Introduction

Understanding what caused the Great Depression of 1929-39 and why it persisted so long has been fairly characterized by Ben Bernanke as the “Holy Grail of Macroeconomics.” The fear that the financial crisis of 2008 would lead to a similar Depression induced the Fed to use its emergency powers to bail out failing firms and to more than quadruple the monetary base, while Congress authorized additional bailouts and doubled the national debt. Could the Great Recession have taken a similar turn had these extreme measures not been taken?

Economists have often blamed the Depression on U.S. monetary policy or financial institutions. Friedman and Schwartz (1963) famously argued that a spontaneous wave of runs against fragile fractional reserve banks led to a rise in the currency/deposit ratio. The Fed failed to offset the resulting fall in the money multiplier with base expansion, leading to a disastrous 24% deflation from 1929 to 1933. Through the short-run Phillips curve effect (Friedman 1968), this in turn led to a surge in unemployment to 22.5% by 1932.

The Debt-Deflation theory of Irving Fisher, and later Ben Bernanke (1995), takes the deflation as given, and blames the severity of the disruption on the massive bankruptcies that were caused by the increased burden of nominal indebtedness. Murray Rothbard (1963) uses the “Austrian” business cycle theory of Ludwig von Mises and F.A. Hayek to blame the downturn on excessive domestic credit expansion by the Fed during the 1920s that disturbed the intertemporal structure of production (cf. McCulloch 2014).

My own view, after pondering the problem for many decades, is that indeed the Depression was monetary in origin, but that the ultimate blame lies not with U.S. domestic monetary and financial policy during the 1920s and 30s. Rather, the massive deflation was an inevitable consequence of Europe’s departure from the gold standard during World War I -- and its bungled and abrupt attempt to return to gold in the late 1920s.

In brief, the departure of the European belligerents from gold in 1914 massively reduced the global demand for gold, leading to the inflation of prices in terms of gold -- and, therefore, in terms of currencies like the U.S. dollar which were convertible to gold at a fixed parity. After the war, Europe initially postponed its return to gold, leading to a plateau of high prices during the 1920s that came to be perceived as the new normal. In the late 1920s, there was a scramble to return to the pre-war gold standard, with the inevitable consequence that commodity prices -- in terms of gold, and therefore in terms of the dollar -- had to return to something approaching their 1914 level.

The deflation was thus inevitable, but was made much more harmful by its postponement and then abruptness. In retrospect, the UK could have returned to its pre-war parity with far less pain by emulating the U.S. post-Civil War policy of freezing the monetary base until the price level gradually fell to its pre-war level. France should not have over-devalued the franc, and then should have monetized its gold influx rather than acting as a global gold sink. Gold reserve ratios were unnecessarily high, especially in France.

However, given that the U.S. had a fixed exchange rate relative to gold and no control over Europe’s misguided policies, it was stuck with importing the global gold deflation -- regardless of its own domestic monetary policies. The debt/deflation problem undoubtedly aggravated the Depression and led to bank failures, which in turn increased the currency/deposit ratio and compounded the situation. However, a substantial portion of the fall in the U.S. nominal money stock was to be expected as a result of the inevitable deflation -- and therefore was the product, rather than the primary cause, of the deflation. The anti-competitive policies of the Hoover years and FDR’s New Deal (Rothbard 1963, Ohanian 2009) surely aggravated and prolonged the Depression, but were not the ultimate cause.

Contemporary economists Ralph Hawtrey, Charles Rist, and Gustav Cassel warned throughout the 1920s that substantial deflation, in terms of gold and therefore the dollar, would be required to sustain a return to anything like the 1914 gold standard.[1] In 1928, Cassel actually predicted that a global depression was imminent:

The post-War superfluity of gold is, however, of an entirely temporary character, and the great problem is how to meet the growing scarcity of gold which threatens the world both from increased demand and from diminished supply. We must solve this problem by a systematic restriction of the monetary demand for gold. Only if we succeed in doing this can we hope to prevent a permanent fall in the general price level and a prolonged and world-wide depression which would inevitably be connected with such a fall in prices [as quoted by Johnson (1997, p. 55)].

