A Time article by James Grant warning about rising federal debt has prompted pushback by columnists questioning whether debt is really so bad. At the Washington Post, Wonkblog columnist Matt O’Brien says “there’s no reason to cut the debt today.” Fellow Wonkblog columnist Max Ehrenfreund suggests that Grant’s figure of $42,998 government debt per person overstates the problem.

O’Brien suggests that the only reason to fear debt would be if it was leading to a financial crisis, but it isn’t because interest rates are low. But O’Brien neglects to mention that interest rates may rise substantially in coming years. CBO projects that as rates rise, federal interest costs will triple from $253 billion this year to $839 billion by 2026.

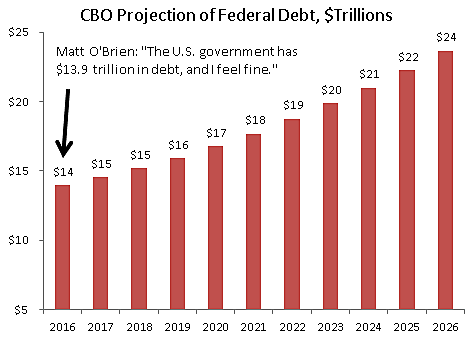

As for Ehrenfreund, he is right that $42,998 overstates the debt problem because it does not take into account our future rising population. At the same, however, $42,998 understates the problem because each year the government adds more debt. Over the next 10 years, the U.S. population will grow 8 percent, but the CBO says federal debt will rise 69 percent. So Grant’s simple debt metric will increase over time.

Other than possibly causing a financial crisis, rising federal debt creates other harms:

- Raises Future Taxes. Taxes damage the economy by reducing incentives for productive activities, a harm called deadweight losses. With borrowing, the deadweight losses from taxes are moved to the future when taxes are raised to pay the interest and principal on the debt. So the damage from borrowing is imposed on people down the road because that is when the government will use its coercive power to extract the extra money.

- Reduces National Saving. Rising debt may crowd out private investment, reduce the U.S. capital stock, and thus reduce future incomes. Economist James Buchanan said, “By financing current public outlay by debt, we are, in effect, chopping up the apple trees for firewood, thereby reducing the yield of the orchard forever.” Such a decline in investment may be averted if private saving rises to offset government deficits. But the CBO says, “the rise in private saving is generally a good deal smaller than the increase in federal borrowing, so greater federal borrowing leads to less national saving.”

- Saps Business Confidence. Rising government debt may also deter private investment through the mechanism of business expectations. Businesses may be reluctant to make long-term investments, such as building new factories, if high and rising government debt creates a fear of tax increases down the road.

- Siphoned to Pay Foreigners. Some pundits, such as Paul Krugman, tell us not to worry about government debt because we “owe it to ourselves.” But today about half of federal debt is owed to foreigners. So growing debt means that a rising share of the future earnings of U.S. workers will be siphoned off by the government to repay foreign creditors.

- Distorts Government Decisionmaking. The availability of debt finance may induce policymakers to increase spending excessively. Since borrowing makes programs appear to be “free” to citizens and policymakers, the government has less incentive to be frugal, and is more likely to spend on low-value programs.

Wonkblog’s O’Brien says he “feels fine” about today’s $13.9 trillion of debt. But how about tomorrow’s $24 trillion, as shown in the chart? And what if America has further recessions, wars, and other negative shocks, and it becomes $30 trillion? Surely, in today’s uncertain world, we want our policymakers to err on the side of prudence, and so debt growth measured in trillions makes me feel far from fine.

For a brief history of federal debt and why it is a major problem, see this 2015 report.