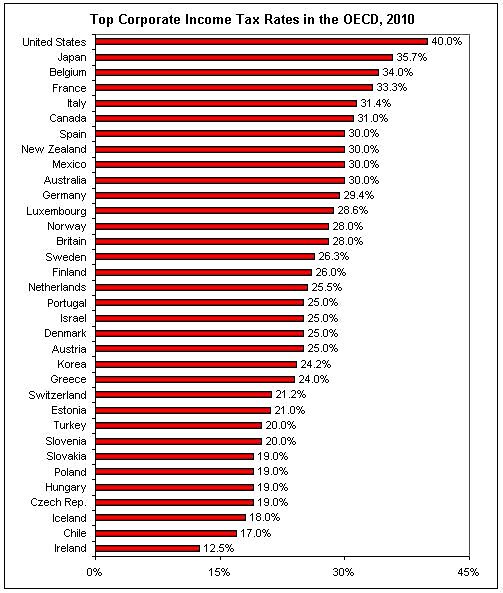

Japan has announced that it will cut its corporate tax rate by five percentage points. Japan and the United States had been the global laggards on corporate tax reform, so this leaves America with the highest corporate rate among the 34 wealthy nations of the Organization for Economic Cooperation and Development.

That is not a good position for us to be in. Most of the competition faced by U.S. businesses comes from businesses headquartered in other OECD countries. America also competes with other OECD nations as a location for investment. Our high corporate tax rate scares away investment in new factories, makes it difficult for U.S. companies to compete in foreign markets, and provides strong incentives for corporations to avoid and evade taxes.

The chart shows KPMG data on statutory corporate tax rates in the OECD for 2010, but I’ve also put in the new lower rate for Japan. With the Japanese reform, the average rate in the OECD will be 25.6 percent. That means that the 40 percent U.S. rate is 56 percent higher than the wealthy-nation average.

Most fiscal experts agree that cutting the U.S. corporate tax rate is a high priority, and President Obama’s fiscal commission endorsed the idea. If the president wants to get the economy firing on all cylinders–and generate a new pragmatic and centrist image for himself–he should lead the charge to drop the corporate rate to at least 20 percent.

With state-level taxes on top, a federal corporate rate of 20 percent would put America at about the OECD average, and give all those corporations sitting on piles of cash a great reason to start investing again.

Dan Mitchell’s comments are here.

Buy Global Tax Revolution here.