The European leaders’ meeting in Brussels yesterday will likely fail to reassure the financial markets. First, the intergovernmental agreement on stricter budget controls among the members of the eurozone will still have to be approved by national parliaments and could potentially face legal challenges in one or more countries. Second, there is no guarantee that the agreed penalties for countries that run excessive budget deficits are either enforceable or sufficiently onerous to limit government spending. Third, the European leaders failed to make progress on the most important issue facing the EU economies—slow growth. Indeed, it is difficult to see how EU leaders—many of whom backed higher taxes and support more regulation—can be trusted to do anything useful to spur economic growth and private sector job creation in Europe.

Cato at Liberty

Cato at Liberty

Topics

General

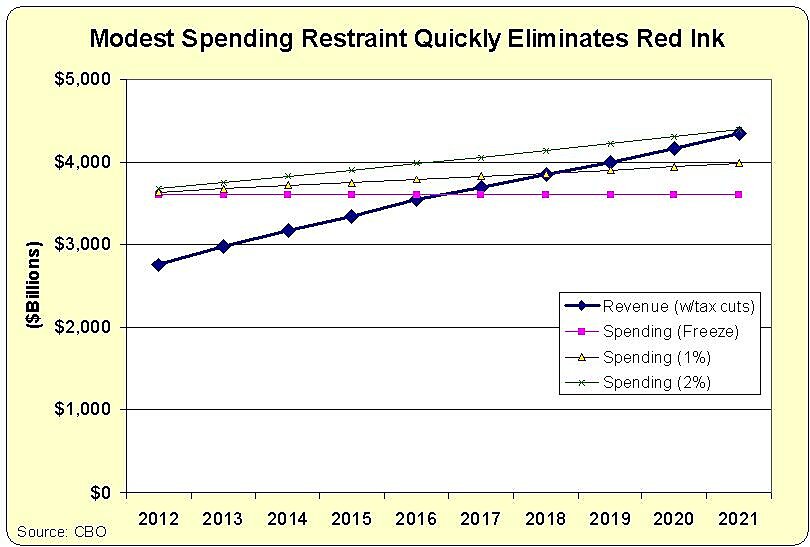

New Congressional Budget Office Numbers Once Again Show that Modest Spending Restraint Would Eliminate Red Ink

Back in 2010, I crunched the numbers from the Congressional Budget Office and reported that the budget could be balanced in just 10 years if politicians exercised a modicum of fiscal discipline and limited annual spending increases to about two percent yearly.

When CBO issued new numbers early last year, I repeated the exercise and again found that the same modest level of budgetary restraint would eliminate red ink in about 10 years.

And when CBO issued their update last summer, I did the same thing and once again confirmed that deficits would disappear in a decade if politicians didn’t let the overall budget rise by faster than two percent each year.

Well, the new CBO 10-year forecast was released this morning. I’m going to give you three guesses about what I discovered when I looked at the numbers, and the first two don’t count.

Yes, you guessed it. As the chart illustrates (click to enlarge), balancing the budget doesn’t require any tax increases. Nor does it require big spending cuts (though that would be a very good idea).

Even if we assume that the 2001 and 2003 tax cuts are made permanent, all that is needed is for politicians to put government on a modest diet so that overall spending grows by about two percent each year. In other words, make sure the budget doesn’t grow faster than inflation.

Tens of millions of households and businesses manage to meet this simple test every year. Surely it’s not asking too much to get the same minimum level of fiscal restraint from the crowd in Washington, right?

At this point, you may be asking yourself whether it’s really this simple. After all, you’ve probably heard politicians and journalists say that deficits are so big that we have no choice but to accept big tax increases and “draconian” spending cuts.

But that’s because politicians use dishonest Washington budget math. They begin each fiscal year by assuming that spending automatically will increase based on factors such as inflation, demographics, and previously legislated program changes.

