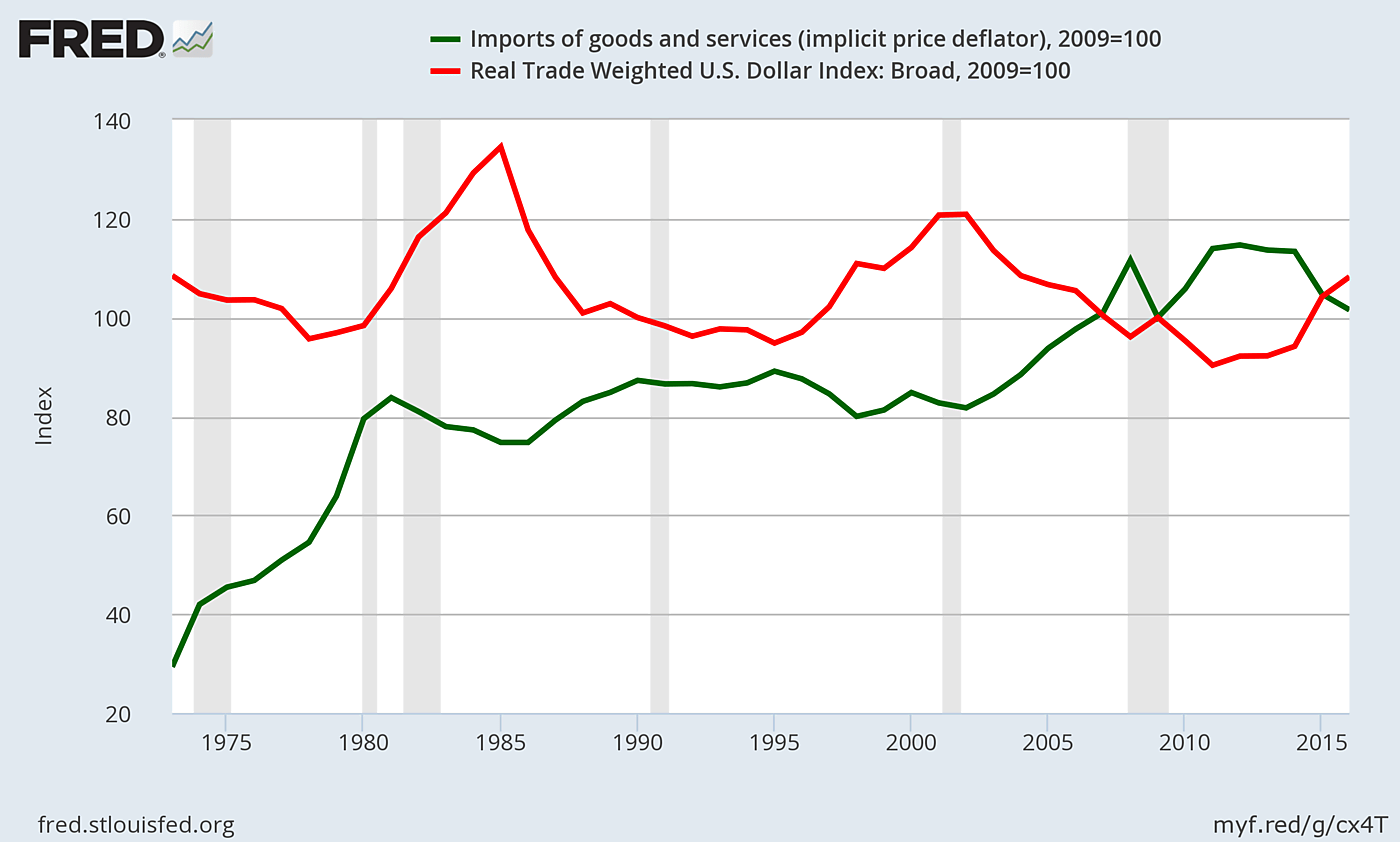

The House Republican tax plan would cut the federal corporate tax rate from 35 percent to 20 percent, but it would broaden the tax base in a misguided way. It would deny businesses a deduction for their imported inputs to production, but exempt exports from their taxable income.

