It’s no secret that the Senate’s proposed legalization for some unauthorized immigrants was a deal breaker in 2013. Detractors labelled such a legalization “amnesty” even though it is anything but that – and that label has stuck. That, at minimum, some unauthorized immigrants become legalized is economically and ethically imperative, so it’s time to consider less-than-comprehensive, keyhole solutions that will fix at least some of the problems with our immigration system.

One such solution, which even many of those opposed to immigration reform have endorsed, is a small legislative reform to the 3/10 year bars that will allow some unauthorized immigrants to depart and apply for reentry under the legal system without special treatment. This reform would avoid the so-called amnesty objection to immigration reform.

Removing the Bars

The 3/10 year bars require any immigrant who stays in the United States illegally for more than six months but less than one year may not leave, reenter, or apply for a green card for three years. Any immigrant who illegally stays for more than a year may not leave, reenter, or apply for a green card for 10 years. Any immigrant who violates it triggers a twenty-year ban from reentering the United States for any reason. That’s a problem because almost all applicants for a green card or visa have to visit a U.S. embassy or consulate abroad to apply which, in the case of unauthorized immigrants, requires them to leave the Untied States thus triggering the bars. The 3/10 year bars prevent any unauthorized immigrant from using the legal immigration system.

Removing these bars and allowing unauthorized immigrants to leave and apply for green cards would legalize millions of unauthorized immigrants without an amnesty – although the numbers who could be legalized are uncertain. If unauthorized immigrants could leave and apply, which would happen by removing the 3/10 year bars, about 20 percent of the unauthorized population could immediately become eligible for a visa, and as many as half could become eligible after leaving.

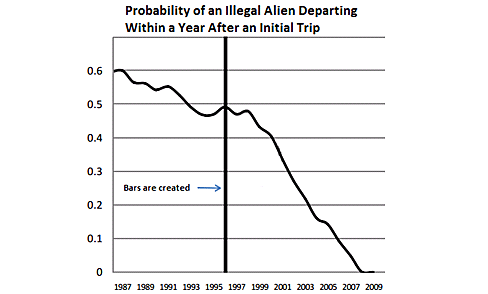

One reason why the number of unauthorized immigrants has increased so much in recent decades is that the 3/10 year bars raise the cost of returning to their home countries. Prior to the bars being enacted in 1996, unauthorized immigration was a largely circular phenomenon. Unlawful immigrants would come for a few years, work here, return home, and often return to the United States again before eventually settling back in their home countries. The 3/10 year bars raised the cost of leaving the United States and, predictably, more undocumented immigrants stayed longer and thus increased the size of the unauthorized immigrant population.

Source: Adapted and slightly edited from Doug Massey’s “Chain Reaction: The Causes and Consequences of America’s War on Immigrants.” http://www.iza.org/conference_files/amm2011/massey_d1244.pdf#page=29&nb…;

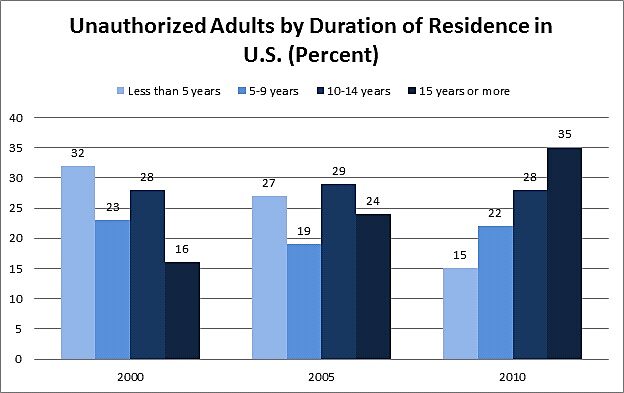

Ironically, these restrictions did more to lock unauthorized immigrants in the United States than to keep them out. The chance of an unauthorized immigrant leaving soon after his or her first trip to the United States has dropped from 50 percent to near zero since 1996. And the percentage of unauthorized immigrants who have resided in the United States for long periods of time has increased.

