During the Cold War, Washington’s foreign policy establishment operated comfortable in the knowledge that sizeable majorities supported vigorous American global leadership in the struggle with the Soviet Union. More recently, however, many observers have started worrying about the growing disconnect between the Washington’s elites and the public. The scholar Walter Russell Mead argued in a recent Wall Street Journal opinion piece that the most important question in world politics today is “Will U.S. public opinion continue to support an active and strategically focused foreign policy? The answer is a qualified yes. Americans on balance remain committed to international engagement but advocates of the status quo are right to worry because Americans increasingly disagree with Washington about how to engage the world. Americans are not isolationists. As the 2018 Chicago Council on Global Affairs revealed, 70% of Americans want the United States to take an “active part” in world affairs. But the more important question is what does an “active part” really mean? A recent study by the Eurasia Group Foundation, for example, found that 47% of elites subscribe to the “indispensable nation” vision for foreign policy, which calls on the United States to maintain overwhelming military superiority and continue intensive efforts to manage world order, while just 9% supported a more restrained vision of foreign policy. The same study, however, found public preferences to be the reverse of elites: 44% supported a more restrained approach to foreign policy and just 10% supported the indispensable nation approach. Looking deeper, despite all the nostalgia for the Cold War consensus, there have always been important differences between the public and elites when it comes to foreign affairs. Academic analysis of decades of survey data has identified a stable set of attitude gaps between the public and their leaders. Moreover, while many of the gaps are quite large – often in the range of 30 percentage points or more – the gaps between Republican and Democratic leaders on the key issues are quite small – typically just a few percentage points. Elites are far more likely to view globalization and international trade positively, for example, while the public is are more likely to express support for focusing on domestic affairs over foreign affairs. A 2017 Chicago Council on Global Affairs study found that 90% of Republican leaders and 94% of Democratic leaders believe globalization and trade are “mostly good” for the United States, while the figures hover around 60% for the public. The same study shows that the public, on the other hand, is more sensitive than elites to perceived threats to the economy and to the homeland. Seventy-eight percent of Republicans and 74% of Democrats think protecting American jobs should be a “very important” foreign policy goal, compared to just 25% of Republican leaders and 37% of Democratic leaders. Meanwhile 27% of Democrats, 40% of Independents, and 67% of Republicans view “large numbers of immigrants and refugees coming into the U.S.” as a critical threat in the next 10 years, compared to just 5% of Democratic leaders and 19% of Republican leaders. Finally, though it depends on the scenario, the public has always been more hesitant about the use of military force abroad than elites. In the Eurasia Group Foundation study, for example, 95% of foreign policy experts would support using military force if Russia invaded Estonia, a NATO ally, compared to just 54.2% of the public. The 2017 Chicago Council on Global Affairs survey similarly found that 64% of Democratic leaders and 71% of Republican leaders think that defending allies’ security should be a very important foreign policy goal for the United States compared to 36% of Republicans and 37% of Democrats generally. But despite the size and stability of the gaps between elites and the public, Washington has not budged. Defenders of the status quo tend to view the public as too inattentive and too ignorant to form meaningful opinions about foreign policy. From this view, public support might be important from a political perspective, but the content of people’s actual opinions is not. The task for Washington today, according to this camp, is to reframe existing foreign policy in a manner that shores up public support for the elite consensus. This obstinance might be defensible were the United States not a democracy or if the American track record on foreign policy were more glorious. As it happens, the track record of American foreign policy is far from glorious and recent surveys thus reveal entirely sensible reactions to our failures. Instead of wringing its collective hands about the fragility of public support, Washington needs to wake up and start taking public opinion seriously. No one will confuse the average American with a foreign policy expert, but given America’s history and current situation, public preferences are stable, clear, and prudent. The American public wants a less ambitious and less aggressive foreign policy than the United States has pursued since the end of the Cold War, and especially over the past 18 years. The task for Washington today is to embrace these attitudes and create a new foreign policy worthy of public support.

Cato at Liberty

Cato at Liberty

Topics

Opportunity Zones Invite Corruption

Federal politicians routinely lambast the tax code as full of loopholes favoring special interests and generating lobbying—then they add more loopholes generating even more lobbying and corruption.

