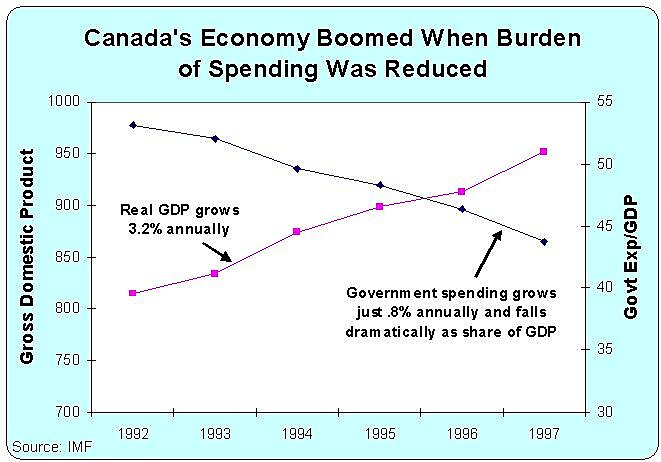

Triggered by an appearance on Canadian TV, I asked yesterday why we should believe anti-sequester Keynesians. They want us to think that a very modest reduction in the growth of government spending will hurt the economy, yet Canada enjoyed rapid growth in the mid-1990s during a period of substantial budget restraint. I make a similar point in this debate with Robert Reich, noting that the burden of government spending was reduced as a share of economic output during the relatively prosperous Reagan years and Clinton years:

Being a magnanimous person, I even told Robert he should take credit for the Clinton years since he was labor secretary. Amazingly, he didn’t take me up on my offer.

These two charts show the stark contrast between the fiscal policy of Reagan and Clinton compared to Bush.

There’s lots of additional information comparing the fiscal performance of various presidents here, here, and here. For more information on Reagan and Clinton, this video has the details.

That brings us back to the original issue. The Keynesians fear that a modest reduction in the growth of government (under the sequester, the federal government will grow $2.4 trillion over the next 10 years rather than $2.5 trillion) will somehow hurt the economy. But government spending grew much slower under Reagan and Clinton than it has during the Bush-Obama years, yet I don’t think anybody would claim the economy in recent years has been more robust than it was in the 1980s and 1990s. And if somebody does make that claim, just show them this remarkable chart (or if they want a laugh, this Michael Ramirez cartoon makes the same point). So perhaps the only logical conclusion to reach is that government is too big and that Keynesian economics is wrong. I don’t think I’ll ever convince Robert Reich, but hopefully the rest of the world can be persuaded by real-world evidence.