In what follows, I update my annual Misery Index calculations. A Misery Index was first constructed by economist Art Okun as a way to provide President Lyndon Johnson with a snapshot of the economy.

The original Misery Index was just a simple sum of a nation’s annual inflation rate and its unemployment rate. The Misery Index has been modified several times, first by Robert Barro of Harvard and then by myself. My modified Misery Index is the sum of the unemployment, inflation, and bank lending rates, minus the percentage change in real GDP per capita. A higher Misery Index score reflects higher levels of “misery,” and it’s a simple enough metric that a busy president without time for extensive economic briefings can understand at a glance.

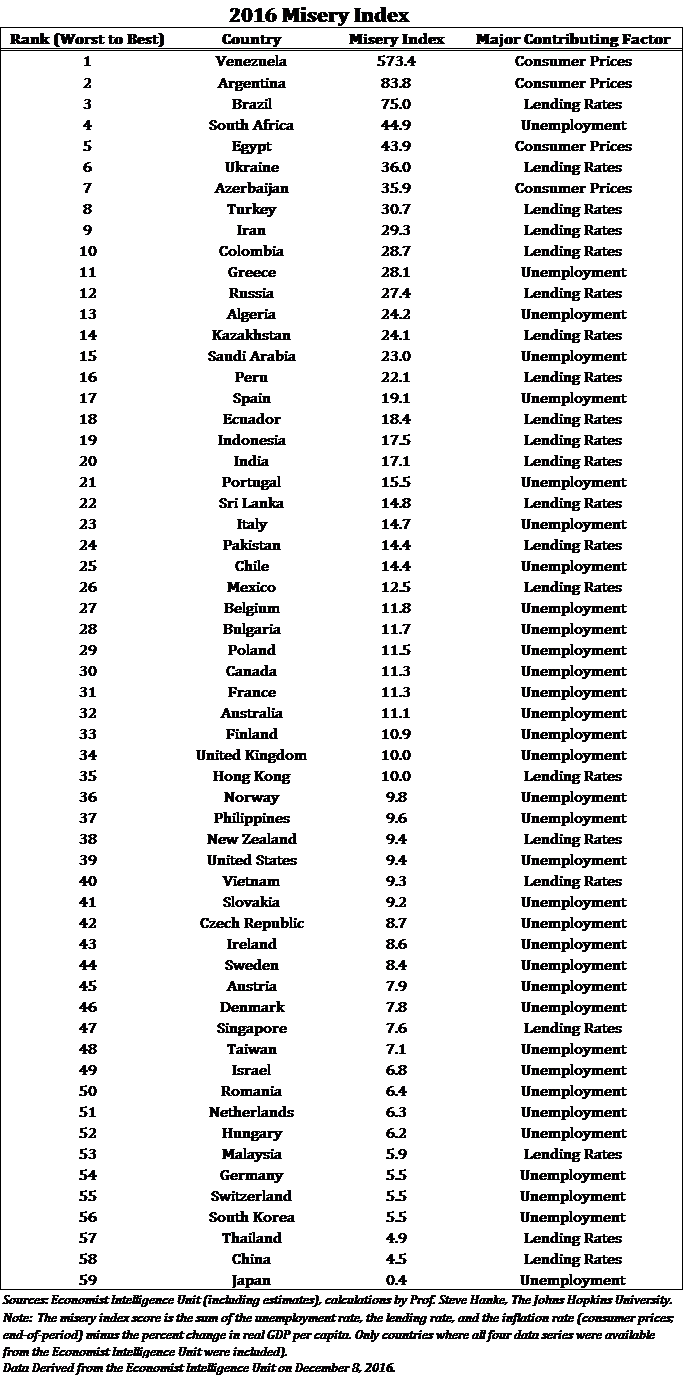

Below is the 2016 Misery Index table. For consistency and comparability, all data come from the Economist Intelligence Unit (EIU).

Venezuela holds the inglorious spot of most miserable country for 2016, as it did in 2015. The failures of the socialist, corrupt petroleum state have been well documented over the past year, including when Venezuela became the 57th instance of hyperinflation in the world.

Argentina holds down the second most miserable rank, and the reasons aren’t too hard to uncover. After the socialist Kirchner years, Argentina is transitioning away from the economy-wracking Kirchner policies, but many problematic residues can still be found in Argentina’s underlying economic framework.

Brazil, at number 3, is a hotbed of corruption and incompetence, as the recent impeachment of Brazilian President Dilma Rousseff indicates. It’s similar in South Africa, at number 4, where corruption runs to the very highest office. President Zuma of South Africa just recently survived impeachment after the Constitutional Court unanimously decided that Zuma failed to uphold the country’s constitution.

Egypt, ranked fifth most miserable, is mired in exchange controls, a thriving Egyptian pound black market, and military-socialist rule. However, Egypt is likely suffering even more than this table indicates, as the EIU’s inflation estimate for Egypt (17.8 percent) is far off from the Johns Hopkins-Cato Institute Troubled Currencies Project, which I direct, estimate of 150.7 percent.

Next, with a Misery Index score of 36.0, is Ukraine, a country still feeling the effects of the highly-publicized civil war that began three years ago. With a civil war and endemic corruption, it comes as a shock to no one that Ukrainians are miserable?

Azerbaijan is plagued by corruption, fraud, and incompetence, and currency devaluations are commonplace – the manat has been devalued twice since 2015, losing 57 percent of its value against the dollar. This weakness in the currency markets makes it difficult to do business, and the Azerbaijani economy has faltered as a result.

Turkey faces a despotic leader in Islamist Erdogan, who devotes all of his resources to staying in power rather than governing the state, leading to a strongly depreciating currency and a populous mired in fear. The Turkish lira has lost over 24 percent of its value against the dollar in the last year, and the economy is in the process of spontaneously dollarizing. Not surprisingly, Turkey is a member of the Fragile Five, which also include Brazil, India, Indonesia, and South Africa.

The reasons for Iran’s rank on this list are almost too obvious and plentiful to enumerate, but it’s safe to say that a combination of corruption, incompetence, theocratic-authoritarian rule, and more have led to its state of misery.

Rounding out the ten most miserable countries is Colombia. The Colombian government has been so preoccupied negotiating peace talks with the rebel FARC group that the economy has been neglected, causing interest rates to spike as the economy stands still.

On the other end of the table one finds Japan with the low score of 0.4. Japan’s low misery is not the result of high GDP per capita growth (Japan’s figure is only 0.7 percent), unlike most other countries at the bottom. Instead, it’s Japan’s ‑3.5 percent inflation rate that drives the score down. China is the next best, with the second-least miserable score of 4.5, almost entirely due to its high (6.3 percent) GDP per capita growth rate.

Also of note on this list is the United States. In President Obama’s final year in office, the United States ranked lower than Slovakia, Romania, Hungary, China, and even Vietnam. What a legacy.