This creates a “baseline,” and if they enact a budget that increases spending by less than the baseline, that increase magically becomes a cut. This is what allowed some politicians to say that last year’s Ryan budget cut spending by trillions of dollars even though spending actually would have increased by an average of 2.8 percent each year.

Needless to say, proponents of big government deliberately use dishonest budget math because it tilts the playing field in favor of bigger government and higher taxes.

There are two important caveats about these calculations.

1. We should be dramatically downsizing the federal government, not just restraining its growth. Even if he’s not your preferred presidential candidate, Ron Paul’s proposal for an immediate $1 trillion reduction in the burden of federal spending is a very good idea. Merely limiting the growth of spending is a tiny and timid step in the right direction.

2. We should be focusing on the underlying problem of excessive government, not the symptom of too much red ink. By pointing out the amount of spending restraint that would balance the budget, some people will incorrectly conclude that getting rid of deficits is the goal.

Last but not least, here is the video I narrated in 2010 showing how red ink would quickly disappear if politicians curtailed their profligacy and restrained spending growth.

Other than updating the numbers, the video is just as accurate today as it was back in 2010. And the concluding message—that there is no good argument for tax increases—also is equally relevant today.

P.S. Some people will argue that it’s impossible to restrain spending because of entitlement programs, but this set of videos shows how to reform Social Security, Medicare, and Medicaid.

P.P.S. Some people will say that the CBO baseline is unrealistic because it assumes the sequester will take place. They may be right if they’re predicting politicians are too irresponsible and profligate to accept about $100 billion of annual reductions from a $4,000 billion-plus budget, but that underscores the core message that there needs to be a cap on total spending so that the crowd in Washington isn’t allowed to turn America into Greece.

Related Tags

By George, I Think They’ve Got It: ‘Far Too Many Laws’

Occupy protesters come to Washington and finally notice what the problem is:

Timothy Evans, a D.C. taxicab inspector, … notices too many inside a taxi jerking slowly up Fifth Street NW — not the seven or eight passengers he sometimes sees sardine-stuffed into the Crown Victorias and Town Cars that make up the bulk of the city fleet, but still too many.

He pops on his car’s flashing lights. The cab stops, and out they come, six of them.

While Evans goes to chat with the driver, his partner, Carl Martin, calmly absorbs invective — not from the driver but from the riders, a group of activists from California who are in town for the Occupy Congress protest.

Nadine Hayes, 59, of Camarillo, is none too happy her driver ended up with $50 worth of tickets — $25 for overloading, $25 for an improper manifest. “He was doing us a service and taking us to where we wanted to go,” she said. “I think we’ve got far too many laws. I think the American people are being so oppressed.”

Related Tags

Chinese Currency and the U.S. Financial Crisis

Some people might have been surprised to read in Sunday’s New York Times magazine that I believed “that all that easy money from China helped make the housing bubble much bigger and last longer, which created a far bigger crisis when the bubble finally burst.” As you might suspect, it was only those two little words “from China” that gave me pause. But I’m very grateful to Adam Davidson and his colleagues at NPR’s Planet Money for giving me a chance to elaborate on their blog. Here’s a brief excerpt:

China was eager to buy our debt, both Treasury bonds and Fannie and Freddie’s debt. But it was Congress that ran the deficits, and the Fed that kept interest rates artificially low. We don’t need to go to Beijing to find the villains in this piece.…

Our economy could use plenty of reforms – lower, flatter, simpler taxes; a more stable monetary policy or even a move toward free markets in money; reduced regulatory burdens; the de-monopolization of services from education to mail delivery; and less government spending. In all those cases, the problem and the solution are right here in the USA.

Read it all! And special bonus links: Steve Hanke responds to the argument for a tougher policy toward China at Planet Money. And Adam Davidson talked with me about libertarianism in 2010 (plus a much longer version also featuring Mark Calabria).

Related Tags

New Academic Study Confirms Previous IMF Analysis, Shows that Lower Tax Rates Are the Best Way to Reduce Tax Evasion

Leftists want higher tax rates and they want greater tax compliance. But they have a hard time understanding that those goals are inconsistent.

Simply stated, people respond to incentives. When tax rates are punitive, folks earn and report less taxable income, and vice-versa.

- When tax rates increase, sometimes they engage in tax avoidance, lowering their tax liabilities legally.

- When tax rates change, sometimes they choose to alter their levels of work, saving, and investment.

- And when tax rates go up, sometimes they resort to illegal steps to protect themselves from the tax authority.

In a previous post, I quoted an article from the International Monetary Fund, which unambiguously concluded that high tax burdens are the main reason people don’t fully comply with tax regimes.

Macroeconomic and microeconomic modeling studies based on data for several countries suggest that the major driving forces behind the size and growth of the shadow economy are an increasing burden of tax and social security payments… The bigger the difference between the total cost of labor in the official economy and the after-tax earnings from work, the greater the incentive for employers and employees to avoid this difference and participate in the shadow economy. …Several studies have found strong evidence that the tax regime influences the shadow economy.

Indeed, it’s worth noting that international studies find that the jurisdictions with the highest rates of tax compliance are the ones with reasonable tax systems, such as Hong Kong, Switzerland, and Singapore.

Now there’s a new study confirming these findings. Authored by two economists, one from the University of Wisconsin and the other from Jacksonville University, the new research cites the impact of tax burdens as well as other key variables.

Here are some key findings from the study.

According to the results provided in Table 2, the coefficient on the average effective federal income tax variable (AET) is positive in all three estimates and statistically significant for the overall study periods (1960–2008) at beyond the five percent level and statistically significant at the one percent level for the two sub-periods (1970–2007 and 1980–2008). Thus, as expected, the higher the average effective federal income tax rate, the greater the expected benefits of tax evasion may be and hence the greater the extent of that income tax evasion. This finding is consistent with most previous studies of income tax evasion using official data… In all three estimates, [the audit variable] exhibits the expected negative sign; however, in all three estimates it fails to be statistically significant at the five percent level. Indeed, these three coefficients are statistically significant at barely the 10 percent level. Thus it appears the audit rate (AUDIT) variable, of an in itself, may not be viewed as a strong deterrent to federal personal income taxation [evasion].

Translating from economic jargon, the study concludes that higher tax burdens lead to more evasion. Statists usually claim that this can be addressed by giving the IRS more power, but the researchers found that audit rates have a very weak effect.

The obvious conclusion, as I’ve noted before, is that lower tax rates and tax reform are the best way to improve tax compliance — not more power for the IRS.

Incidentally, this new study also finds that evasion increases when the unemployment rate increases. Given his proposals for higher tax rates and his poor track record on jobs, it almost makes one think Obama is trying to set a record for tax evasion.

The study also finds that dissatisfaction with government is correlated with tax evasion. And since Obama’s White House has been wasting money on corrupt green energy programs and a failed stimulus, that also suggests that the Administration wants more tax evasion.

Indeed, this last finding is consistent with some research from the Bank of Italy that I cited in 2010.

…the coefficient of public spending inefficiency remains negative and highly significant. …We find that tax morale is higher when the taxpayer perceives and observes that the government is efficient; that is, it provides a fair output with respect to the revenues.

And I imagine that “tax morale” in the United States is further undermined by an internal revenue code that has metastasized into a 72,000-page monstrosity of corruption and sleaze.

On the other hand, tax evasion apparently is correlated with real per-capita gross domestic product. And since the economy has suffered from anemic performance over the past three years, that blows a hole in the conspiratorial theory that Obama wants more evasion.

All joking aside, I’m sure the President wants more tax compliance and more prosperity. And since I’m a nice guy, I’m going to help him out. Mr. President, this video outlines a plan that would achieve both of those goals.

Given his class-warfare rhetoric, I’m not holding my breath in anticipation that he will follow my sage advice.

