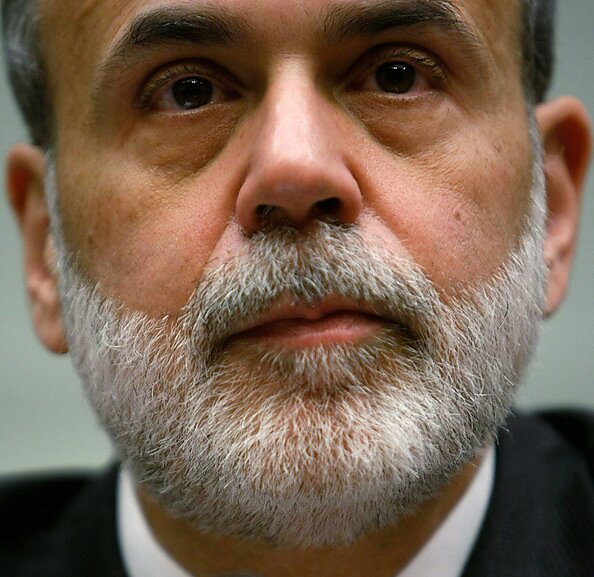

In re-appointing Bernanke to another four year term as Fed chairman, President Obama completes his embrace of bailouts, easy money and deficits as the defining characteristics of his economic agenda.

Bernanke, along with Secretary Geithner (then New York Fed president) were the prime movers behind the bailouts of AIG and Bear Stearns. Rather than “saving capitalism,” these bailouts only spread panic at considerable cost to the taxpayer. As evidenced in his “financial reform” proposal, Obama does not see bailouts as the problem, but instead believes an expanded Fed is the solution to all that is wrong with the financial sector. Bernanke also played a central role as the Fed governor most in favor of easy money in the aftermath of the dot-com bubble — a policy that directly contributed to the housing bubble. And rather than take steps to offset the “global savings glut” forcing down rates, Bernanke used it as a rationale for inaction.

Perhaps worse than Bush and Obama’s rewarding of failure in the private sector via bailouts is the continued rewarding of failure in the public sector. The actors at institutions such as the Federal Reserve bear considerable responsibility for the current state of the economy. Re-appointing Bernanke sends the worst possible message to both the American public and to government in general: not only will failure be tolerated, it will be rewarded.