, that positive inflation was beneficial to the extent that it reduced unemployment along a stationary Phillips Curve. Friedman convincingly argued instead that the Phillips Curve shifts up and down with expected inflation, so that the same “natural rate of unemployment” would arise at any sustained inflation rate.

But that paper left open the more academic question, what inflation rate really is theoretically optimal under a pure fiat money regime in which the central bank is not constrained by any parity to gold or silver? (Recall that 1968-71 was precisely when the US government severed the dollar’s external link to gold.)

In Optiquan, Friedman argued that, since fiat money is socially costless to produce, and since optimal inventory management induces money holders to incur real costs to keep down the foregone interest on their money balances, the first best optimum is to have a real return on money high enough to drive the opportunity cost of holding money balances down to zero. One way this could be achieved would be by paying interest on all forms of money -- both currency and demand deposits -- at the same rate that could be earned on short-term, riskless non-monetary assets. A second way would be to engineer a negative inflation rate just sufficient to drive the nominal interest rate on non-monetary assets to zero. In either case, agents would in theory hold such large money balances that at the margin they would be savings instruments and provide zero purely monetary services.

One big practical problem with the Optiquan Rule that bothered me at the time, and still does today, is that it would leave the price level indeterminate: Friedman’s Quantity Theory of Money predicts that the price level will gravitate to the level that equates the real value of the nominal money stock to the economy’s real demand for it. But this condition requires 1) that there be a predictable real demand for an appropriately defined monetary aggregate, and 2) that the central bank be able to control its quantity.

Friedman recognized that real money demand responds negatively to its opportunity cost which, assuming money pays zero interest (as was the case for currency and all checking accounts outside New England before the 1980 DIDMC Act), would be the nominal interest rate on safe non-monetary alternatives. He also recognized that nominal rates fluctuate owing to natural changes in real interest rates and also to changes in expected inflation. However, inventory models of money demand such as the famous Allais-Baumol-Tobin model[5] predict that the money demand schedule is inelastic and therefore relatively steep at moderate nominal interest rates (when i is on the vertical axis and M/P is on the horizontal axis). Real interest rates are normally positive at all maturities, and must be so at most maturities to prevent the price of land from being infinite. While inflationary finance is always fiscally tempting, deflation is fiscally unattractive, and therefore not an important long-run concern under fiat money, even by accident under a zero-inflation target. Therefore, the demand for zero-interest money is reasonably predictable as long as nominal rates are positive and inflationary expectations don’t drive them excessively high. That is, it’s reasonably predictable as long as there’s an opportunity cost to holding money balances.