The Tax Cuts and Jobs Act of 2017 created special-interest tax breaks called “Opportunity Zones.” The law empowered governors and U.S. Treasury officials to carve up every state in the nation into winner and loser areas. Investment projects in the winner areas receive capital gains tax breaks, while projects in the loser areas get the short end of the stick.

The Wall Street Journal reports that former casino head Steve Wynn lobbied Trump Treasury officials to fiddle with O‑Zone regulations to favor his investments. Apparently, the Treasury did not go along, but the episode shows how narrow tax breaks fuel the lobbying industry in Washington.

Looking ahead, every jurisdiction located just outside the nation’s 8,700 O‑Zones has an incentive to hire lobbyists to pressure governors, federal officials, and members of Congress to redraw the lines and put them in the winner’s circle. Thus, I am guessing that the lobbying and corruption created by O‑Zones has only just begun. A better alternative is to reduce capital gains tax rates across the board.

Here is the WSJ reporting:

Former casino executive Steve Wynn generated $2.1 billion and a big potential tax bill last March when he was forced to sell his stake in Wynn Resorts Ltd. after sexual-misconduct allegations. Less than three months later, he held a meeting with Treasury Department officials as they were writing regulations for a new tax incentive that had the potential to help him defer and reduce those taxes.

Mr. Wynn met with senior Treasury officials on June 4 to discuss “opportunity zones,” a break that was part of the 2017 Republican tax overhaul. The opportunity-zone program gives individuals a chance to defer and reduce capital-gains taxes if they make investments into low-income areas.

Mr. Wynn, who left his company and a Republican National Committee position early last year after being accused of sexual misconduct by former casino employees, attended the meeting in the Treasury building with Daniel Kowalski, a counselor to Treasury Secretary Steven Mnuchin who was helping write opportunity-zone regulations. Mr. Mnuchin stopped by the meeting to greet Mr. Wynn, according to a copy of the secretary’s calendar that the department periodically releases.

Here are other commentaries on O‑Zones:

www.cato.org/blog/opportunity-zones-whom

www.downsizinggovernment.org/opportunity-zones-fuel-corruption

Related Tags

The Fed’s Got Problems But Deflation Isn’t One of Them

The following letter was sent to the editors of the Wall Street Journal in response to a March 13th opinion piece by Stephen Moore and Louis Woodhill entitled “The Fed is a Threat to Growth.”

To the editor,

While we at Cato hardly qualify as apologists for the Fed, I can’t resist defending it from Stephen Moore’s sensational claim (“The Fed is a Threat to Growth,” March 14) that its “deflationary” policies have “chopped 1 to 1.5 percentage points off real growth over the past six months.”

“Deflation,” first of all, means an absolute decline in prices, and not merely a decline in the rate at which prices increase. And notwithstanding Mr. Moore’s assertion that “the consumer-price index has been remarkably flat or slightly negative,” neither the CPI nor any other popular price index has actually declined in during the last six months.

What’s more, again contrary to Mr. Moore’s claims, “core” inflation rate measures, which exclude energy and food prices and are, for that reason, less volatile and more reliable inflation measures, have been both remarkably stable and very close to the Fed’s two percent target over the last six months—and longer. The core CPI rate has actually remained slightly above two percent, while the core PCE (Personal Consumption Expenditures) rate, the Fed’s preferred measure, has hovered just an insignificant smidgen below it. And while Mr. Moore may believe that the especially volatile commodity prices excluded from these core inflation rates are in fact the best indicators of the Fed’s stance, his opinion is sui generis, notwithstanding his utterly fanciful claim that Paul Volcker favored a commodity-price target.

Finally, besides inflation measures there is another, still more reliable gauge of the stance of monetary policy: the rate of change in total consumer spending on goods and services, as measured by the economies nominal GDP growth rate. That rate has been rising steadily since 2016, and has been somewhat above the robust value of 5% since mid-2018.

Sincerely,

George Selgin

Director, Center for Monetary and Financial Alternatives

The Cato Institute, Washington, D.C.