Source: Pew Hispanic Center. http://www.pewhispanic.org/2011/12/01/unauthorized-immigrants-length-of-residency-patterns-of-parenthood/

The number of unlawful immigrants who entered annually after 1996 was about the same as entered annually before, but since fewer left after the bars were enacted the population grew much more rapidly after the 3/10 year bars were put in place. According to Doug Massey at Princeton, if the same percentage of unauthorized immigrants had left during the 1990s and 2000s as left before the bars, there would be 5.3 million fewer unauthorized immigrants here today. Many would have returned home and others would have earned green cards through the family-based immigration system.

Keyhole Solution

All else remaining equal, immigration policy should encourage unauthorized immigrants to apply through the legal system – many of whom would now be able to reenter lawfully through the family immigration system if the 3/10 year bars were removed. Removing the 3/10 year bars would not be an amnesty for unauthorized immigrants, even though it would allow some of them here illegally to use the current system without a comprehensive reform.

Removing or Reforming the 3/10 Year Bars Isn’t Amnesty …

… but don’t take my word for it. Here are what many people, including some noted immigration restrictionists and conservative Republicans (no, they aren’t the same), have said in support of removing or reforming the bars:

- Mark Krikorian, Executive Director of the Center for Immigration Studies: “The 3/10 year bar … is not something I’m a big fan of. I think there are other ways of penalizing illegal immigrants for being illegal aliens. But no, that would not be [amnesty]—first of all, if [someone here illegally] got legal status, she would get legal status because she was the spouse of U.S. citizen through the normal immigration process.”

- Jessica Vaughn, Director of Policy Studies for the Center for Immigration Studies: “A responsible but still compassionate solution would be to offer [family members eligible for green cards] the opportunity to maintain eligibility, not through an amnesty … but by agreeing to wipe out their previous unlawful presence if they leave the country (emphasis added).”

- Paul Virtue, former general counsel of the Immigration and Naturalization Service: “Far from curtailing illegal immigration and deterring people from overstaying their visa as intended, [the] bars to admissibility are actually contributing to the unprecedented rise in the number of undocumented immigrants.”

- Former- Sen. Jim Demint (R‑SC), President of the Heritage Foundation: Sen. Demint endorsed the Krieble Foundation’s “Red Card Solution” which waives the bars and permits unauthorized immigrants to leave and return on work visas. As Demint wrote, “Congress could consider ideas for a practical, temporary worker program such as that being promoted by businesswoman Helen Krieble, called the Red Card Solution.”

- Rep. Bob Goodlatte (R‑VA), Chairman of the Judiciary Committee: “If you address some kind of reform of that aspect of it [3/10 year bars] you can avail people of an opportunity that they don’t have now.”

- Rep. Raúl Labrador (R‑ID), Republican Judiciary Committee member and former immigration attorney: “No one is going to go back home for 10 years. If we get rid of what we call ‘the bars’ … we could fix the problem for about 25 percent of the people that are here illegally. And we would do it through the proper legal system, so there’s no amnesty.”

- Rep. Steve Pearce (R‑NM), the only Republican congressman with a border district (press release): “This bipartisan immigration bill would grant discretionary authority to review specific cases for a small number of Americans who are separated from their families due to minor earlier violations which are technical in nature or occurred when the family member was a minor. Such review was permissible until 1996, when the current regulations were put in place … The American Families United Act would allow a judge or the Secretary of Homeland Security to review these cases and determine whether relief is in the public interest, an option not currently available. The legislation would prohibit this review for individuals without a legal basis to live in the U.S., or those with a serious criminal record.”

None of the people listed above would support broad-based legalization or amnesty. However, they all agree that removing or reforming the 3/10 year bars is a desirable reform that falls far short of “amnesty” but would nevertheless legalize many current unauthorized immigrants.