At the end of 2017, Republicans cut and reformed nearly every major portion of the US tax code through the Tax Cuts and Jobs Act (TCJA). Most of those changes expire at the end of this year, when taxes increase automatically, hitting Americans at every income level with higher taxes.

The following explainer begins with an overview of the individual tax cuts, reviews the business tax cuts’ economic benefits, and then discusses fiscal consequences. The end of the blog includes summaries of the law’s most significant changes.

This is the second part of a four-part series based on notes from a Cato congressional fellowship series covering the US federal tax code. You can read part one on Tax Code 101 here.

Individual Tax Cuts

The TCJA’s changes for individuals were primarily about cutting tax bills and simplifying taxpaying. This was accomplished by lowering tax rates, expanding tax brackets, limiting itemized deductions, and consolidating family subsidies. Almost all the individual tax changes expire at the end of 2025.

When the law passed, the Tax Policy Center estimated that 80 percent of taxpayers received an average tax cut of about $1,600. Fifteen percent saw no change in taxes, and 5 percent paid higher taxes in 2018 than in 2017.

Because the highest-income Americans pay the vast majority of income taxes, they also benefited from the largest dollar value tax cuts and as a share of the total tax cut. However, a more informative way to measure the tax change shows that the lowest-income Americans experienced the largest tax cuts as a portion of what people were already paying.

Figure 1 uses IRS data from before and after the TCJA to show that the largest tax cuts went to Americans in the bottom 75 percent of income earners. The lowest-income 50 percent of individuals saw a 9.3 percent reduction in their tax bill, compared to a 0.04 percent tax cut for the highest-income 1 percent.

Business Tax Cuts

The TCJA’s business tax cuts were designed to boost domestic investment and support long-run economic growth, wage gains, and job creation. The changes included a permanently lower corporate tax rate, temporary immediate investment deductions, and permanent reforms to the international tax system.

Estimates of the law’s economic effects from independent organizations at the time of passage found that TCJA would increase investment and boost GDP by between 0.8 percent and 1.7 percent. Empirical investigations of the actual economic outcomes have confirmed the positive economic results met and likely surpassed early forecasts.

For example, Gabriel Chodorow-Reich and coauthors use variation in how the tax cuts impacted firms to estimate that the TCJA will result in a long-run increase to the capital stock of 7.2 percent. Other recent empirical work also shows a close association between tax cuts and higher investment rates. These results imply a positive overall economic impact larger than the consensus range.

Kyle Pomerleau and Donald Schneider show that in the years immediately after 2017, “real GDP, consumption, business investment, and payrolls grew more rapidly than expected” by pre-reform forecasts from the Congressional Budget Office (Figure 2).

Tax Cuts and Deficits

The Joint Committee on Taxation estimated that the TJCA would add $1.5 trillion to the deficit over ten years, combining about $4 trillion in new revenues and $5.5 trillion in gross tax cuts.

The Tax Foundation found that accounting for the dynamic effects of economic growth, the ten-year deficit effect would be $448 billion, more than $1 trillion less than the official static estimate. These estimates imply the law could have eventually made up its early deficit effects by 2028.

Because significant portions of the law are temporary, assessing its long-term budgetary impact is difficult. Comparing current revenue trends to past forecasts is even more challenging due to unanticipated inflation, pandemic and trade uncertainties, new global conflicts, multiple trillion-dollar tax and spending changes, and higher-than-expected immigration.

However, what is clear is that adjusting the pre-TCJA baseline for unanticipated inflation shows that actual revenues—with all the intervening events—remain close to the pre-TCJA trend (Figure 3). This reinforces the fact that the federal government’s rising deficits are neither caused by nor fixable with the tax code. Spending growth drives long-run fiscal imbalances.

What follows is a brief summary of the most significant changes made by the TCJA.

