In the book I advertised in my last post, I argue that the Fed’s decision to switch to a “floor”-type operating system “deepened and prolonged the Great Recession.” Yet the Fed is only one of several central banks that have adopted floor systems for monetary control during the last dozen years. That fact raises some obvious questions: Did those other floor systems have similarly dire consequences? If not, why not?

In this post I answer these questions for one of those other cases: New Zealand’s. By doing so I also hope to shed some further light upon the U.S. floor system experience.

New Zealand’s Corridor System

From 1999 until July 2006, the Reserve Bank of New Zealand (RBNZ), New Zealand’s Central Bank, relied upon a symmetric corridor system in which the benchmark policy rate, known as the Official Cash Rate, or OCR for short, was kept 25 basis points above the rate paid on banks’ reserve (“settlement”) balances, and 25 basis points below the rate that the RBNZ charged for overnight loans.

Not long before it established its corridor system, the RBNZ implemented a Real Time Gross Settlement (RTGS) system for wholesale payments, in which interbank payments are settled bilaterally and immediately, thereby becoming final and irrevocable as transactions are processed, rather than at the end of the business day only, following the determination and settlement of net balances. Because banks’ overnight settlement balances bore an opportunity cost under New Zealand’s corridor regime, as they do in any corridor-type system, banks held very few such balances — an aggregate value of just NZ $20 million was typical — relying instead on intraday credits from the RBNZ to meet their ongoing settlement needs.

The advantage of RTGS is that it allows payments to be made “final” as soon as they’re processed, so that payees don’t have to wait until the end of the day to find out whether their money came through. In a net-settlement system, in contrast, a transfer made earlier in the day remains tentative until banks pay their net settlement dues. Should a bank fail to settle, its intraday payments have to be “unwound,” reversing any transfers made with money the bank wasn’t good for.

“Cashing Up” the Banking System

The disadvantage of RTGS, or rather of any RTGS system that relies on intraday central bank credits by permitting overdrafts on participants’ settlement accounts, is that it exposes the central bank itself to credit risk: should a bank fail while in overdraft, the central bank would incur a loss. To avoid that risk the Reserve Bank, instead of supplying unsecured intraday credit by allowing banks to overdraw their accounts, chose to supply it in the form of free but nonetheless fully-secured intraday repurchase agreements. In principle at least, if a bank with an outstanding repo failed, the RBNZ could sell the purchased security to recover any cash it had advanced.

In practice, however, the RBNZ’s decision to accept municipal and corporate paper as repo collateral meant that it still faced some risk of loss; moreover, it soon discovered that the volume of its outstanding repos with particular banks was such as made that risk uncomfortably large. Recognizing the danger, and desiring as well to reduce the frequency of delayed or failed settlements, the RBNZ determined to encourage banks to rely on overnight settlement balances, instead of intraday repos, to meet their settlement needs.