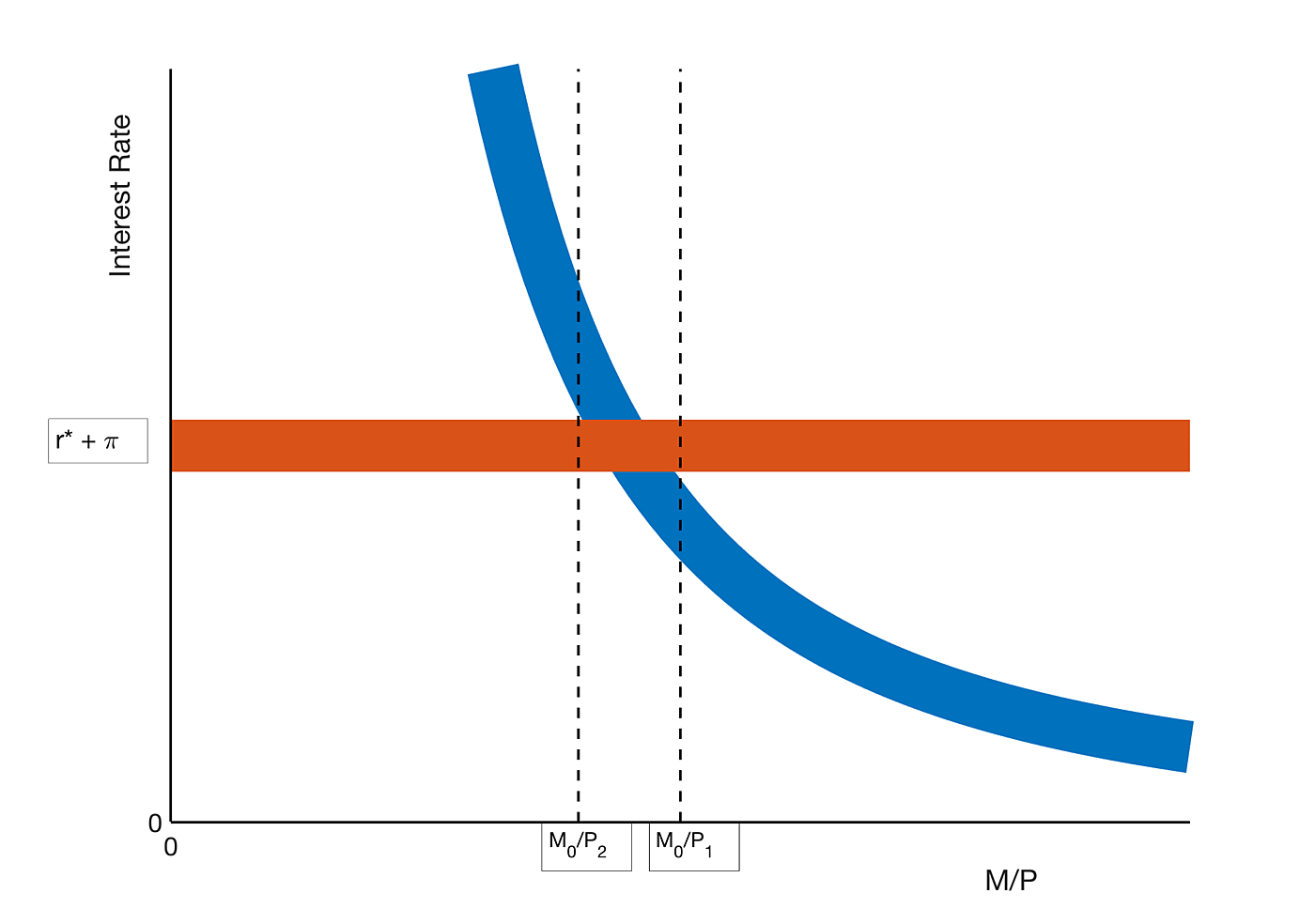

Figure 1 above illustrates the classical Quantity Theory of Money when money pays zero interest, with moderate uncertainty as to the relevant parameters. The blue line represents the inventory demand for real money balances M/P, with M/P on the horizontal axis and the nominal interest rate on the vertical axis. Because the money demand function is only known approximately, it is shown as a thick line. In equilibrium, the nominal interest rate will average out to the equilibrium real interest rate r*, plus the inflation π that results from the central bank’s money growth policy. Since neither r* nor π is known with perfect certainty, their sum is depicted as a thick horizontal orange line. The intersection of the two curves determines real money balances and therefore the price level, but only imperfectly: Given a nominal money stock M0, the price level could be as high as P2 or as low as P1. So the price level is not determined precisely, but at least it’s reasonably bounded.