War and Peace

War is a very expensive enterprise, and governments often resort to printing money to help finance them. Under a gold standard, this may require a temporary suspension of convertibility to gold. After the war, the government will ordinarily have to either deflate back to the pre-war price level to restore the pre-war parity, or else devalue in proportion to their wartime inflation to get back on gold at a new parity (or some combination of the two). A credible promise to restore the pre-war standard after the war will increase the demand for paper money during the war -- and will reduce the inflation necessary to achieve a given real spending goal. Returning to the pre-war parity is thus more like a compulsory, interest-free loan to the government than pure inflationary finance.

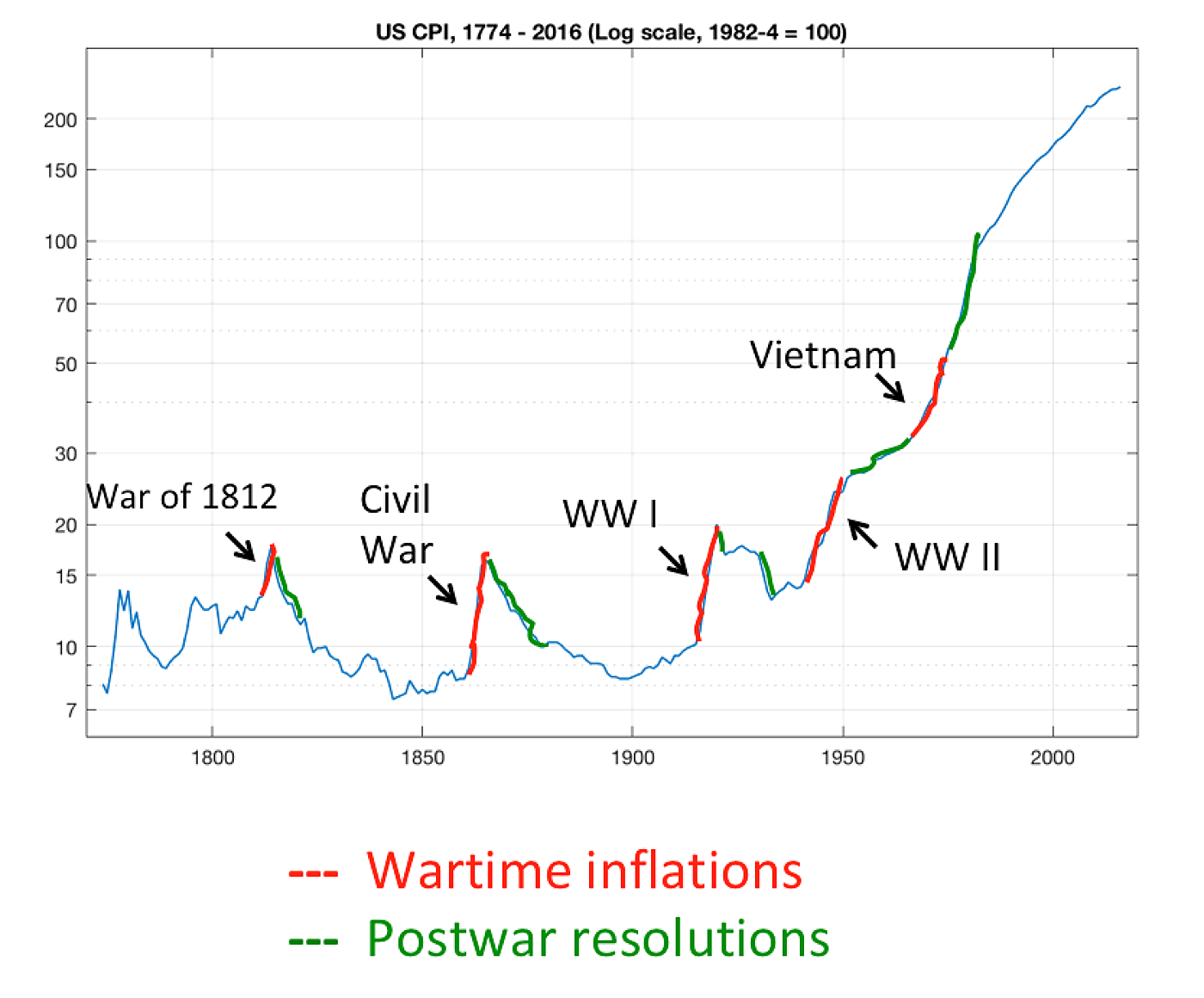

Figure 1 [2] shows two centuries of the U.S. price level. Major wartime experiences, marked in red, coincide with major inflations. Prior to World War II, these were followed by deflations, marked in green, which largely reversed the wartime inflation.

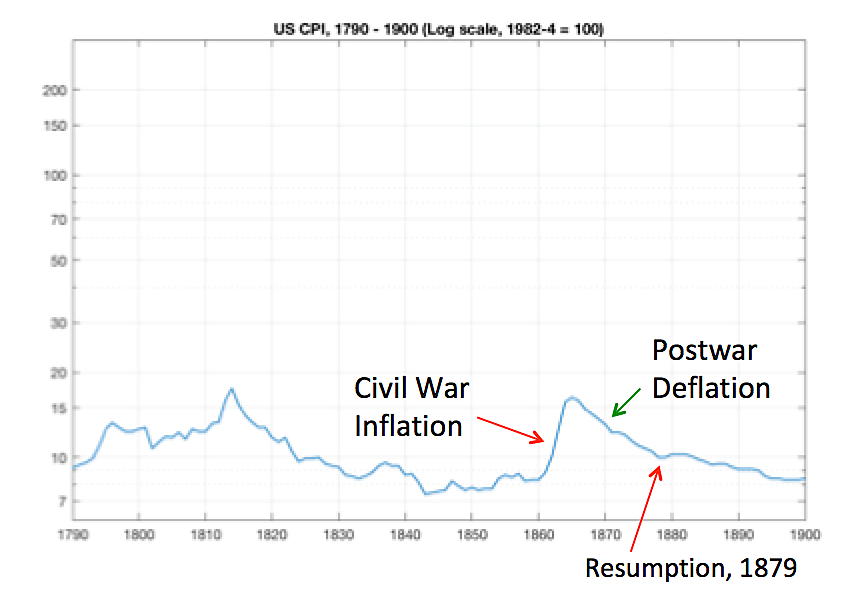

Figure 2 zooms in on the 19th century. From 1840 to 1900, the price level mostly hovered in the range 8.0 to 10.0 (1982-4 = 100), with the significant exception of the Civil War and post-Civil War period 1861-79. During the war (1861-65), the federal government printed paper money or “greenbacks” to pay troops and suppliers. At first, these were convertible at the Treasury for gold at the