The Individual Tax Changes

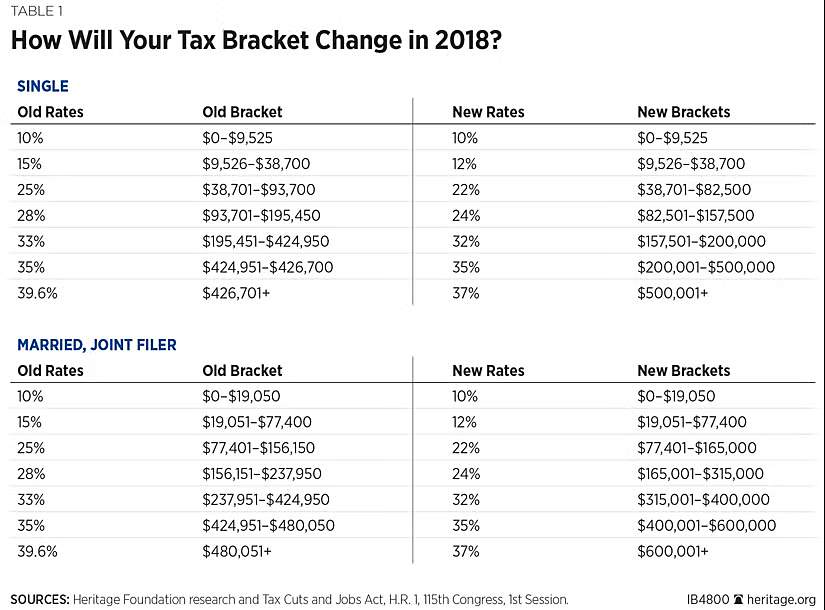

Lower Tax Rates, Wider Tax Brackets. Under the new system, income is generally taxed at lower rates. The law retains seven brackets, lowered rates for all but the 10 percent bracket, and adjusted income thresholds. Table 1, from a Heritage Foundation report, describes the changes for single and married filers. The bill also made similar adjustments to the head of household status.

Additional reading:

Larger Standard Deduction, Repealed Personal Exemptions. The law almost doubled the standard deduction to $12,000 for single filers and $24,000 for married filing jointly. In 2025, due to inflation indexing, the deduction is $15,000 and $30,000, respectively. The standard deduction functions like an eighth tax bracket with a zero percent tax rate.

The larger deduction was partially offset by repealing the personal and dependent exemptions, a $4,050 deduction (in 2017) for each member of the household.

Doubled Child Tax Credit. The TCJA increased the child tax credit (CTC) from $1,000 to $2,000 per child to offset the repealed dependent exemptions. Exemptions, like deductions, are more valuable for taxpayers in higher income brackets. Thus, the larger CTC for personal exemption swap increased the size of the child subsidy for lower-income taxpayers and reduced it for higher incomes. For taxpayers in the 25 percent income tax bracket, the pre-TCJA $4,050 exemption was worth $1,013 in reduced taxes. The change did not meaningfully increase the total fiscal cost of the child subsidy program.

For higher-income families, the income threshold for where the CTC begins to phase out was raised from $110,000 to $400,000 for married taxpayers. The refundable portion of the credit for taxpayers with no positive income tax liability was increased to $1,400 and indexed to inflation (the rest of the credit is not indexed). The non-child dependent exemption was replaced with a new $500 tax credit.

Additional reading:

- More than Just a Tax Cut: the Case of Child Tax Credit Reform, Adam Michel

- The Case Against the Child Tax Credit, Adam Michel, Vanessa Brown Calder

$10,000 State and Local Tax Deduction Cap. State and local taxes (SALT) are one of 14 deductions for taxpayers who “itemize” their deductions instead of taking the standard deduction. Previously unlimited, the TCJA placed a $10,000 cap on the deduction for state and local property and income taxes (or sales taxes) paid. The cap is not indexed for inflation and does not increase for married taxpayers.

The write-off is an implicit subsidy for state and local governments with higher taxes. Capping the deduction dramatically shrunk the disparate treatment of similar taxpayers in states with different fiscal policies. Most taxpayers impacted by the SALT cap still received a net tax cut due to lower tax rates, a larger AMT exemption, and other changes.

Additional reading:

- Understanding SALT, Adam Michel

- The SALT Cap Is Fair Treatment for States and Congressional Districts, Adam Michel

$750,000 Limit on Mortgage Interest Deduction. For taxpayers who itemize, the home mortgage interest deduction limit was lowered from $1 million to $750,000 of debt. Treatment of pre-2018 mortgages did not change. The home mortgage interest deduction subsidizes larger houses for older, higher-income taxpayers and is not associated with higher homeownership rates.

Additional reading:

- Priced Out: Why Federal Tax Deductions Miss the Mark on Family Affordability, Joint Economic Committee

Other Changes to Itemized Deductions. The TCJA also limited deductions for personal casualty and theft loss, wagering losses, and other miscellaneous expenses. The limits to specific deductions replaced the overall limitation on itemized deductions (called the Pease limitation), which reduced the value of a taxpayer’s itemized deductions by 3 percent of income over a certain threshold.

