In a thought-provoking article published by the IMF in April, Ruchir Agarwal and Miles Kimball argue for moving away from a “paper money standard” and toward an “electronic money standard.” The promised benefits include shorter recessions and lower average inflation. These benefits are said to result from eliminating the “zero lower bound” to nominal interest rates, giving the Federal Reserve the power to cut nominal interest rates as far as it needs—even into negative territory—to spur recovery from a recession. Even if nominal interest rates are only 2 percent going into the recession, the Fed could cut rates by 5 percentage points (say), reaching ‑3 percent, if that’s what they think a prompt recovery requires. The ability to conduct a negative interest rate policy, Agarwal and Kimball (hereafter AK) argue, removes the need to have an inflation target well above zero in order to keep nominal interest rates high enough to allow 5 percentage points of rate-cutting.[1] It thereby encourages the Fed to lower its inflation target from 2 percent to zero.

The “zero lower bound” is created by the unlimited availability of a zero nominal return on currency: nobody will accept significantly negative returns when they can always get a zero return (or more precisely, zero minus a small cost of storage) by holding Federal Reserve Notes. Think of the scene in Breaking Bad where Walter and Skyler White survey a room-sized storage locker where they are keeping millions of dollars in stacks of $100 bills. A back-of-the-envelope estimate indicates that their storage costs were less than one-tenth of one percent per year. Under such conditions, the public will not accept bond returns more than one-tenth of one percent per year below zero.

The “electronic money standard” the authors advocate is a novel kind of fiat dollar standard in which Federal Reserve Notes (the circulating paper part of the Fed’s monetary liabilities) would no longer always provide a zero return because they would no longer always trade 1:1 against bank reserves (the account-balance electronic part). AK note that it isn’t necessary to eliminate large denominations of paper currency (as some other proposals to enable a negative interest rate would, for example Kenneth Rogoff’s) to stop it from being a zero-nominal-return asset that sets a zero lower bound on nominal interest rates. It is only necessary to ensure that holding currency also pays a negative rate when the Fed pays a negative interest rate on bank reserves. When a negative interest rate on bank reserves is deemed necessary to fight recession, AK propose devaluing paper dollars against electronic dollars at a corresponding rate. If (for example) bank reserves pay ‑3% per annum, paper dollars are to lose their value at 3% per year against electronic dollars held on the books of the Fed (bank reserves) and on the books of the banking system (deposit balances).

AK do not spell out a specific mechanism in their 2022 paper for imposing a negative return on cash, but refer to a 2019 paper in which they consider several mechanisms. There they rate as the “first-best” policy one that “takes paper currency off par.” In essence, the Fed would announce and maintain a sliding peg between Federal Reserve Notes and bank reserves. When the policy rate is ‑3 percent per year, what is a “$100 bill” at the start of the year will be convertible into (and purchasable with) only $97 of electronic dollars at year’s end. Conversions on intermediate dates will fetch intermediate rates, so that “the paper currency smoothly depreciate[es] … over the course of the year.” There is no limit on the Fed’s ability to enforce its chosen exchange rate because it can issue or buy back Federal Reserve Notes in unlimited quantities. Private-sector businesses and individuals will discount paper currency at the rate their banks discount it for deposits, and their banks will discount it at the rate the Fed discounts it in exchange for bank reserves.

The AK proposal usefully shows that eliminating the zero lower bound can be separated from eliminating large-denomination paper currency and the financial privacy it provides. It also usefully makes the point that a positive secular inflation rate is not necessary to make room for anti-recession policy.

Assuming that we retain a fiat dollar, would enacting the AK proposal make the public better off? That is, would the typical dollar-holder benefit from enabling the Fed to impose negative returns on dollars in all forms? The answer isn’t obviously no. Note that a 2 percent average dollar inflation rate (the Fed’s currently declared target) already imposes a ‑2 percent average real return on dollar currency holders. If (as AK hope it would) enabling negative interest rate policy in this way really would lead the Fed to lower its non-recession inflation target to zero percent from 2 percent, and a negative nominal rate on currency would be imposed less than half the time, the program might actually raise the average expected real return on holding U.S. currency.

Such a program would be dominated, however, by a program of lowering the inflation target to zero and combatting recessions in an equally effective alternative way that does not require negative nominal rates, if such an alternative way were available. (A plausible alternative will be discussed momentarily.) Judged by that benchmark, the devaluation of paper currency is a welfare-reducing tax on currency, compared to currency that holds its value in the unit of account. I have written before about the dubious wisdom of punishing money-holders in order to escape the zero lower bound.

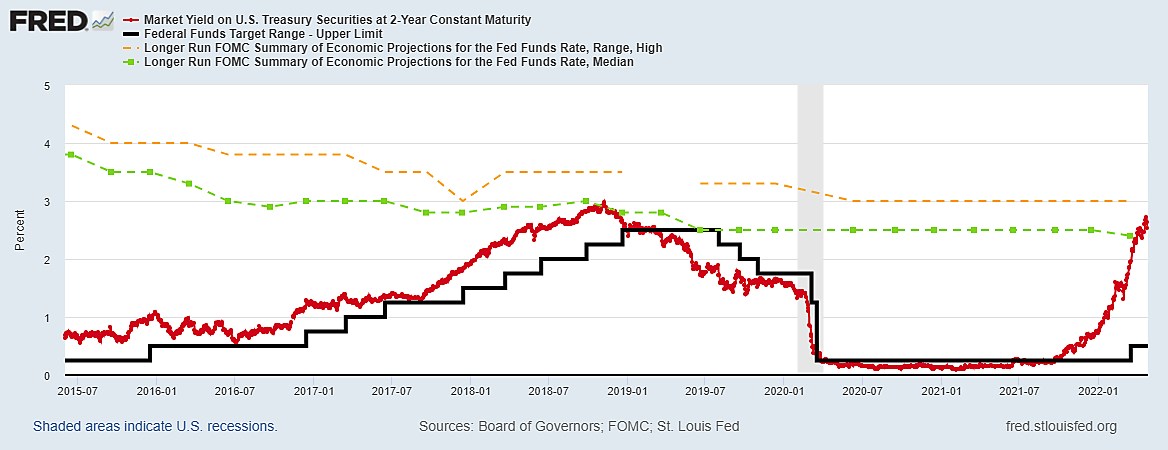

AK’s proposal thus promises to improve money-holders’ welfare only if (1) it actually results in a lower combination of (inflation + negative nominal own-return on money) on average, or, failing that, (2) negative interest rate policy is so much more effective at recession-fighting than the alternative that its benefits exceed its burden on money-holders. The second has not been shown, and may be considered doubtful. Note that the U.S. economy has just recovered rapidly from a sharp recession without cutting interest rates below zero, and without cutting them more than 1.5 percentage points. The Fed’s policy instrument of interest on reserve balances was 1.6 percent on 1 February 2020, the eve of the pandemic recession of 2020, fell to 0.1 percentage points over the next six weeks, and remained there for the next 15 months. Real output plunged for the first two quarters of 2020, then recovered its losses in the level of real GDP over the next four quarters, and even closed the gap to 99.5 percent of the full-employment or “real potential GDP” growth path over the following two quarters (see Figure 1).

Figure 1: Real GDP and Real Potential GDP, 2014–2022.

Granted, this was an atypical recession and recovery. The point I seek to make in citing it is only that prompt recovery is at least sometimes possible without a deep cut in the Fed’s interest-rate instrument. The broader point I want to make is that, under alternative policy procedures, counter-cyclical monetary policy does not require the Fed to use an interest rate instrument at all. The class of Taylor Rules, which specify the proper value of an interest rate target or instrument as a function of current macro data, does not exhaust the set of viable monetary policy rules with recovery-supporting feedback from current macro data.