Obama’s Wistful Military Metaphor

George Will takes President Obama to task for the theme in his State of the Union Address that America should be more like the army:

War, said James Madison, is “the true nurse of executive aggrandizement.” Randolph Bourne, the radical essayist killed by the influenza unleashed by World War I, warned, “War is the health of the state.” Hence Barack Obama’s State of the Union hymn: Onward civilian soldiers, marching as to war.…

The armed services’ ethos, although noble, is not a template for civilian society, unless the aspiration is to extinguish politics. People marching in serried ranks, fused into a solid mass by the heat of martial ardor, proceeding in lock step, shoulder to shoulder, obedient to orders from a commanding officer — this is a recurring dream of progressives eager to dispense with tiresome persuasion and untidy dissension in a free, tumultuous society.

Progressive presidents use martial language as a way of encouraging Americans to confuse civilian politics with military exertions, thereby circumventing an impediment to progressive aspirations — the Constitution and the patience it demands.

He reminds us that President Franklin D. Roosevelt pioneered such rhetoric, and that FDR supporters demonstrated appalling enthusiasm for actual dictatorship:

In his first inaugural address, FDR demanded “broad executive power to wage a war against the emergency, as great as the power that would be given to me if we were in fact invaded by a foreign foe.” He said Americans must “move as a trained and loyal army” with “a unity of duty hitherto evoked only in time of armed strife.” …

Commonweal, a magazine for liberal Catholics, said that Roosevelt should have “the powers of a virtual dictatorship to reorganize the government.” Walter Lippmann, then America’s preeminent columnist, said: “A mild species of dictatorship will help us over the roughest spots in the road ahead.”

Ben Friedman deplored this theme in the speech as well:

There is an even bigger problem with this “be like the troops, put aside our differences, stop playing politics, salute and get things done for the common good” mentality. It is authoritarian. Sure, Americans share a government, much culture, and have mutual obligations. But that doesn’t make the United States anything like a military unit, which is designed for coordinated killing and destruction. Americans aren’t going to overcome their political differences by emulating commandos on a killing raid. And that’s a good thing. At least in times of peace, liberal countries should be free of a common purpose, which is anathema to freedom.

As did I, in the first few minutes of this post-speech interview on Stossel. Cato scholars have also quoted that appalling inaugural speech from FDR — asking for “broad executive power” at the head of “a trained and loyal army” — several times. Let’s hope that after George Will’s skewering, Obama will drop this theme. Hierarchy, centralization, common purpose, command, and control are appropriate for an army, not for a free people.

Related Tags

Arlo Sings Bailouts

Only days after the president declared, “No more bailouts, no more handouts,” I see that Arlo Guthrie is touring the South in February and March. What’s the connection? If you have the good fortune to see him, be sure to ask for “I’m Changing My Name to Fannie Mae.” That 2008 song was itself a new version of Tom Paxton’s classic song “I’m Changing My Name to Chrysler,” sung here by Arlo: “When they hand a million grand out, I’ll be standing with my hand out.…If you’re a corporate titanic and your failure is gigantic, Down in Congress there’s a safety net for you.”

The 2008 version is sung here by Arlo and here by Paxton. Besides the name of the company, they had to make a few other changes in the lyrics, like “When they hand a trillion grand out, I’ll be standing with my hand out.”

But that was October 2008. By the end of December, I was noting that it was a Merry Christmas for GMAC, which learned on Christmas Eve that the Federal Reserve had approved its application to become a bank holding company. That gave GMAC “access to new sources of funding, including a potential infusion of taxpayer dollars from the Treasury Department and loans from the Fed itself,” as the Washington Post explained. GMAC wasn’t the only company that suddenly became a “bank holding company” in order to cash in on the $700 billion financial bailout. Late one night in November, American Express was granted the same privilege, along with Morgan Stanley, Goldman Sachs, and CIT. Which was why I suggested then that Tom and Arlo needed a new version: “I’m Changing My Name to Bank Holding Company.”

For now, enjoy “I’m Changing My Name to Fannie Mae”: