The Inflation Reduction Act being considered by Congress would vastly expand the Internal Revenue Service. The IRS currently has 82,000 employees, and the legislation would boost the number by roughly 87,000, according to a related Treasury estimate (Table 3).

Of the $80 billion increased IRS funding in the Act, $46 billion would go to enforcement. That expansion promises to damage small- and medium-sized businesses and undermine civil liberties. Politicians complain about tax cheats, but noncompliance is low in the United States compared to other countries.

All those new IRS employees would undermine GDP rather than producing it. But that would be only part of the waste. Another cost would be the increased time and energy needed by taxpayers, lawyers, and accountants to defend against a more aggressive IRS.

The Inflation Reduction Act adds or expands a slew of special-interest tax breaks and creates a parallel corporate tax structure based on financial statement income. Those misguided changes would also increase tax compliance costs on the private sector.

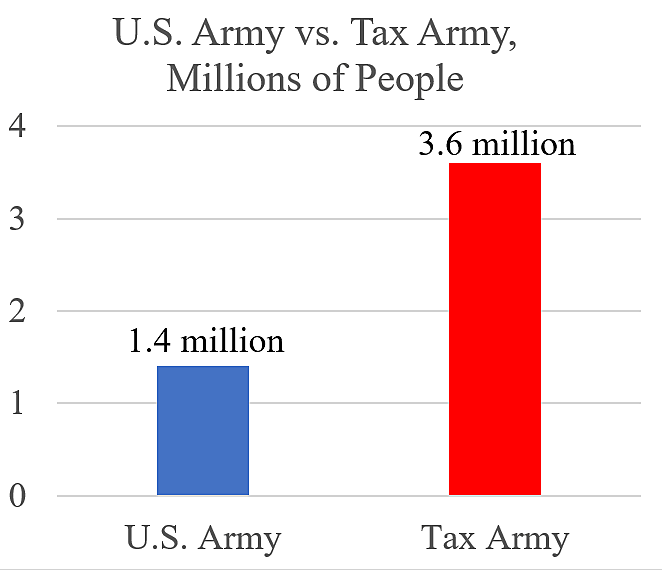

The Office of Management and Budget estimates that individuals and businesses currently spend 6.5 billion hours a year on federal tax paperwork, which is equivalent to 3.6 million people working full-time on this unproductive activity. That “Tax Army” is two and half times larger than our uniformed military of 1.4 million service members, as shown in the chart.

The Inflation Reduction Act will prompt an expansion in the private-sector Tax Army. If the Tax Army expands even 10 percent, that would be 140,000 more Americans consumed in unproductive paperwork, tax planning, and IRS defense activities.

Congress has created a tax code at war with growth and efficiency. The government needs to collect adequate revenue, but we could reduce the compliance burden by 90 percent if we replaced the income tax with a consumption-based flat tax. We could demobilize most of the Tax Army and put people back to work adding to the nation’s economy.