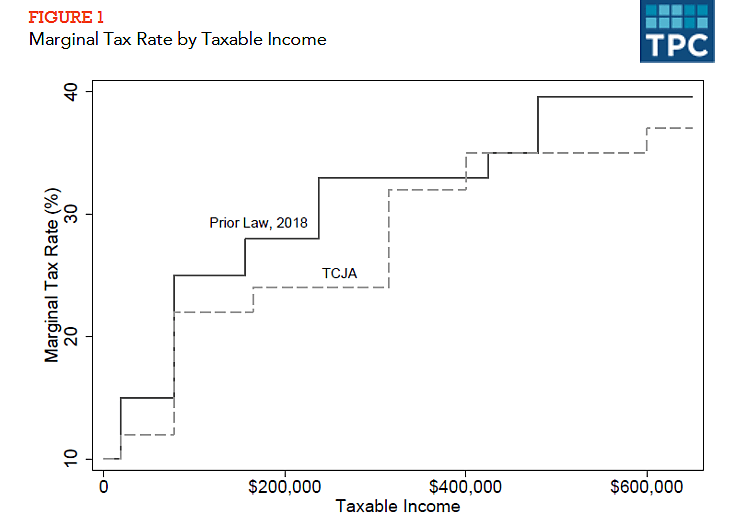

The Republican Tax Cuts and Jobs Act of 2017 created 8,700 “opportunity zones” across the country which receive special capital gains tax breaks. O Zones have balkanized American cities into winner and loser zones, while encouraging corruption and making the tax code more complex.

O Zones are supposed to alleviate poverty, but the main beneficiaries are the landlords who own development sites within the politically chosen zones.

From the Wall Street Journal the other day:

A new federal incentive program designed to help low-income neighborhoods is adding fuel to Miami’s real-estate boom.

When President Trump signed the Opportunity Zone program into law as part of the 2017 tax overhaul, the administration said the goal was to incentivize investment in economically distressed areas.

But in the case of Miami and other U.S. cities, many of the opportunity zones are in gentrifying neighborhoods that were already attracting plenty of investment from hotel and luxury apartment developers.

Sales of development sites within opportunity zones in the Miami metropolitan area increased by 45% to $238.3 million in the first quarter of 2019, while sales were down outside the area’s opportunity zones, according to research company Real Capital Analytics.

… Some critics say there is evidence that Opportunity Zone money is pouring into Miami neighborhoods that already had developers’ money and attention.

The problems with O Zones are discussed further here, here, here, here, here, and here.

HUBZones is another federal program that is based on geographical discrimination.

The Washington Post reported that HUBZones were “created as Congress sought to stimulate development in economically distressed areas nationwide by steering billions of dollars worth of federal contracts. There are more than 6,500 businesses in the program across the country.”

The Post looked at who benefits from HUBZones:

A federal program created to boost small companies in disadvantaged areas has funneled hundreds of millions of dollars into some of Washington’s most affluent areas, where a handful of businesses have grown while reaping most of the program’s benefits.

The Historically Underutilized Business Zones program began in 1997 with a promise of stimulating distressed communities by using federal contracting incentives to reverse unemployment, reduce poverty and create jobs. Some businesses that have secured contracts have seen annual revenue triple or quadruple.

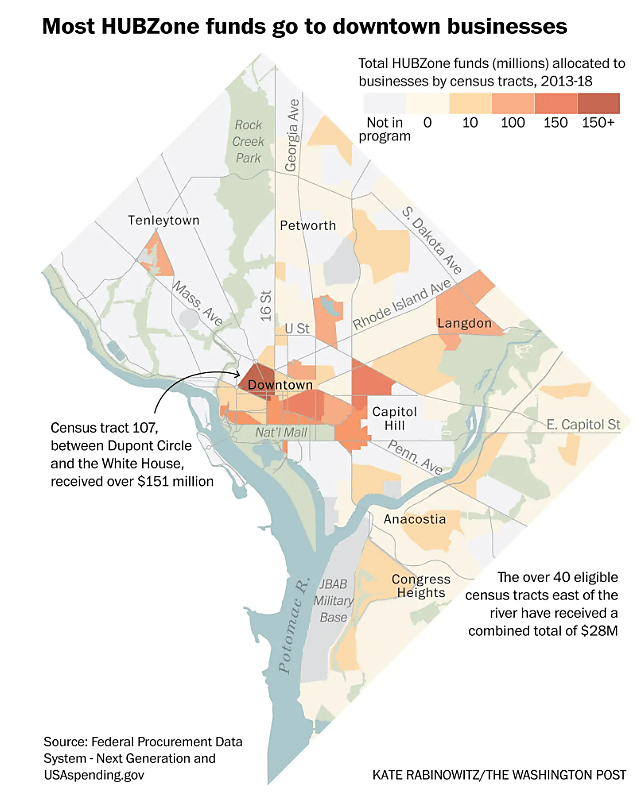

HUBZone was designed to offer firms a path to securing federal contracts based on geography — not veteran, gender or race-based qualifications used by some other programs. But the program appears to have inadvertently fostered a new divide. A Washington Post analysis of 20 years of HUBZone data shows that about $800 million earmarked for firms enrolled in the program was awarded to just 11 D.C. businesses.

Those 11 firms accounted for 70 percent of HUBZone dollars allocated in the District since the program’s debut. The money usually went to firms in wealthier areas of the city, such as Dupont Circle, Navy Yard and downtown Washington.

… Businesses in wealthier parts of the city have grown larger through securing HUBZone contracts, while those in the city’s poorest areas — locations the program was designed to help — have largely been left behind.

… The Post’s analysis found that, in 2018, more than $49 million was awarded to 40 D.C. businesses, with seven businesses receiving more than 70 percent of the money. Those seven companies have their main offices downtown or in wealthier neighborhoods where unemployment rates are lower and household incomes higher than much of the city.

… The disparity within the HUBZone program extends nationally. The Post analyzed data from several cities, with many having results similar to those in the District.

… GAO investigations spanning several years have found problems with the program, including inadequate vetting of firms that submitted falsified documents, misrepresenting the number of employees who lived in HUBZones. That led to numerous fraudulent contracts being awarded.