long-standing gold price of $20.67 per troy ounce. By the end of 1861, however, the Treasury was forced to suspend conversion. Paper dollars quickly fell to a discount, relative to gold, but Congress made them legal tender early in 1862. Gold coin and bank reserves were not seized by the government, as in 1933, but gold was nevertheless driven out of circulation by Gresham’s Law. By 1865, the volume of greenbacks had expanded to about $400 million, the general price level in terms of the greenback had risen by 85%, and a $1 gold coin sold for as much as $2.50 in paper.

To restore the greenback to gold at the pre-war parity, it was necessary to bring the price of gold back down to $20.67, and therefore to reduce the general price level back to approximately its 1861 level. Under the Contraction Act of 1866, the Treasury began retiring greenbacks at a rate of up to $4 million per month. If this had continued, there would have been a very sharp, if brief, deflation and a major post-war depression.

However, this act was repealed in 1868 and the quantity of greenbacks was simply frozen at $347 million. As the economy grew with a constant monetary base, there ensued a relatively gradual deflation (averaging 3.4% per year) until the “Resumption” of 1879, when the Treasury resumed gold conversion of the greenback at the pre-war parity of $20.67 per ounce. This gradual, yet substantial deflation was undoubtedly difficult for debtors and the labor market, but it was not as traumatic as a sudden deflation would have been.

World War I

Figure 3 looks at the 20th century. From 1900 to 1914, U.S. inflation averaged 1.3% per year, even with a peacetime gold standard. This “gold inflation” was primarily due to new gold discoveries in South Africa and elsewhere, along with the new cyanide process for extracting gold from low-grade ores.

In 1914, World War I broke out in Europe, and the belligerent countries did essentially what the U.S. had done during the Civil War -- they printed money, suspended gold convertibility, and then printed even more money, with the promise that they would restore the pre-war standard after victory. The European nations then used their gold stores to buy war materials from countries like the U.S., which remained neutral for the first three years of the war and remained on gold at $20.67 an ounce throughout. The resulting gold influx expanded the U.S. monetary base and money supply, leading to an “imported inflation” in the U.S. and in other countries remaining on gold.

Looked at differently, before the war, there were three primary sources of demand for gold: monetary demand in Europe, monetary demand in the U.S. and other neutral countries, and global non-monetary demand for uses like jewelry. When Europe went off gold, European monetary demand for gold temporarily disappeared. This abrupt reduction in the global demand for gold temporarily depressed the value of gold, and also the value of the dollar, in terms of commodities. Since U.S. real money demand was not directly affected by the inflation, a portion of the gold released by Europe temporarily went into the nominal money stocks and central bank reserves of the U.S. and other neutral countries and the remainder went into global non-monetary uses.

From 1914 to 1917, the U.S. inflation was not due to domestic inflationary finance, but was primarily an indirect consequence of the inflationary policies in Europe. It did not matter for U.S. inflation how much the European countries inflated, but rather how much gold they exported after they went off the gold standard.

The U.S. was in the war from 1917 to 1918, and the new Federal Reserve System began adding domestic inflation to the global gold inflation by discounting War Bonds. From 1914 to 1920, the U.S. price level roughly doubled, and inflation averaged 12.2% per year.

The Gold Exchange Standard

After the war, in order to stay on gold at $20.67 an ounce, with Europe off gold, the U.S. had to undo its post-1917 inflation. The Fed achieved this by raising the discount rate on War Bonds, beginning in late 1919, inducing banks to repay their corresponding loans. The result was a sharp 16% fall in the price level from 1920 to 1922. Unemployment rose from 3.0% in 1919 to 8.7% in 1921. However, nominal wages fell quickly, and unemployment was back to 4.8% by 1923, where it remained until 1929.[3]

The 1920-22 deflation thus brought the U.S. price level into equilibrium, but only in a world with Europe still off gold. Restoring the full 1914 gold standard would have required going back to approximately the 1914 value of gold in terms of commodities, and therefore the 1914 U.S. price level, after perhaps extrapolating for a continuation of the 1900-1914 “gold inflation.”

However, the European countries did not seriously try to get back on gold until the second half of the 1920s. The Genoa Conference of 1922 recognized that prices were too high for a full gold standard, but instead tried to put off the necessary deflation with an unrealistic “Gold Exchange Standard.” Under that system, only the “gold center” countries, the U.S. and UK, would hold actual gold reserves, while other central banks would be encouraged to hold dollar or sterling reserves, which in turn would only be fractionally backed by gold. The Gold Exchange Standard sounded good on paper, but unrealistically assumed that the rest of the world would permanently kowtow to the financial supremacy of New York and London.

Like the U.S. after the Civil War, Britain felt honor-bound to restore its pre-war parity, but unfortunately this was done prematurely in 1925 -- before prices and wages had adequately deflated. This left the pound overvalued and the Bank of England (BOE) saddled with a balance of payments deficit as it struggled to retain gold reserves. The UK fought back with very tight money, but then offset the deflationary effect with protective tariffs. Tariffs, by taxing the import of everything but gold, do raise the equilibrium domestic commodity price level relative to gold. However, the whole advantage of having a currency unit that is convertible into a lot of gold is that it allows consumers to purchase a lot of foreign goods with their money. Taxing those imports to support an unrealistic exchange rate thus defeats the very purpose of a strong currency.