This base change would raise tax revenues by about $100 billion a year, which is causing major blowback in the business community. It would be a radical change in the structure of business taxes and cause large disruptions in the supply chains and tax liabilities of many firms. No other nation that I am aware of structures their income tax base that way.

I’m for radical change in the tax system, but not radical change that would increase taxes on so many businesses and make the system more complex. Yes, border adjustment would reduce tax avoidance and cut compliance costs related to transfer pricing, but it would create other avoidance and compliance issues by spurring manipulation of imports and exports on tax returns.

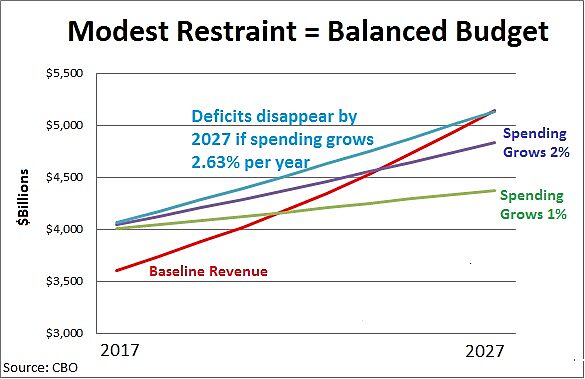

Most supporters of border adjustment know that the economics of it are dubious, but support it anyway because it would limit the deficit impact of tax reform. That’s an understandable goal, but there are three better solutions than broadening the tax base in a way that would harm companies.

1) Match a corporate tax rate cut with corporate welfare spending cuts. Romina Boccia, Tom Schatz, and I identify $50 billion in corporate welfare cuts in a new op-ed. And it’s easy to find another $50 billion in cuts in tables 1 and 2 here to match the $100 billion from border adjustment. Unlike the proposed tax base broadening, spending cuts would boost growth by reducing microeconomic distortions caused by federal programs.

2) Limit individual tax cuts. The GOP tax plan is generally excellent, moving in a pro-growth direction on many fronts. I’ve lauded the great work of Chairman Brady and his team in assembling the plan. However, the individual portion of the plan could be tweaked to limit revenue losses and increase the focus on growth, for example, by reducing the mortgage interest deduction and not expanding the child credit.

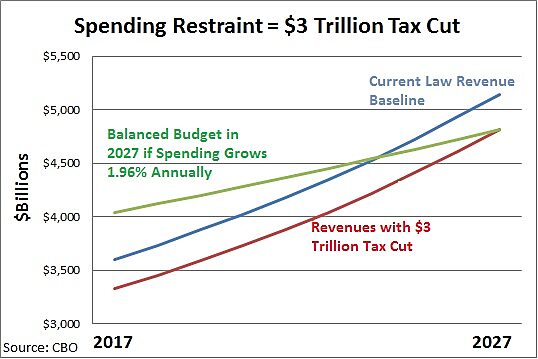

3) Slash the corporate rate without a legislated offset. The corporate income tax is the most damaging tax in the government’s revenue arsenal, and so cutting it would generate the most growth. Trump’s 15 percent corporate rate should be the goal. Canada’s federal corporate income tax at 15 percent generates as much revenue as ours at 35 percent—about 2 percent of GDP—partly because of the positive dynamic effects that a low rate has on growth and tax avoidance.

It is true that Canada is a smaller economy and so the dynamic effects are more powerful. But as globalization intensifies, and as corporate tax rates elsewhere fall further, the more economic growth and less revenue loss the United States would experience as it reduces its tax rate.

In sum, America must cut its corporate tax rate, but boarder adjustment is creating a major political barrier to reform. The economics of it are not good, and our trading partners may retaliate by denying their companies income tax deductions for U.S. products.

Spending cuts are a much better offset to tax cuts, and they would generate growth benefits of their own.

Dan Mitchell examines border adjustment here. Alan Reynolds here.