To make fun of big efforts that produce small results, the Roman poet Horace wrote, “The mountains will be in labor, and a ridiculous mouse will be brought forth.”

That line sums up my view of the new tax reform plan introduced by Rep. Dave Camp (R‑Mich.), chairman of the House Ways and Means Committee.

To his credit, Chairman Camp put in a lot of work. But I can’t help but wonder why he went through the time and trouble. To understand why I’m so underwhelmed, let’s first go back in time.

Back in 1995, tax reform was a hot issue. The House Majority Leader, Dick Armey, had proposed a flat tax. Congressman Billy Tauzin was pushing a version of a national sales tax. And there were several additional proposals jockeying for attention.

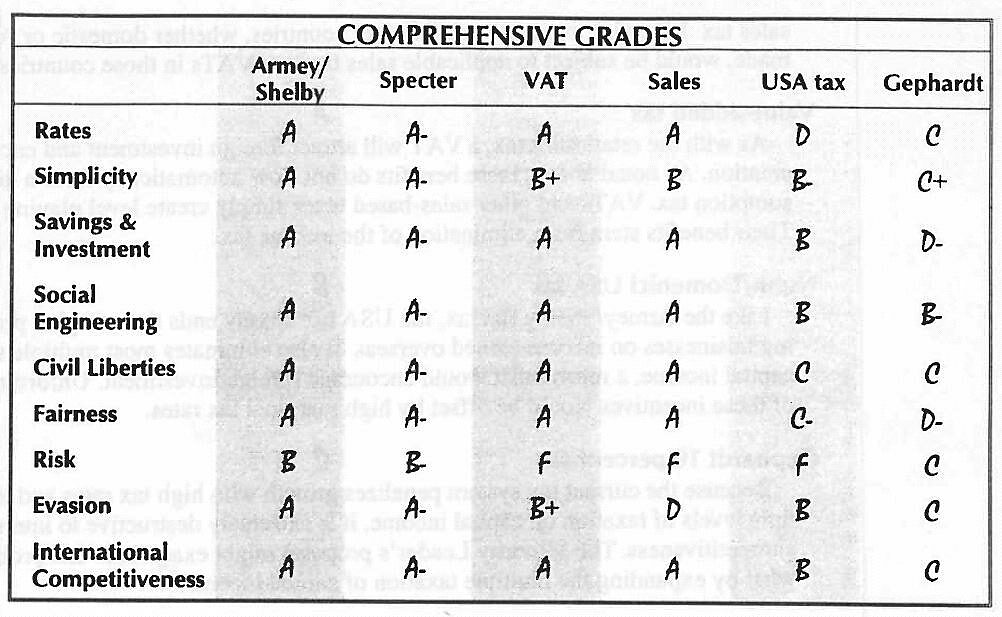

To make sense of the clutter, I wrote a paper for the Heritage Foundation that demonstrated how to grade the various proposals that had been proposed.