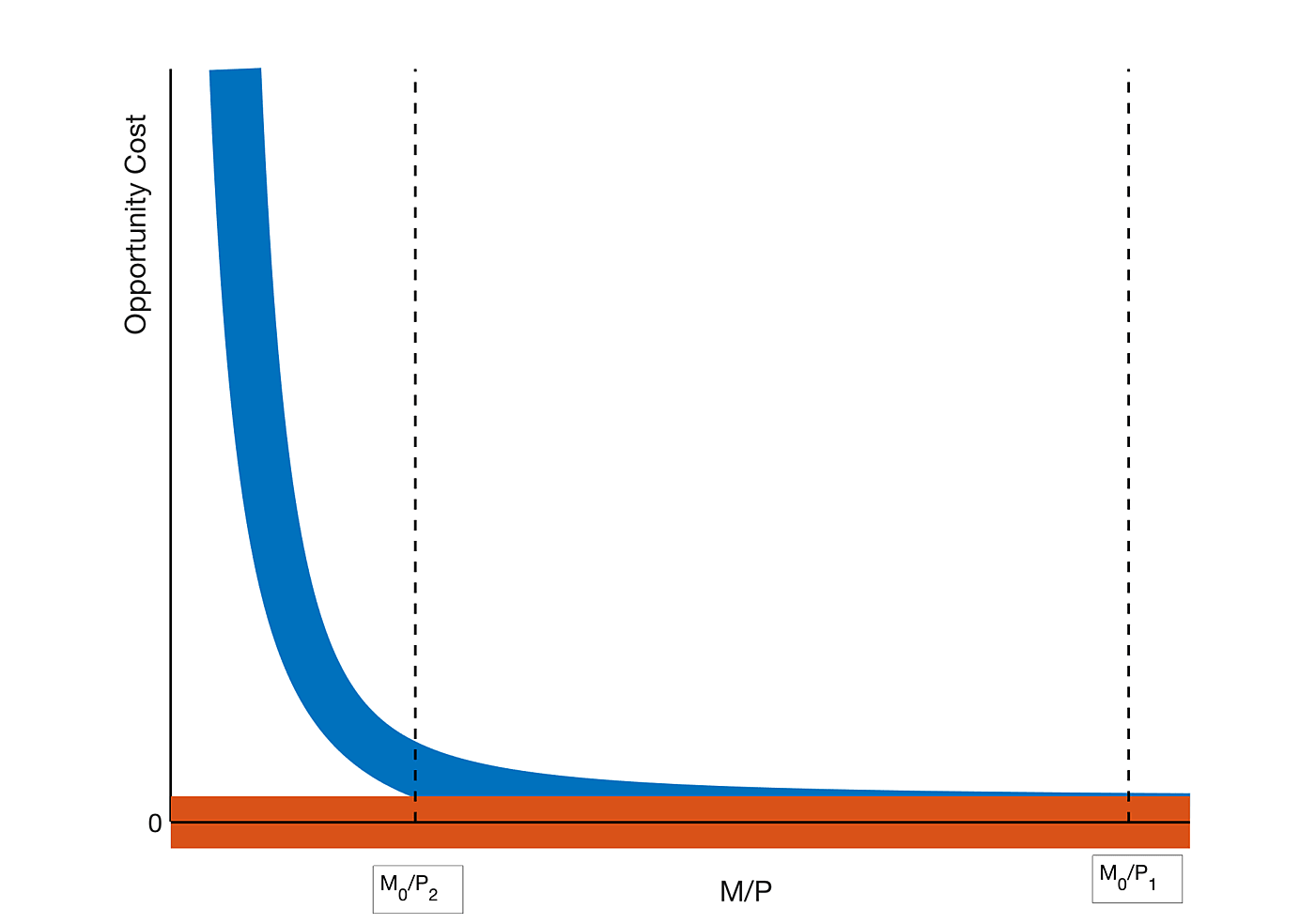

However, inventory models predict that if the opportunity cost of money actually falls to zero, real money demand will be literally unbounded. Of course if the resources of the economy are finite and money is not entirely costless -- due to the risk of theft, loss, bank failures or unanticipated inflation -- money demand will never actually reach infinity, but the point remains that the money demand schedule becomes virtually indistinguishable from the M/P axis over a wide range of values. Such a horizontal demand schedule for money implies an equally wide range of price levels capable of equating the supply and demand for money. In that case, the Quantity Theory would no longer predict either the price level or inflation.

Figure 2 above illustrates the inventory demand for money as a function of its net opportunity cost -- net of any interest paid on money or real return from deflation -- again as a thick blue line. As the opportunity cost approaches zero, this schedule coincides with the horizontal axis, for all practical purposes. The thick horizontal orange line depicts the approximately zero opportunity cost under the Friedman Optiquan deflation rule. Because the neutral real rate r* is uncertain and because the central bank cannot precisely control any deflation it engineers, this line again incorporates some uncertainty. Given a nominal money stock M0, the price level is now indeterminate at any level between P2 and P1, and could be even lower than P1.

