Over at Zero Hedge, “Tyler Durden” reposts a piece by Sean Corrigan, the link to which appears to be non-working, in which Corrigan imagines that he is having a “Gotcha!” moment, at the expense of yours truly, because he has discovered some reputable authorities who claim that (commercial) banks are in fact capable capable of making loans above and beyond any sum of deposits they acquire. Here are the first few paragraphs:

Of late there has been much breathless wonder expressed at the Bank of England’s supposedly ground-breaking release. ‘Money in the Modern Economy’, in which it argues – shock! horror! — that banks do not lend out previously received deposits, but that they create the latter ex nihilo by first making loans. Alas, as Gunnar Myrdal waspishly observed of Keynes himself, this has been a reaction plagued with the ‘unnecessary originality’ of those who don’t know their literature.

As an example, some few months ago, I had an exchange with the disputatious George Selgin (he of the perfervid fractional free banking bent) in which I cited – after a good twenty minutes’ research – the following authorities to that very same effect:-

Roepke from a footnote (p113) to his 1936 work, ‘Crises & Cycles’:

The process [of credit creation] is now clearly explained in any text-book on economics, banking or money (especially recommendable is Hartley Withers’ Meaning of Money). A fuller treatment may be found in the following books: R. G. Hawtrey, op. cit.; J. M. Keynes, A Treatise on Money, pp. 23–49 : C. A. Philips, Bank Credit, New York, 1920; W. F. Crick, “The Genesis of Bank Deposits,” Economica, June 1927, and F. A. von Hayek, Monetary Theory and the Trade Cycle, London,1933.

Without an understanding of this process and of its limitations, no real insight into the working of our banking system and, consequently, of our entire economic system seems possible, to say nothing of the mechanism of business cycles. There may still be many people who can no more believe the story of the genesis of bank money than they can believe the genesis of the Bible, but on the whole it now seems to be generally accepted. A last but hopeless attempt at disproving it has recently been made by M. Bouniatian, Credit et conjoncture, Paris, 1933. [Emphasis mine and apparently NOT the last!]

Or as Hayek indeed noted in ‘Prices and Production’ above his own lengthy footnote (pp 81–2):

The main reason for the existing confusion with regard to the creation of deposits is to be found in the lack of any distinction between the possibilities open to a single bank and those open to the banking system as a whole.

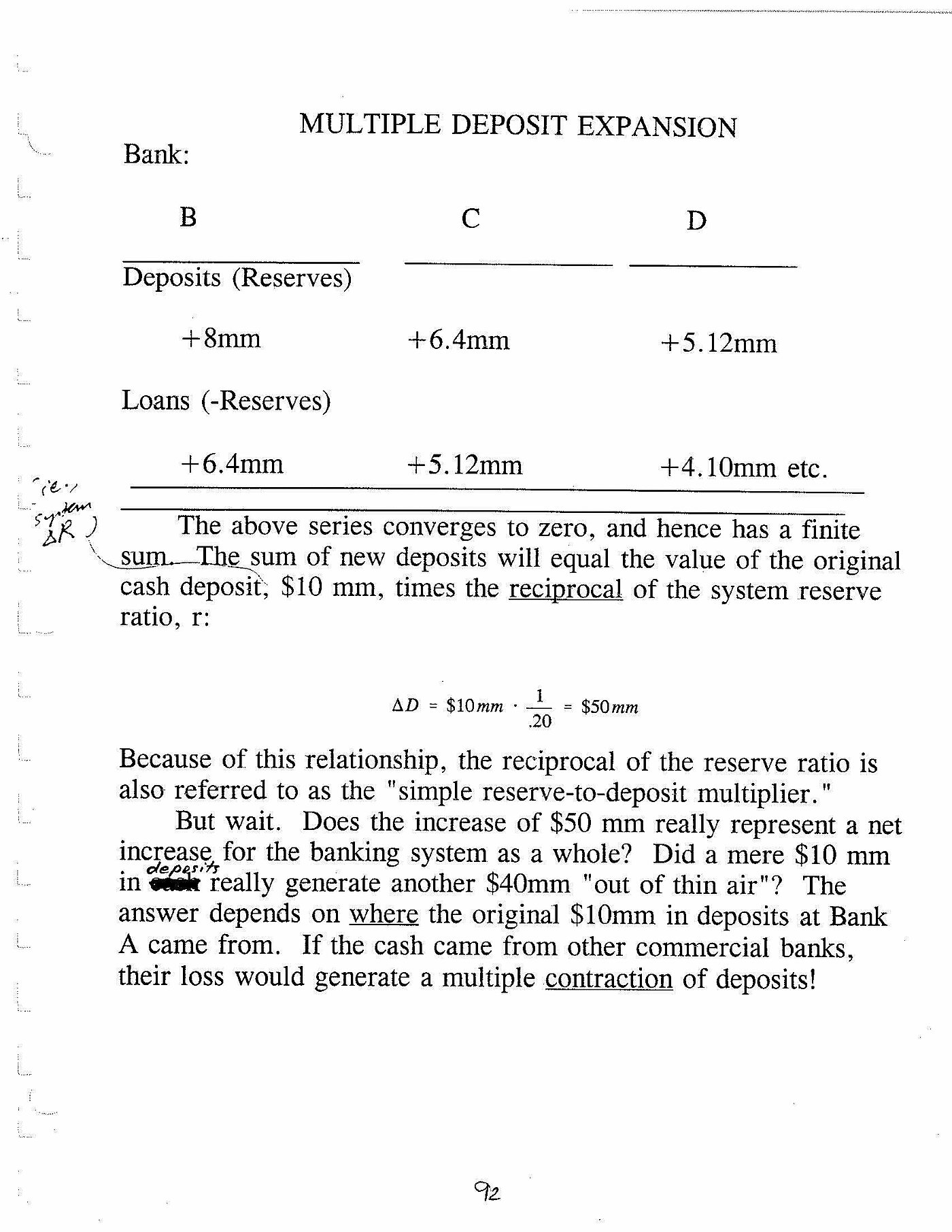

Actually, Sean, I can assure you that I’ve read them all, and carefully; what’s more, I’ve probably taught several thousand students about the process of multiple deposit expansion, being careful in doing so to make precisely the distinction Hayek insists upon between what individual banks on one hand and the system as a whole on the other are capable of making doing with any fresh deposits.* In fact, no individual bank involved can lend more than a part–usually the greater part–(the “excess reserves”) of whatever fresh funds it is able to secure. It is precisely your misunderstanding of Hayek’s point that was, I am inclined to think, the nub of our original disagreement!

*Here FYI is a screenshot of the relevant page of the class notes I give to my students: