Since the U.S. and E.U. first enacted sanctions against Iran, in 2010, the value of the Iranian rial (IRR) has plummeted, imposing untold misery on the Iranian people. When a currency collapses, you can be certain that other economic metrics are moving in a negative direction, too. Indeed, using new data from Iran’s foreign-exchange black market, I estimate that Iran’s monthly inflation rate has reached 69.6%. With a monthly inflation rate this high (over 50%), Iran is undoubtedly experiencing hyperinflation.

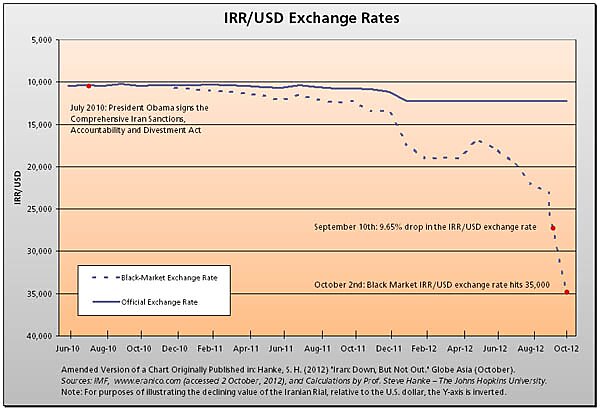

When President Obama signed the Comprehensive Iran Sanctions, Accountability, and Divestment Act, in July 2010, the official Iranian rial‑U.S. dollar exchange rate was very close to the black-market rate. But, as the accompanying chart shows, the official and black-market rates have increasingly diverged since July 2010. This decline began to accelerate last month, when Iranians witnessed a dramatic 9.65% drop in the value of the rial, over the course of a single weekend (8–10 September 2012). The free-fall has continued since then. On 2 October 2012, the black-market exchange rate reached 35,000 IRR/USD – a rate which reflects a 65% decline in the rial, relative to the U.S. dollar.

The rial’s death spiral is wiping out the currency’s purchasing power. In consequence, Iran is now experiencing a devastating increase in prices – hyperinflation. As Nicholas Krus and I document in our recent Cato Working Paper, World Hyperinflations, there have been 57 documented cases of hyperinflation in history, the most recent of which was North Korea’s 2009-11 hyperinflation. That said, North Korea’s hyperinflation did not come close to the magnitudes reached in the recent, second-highest hyperinflation in the world, that of Zimbabwe, in 2008, nor has Iran’s hyperinflation – at least not yet.