In order for the value of a fiat money to be determinate, therefore, some appropriate monetary aggregate must have a clear and positive opportunity cost relative to non-monetary assets. With all due respect to Milton Friedman, his “Optiquan” rule is therefore just an interesting academic exercise that is not implementable in practice. Its reasoning does argue against high-inflation policies, and does make a case for reducing the opportunity cost of at least the deposit component of M1 through interest on checking accounts. However, in order for the Quantity Theory to determine the price level, there must be a substantial aggregate controlled by the central bank that pays zero or at least greatly reduced interest. It certainly does not make a case for interest on excess reserves.

If the central bank believes it has better knowledge of the “natural rate of interest” (the real interest rate at which the non-monetary supply and demand for credit are equated [6]) than it does of the demand for real money balances, or if it has given up on trying to measure the narrow money supply (as when Sweep Accounts are not included in official M1), it may prefer to use a Taylor-type rule to manipulate the price level through short-term nominal interest rates. However, this only works to the extent that low or high real interest rates create an (albeit unobserved) excess supply or demand for money -- but this is again indeterminate if no form of money has a clear and positive opportunity cost.

So long as currency pays zero interest, it has a clear opportunity cost (at least since early 2016 as nominal rates return to normal positive levels), and the price level must eventually equate the real value of its nominal quantity to its real demand. However, when banks are awash with zero-opportunity-cost excess reserves as at present, the Fed has no control over how much base drains from bank reserves into currency in circulation. Lately this currency drain has been steady, though lethargic, so that currency in circulation has almost doubled since 2007, while the nominal economy has only grown about 33%. This huge growth in currency should be a great cause for concern. However, more readily controllable bank excess reserves have a much more immediate impact on banks’ ability and willingness to lend, but only provided they likewise have a clear and positive opportunity cost.

While it is true that banks’ aggressive efforts to minimize zero-interest excess reserves are “wasteful” in the sense implied by Friedman’s “Optiquan” model, there is a flip side to this observation: If banks are being paid not to make loans they will be in no hurry to make (or cut back on) loans and thus to permit borrowers to engage in (or cut back on) the spending that stabilizes the price level on target as the Fed expands (or contracts) the base and therefore reserves. As I argued in my previous post on Alt-M, “The Rudderless Fed,” [7] the Fed has rendered itself essentially rudderless in its conduct of monetary policy as a result of its misguided policy of paying interest on excess reserves.

_____________

h/t George Selgin for the title of this post.

[1] Published in his collection, The Optimum Quantity of Money and Other Essays, Chicago 1969.

[2] Ben S. Bernanke and Donald Kohn, “The Fed’s Interest Payments to Banks,” Brookings blog, Feb. 16, 2016.

[3] Laura Lipscomb, Antoine Martin and Heather Wiggens, “Why Pay Interest on Required Reserve Balances?,” Liberty Street Economics blog, Federal Reserve Bank of New York, Sept. 25, 2017; see also Lipscomb et. al., “Why Pay Interest on Excess Reserve Balances?,” Liberty Street Economics blog, Sept. 27, 2017.

[4] Published May, 1968 in the American Economic Review 58: 1-17.

[5] Willliam Baumol and James Tobin (1989). “The Optimal Cash Balance Proposition: Maurice Allais’s Priority,” Journal of Economic Literature ,1160-2.

[6] See J. Huston McCulloch, “The Theory of Money and Credit,” class notes dated Sept. 2012.

[7] J. Huston McCulloch, “The Rudderless Fed,” Alt-M, Aug. 9, 2017.

More from Alt-M on Interest on Reserves:

Disclaimer

This post was originally published at Alt‑M.org. The views and opinions expressed here are those of the author(s) and do not necessarily reflect the official policy or position of the Cato Institute. Any views or opinions are not intended to malign, defame, or insult any group, club, organization, company, or individual.

All content provided on this blog is for informational purposes only. The Cato Institute makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. Cato Institute, as a publisher of this article, shall not be liable for any misrepresentations, errors or omissions in this content nor for the unavailability of this information. By reading this article and/or using the content, you agree that Cato Institute shall not be liable for any losses, injuries, or damages from the display or use of this content.