The main goal of fiscal policy should be to shrink the burden of government spending as a share of economic output. Fortunately, it shouldn’t be too difficult to achieve this modest goal. All that’s required is to make sure the private sector grows faster than the government.

But it’s very easy for me to bluster about “all that’s required” to satisfy this Golden Rule. It’s much harder to convince politicians to be frugal. Yes, it happened during the Reagan and Clinton years, and there also have been multi-year periods of spending discipline in nations such as Estonia, New Zealand and Canada.

But these examples of good fiscal policy are infrequent. And even when they do happen, the progress often is reversed when a new crop of politicians take power. Federal spending has jumped to about 23 percent of GDP under Bush and Obama, for instance, after falling to 18.2 percent of economic output at the end of the Clinton years.

This is why many advocates of limited government argue that some sort of external force is needed to somehow limit the tendency of politicians to over-tax and over-spend.

I’ve argued on many occasions that tax competition is an important mechanism for restraining the greed of the political class. But even in my most optimistic moments, I realize that it’s a necessary but not sufficient condition.

Another option is budget process reform. If you can somehow convince politicians to tie their own hands (in the same way that alcoholics can sometimes be convinced to throw out all their booze), then perhaps rules can be imposed that improve fiscal policy.

But what sort of rules? Europe has “Maastricht” requirements that theoretically limit deficits and debt, and 49 states have some sort of balanced budget requirement, but these policies have been very unsuccessful — perhaps because they mistakenly focus on the symptom of red ink rather than the underlying disease of government spending.

Are there any budget process reforms that do work? Well, I’ve written about Switzerland’s “debt brake,” which has generated some good results over the past 10 years because it actually imposes an annual spending cap.

Some American states also impose expenditure limits. Have they been successful?

Unfortunately, they usually don’t seem to do a good job of controlling spending. Here are some key passages from a new study by Benjamin Zycher from the American Enterprise Institute.

…tax and expenditure limits (TELs) vary substantially in terms of their details, definitions, and underlying structures, but the empirical finding reported here is simple and powerful: TELs are not effective. …The ineffectiveness of TELs is unambiguous in terms of summary statistics, case-study examination of the records of several individual states, and estimation of an econometric model. This model was estimated for both state and local spending combined and state outlays considered alone.

The author finds some positive impact, but it’s unclear whether the results are meaningful…or durable.

In terms of the growth rates of per capita outlays, 20 of the 30 states display a decline in that growth rate during the periods when the respective TELs were effective, but none of those differences is statistically significant. …to the (highly limited) extent that spending limits prove effective, they are likely to be subject to erosion driven by the same political factors that yield the fiscal pressures.

Though three states seem to have generated genuine budgetary savings.

Among the 30 states with TELs in effect during 1970–2010, the econometric analysis finds that only three of those limits had the effect of reducing total outlays, by approximately 4–6.5 percent. This evidence does not provide grounds for optimism that an emphasis on spending limits would prove useful in terms of reducing long-term fiscal pressures.

Looking at all the evidence, Zycher is not very optimistic about expenditure limits, though he does recognize the valuable role of tax competition.

…a TEL is unlikely by itself to reverse the underlying conditions that yield expanding government. In particular, the incentives of interest groups to circumvent and neutralize the effects of TELs are unsurprising; that may be one central lesson from the California and Washington experiences. Future efforts to restrain the growth in government spending may find greater success if they are directed at increasing competition… One obvious way to achieve this is to strengthen the institutions of federalism, thus forcing states and localities to compete with each other.

Other researchers also have looked at tax and expenditure limits, so let’s see whether they have different perspectives.

Matt Mitchell (no relation) has a slightly more optimistic assessment. Here’s some of what he wrote in a study for the Mercatus Center.

…some varieties of TELs can decrease state spending as a share of state income, but the effect is small—in the range of about 2 to 3 percent. …Certain characteristics can make TELs more effective. These include constitutional (as opposed to statutory) codification, a focus on spending rather than on revenue, a provision that automatically and immediately refunds surpluses, and—of particular importance—a provision that requires either a supermajority vote or a public vote for override.

Here are some of his specific findings.

Weak TELs…tend not to impact state spending very much in either low or high-income states. At best, they decrease spending by about 1/10 of one percentage point in low-income states. At worst, they increase spending by less than 1/100 of one percentage point in high-income states. The most-stringent TELs, on the other hand, do have an appreciable impact on state spending. …Those TELs that limit budgets to inflation plus population growth seem to limit combined state and local spending. In states with this variety of TEL, state and local spending as a share of state income is about 6/10 of a percentage point less than in other states (this is a 3‑percent difference relative to the average state and local spending share). …This variety of TEL is often favored by advocates of limited government because it is particularly restrictive (the sum of inflation and population growth is typically less than income growth).