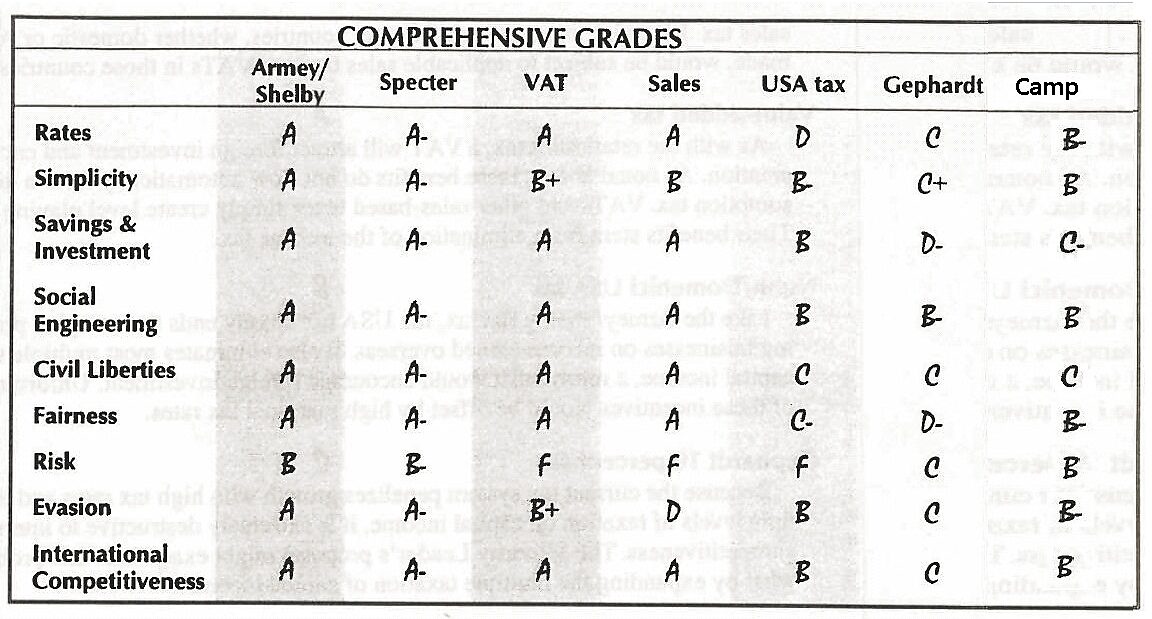

As you can see, I included obvious features such as low tax rates, simplicity, double taxation, and social engineering, but I also graded plans based on other features such as civil liberties, fairness, and downside risk.

There obviously have been many new plans since I wrote this paper, most notably the Fair Tax (a different version of a national sales tax than the Tauzin plan), Simpson-Bowles, the Ryan Roadmap, Domenici-Rivlin, the Heritage Foundation’s American Dream proposal, the Baucus-Hatch blank slate, and—as noted above—the new tax reform plan by Chairman Camp.

Given his powerful position as head of the tax-writing committee, let’s use my 1995 methodology to assess the pros and cons of Camp’s plan.

Rates: The top tax rate for individual taxpayers is reduced from 39.6 percent to 35 percent, which is a disappointingly modest step in the right direction. The corporate tax rate falls from 35 percent to 25 percent, which is more praiseworthy, though Camp doesn’t explain why small businesses (which file using the individual income tax) should pay higher rates than large companies.

Simplicity: Camp claims that he will eliminate 25 percent of the tax code, which certainly is welcome news since the code has swelled to 70,000-plus pages of loopholes, exemptions, deductions, credits, penalties, exclusions, preferences, and other distortions. And his proposal does eliminate some deductions, including the state and local tax deduction (which perversely rewards states with higher fiscal burdens).

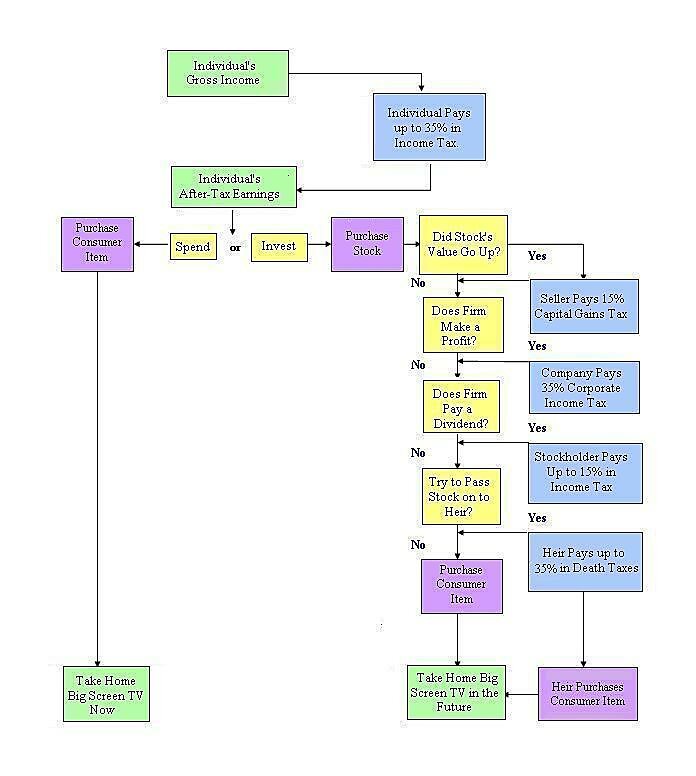

Saving and Investment: Ever since Reagan slashed tax rates in the 1980s, the most anti-growth feature of the tax code is probably the pervasive double taxation of income that is saved and invested. Shockingly, the Camp plan worsens the tax treatment of capital, with higher taxation of dividends and capital gains and depreciation rules that are even more onerous than current law.

Social Engineering: Some of the worst distortions in the tax code are left in place, including the health care exclusion for almost all taxpayers. This means that people will continue to make economically irrational decisions solely to benefit from certain tax provisions.

Civil Liberties: The Camp plan does nothing to change the fact that the IRS has both the need and power to collect massive amounts of private financial data from taxpayers. Nor does the proposal end the upside-down practice of making taxpayers prove their innocence in any dispute with the tax authorities.

