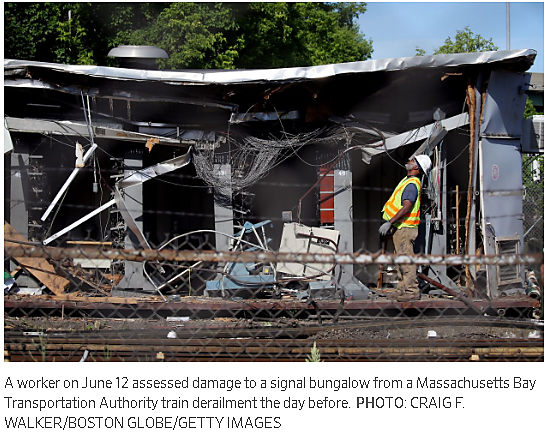

My new op-ed at The Hill discusses the disastrous rise in federal government debt as profligacy dominates both parties in Washington. With the far-left lurch of the Democrats and the complete abdication of responsible budgeting by Republicans, I don’t see how the nation escapes from a damaging and protracted economic crisis down the road.

It does not have to be this way, as my article discusses. Canada escaped a similar debt spiral in the 1990s as a left-of-center government imposed and sustained sharp spending cuts. We can and should do that here, now, yet virtually all members of Congress appear uninterested in reform.

An excerpt from The Hill:

So while debt projections already look scary, we’ll probably be hit by surprises that make the outlook even worse, such as recessions, wars, higher interest rates or a new president in 2021 who wants spending on a Green New Deal or Medicare for All.

We are on a budget death spiral similar to what Canada faced in the 1990s. As deficits soared, interest costs began devouring their federal budget—rising from 10 percent of total spending in the mid-1970s to 30 percent by the mid-1990s. The high debt scared away investors and the economy struggled. Canada’s federal debt was downgraded by the ratings agencies, and a Wall Street Journal editorial called the country a “basket case” and “an honorary member of the Third World” for its bleak outlook.

The Canadian story has a happy ending because leaders were jolted to their senses and made gutsy decisions to slash spending. They cut defense, business subsidies, farm aid, welfare, grants to lower governments, federal jobs and much else. Federal debt plunged from 67 percent of GDP in 1996 to 34 percent by 2006. Defying Keynesian predictions, the large spending cuts revived the economy and launched the nation on a long boom.

American leaders used to know how to reduce debt. Debt spiked during every war over the past 230 years but was always paid down afterwards. After the Civil War, for example, the government ran surpluses 28 years in a row, causing debt to plunge from 31 percent of GDP down to just 7 percent.

Today we are at peace yet the debt is soaring. The profligacy is so scary because our leaders don’t seem to have the guts to make tough spending decisions like Canada did. We’re marching into a fiscal crisis and few of our leaders seem to care about debt or know how to tackle it.

This study puts government debt in historical perspective and explains why it is so harmful.

This chart shows the history of federal debt and CBO’s baseline projection, which is an “optimistic” forecast if Congress does not make spending reforms.

Image Credit: Congressional Budget Office