Relieved of the moral obligations of victory, Germany and Austria hyperinflated in 1919-23, instead of making any attempt to restore their pre-war parities or even stabilize their price levels. France deflated somewhat between 1919 and 1922, but then inflated to almost double 1919 wholesale prices by 1926 (Johnson 1997, p. 74). It does appear, however, that these inflations did give the public an understandable distrust of paper money and a sense of urgency to get back on gold as soon as possible.

Germany stabilized the Reichsmark in 1924, with a legal requirement of 40% foreign exchange or gold reserves, at least 3/4 of which had to be in gold, contrary to the spirit of the Gold Exchange Standard. The following year, Reichsbank president Hjalmar Schacht independently went even further by announcing that the bank would henceforth accumulate only gold rather than dollar or sterling reserves (Johnson 1997, p. 115).

In 1926, under Raymond Poincaré, France stabilized the franc after a 5:1 devaluation. However, it overdid the devaluation, leaving the franc undervalued by about 25%, according to The Economist (Johnson 1997, p. 131). Normally, under the specie flow mechanism, this would have led to a rapid accumulation of international reserves accompanied by monetary expansion and inflation, until the price level caught up with purchasing power parity. But instead, the Banque de France sterilized the reserve influx by reducing its holdings of government and commercial credit, so that inflation did not automatically stop the reserve inflow. Furthermore, it often cashed dollar and sterling reserves for gold, again contrary to the Gold Exchange Standard. The Banking Law of 1928 made the new exchange rate, as well as the gold-only policy, official. By 1932, French gold reserves were 80% of currency and sight deposits (Irwin 2012), and France had acquired 28.4% of world gold reserves -- even though it accounted for only 6.6% of world manufacturing output (Johnson 1997, p. 194). This “French Gold Sink” created even more deflationary pressure on gold, and therefore dollar prices, than would otherwise have been expected.

The Second Post-War Deflation

By 1931, French gold withdrawals forced Germany to adopt exchange controls, and Britain to give up convertibility altogether. However, these countries did not then disgorge their remaining gold, but held onto it in the hopes of one day restoring free convertibility. Meanwhile, after having been burned by the Bank of England’s suspension, the “Gold Bloc” countries -- Belgium, Netherlands and Switzerland -- also began amassing gold reserves in earnest, raising their share of world gold reserves from 4.2% in June 1930 to 11.1% two years later (Johnson 1997, p. 194). Despite the dollar’s relatively strong position, the Fed also contributed to the problem by raising its gold coverage ratio to over 75% by 1930, well in excess of the 40% required by law (Irwin 2012, Fig. 5).

The result was a second post-war deflation as the value of gold, and therefore of the dollar, in terms of commodities, abruptly caught up with the greatly increased global demand for gold. The U.S. price level fell 24.0% between 1929 and 1933, with deflation averaging 6.6% per year for 4 years in a row. Unemployment shot up to 22.5% by 1932.

By 1933, the U.S. price level was still well above its 1914 level. However, if the “gold inflation” of 1900-1914 is extrapolated to 1933, as in Figure 3, the trend comes out to almost the 1933 price level. It therefore appears that the U.S. price level, if not its unemployment rate, was finally near its equilibrium under a global gold standard with the dollar at $20.67 per ounce, and that further deflation was probably unnecessary.[4]

The 1929-33 deflation was much more destructive than the 1920-22 deflation, in large part because it followed a 7-year “plateau” of relatively stable prices that lulled the credit and labor markets into thinking that the higher price level was the new norm -- and that gave borrowers time to accumulate substantial nominal debt. In 1919-1920, on the other hand, the newly elevated price level seemed abnormally high and likely to come back down in the near future, as it had after 1812 and 1865.

Thus, although the onset of the Depression was monetary in origin, it was not the fault of the Fed’s domestic monetary policy as per Friedman and Schwartz or Rothbard, but rather was caused by the European countries’ resolution of their World War I inflations. To be sure, the debt/deflation bankruptcy mechanism of Fisher and Bernanke aggravated the Phillips Curve effect of the deflation. Furthermore, the resulting loan defaults led to bank failures, loss of confidence in the banks, and a rise in the currency/deposit ratio per Friedman and Schwartz. However, it is not clear that the ensuing contraction of the U.S. nominal money supply was any more than was appropriate, given the externally caused and inevitable deflation. As Rothbard (1963) and Ohanian (2009) have pointed out, the Depression was needlessly aggravated and extended by the anticompetitive “New Deal” policies of the Hoover and FDR administrations, but these policies were in response to the pre-existing Depression rather than its cause. Deficit-suppressing, protective tariffs, including pre-eminently America’s Smoot-Hawley Tariff, greatly compounded the depression -- but these were often an outcome of the struggle to get or stay on gold.