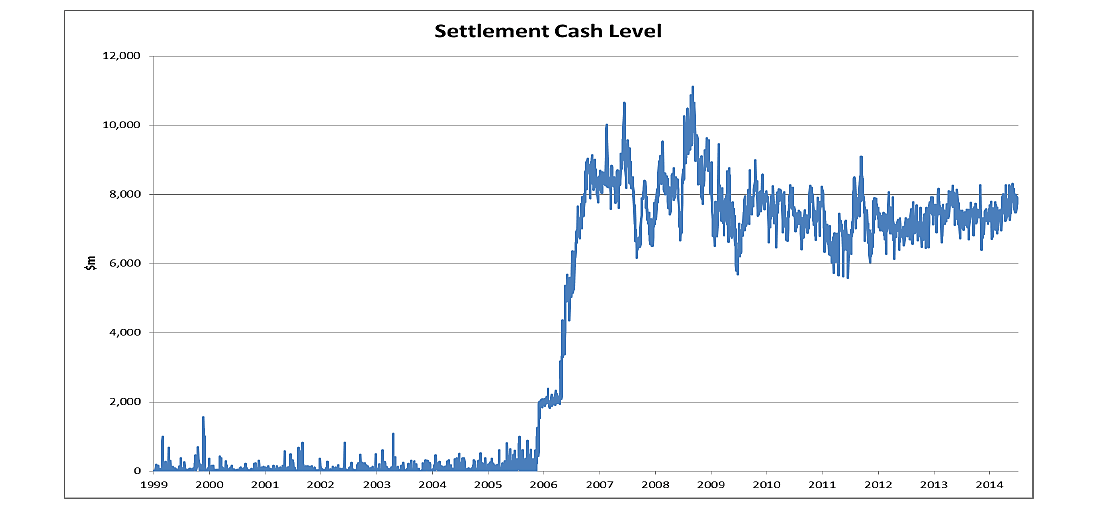

With that aim in mind, in July 2006 the RBNZ began its program of “cashing up” the New Zealand banking system. Because the Reserve Bank’s intent was to enhance banks’ liquidity without altering its monetary policy stance, this program involved several components. The first consisted of the RBNZ’s creation, between July and October, of an additional NZ $7 billion of settlement balances, while the second consisted of a concurrent 25 basis-point increase, made in five five-point increments, in the interest rate paid on those balances, aimed at encouraging banks to hold them. Finally, these other steps having been taken, the RBNZ stopped providing intraday repos. As the figure below shows, although total settlement balances hovered around NZ $8 billion during the crisis, and occasionally were raised beyond NZ $10 billion, they eventually settled down near the RBNZ’s originally-chosen target of NZ $7 billion, where they’ve remained ever since.

New Zealand Settlement Balances, 1999–2014

A Floor System, but Not for Long

Since the Reserve Bank did not find it necessary to alter its policy rate until March 2007, when it raised the OCR from 7.25 to 7.5 percent, it seems to have achieved its goal of cashing-up the banks without altering its policy stance. However, the steps it took to cash-up the New Zealand banking system did involve a fundamental change in the central bank’s operating system: from a symmetrical corridor system to what most observers have regarded as a “floor” system, in which the interest rate on settlement balances was identical to the Reserve Bank’s policy rate, and banks were well-supplied, if not satiated with, liquidity.

However, at least two crucial facts distinguish New Zealand’s floor system from floor systems employed by the Fed, the ECB, and the Bank of England. One is that, while it involved a quantity of settlement balances that was adequate to meet banks’ settlement needs, the RBNZ never took advantage of it to engage in Quantitative Easing. Having supplied banks with a level of settlement balances it judged adequate for their ordinary liquidity needs, it never attempted to enlarge those balances substantially and for an extended period by means of further, large-scale asset purchases. Instead, as the world crisis deepened during the last half of 2008 and first half of 2009, it mainly responded by cutting the OCR, and hence the interest rate it paid on banks’ settlement balances, aggressively, from 8.25 percent in June 2008 to just 2.5 percent at the end of April 2009 — with the biggest cuts coming between September 2008 and January 2009. It was, it bears noting, while these cuts were in progress that the Fed introduced its own floor system, raising the interest rate it paid on banks’ excess reserves from zero to a final level of 25 basis points, where it was to stay until December 2015.

Second, while the Fed, the ECB, and the Bank of England retained full-fledged floor systems throughout the crisis and since, the Reserve Bank of New Zealand had already taken important steps away from such a system in August 2007, or well before the crisis reached its most critical stage with Lehman Brothers’ failure.

The RBNZ’s decision to modify its floor system was informed by a recommendation made in the same March 2006 consultation document that caused it to install that system in the first place, to wit: that “Incentives should be in place to foster an environment where the commercial banks get liquidity from each other and deal with the Reserve Bank only when liquidity is not otherwise available in the market.”

The RBNZ had hoped that its “cashed up” floor system would satisfy this requirement. “The increased base level of settlement account balances in the system,” the consultation document claimed,

should better foster the development of an inter-bank cash market. In the presence of significant market liquidity, market participants should transact cash with each other at the end of day in preference to using the Bank’s standing facilities. Development of the inter-bank market is desirable to improve the distribution of cash between ESAS [Exchange Settlement Account System] participants, leaving the Bank to concentrate on the liquidity to the system as a whole. This market, if developed, would also provide another source of information for the Bank on any inefficiencies in the market.”

However, once the floor system was up and running it became clear that, instead of encouraging banks to lend and borrow settlement balances in the private, overnight market, it was encouraging at least some banks to hoard any surplus balances that came their way. Like floor systems elsewhere, New Zealand’s involved a deposit rate equal to the central bank’s overnight policy rate, which tended to be higher than the corresponding, secured interbank overnight repo rate. New Zealand’s floor system therefore allowed banks to accumulate reserves without incurring any substantial opportunity cost by doing so.