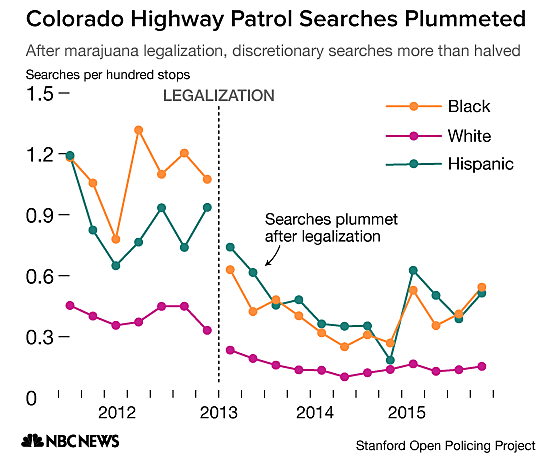

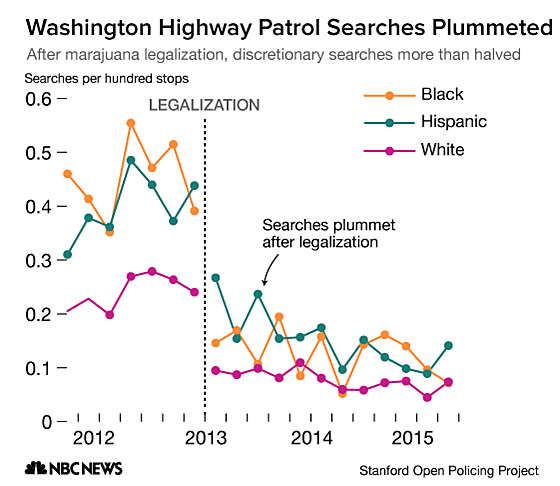

Marijuana Legalization Reduces Police Searches

Marijuana advocates often cite the expansion of individual freedom as a major benefit of legalization. One aspect of this enhanced freedom is fewer police searches. NBC News reports:

Traffic searches by highway patrols in Colorado and Washington dropped by nearly half after the two states legalized marijuana in 2012. That also reduced the racial disparities in the stops, according to a new analysis of police data, but not by much. Blacks and Hispanics are still searched at higher rates than whites.

For more on the effects of state marijuana legalizations, see here.

Research assistant Erin Partin co-authored this blog post.

Private Satellite Firm Aids Boeing 737 Investigation

Canada privatized its air traffic control (ATC) system in 1996. Today, Nav Canada is on the leading edge of ATC innovation worldwide. With Iridium, Nav Canada co-founded Aerion in 2012, which produces satellite-based tracking of global airliner movements. This is the future of air traffic control as it promises greater safety, fewer delays, savings of fuel, and more efficient use of airspace. The U.S. ATC system is not an investor in this revolutionary project.

Our government-run ATC is falling behind the privatized systems in Canada and the United Kingdom. ATC is a high-tech business, yet we run our system as an old-fashioned and mismanaged bureaucracy within the Federal Aviation Administration (FAA).

Aerion made the news last week when it provided crucial data on the Ethiopian Airlines Boeing 737 MAX crash, which killed 157 people. CNBC reported, “Even after dozens of countries grounded Boeing’s 737 Max, the FAA did not. It was only until ‘actionable data’ arrived from Aireon that the FAA made the decision, acting Administrator Daniel Elwell told CNBC.”

And here is what the Wall Street Journal reported:

When the Federal Aviation Administration reversed course and grounded Boeing Co.’s 737 MAX jetliner, it moved partly after seeing data from a little-known aerospace newcomer that is changing the way the aviation industry tracks planes.

Aireon LLC, based in McLean, Va., was founded less than a decade ago—the brainchild of satellite maker Iridium Communications Inc. and Canada’s air-traffic managers. It collects and then distributes to partners, including air-traffic-control providers around the world, some of the operational data that passenger jets automatically send out in real time.

Using gear it has placed on satellites, Aireon gathers data such as a plane’s speed, heading, altitude and position. It gets updates every eight seconds or less. Air-traffic-control providers increasingly use the data to track planes from tarmac to tarmac—a capability only made possible with the development of sophisticated satellite networks.

In the case of Ethiopian Airlines Flight 302, which crashed Sunday killing 157, Aireon said it started furnishing its raw data as early as Monday to the FAA, the National Transportation Safety Board, Canadian officials and other authorities. The data would have required some time to analyze, according to an Aireon spokeswoman.

