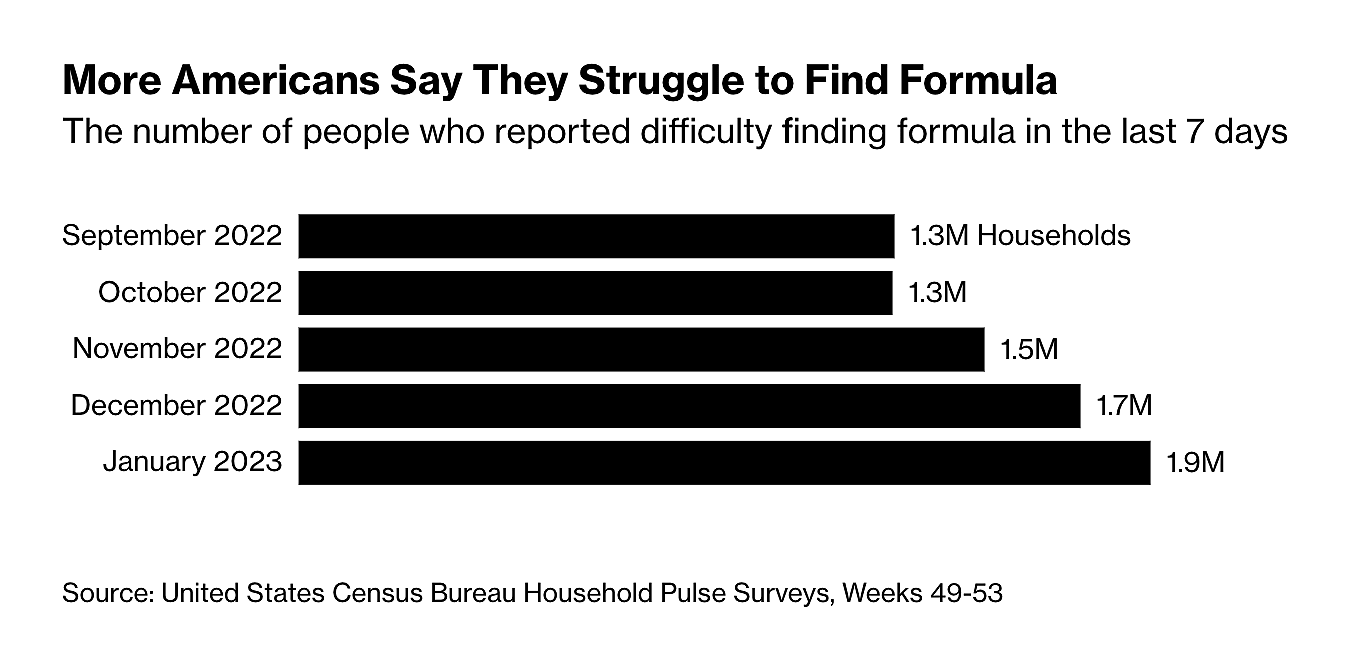

Bloomberg reports that yet another baby formula recall is stressing the U.S. market—and American parents. As major producer Reckitt voluntarily pulled 145,000 cans of its Enfamil brand formula (to guard against “potential cross-contamination with bacteria”), the U.S. Census Bureau’s Household Pulse Survey reports that American households have experienced increased difficulty finding baby formula in stores around the country:

(Chart credits to Bloomberg)

As we explained in a January briefing paper and related Wall Street Journal piece last week, the U.S. formula market remains highly vulnerable to another economic shock because government policies actively discourage dynamism, competition, and resiliency. Tariffs and non-tariff barriers block imports from almost every country in the world, including those with highly-competent regulatory regimes (e.g., in Europe, the UK, and New Zealand) and products that American families really want. Extraordinary domestic regulations and restrictive government contracts (via the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC)) create a major barrier to new U.S. players and amplify a few large companies’ market power. Combined, these policies created a U.S. market that crumbled when a single factory went offline a year ago and still hasn’t recovered.

Making matters worse, most of the emergency measures enacted by Congress and the executive branch to provide relief to families—measures targeting the aforementioned policy problems—have either expired or are close to doing so. Most notably tariff rate quotas on imported formula, suspended in July, were reinstated on January 1, making it even more difficult for consumers to adjust to shortfalls in domestic production through increased imports. While the FDA allowed imports of pre-qualified formula under relaxed regulatory enforcement in 2022, since January 6 it only allows foreign companies that previously indicated their intent to permanently enter the U.S. market to continue shipping their products under this regime. Finally, waivers to regulations prescribed by the WIC program will begin to expire on February 28, further limiting participating families’ ability to purchase alternatives to the only WIC-approved brand.

As we explained in our paper and in the Journal, last year’s crisis provided a roadmap for policymakers to enact fundamental, long-term reforms that would ensure a more resilient baby formula market. Unfortunately, the federal government has not yet taken that opportunity, and now another shock could be on the horizon. Indeed, Reckitt is the second-largest domestic producer of formula, with a 20.57 percent market share. Abbott Laboratories—whose factory closure a year ago fueled the formula crisis—is the largest. Hopefully, the Reckitt recall will not expand and thus exacerbate current market difficulties. That we must rely on hope, however, is an unfortunate consequence of congressional inaction.

When will Washington finally learn its lesson?