Paul Krugman recently tried to declare victory for Keynesian economics over so-called austerity, but all he really accomplished was to show that tax-financed government spending is bad for prosperity.

More specifically, he presented a decent case against the European-IMF version of “austerity,” which has produced big tax increases.

But what happens if nations adopt the libertarian approach, which means “austerity” is imposed on the government, rather than on taxpayers?

In the past, Krugman has also tried to argue that European nations have erred by cutting spending, but this has led to some embarrassing mistakes.

- He asserted that “British growth has stalled” because of “spending cuts,” but he overlooked the elementary fact that government spending in the U.K. was growing twice as fast as inflation.

- And in the case of Estonia, where there actually were genuine spending cuts, he wanted people to somehow think that those cuts in 2009 were responsible for an economic downturn that occurred in 2008.

Now we have some additional evidence about the absence of spending austerity in Europe. A leading public finance economist from Ireland, Constantin Gurdgiev, reviewed the IMF data and had a hard time finding any spending cuts:

…in celebration of that great [May 1] socialist holiday, “In Spain, Portugal, Greece, Italy and France tens of thousands of people took to the streets to demand jobs and an end to years of belt-tightening”. Except, no one really asked them what did the mean by ‘belt-tightening’. …let’s check out expenditure side of Europe’s ‘savage austerity’ story… The picture hardly shows much of any ‘savage cuts’ anywhere in sight.

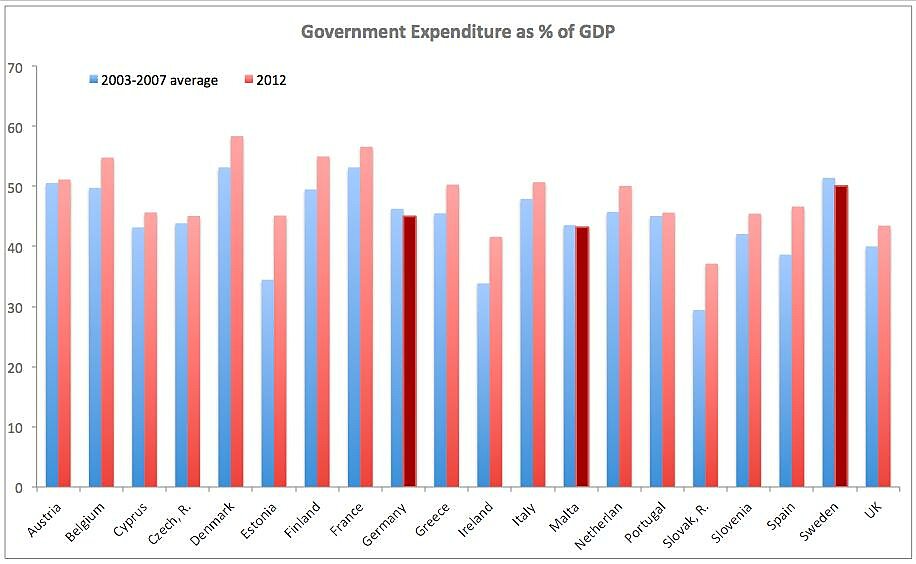

As seen in his chart, Constantin compared government spending burdens in 2012 to the average for the pre-recession period, thus allowing an accurate assessment of what’s happened to the size of the public sector over a multi-year period.

Here are some of his conclusions from reviewing the data:

Of the three countries that experienced reductions in Government spending as % of GDP compared to the pre-crisis period, Germany posted a decline of 1.26 percentage points (from 46.261% of GDP average for 2003–2007 period to 45.005% for 2012), Malta posted a reduction of just 0.349 ppt and Sweden posted a reduction of 1.37 ppt.

No peripheral country — where protests are the loudest — or France et al have posted a reduction. In France, Government spending rose 3.44 ppt on pre-crisis level as % of GDP, in Greece by 4.76 ppt, in Ireland by 7.74 ppt, in Italy by 2.773 ppt, in Portugal by 0.562 ppt, and in Spain by 8.0 ppt.

Average Government spending in the sample in the pre-crisis period run at 44.36% of GDP and in 2012 this number was 48.05% of GDP. In other words: it went up, not down.

…All in, there is no ‘savage austerity’ in spending levels or as % of GDP.

I’ll add a few additional observations.

Sweden and Germany are among the three nations that have reduced the burden of government spending as a share of GDP, and both of those nations are doing better than their European neighbors.

Switzerland isn’t an EU nation, so it’s not included in Constantin’s chart, but government spending as a share of economic output also has been reduced in that nation over the same period, and the Swiss economy also is doing comparatively well.

The moral of the story is that reducing the burden of government spending is the right recipe for sustainable and strong growth. Growth also is far more likely if lawmakers refrain from class-warfare tax policy and instead seek to collect revenue in ways that minimize the damage to prosperity.

Unfortunately, that’s not happening in Europe…and it’s not happening in the United States.

A few countries are moving in the right direction, such as Canada, but with still a long way to travel.

The best role models are still Hong Kong and Singapore, and it’s no coincidence that those two jurisdictions regularly dominate the top two spots in the Economic Freedom of the World rankings.