The macro economist Bennett McCallum (2000) long ago formulated a feedback rule for using the monetary base—the degree of quantitative easing—as an instrument to target the path of nominal income. Under the McCallum Rule procedure, the Fed varies the rate of growth of the monetary base in response to the moving-average rates of growth of base velocity and real income, without feedback from interest rates. Until 2015 the monthly St. Louis Fed publication Monetary Trends tracked whether monetary base growth was currently above or below a range of McCallum Rule prescriptions, just as it also tracked whether the Fed Funds rate was above or below a range of Taylor Rule prescriptions. Unlike a Taylor Rule, a McCallum Rule does not require using an interest rate target or instrument.[2] It does not require an estimate of the real natural rate of interest[3], which is a well-known problem in implementing a Taylor Rule. It is agnostic about the role of interest rate changes in monetary policy transmission.

The intuition behind the effectiveness of using the monetary base as the policy instrument is straightforward, although unfortunately less familiar today than the logic of IS-LM and the Taylor Rule. It begins with considering it an appropriate goal for fiat monetary policy to avoid creating or prolonging a monetary disequilibrium, meaning an excess supply or demand for money balances by the public at the current price level. (This theme was central to the work of Leland B. Yeager and the late Axel Leijonhufvud, who emphasized that recessions characterized by an aggregate excess supply of non-money goods are logically equivalently characterized by an excess demand for money balances.) To minimize monetary disequilibrium, the system should expand the supply of fiat money in response to signs of an unsatisfied excess demand for money balances, and contract it in response to signs of excess supply.

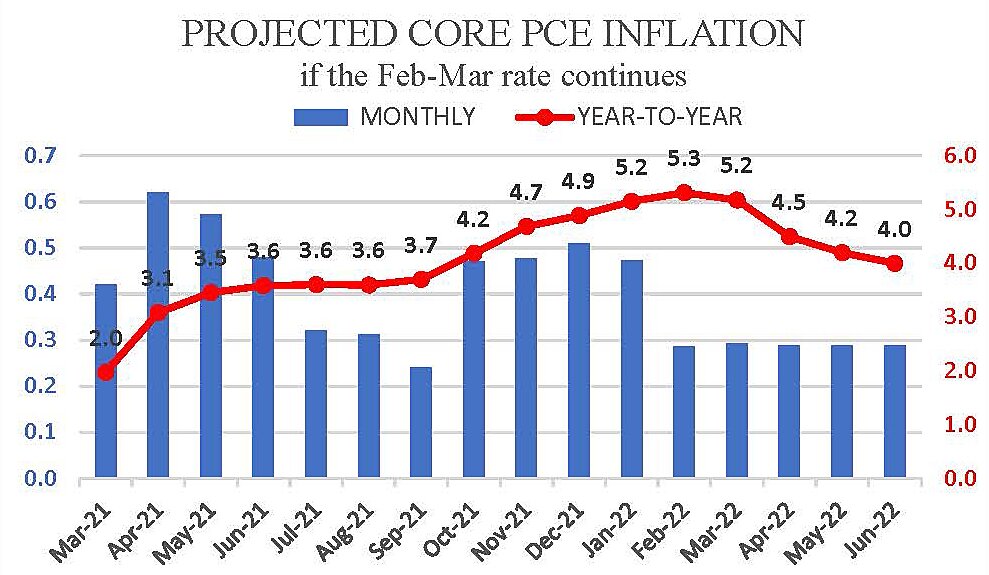

In a closed economy, the central bank manages the supply of base money. Quantitative easing or tightening—open market purchases that enlarge the monetary base, or sales that shrink it—expands or contracts broader money in the hands of the public, supposing that the “money multiplier” remains the same (under the Federal Reserve’s current operating system, this requires that the interest rate on reserves that the Fed pays banks reserves tracks the risk-free rate that banks could earn on Treasuries). In 2020 the Fed quite properly acted to expand M2 in response to the spike in the demand to hold M2 balances, or in other words, in response to the plunge in M2 velocity. The expansion did not come soon enough to prevent nominal GDP from falling in 2020, but it was more than enough to restore nominal GDP to its pre-pandemic path by the end of 2021 and to push it well above that path in 2022 (see figure 2).

