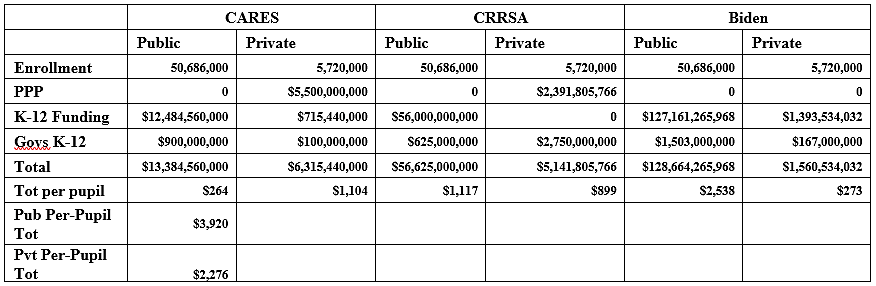

Since March, the federal government has enacted two big COVID-19 relief bills affecting elementary and secondary education, and there is another, colossal bill on the way. The combination of the Coronavirus Aid, Recovery, and Economic Security (CARES) Act, Coronavirus Response and Relief Supplemental Appropriations Act (CRRSA), and developing Biden plan would provide nearly $212 billion for K‑12 education according to the estimate itemized below. This is a huge sum considering that in a normal year – 2018 – we spent a total of $832 billion on elementary and secondary education.

I am interested in two major questions about this funding: Is it being shared equitably between public and private schools, and is it sufficient to cope with COVID-19? Below is a breakdown of K‑12 funding under the two passed, and one proposed, acts.

According to this estimate, public schools will have received an estimated $3,920 per student, and private schools $2,276, when all is said and done. This is inequitable for private schools if we want to treat all kids equally and all have been impacted by COVID-19. However, if the goal is to direct funds to low-income students, this may be equitable because public schools serve higher shares of such students.

Whether federal aid should benefit all students or just low-income has been a source of contention throughout the COVID struggle. Much of the aid has been parceled out based on low-income shares of total enrollment, but it has been usable for the benefit of all children in a school (e.g., funding building upgrades, additional cleaning supplies, and more.) Also, most of the aid to private schools has been in the form of PPP loans – roughly $7.9 billion out of $13.0 billion – that have to be repaid if recipients fail to meet usage terms.

What about the overall magnitude of relief? Has it been well tailored to need?

Here the overwhelming conclusion is no – the relief far exceeds the need. The CDC estimated in December that the cost of providing full anti-COVID measures in schools, including materials and staff, is about $442 per student – roughly one-ninth of what public schools could receive from all relief efforts, and one-third of what they have received under CARES and CRRSA. The amount even well exceeds the all-but-the-kitchen-sink COVID-coping estimate of the American Federation of Teachers, which put the total public school need at $116.5 billion, or about $2,300 per student. Finally, state and local tax revenues have experienced very little decline under COVID, obviating any clear need for a major federal assist.

That said, the emphasis for this post is on “estimate” – there is a lot we do not know about the still-developing Biden relief plan, about how money in previous acts has been spent, and I may have missed some things. Here is how I produced the figures in the table:

Enrollment comes from the federal Digest of Education Statistics and is from 2017, the most recent year with confirmed data.

PPP funding is an estimate of what private schools have received. COVID Stimulus Watch has calculated that private schools took in $4.5 billion from PPP under CARES. They also identified $7 billion of CARES PPP going to churches. I simply guessed that $1 billion of the CARES PPP church money helped to maintain affiliated schools, and added that amount to the private school total. I estimated that the same share of the total CARES PPP funds that went to private schools – about 0.83 percent – also went to them under CRRSA. The Biden proposal includes no PPP funding.

For direct K‑12 funding, the private share under CARES is the estimated amount that would flow to private schools under “equitable services” sharing based on enrollment of low-income kids. Using federal data here, I calculated the share of all “poor” and “near poor” students that attended private schools to estimate that 5.42 percent of such children attend private schools. I then multiplied that percentage by the total amount of funding to calculate private and public shares. It is not clear if what the Biden proposal will ultimately become will include equitable services language, but developing House legislation would set aside 20 percent of all local educational agency (LEA) funding to mitigate “learning loss.” This LEA learning loss funding would provide services to private schools based on the equitable services formula, which is reflected in the estimate.

Funding for governors also changed from act to act. Under CARES, $3 billion was given to governors to use at their discretion to cover early childhood, K‑12, and higher education. Assuming about one-third of the money went to K‑12 yields a total of $1 billion, and I assumed distribution to public and private schools commensurate with total public and private enrollment shares nationally: 90 percent to public schools, 10 percent to private.

CRRSA’s allocation to governors was different, with $2.75 billion of $4 billion specifically designated for private K‑12 schools. I assumed the remaining $1.25 billion was split evenly between K‑12 public schools and other education sectors. CRRSA also prohibits private schools from benefiting if they have used PPP, but I did not try to adjust for that because my concern was the total pot of money.

The Biden proposal would have $5 billion go to governors, though the House draft bill does not currently include it. I assumed there would ultimately be a $5 billion fund, split evenly among three sectors, and I again divided the K‑12 money based on 9 to 1 public to private enrollment.

Again, this is a rough estimate. If you find problems or errors – and you likely will – please let me know: nmccluskey@cato.org. I will adjust this in the future to correct errors and reflect new information. Thanks to crack CEF research associate Solomon Chen for helping to pull this estimate together.