Once recipients crunched the numbers, they found similarities between the six-minute flight path of the crashed Ethiopian Airlines 737 MAX and that of a Lion Air 737 MAX that crashed, after 11 minutes, killing all 189 aboard, less than five months earlier. Canadian officials said they had finished analyzing the Aireon-provided data only by Wednesday morning. They decided to ground the jet a few hours later. President Trump announced a U.S. grounding a few hours after that.

The FAA isn’t an Aireon investor, though the two have worked together previously.

… Aireon is owned by Iridium; Nav Canada, the Canadian air-traffic-control agency; and a handful of other air-traffic-control providers, including those in Britain and Ireland. … Aireon currently offers its services to 11 air-traffic-service providers spanning 28 countries. … No U.S. airline has said it is using the system.

Related Tags

Do Minimum Wage Increases Raise Crime Rates?

They do for younger workers and property crimes, finds a new paper by Zachary S. Fone, Joseph J. Sabia and Resul Cesur.

Back in 2016, President Obama’s Council of Economic Advisors (CEA) claimed raising the minimum wage to $12 per hour could prevent up to half a million crimes annually. The basic idea was simple: there is good evidence criminal behavior is negatively related to wages. The CEA thought raising the minimum wage would raise the opportunity cost of low-paid workers engaging in crime.

Implicitly they were saying this crime-reduction effect would dominate any impact of job losses or hour reductions leading to more property crime, for economic reasons, or violent crime, for despair-related reasons. But this new paper suggests the CEA’s intuition on the balance of the effects was wrong, for younger workers especially.

The economists use three large crime datasets over a two-decade period to undertake regression analysis of the effect of minimum wages on different crime rates. They control for policing characteristics, crime policy, demographics, health and social welfare policies, minimum high school dropout ages and government lifestyles regulation. Doing so presents robust evidence that minimum wage hikes do not reduce crime. In fact, they increase property crime arrests among 16–24 year olds – the group for whom the minimum wage is most likely to bite.

Their regressions find little evidence minimum wage hikes affect violent or drug crime, or net crime among older individuals. But the impact on young people is positive and strongest when the minimum wage hikes are larger. Digging deeper, they find that the property crimes spike is driven larcenies rather than burglaries, motor vehicle theft or arson. The results are strongest for counties with populations over 100,000 and are likely driven by the traditional labor demand impact of minimum wage hikes (fewer jobs or reduced hours).

The results they obtain of the crime responsiveness to minimum wage hikes implies that a 10 percent increase in the minimum wage between 1998 and 2016 led to nearly 80,000 additional property crimes committed by 16-to-24 year olds. This would imply that implementing the $15 per hour Raise The Wage Act today could generate another 410,000 property crimes.

Related Tags

From “Meth Crisis” to “Opioid Crisis” to “Fentanyl and Meth Crisis” to…

Today’s Wall Street Journal reports that, just as overdose deaths related to prescription pain relievers are showing signs of leveling off, officials worry that the surge in methamphetamine-related deaths is joining the surge in fentanyl-related deaths to fuel the total drug overdose rate.

There were 1887 meth-related deaths reported in 2011. By 2017 more than 10,000 deaths were reported related to meth and other chemically-similar psychostimulants.

The Drug Enforcement Administration has seen a 118 percent increase in meth seizures by law enforcement between 2010 and 2017. The meth is cheap and abundant and flooding the US mainly from Mexico, according to the agency. The Mexican cartels have taken up the meth trade to compete with cocaine coming up from South America.

The Journal article quotes a spokesman from the Phoenix office of the DEA as saying the meth is smuggled through tunnels, through ports of entry, and between ports of entry.

As I wrote here, the meth trade became the domain of the Mexican cartels after the US cracked down on homegrown meth labs and made Sudafed (a decongestant converted to meth in those labs) more difficult to obtain.

I pointed out elsewhere that waging a war on drugs is like playing a game of “Whac-a-mole.” The war should be drawn to a close and attention should turn to ameliorating the death and other harms that prohibition has wrought.

In 2005 Congress acted to address the “Meth Crisis.” Shortly thereafter it turned its attention to the “Opioid Crisis.” Now it is dealing with a fentanyl crisis and a replay of the meth crisis. How many more will die or suffer needlessly before lawmakers wise up?