Figure 2: Nominal GDP and Nominal Potential GDP.

The McCallum Rule (McCallum 2000, p. 52), for readers who are unfamiliar with it, specifies the appropriate quarterly growth rate for the monetary base as

where (all variables in logs) Δbt is the quarter-over-quarter change in the adjusted monetary base, Δνta is the moving-average change in base velocity over the previous 16 quarters, Δxt* is the target level of nominal GDP, Δxt–1 is lagged actual nominal GDP, and the parameter λ= 0.5. The rule (the first equation) prescribes that base money growth should offset base velocity growth shocks. And, if nominal GDP is undershooting its reference path, the Fed should loosen monetary policy by increasing the expansion of base money by half the discrepancy. The second equation says that the nominal income target Δxt* is the sum of the desired price level π* plus the 40-quarter moving average of real GDP Δyt*. In sum, the rule stabilizes nominal GDP along a pre-determined path using a monetary instrument. McCallum calibrated the λ parameter and the moving-average lengths using various simulations, and found that the calibrated rule’s counterfactual performance across a variety of macro models was better than the Federal Reserve’s actual performance even during the Great Moderation.

AK take for granted that anti-recession monetary policy must work by cutting an interest rate target or instrument. They observe that “[b]efore zero lower bounds became a problem,” postwar central banks “typically cut nominal rates by 5 to 6 percentage points to restore the economy to its full potential.” But such a method of operation is not dictated by the structure of a monetary economy on a fiat standard. It derives from a self-imposed policy framework. In the pre-2008 monetary regime, the Fed used the Federal Funds rate as an intermediate target, which may be interpreted as a guideline for supplying the quantity of money sufficient to meet the quantity of money demand at the desired price level. Switch from using an interest-rate-targeting procedure to using a monetary aggregate instrument, and it stands to reason that the “need” for cutting nominal rates by 5 or 6 percentage points to alleviate an excess demand for money disappears with it. To put the point another way, zero lower bounds are “serious obstacles to monetary policy,” as AK put it, only insofar as monetary policy is conducted using an interest rate as its instrument or intermediate target. Where AK comment that the zero lower bound “is not a law of nature, but a policy choice,” I suggest that the same is true about the need to fight an excess demand for money by cutting an interest rate instrument or target.

McCallum (1989) provided some evidence that a Taylor Rule (during a period in which the zero lower bound is not binding) is no more effective at mitigating recession than a McCallum Rule. If this finding is persuasive empirically (an update would be welcome) or theoretically, then it is hard to justify imposing the burden of negative interest rates on depositors and the burden of currency devaluation on currency-holders. For this reason, devaluing currency would rightly be highly controversial among members of the public—nearly as much as abolishing currency altogether.

References

McCallum, Bennett T. (1989). “Targets, Indicators, and Instruments of Monetary Policy,” NBER Working Paper 3047 (July).

McCallum, Bennett T. (2000). “Alternative Monetary Policy Rules: A Comparison with Historical Settings for the United States, the United Kingdom, and Japan,” Federal Reserve Bank of Richmond Economic Quarterly 86 (Winter), pp. 49–79.

***

[1] George Selgin cogently criticizes a proposal to raise the Fed’s inflation target, and thereby nominal interest rates, in order to give the Fed more room above zero to cut nominal rates in a recession.

[2] An “instrument” here, following standard monetary policy usage, is a variable that the Fed can directly control in the execution of monetary policy. Today the interest rate on reserves is an instrument. Under the pre-2008 Fed procedures, the Fed Funds rate was not an instrument but an intermediate target. It was a market rate that the Fed tried to keep in a target range as a guideline for keeping bank reserves at the desired degree of scarcity. The monetary base was an instrument then and remains an instrument now.

[3] I owe this point to Patrick Horan.