Fairness: In a non-corrupt tax system, all income is taxed, but only one time. On this basis, Camp’s plan is difficult to assess. Loopholes are slightly reduced, but double taxation is worse, so it’s hard to say whether the system is more fair or less.

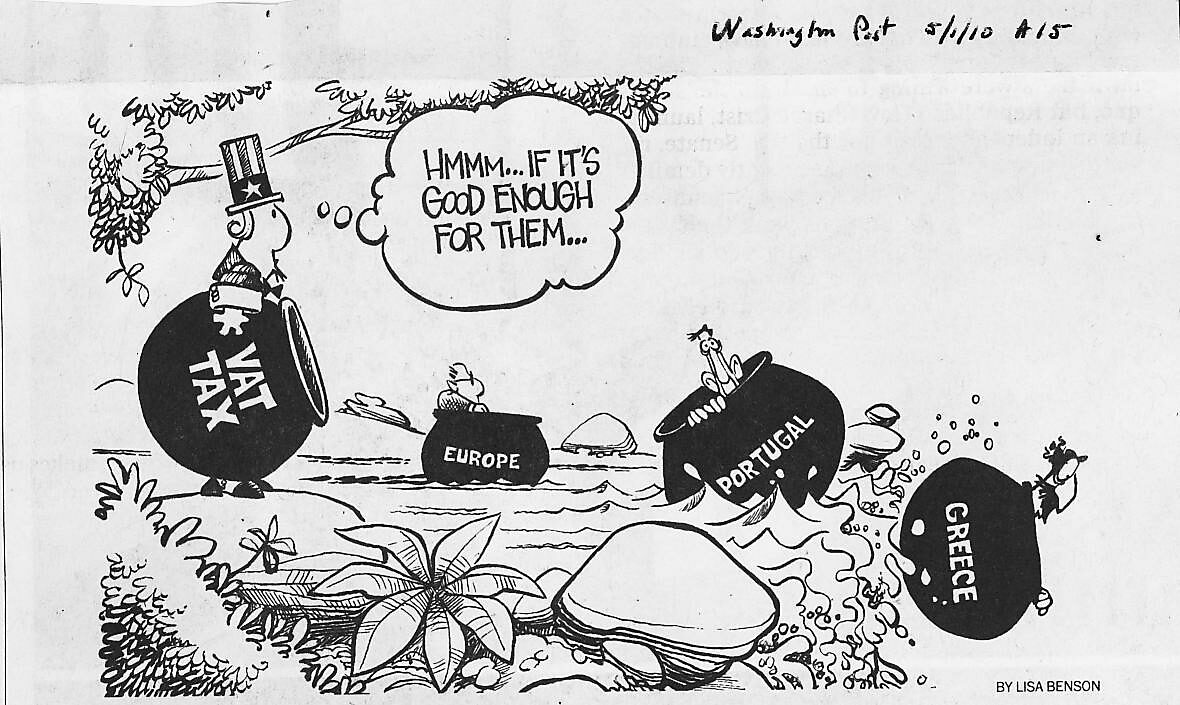

Risk: There is no value-added tax, which is a critically important feature of any tax reform plan. As such, there is no risk the Camp plan will become a Trojan Horse for a massive expansion of the fiscal burden.

Evasion: People are reluctant to comply with the tax system when rates are punitive and/or there’s a perception of rampant unfairness. It’s possible that the slightly lower statutory rates may improve incentives to obey the law, but that will be offset by the higher tax burden on saving and investment.

International Competitiveness: Reducing the corporate tax rate will help attract jobs and investment, and the plan also mitigates some of worst features of America’s “worldwide” tax regime.

Now that we’ve taken a broad look at the components of Camp’s plan, let’s look at the grades in comparison to the other plans I’ve reviewed over the years:

You can see why I’m underwhelmed by his proposal.

Camp’s proposal may be an improvement over the status quo, but my main reaction is, what’s the point?

In other words, why go through months of hearings and set up all sorts of working groups, only to propose a timid plan?

Now, perhaps, readers will understand why I’m rather pessimistic about achieving real tax reform.

We know the right policies to fix the tax code.

And we have ready-made plans—such as the flat tax and national sales tax—that would achieve the goals of tax reform.

Camp’s plan, by contrast, simply rearranges the deck chairs on the Titanic.

P.S.: If you need to be cheered up after reading all this, here’s some more IRS humor to brighten your day, including the IRS version of the quadratic formula, a new Obama 1040 form, a list of tax day tips from David Letterman, a cartoon of how GPS would work if operated by the IRS, a sale on 1040-form toilet paper (apparently a real product), and two satirical songs about the tax agency (here and here).