How It Could Have been Different

In retrospect, the UK could have successfully gotten itself back on gold with far less disruption simply by emulating the U.S. post-Civil War policy of freezing the monetary base at its war-end level, and then letting the economy grow into the money supply with a gradual deflation. This might have taken 14 years, as in the U.S. between 1865-79, or even longer, but it would have been superior to the economic, social, and political turmoil that the UK experienced. After the pound rose to its pre-war parity of $4.86, the BOE could have begun gradually buying gold reserves with new liabilities and even redeeming those liabilities on demand for gold, subject to reserve availability. Once reserves reached say 20% of its liabilities, it could have started to extend domestic credit to the government and the private sector through the banks, while still maintaining convertibility. Gold coins could even have been circulated, as demanded.

If other countries had followed a similar policy, with or without first devaluing, the global demand for gold would have only grown gradually, rather than abruptly. The U.S. would have had a steady gold outflow and/or deflation, as other countries built their gold reserves and coinages. And the episode would have been an historical footnote rather than the defining economic catastrophe of the inter-war period.

If the UK and other countries had all simply devalued in proportion to their domestic price levels at the end of the war, they could have returned to gold quicker, and with less deflation. However, given that a country’s real demand for money -- and therefore its demand for real gold reserves -- depends only on the real size of the economy and its net gold reserve ratio, such policies would not have reduced the ultimate global demand for gold or lessened the postwar deflation in countries that remained on gold at a fixed parity. The significant downside of such a devaluation, or of a similar policy in the U.S. after the Civil War, is that it would have betrayed the confidence of the note holders and bondholders whose trust helped finance the war. If correctly foreseen, such a policy would have reduced the wartime demand for paper money, and therefore caused even higher wartime inflation.

Lower gold reserve ratios for central bank liabilities could have greatly reduced the total global demand for gold, and therefore the gold deflation that was necessary to restore a global gold standard. Unfortunately, however, there was often a misguided assumption that central banks (and private banks) should suspend redemptions whenever the legal reserve requirement was not met. This gave them an incentive to hold a substantial amount of excess, or “free,” reserves over and above the legal requirement. Instead, it should have been understood that a bank is obligated to meet its demand liabilities, so long as it has any reserves at all, and that a “reserve requirement” means that it may extend or renew credit to the government and/or the private sector only if it has reserves in excess of the “required” level. This would automatically freeze the base, and even contract it as assets were repaid, whenever there was a reserve deficiency. It would put real teeth into the reserve requirement without unnecessary suspensions. The central bank could permanently maintain a small inventory of excess reserves by appropriately raising or lowering its discount rate whenever this inventory became excessively small or large.

H. Clark Johnson views the non-monetary demand for gold as a destabilizing factor during the 1920s and points a particularly accusatory finger at India (pp. 46-8). However, the non-monetary demand for gold actually stabilizes prices under a gold standard, since it will reduce the inflation that occurs when monetary demand is reduced (as during the early 1920s), and its reversal will mitigate the deflation that occurs when monetary demand has increased (as at the end of the 1920s and early 1930s).

Johnson repeatedly argues that the problem was the “undervaluation” of gold at $20.67 an ounce, and calls for the U.S. to have devalued the dollar in 1922, or even 1919, to prevent deflation (e.g. p. 157). However, had the mint price of gold been increased to around $35 an ounce in 1922, with the rest of the world still off gold, even more gold would have poured into the U.S. from all over the world. This would have raised the U.S. price level again roughly in proportion, making it that much more difficult for the rest of the world to acquire gold reserves. As the world did eventually get back on gold at whatever parities, gold demand would have risen again, and the U.S. would still have experienced a deflation, albeit from its newly elevated price .