Combining a larger standard deduction and limits on itemized deductions shifted about 30 million taxpayers to the more straightforward standard deduction, saving them time and money. The share of itemizers fell from 30 percent to 10 percent after the reform.

Additional reading:

- The Tax Cuts and Jobs Act Simplified the Tax Filing Process for Millions of Households, Erica York, Alex Muresianu

Higher Alternative Minimum Tax Exemption. The individual alternative minimum tax (AMT) is a parallel tax system that applies 26 percent and 28 percent tax rates to a broader definition of income after an income exemption (similar to the standard deduction). Taxpayers pay whichever is higher, the AMT or the regular income tax. The TCJA increased the AMT exemption and exemption phase-out, limiting the number of taxpayers burdened with the additional paperwork from about 10 million in 2017 to 1 million in 2018. The number of taxpayers who paid the AMT was 5 million in 2017, estimated to fall to 200,000 following the reform.

Additional reading:

Doubled Estate Tax Exemption. The estate and gift tax (often called the death tax) imposes a 40 percent tax on the transfer of wealth, either as a gift during a person’s life or as an inheritance after death. The TCJA doubled the estate tax exemption from $5.6 million per person to about $12 million. In 2025, the exemption is almost $14 million per person. The estate tax forces millions of asset-rich families—families without a lot of cash on hand but with small businesses, farms, and other productive assets—to engage in complex tax planning to ensure that their heirs are not forced to liquidate their life’s work to pay a federal tax bill when they die.

Additional reading:

- Repealing the Federal Estate Tax, Chris Edwards

Expanded 529 College Savings Accounts. Internal Revenue Code Section 529 Plan college savings accounts were expanded to cover K‑12 expenses.

Repealed Individual Mandate Tax. Obamacare’s tax on uninsured individuals was reduced to zero, effectively repealing the provision.

Business Tax Changes

Cut Corporate Rate to 21 Percent. The permanent reduction in the federal corporate income tax rate from 35 percent to 21 percent brought the US in line with other countries around the world. Pre-TCJA, US businesses faced the highest statutory corporate tax rates in the developed world (on their worldwide income), forcing more than 60 US firms to move their headquarters overseas in the decade before 2017.

When accounting for average state corporate taxes (about 6 percent), American corporations face a combined statutory tax rate of 25.6 percent. This is higher than the non-US Organisation for Economic Co-operation and Development’s (OECD) average rate of 24 percent and higher than China’s 25 percent rate.

Additional reading:

