My post yesterday discussed voting on state and local government bonds. I argued that funding routine government spending by debt is misguided, and that issuing debt this year is a particularly bad idea because governments are already flush with cash and interest rates are rising.

Voters usually reject tax increases at the ballot box, but they usually approve the passage of bonds—often by large margins of around 75–25. Apparently, voters do not realize that general obligation bonds are equivalent to tax hikes.

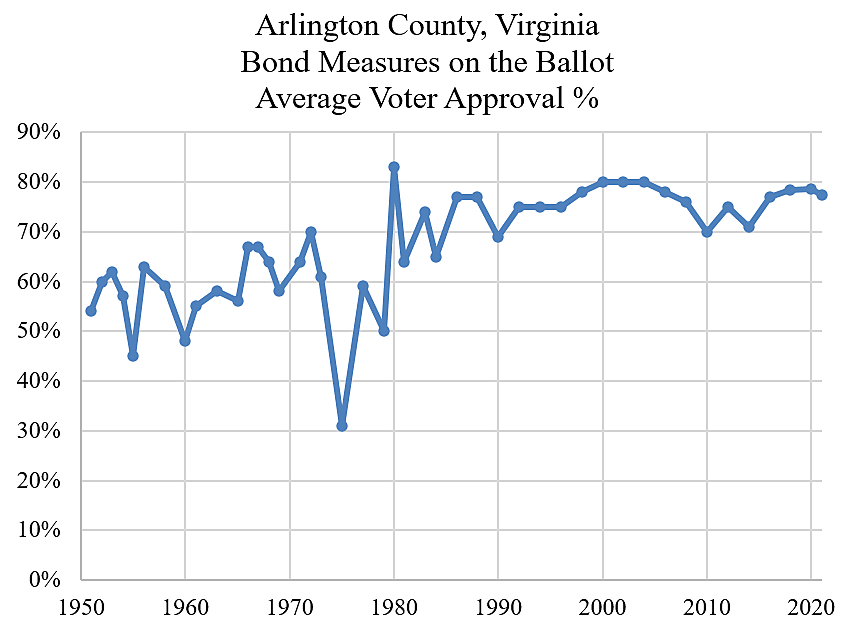

Voters in Arlington County, Virginia, will decide today on six bonds to fund schools, parks, and other items. Interesting, the county has posted its bond election results back to 1951. Not every year has a bond election, and some years have multiple bonds on the ballot.

The chart shows that the average bond passage rate has risen substantially since the 1950s, although it has leveled out in recent decades. The average passage rate increased from 58 percent (1951–1979) to 75 percent (1980–2021).

Arlington voters have become more supportive of government debt, or maybe less aware of the risks and costs. I wonder whether that is true nationwide? Is federal government debt so high today because congressional budgeting is broken or because Americans have become more tolerant of debt?

One caveat: The share of Arlington’s population voting on bond issues has increased over the decades, which could be a cause of the changing results.