In fact, the problem was not that gold was “undervalued” (as Johnson puts it) or that there was a “shortage” of gold (as per Cassel and others), but that the price level in terms of gold, and therefore dollars, was simply unsustainably high given Europe’s determination to return to gold. In any event, it was inconceivable that the U.S. would have devalued in 1922, since it had plenty of gold, had already corrected its price level to the world situation with the 1920-22 deflation, and did not have the excuse of a banking crisis as in 1933.

2008 Revisited

This leads to the question of whether the 2008 financial crisis would likely have spiraled into another Great Depression in the absence of the extraordinary monetary, fiscal, and financial measures that were taken. The unequivocal answer is No. In 2008, the U.S. was not on a gold standard, and the world had not just gone through the unique historical experience of World War I, so that there was absolutely no reason to expect a reprise of the Great Depression.

For several years before the 2008 crisis, the financial sector, led by the Government Sponsored Enterprises, Fannie Mae and Freddie Mac, had indulged in reckless mortgage underwriting standards, with the result that by 2008 several large firms were economically bankrupt. The simple solution would have been to wipe out the equity of the responsible firms -- including Fannie, Freddie, and a few large financial holding companies -- and then mark down the debt held by the creditors who carelessly enabled this lending. The flagship commercial banks whose shares were held by these financial holding companies might have had new owners, but their own operations and capital would not have been interrupted, so long as the “firewalls” promised by the 1999 Gramm-Leach-Bliley Act were actually in place. Wall Street would have been sadder, but wiser, and life would have gone on.

The panicky monetary, fiscal, and financial measures that were actually taken in response to the 2008 financial crisis therefore cannot be justified by the experience of the Great Depression.

____________________

[1] Johnson (1997), Mundell (2000). I am thankful to George Selgin for calling my attention to Johnson’s very informative book.

[2] David-Solar consumer price index pre-1912, linked to BLS after, via Historical Statistics of the United States.

[3] Christina Romer (1986). Stanley Lebergott’s often-quoted 1964 figures are more extreme: 1.4% in 1919, 11.7% in 1921, 2.4% in 1923, but Romer makes a good case that his limited data over-stated the fluctuation.

[4] Johnson (1997, pp. 53-4) points out that gold production was somewhat discouraged during the 1920s, and in particular before 1922, by the low real value of gold. However, once discoveries like the Witwatersrand and innovations like the cyanide process were in place, they continued to produce abundant quantities of gold cheaply, so that the underlying gold inflation trend likely continued, though perhaps at a slower rate than before the war.

References

Ben Bernanke (1995), “The Macroeconomics of the Great Depression: A Comparative Approach,” Journal of Money, Credit and Banking 27, No. 1.

Milton Friedman and Anna Schwartz (1963), Monetary History of the United States, NBER, esp. Ch. 7, “The Great Contraction.”

Milton Friedman (1968), “The Role of Monetary Policy,” American Economic Review 58: 1017.

Douglas Irwin (2012), “The French Gold Sink and the Great Deflation of 1929-32,” Cato Papers on Public Policy 2: 1-41.

H. Clark Johnson (1997), Gold, France, and the Great Depression, 1919-1932. Yale University Press.

Huston McCulloch (2014), “Misesian Insights for Modern Macroeconomics,” Quarterly Journal of Austrian Economics 17: 3-18.

Robert A. Mundell (2000), “A Reconsideration of the Twentieth Century,” American Economic Review 90 (3): 327-40.

Disclaimer

This post was originally published at Alt‑M.org. The views and opinions expressed here are those of the author(s) and do not necessarily reflect the official policy or position of the Cato Institute. Any views or opinions are not intended to malign, defame, or insult any group, club, organization, company, or individual.

All content provided on this blog is for informational purposes only. The Cato Institute makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. Cato Institute, as a publisher of this article, shall not be liable for any misrepresentations, errors or omissions in this content nor for the unavailability of this information. By reading this article and/or using the content, you agree that Cato Institute shall not be liable for any losses, injuries, or damages from the display or use of this content.