New Zealand Adopts a Tiering System

To correct the problem of reserve hoarding, the Reserve Bank needed to modify the terms of its interest payments on banks’ settlement balances so as to keep banks from holding settlement balances beyond what they actually needed for settlement purposes. The solution it settled on was a “tiering system,” with settlement balances up to a bank’s assigned tier limit earning the OCR, and balances beyond that level earning 100 basis points less. The tier levels were themselves based on banks’ apparent settlement needs, but collectively still amounting to the aggregate target of NZ $7 billion.

Although it was originally supposed to go into effect in September 2007, the tiering system was put in place a month ahead of schedule to deal with stresses from the emerging global crisis — which “threatened to materially tighten monetary and credit conditions in New Zealand, jeopardising banks’ confidence in continuing access to credit.” In other words, the RBNZ found it more desirable than ever to move away from an orthodox floor system as credit markets, and markets for overnight bank funding especially, tightened, so as to keep its own payments arrangements from contributing unnecessarily to that tightening.

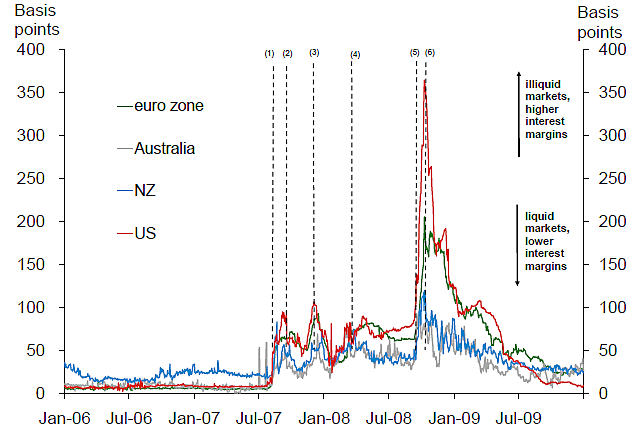

As Ian Nield (2008, p. 14) explains, the establishment of the tiering system, together with the Reserve Bank’s decision to accept domestic bank bills in its overnight standing facility, “had an immediate effect which, broadly speaking, re-normalised the domestic bank bill market,” especially by reducing short-term money market spreads. As the next figure shows, from Enzo Cassino and Aidan Yao (2011, p. 40), it managed to limit such spreads far more successfully then either the Fed or the ECB, and to do so without adding large quantities of fresh reserves to its banking system, though the difference also reflected the fact that New Zealand’s banks were not so encumbered with toxic assets as some U.S. and European banks.

Three-Month LIBOR-OIS Spread

Some Lessons

New Zealand’s floor experience makes for an interesting comparison with that of the United States. Of parallels, perhaps the most interesting is that in both cases a mere 25 basis point increase in the rate paid on banks’ central-bank balances proved sufficient to sustain a switch from a corridor or corridor-like operating system to a floor system. That such a small absolute change was all it took is particularly impressive in New Zealand’s case, for whereas in the U.S. between 2009 and 2015 25 basis points was a relatively significant amount in comparison to then-prevailing short-term rates, in New Zealand in July 2007 the OCR rate was 7.25 basis points — making the 25 point increase in the rate paid on bank deposits proportionately much smaller. The New Zealand case therefore seems to supply strong evidence in support of Donald Dutkowsky and David VanHoose’s claim that even very small changes in reserve-compensation schemes can suffice to trigger major central bank operating-system regime changes.

But it’s the differences between the two experiences that are, after all, most striking. Chief among these is the fact that New Zealand installed its floor system well before the financial crisis began, and did it for reasons unrelated to monetary control. It’s sole goal was that of boosting banks liquidity to limit its own exposure to intraday credit risk — not to combat a crisis. For this purpose, raising the reward paid on bank settlement balances made perfect sense, for the point was to encourage banks to hold more such balances, and therefore become more liquid, at a time when there was no credit crunch. The switch was undertaken, moreover, in a neutral manner, so as to leave the Reserve Bank’s monetary policy stance unchanged.

The U.S. in October 2008 was, in contrast, in the throes of a credit crisis, when, in retrospect at least, the last thing it needed was a further tightening of credit. Yet the Fed’s decision to start paying interest on bank reserves that month was motivated by its desire, not to enhance banks’ liquidity, but to get them to hoard reserves that the Fed was creating through its emergency lending programs, so that those reserves would not translate into a loosening of the Fed’s policy stance. Interest on excess reserves was therefore resorted to as an instrument of monetary control, and specifically as a means of monetary tightening aimed at offsetting the loosening that would otherwise follow fresh reserve injections. Later, the same new instrument would see to it that still larger reserve additions — the by-product of the Fed’s Large-Scale Asset Purchases — would also be hoarded as so many trillions of dollars of excess bank reserves.

In New Zealand, in contrast, even before the crisis struck authorities became anxious to prevent banks from accumulating more reserves than were deemed necessary for their settlement needs. In consequence a tiering system was planned, which would prevent such hoarding by imposing an interest penalty on above-tier settlement balances. The outbreak of the crisis merely caused the RBNZ to hasten its implementation of the new plan.

Thanks to New Zealand’s switch to a tiered system, its overnight interbank lending market remained active throughout the crisis. New Zealand’s banks therefore continued to rely upon one another as lenders of first resort, turning to the RBNZ for overnight funds only as a last resort — an outcome fully in accord with orthodox doctrine. In the U.S., in contrast, the establishment of a floor system caused the once active federal funds market to altogether cease to function as a conduit for interbank loans.

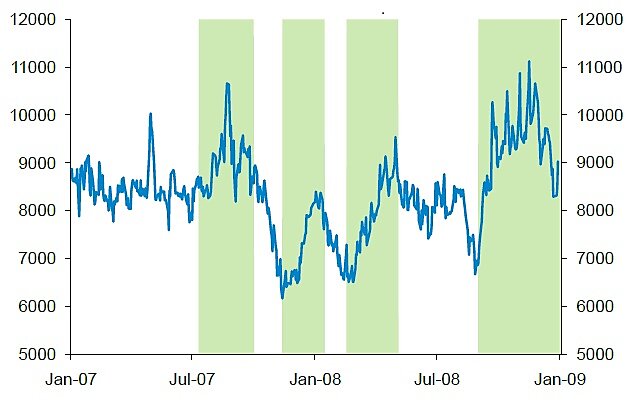

Finally, although the RNZB occasionally found it desirable to inject some extra cash into the New Zealand banking system during the crisis, as it did in August 2007 and again in fall of 2009, those cash additions were — as could be seen in our first figure and as the next figure (Cassino and Yao, 2011, p. 42) makes especially clear — both relatively modest and temporary. Even recently, New Zealand’s settlement balances amount to little more than 5 percent of that nation’s GDP, whereas banks’ reserve balances held at the Fed amount to about 13.5 percent of U.S. GDP.

RBNZ Settlement Balances, 2007–2009, Millions of NZ$

Those modest cash additions proved capable, together with several other Reserve Bank programs, of “maintaining the functioning of the New Zealand money market and the flow of domestic credit during the global financial crisis,” as a later RBNZ study concluded. That they did so was due in part to the fact that, by discouraging banks from hoarding reserves in excess of their fixed tier limits, New Zealand’s tiering system preserved the banking system money multiplier, instead of causing it to collapse, as happened in the U.S. The RBNZ’s success in keeping credit flowing may have in turn contributed, if only to a modest extent, to New Zealand’s Great Recession being both one of the first to end and one of the shallowest.

Conclusion

Although the Fed was hardly alone in establishing a floor system of monetary control — and not all floor systems had consequences like those I document in my book about the U.S. case — the relative success of these other floor systems does not necessarily serve as a vindication of the general concept. The New Zealand floor system, in particular, only functioned in a relatively orthodox manner for a period of less than a year, predating the financial crisis. As that crisis dawned, the Bank of New Zealand retreated from an orthodox floor system, by placing definite limits on the balances on which banks would incur no substantial interest opportunity cost. Having thus curtailed New Zealand banks’ appetite for settlement balances, the RBNZ could expect its additions to New Zealand’s monetary base to influence economic activity by way of the same orthodox transmission mechanism, leading to the same marginal stimulus affect, as might have been the case if settlement balances bore no interest at all. Federal Reserve authorities cannot, for all of these these reasons, point to New Zealand as supplying a precedent favoring their own decision to adopt and retain a floor system of monetary control.