This is the sixth post in a series covering the advance of educational choice legislation across the country this year. As of my last update in early July, there were 18 new or expanded choice programs in 14 states. A few days after that update, Wisconsin enacted a new voucher program for students with special needs. And on Friday, North Carolina lawmakers finally passed a long-overdue budget that expanded the state’s two school voucher programs for low-income and special-needs students, bringing the total number to 21 new or expanded programs in 15 states. The updated tally is below.

A lawsuit against the Tar Heel State’s voucher law impeded implementation so only 1,216 low-income students participated last year, barely 10 percent of the 12,000+ applications the state received. In July, the North Carolina Supreme Court upheld the program, clearing the way for the legislature to expand it.

Meanwhile, opponents of educational choice have launched a second legal attack on Nevada’s new education savings account law. Last month, the ACLU filed a similar lawsuit. The state of Nevada has hired one of the top law firms in the nation to help defend the ESA program. In addition, the Institute for Justice will be defending the law against both challenges on behalf five families who would benefit from the ESAs. You can learn about their stories in this short video:

In other school choice news, Indiana is poised to surpass Wisconsin as the state with the most students receiving school vouchers with more than 33,000 students. However, that number is dwarfed by the nearly 70,000 students who received tax-credit scholarships in Florida during the last school year.

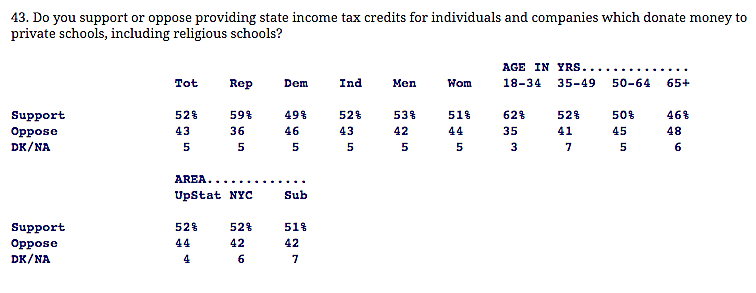

And speaking of tax credits, a new poll from Quinnipiac University finds that New York Gov. Andrew Cuomo’s most popular education proposals were the personal-use and scholarship tax credits that he unsuccessfully pushed this year. More than half of respondents–including 62 percent of Millennials–supported tax credits for donations to private schools (though the question should have asked about donations to nonprofit scholarship organizations, which was Cuomo’s actual proposal).

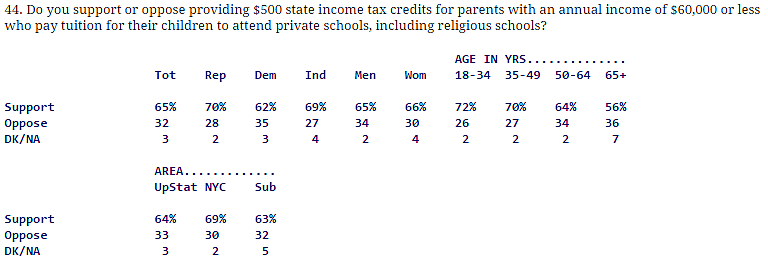

Additionally, 65 percent of respondents–including 72 percent of Millennials and 70 percent of respondents ages 35–49–voiced support for a $500 state income tax credit for low- and middle-income parents to pay private school tuition.

Updated tally for new and expanded choice programs in 2015:

New Educational Choice Programs (8 in 7 states)

- Arkansas: vouchers for students with special needs.

- Mississippi: ESAs for students with special needs.

- Montana: universal tax-credit scholarship law.

- Nevada: tax-credit scholarships for low- and middle-income students.

- Nevada: nearly universal ESA for students who previously attended a public school.

- South Carolina: voucher-like “refundable” direct tuition tax credit for students with special needs.

- Tennessee: ESAs for students with special needs.

- Wisconsin: vouchers for students with special needs.

Expanded Educational Choice Programs (13 in 9 states)

- Alabama: Raised the annual scholarship tax credit cap from $25 million to $30 million and raised the contribution cap from $7,500 to $50,000. However, the expansion came at a price: the legislation lowered income eligibility threshold from 275 percent of the federal poverty level to 185 percent (from about $67,000 to about $45,000 for a family of four). Current scholarship recipients are grandfathered in.

- Arizona: Expanded ESA eligibility to include students living in Native American tribal lands.

- Arizona: Expanded the types of businesses that can receive tax credits for donations to scholarship organizations.

- Florida: Expanded ESA eligibility to include more categories of students with special needs and increased the budget from $18.4 million to nearly $55 million.

- Indiana: Increased amount of tax credits available for donations to scholarship organizations ($2 million over two years).

- Indiana: Eliminated cap on the value of each voucher. Vouchers are worth 90 percent of the state’s per-pupil funding.

- Louisiana: Expanded school voucher program (funding roughly 600 additional vouchers).

- North Carolina: Expanded school voucher program for low-income students ($17.6 million in 2015–16, $24.8 million in 2016–17).

- North Carolina: Expanded school voucher program for students with special needs (vouchers increased from $6,000 to $8,000, total funding increased by $250,000 to $3.25 million annually).

- Ohio: Increased the value of several categories of vouchers.

- Ohio: Raised the funding caps for special-needs vouchers.

- Oklahoma: Expanded eligibility for its special-needs tax-credit scholarships and raised the tax credit value from 50 percent–tied with Indiana for the lowest in the nation–to 75 percent.

- Wisconsin: The state budget raises and eventually eliminates the statewide voucher cap.

Like North Carolina, Pennsylvania lawmakers have been embroiled in a budget battle all summer. Early proposals included expansions of the states two tax-credit scholarship programs, but it is unclear what the final budget will contain.

[Note: updated to correct impact of the amendment to Indiana’s voucher law and add information about the new voucher program in Wisconsin.]