Michael New of the University of Michigan-Dearborn also found that the design of a TEL makes a big difference. Here are some excerpts from his study, which was published in the State Politics and Policy Quarterly.

…most TELs have been enacted by state legislatures, and it is not clear that legislators have the incentive to reduce their autonomy by placing meaningful constraints on their own behavior. …Conversely, TELs enacted through citizen initiatives are likely to be drafted by interest groups that actually possess an interest in limiting state spending, giving them considerably greater potential for effectiveness.

Here are some of his results.

Why has Colorado’s TABOR been more effective than other fiscal limits? …the results of Models 2 and 4, which categorize TELs based on how they were adopted, lend considerable support to my hypothesis. These models indicate that TELs enacted by citizen initiative are the most effective at limiting the size of government. Model 2 predicts that after a TEL is passed by a citizen initiative, annual growth in per capita state and local expenditures will be reduced by $35.70. Similarly, Model 4 predicts that the annual growth in per capita state and local revenues will be reduced by $35.64. Both findings are statistically significant.

Professor New’s research shows that it is very important to limit spending so it grows at inflation plus population rather than letting it climb as fast as personal income.

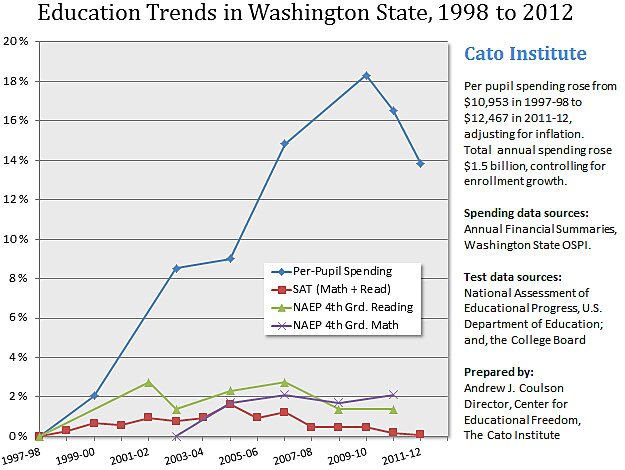

…holding increases in expenditures to increases in personal income is a relatively easy threshold for a state to maintain. …During the early 1990s, however, two states enacted TELs with a lower limit. Both Colorado’s Taxpayer’s Bill of Rights (TABOR) and Washington state’s Initiative 601 (I‑601) established a limit of inflation plus population growth. …Table 4 provides further evidence that strong TELs have been able to restrict government growth. Holding other factors constant, strong TELs annually reduce growth in both state expenditures and state revenues by over $100 per capita. …Both the coefficient for TABOR and the coefficient for I‑601 are negative in all four regressions and statistically significant in three of the four. …My analysis provided solid evidence that these two TELs were even more effective at restraining expenditures and revenues as demonstrated by both statistical analysis and case studies.

Some people would conclude from the research of Zycher, Mitchell, and New that spending limits are not very effective. But that’s a hasty conclusion. The real lesson is that spending limits work, but only if they actually limit spending so that it grows slower than personal income, just as suggested by my Golden Rule.

In other words, spending limits are like speed limits in school zones. They are only effective if they’re set low enough to actually protect taxpayers and children.

This debate reminds me of the intellectual fight over the starve-the-beast hypothesis. Some have argued that tax cuts are not an effective way of limiting spending. But the research actually shows that tax cuts are an effective way of “starving the beast” if lawmakers don’t subsequently raise taxes.

The bottom line is that expenditure limits — if properly designed and enforced — are an effective way of controlling government spending. That doesn’t mean that politicians won’t figure out ways to over-spend, just like locks on doors don’t always stop burglars. But both are better than the alternative of no limits or no locks.

In prior posts, I’ve shared research showing that the United States today would be very close to a balanced budget if we had implemented something akin to the Swiss Debt Brake.

So far as I know, there’s no legislation to impose a spending cap specifically modeled on the Swiss system, but I’ve previously noted that Senator Corker’s CAP Act and Congressman Brady’s MAP Act both have sequester-enforced spending limits.

And the good news about sequestration is that the savings are real, unlike the gimmicks that you get when the politicians are in charge of “cutting” spending.