- The Case for Trump’s 15 Percent Corporate Tax Rate, Adam Michel, Joshua Loucks

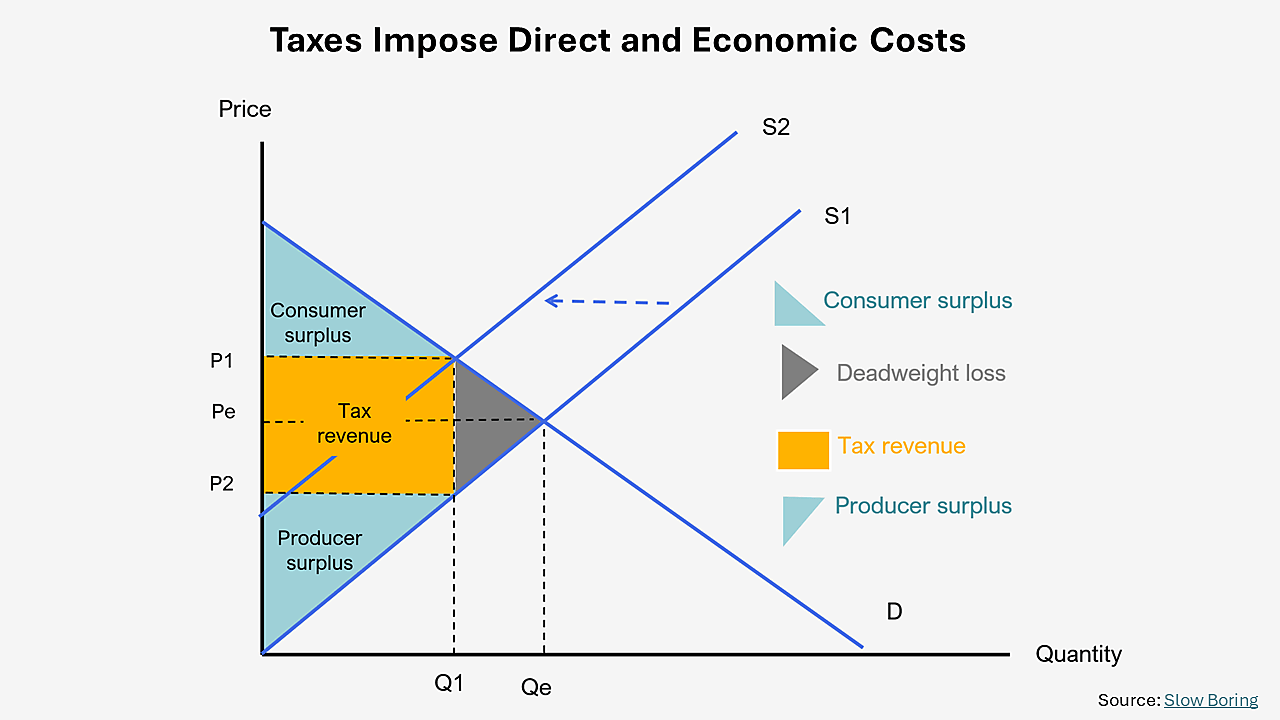

Full Investment Deductions. The normal income tax rules require businesses to deduct the cost of new investments over their asset life (between three and 39 years). These rules increase the after-tax cost of new investments because the real value of the associated tax deduction declines with inflation and time. Figure 4 shows that at sustained 3 percent inflation, the present value of a $1 investment deduction falls quickly for longer-lasting assets.

The TCJA temporarily fixed this problem by allowing businesses to fully deduct the cost of new machinery and equipment in the year purchased; this is called full expensing or 100 percent bonus depreciation. Beginning in 2023, equipment and other short-lived investments lose 20 percentage points of the 100 percent bonus deduction each year through 2026. In 2022, companies were also required to start amortizing research expenses over five years instead of the previous policy of immediate deduction. The bill also permanently expanded expensing for small businesses under Section 179.

Additional reading:

- Expensing and the Taxation of Capital Investment, Adam Michel

New Pass-Through Business Deduction. Small and pass-through businesses pay their taxes as individuals and benefit from the TCJA’s lower individual tax rates. The law also created a new pass-through business deduction equal to 20 percent of certain types of non-salary business income. The deduction lowers most pass-through’s top marginal tax rate from 37 percent to 29.6 percent. Certain high-income service providers are denied the deduction in the fields of health, law, consulting, athletics, financial, or brokerage services.

The comparable rate for large C corporations must account for the 21 percent entity-level tax and the 20 percent capital gains and dividend taxes assessed on distributed profits. Taken together, the total tax rate on corporate income is 36.8 percent. This simple comparison illustrates a more general finding that pass-throughs tend to be tax-advantaged over C corporations, although particular circumstances vary greatly.

Additional reading:

- Section 199A and “Tax Parity,” Kyle Pomerleau

Limited Interest Deduction. The TCJA placed new limits on previously unlimited deductions for net interest expense. The limit is 30 percent of earnings before interest and taxes (EBIT). From 2018 through 2021, the cap applied to a broader definition of earnings before interest, taxes, depreciation, and amortization (EBITDA). Moving from EBIT to EBITDA was an effective tax increase on capital and R&D‑intensive businesses. No other OECD country uses EBIT as the base for interest limitations.

Additional reading:

- Tighter Limits on U.S. Interest Deductibility Make U.S. an Outlier and Increase Pain of Rising Interest Rates, Garrett Watson

Limited Loss Deductions. Businesses can generally use losses from one year (when expenses exceed revenues) to offset taxes in other years, called net operating losses (NOLs). NOLs allow businesses to smooth their tax liability over multiple years and help start-ups that may not earn a profit for their first years in operation. The TCJA permanently limited C corporate NOL deductions to 80 percent of income and prohibited carrybacks. Pass-through NOLs are limited to $305,000 ($610,000 if married filing jointly) in 2024. Pass-through limits extend through 2028.

Additional reading:

- Business Net Operating Loss Provisions, Andrew Lautz and Arianna Fano

Shift Toward Territorial System. Pre-TCJA, the United States maintained one of the few worldwide international tax systems, claiming taxing rights to all business income, no matter where it was earned. Aligning the US with the global convention, the TCJA included a partial participation exemption (territorial treatment) with a three-part anti-base-erosion regime. The law also repealed the corporate AMT (although the Inflation Reduction Act reinstated a newer version) and imposed a one-time transition tax on international firms’ accumulated overseas profits, which was the subject of the Supreme Court Case Moore v. United States.

Additional reading: