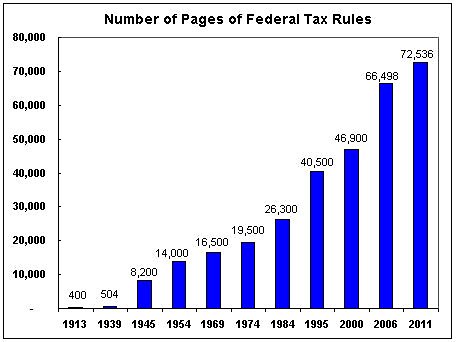

According to tax publisher CCH, there are now 72,536 pages of federal tax code rules, regulations, and IRS rulings.

Cato at Liberty

Cato at Liberty

Topics

Tax and Budget Policy

Millionaires and Billionaires on Tax Day

In a high-profile speech last week, President Obama said: “We cannot afford $1 trillion worth of tax cuts for every millionaire and billionaire in our society. We can’t afford it. And I refuse to renew them again.”

Mr. President, it’s their money, not yours. And note that your speechwriters gave you a wildly exaggerated dollar figure for tax hikes on millionaires and billionaires.

What Americans “cannot afford” is the president’s ongoing demonization of high earners. Yahoo Finance ran an interesting story yesterday describing the crucial role played by high earners in the economy. Rather than the cartoonish image of high earners propagated by the political left, the article notes:

Today, most of those folks with a net worth of $1 million or more have earned it themselves. They’re mostly entrepreneurs who create everything from high-speed networks to garbage haulers. They dig ditches and build houses and grow corn and make jewelry. They deal stamps or coins or artwork and control pests and cut lawns. They also cure people and give them new teeth.

Perhaps the president wants to hike taxes on the wealthy because they were just lucky or benefited from misguided greed. Instead, the well-known researchers of the wealthy, Thomas Stanley and William Danko, note in the article:

It is seldom luck or inheritance or advanced degrees or even intelligence that enables people to amass fortunes … Wealth is more often the result of a lifestyle of hard work, perseverance, planning, and, most of all, self discipline.

Ironically, those are probably the traits that made President Obama a successful political entrepreneur. Yet he doesn’t seem to appreciate that the same traits drive market entrepreneurs to generate growth and earn profits. Profits are the reward for “good behavior” in the free market, so punishing them with higher taxes makes no economic sense.

Rather than breeding resentment against the wealthy, the president should use his bully pulpit to encourage people to emulate their success by working hard, increasing their savings, and eschewing debt. Unfortunately, those are the attributes that today’s income tax punishes, and on this Tax Day the president is pushing policies to make the situation even worse.

Related Tags

News Items: Internet Gambling and Agriculture

Some items from my inbox:

- The Department of Justice late Friday announced it had indicted 11 online poker executives, charging them with money-laundering and bank fraud. (HT: Jonathan Blanks). This crackdown is far stronger than any seen from the Bush administration, and is disappointing people like me, who had hoped for a better stance on civil liberties from the Obama administration. To quote my former colleague Radley Balko (language warning): “Good to know where the DOJ’s priorities lie. In this case, it’s preventing millions of people from consensually wagering money in online card games, an exchange that causes no harm to anyone else.”

- Ironically Insanely, the indictments came just days after the District of Columbia announced it would allow internet gambling.

- In keeping with the new set of talking points the farm lobby has devised (“we already gave at the office through crop insurance reforms” and “agriculture should face cuts no larger than the average of other programs”), the Democratic members of the House Agriculture Committee on Friday sent out a press release complaining about the “disproportionate” cuts agriculture would face if the House-passed FY2012 budget resolution went into effect. While Agriculture would face a 23 percent cut, they say, other committees’ program areas would face an average cut of 14 percent. And they complain that Defense faces only minimal cuts. I’ve said it before, but I’ll say it again: all government programs are not created equal. Some — like Defense, although clearly there is significant room for cuts there — are legitimate uses of government’s power. Others — like farm subsidies — are not.

- An interesting article on the non-link between farm subsidies and obesity, by political scientist Robert Paarlberg (co-author of an excellent book on American farm policy). He cites Cato as being one of the groups engaging in “careless thinking” on this issue, and although I have in the past linked farm subsidies to certain food consumption patterns, over the past year or so I have become increasingly skeptical of that view, mainly as a result of reading stuff like this from smart folks at UCDavis.

The IRS: Even Worse Than You Think

Since it is tax-filing season and we all want to honor our wonderful tax system, let’s go into the archives and show this video from last year about the onerous compliance costs of the internal revenue code.

Narrated by Hiwa Alaghebandian of the American Enterprise Institute, the mini-documentary explains how needless complexity creates an added burden — sort of like a hidden tax that we pay for the supposed privilege of paying taxes.

Two things from the video are worth highlighting.

First, we should make sure to put most of the blame on Congress. As Ms. Alaghebandian notes, the IRS is in the unenviable position of trying to enforce Byzantine tax laws. Yes, there are examples of grotesque IRS abuse, but even the most angelic group of bureaucrats would have a hard time overseeing 70,000-plus pages of laws and regulations (by contrast, the Hong Kong flat tax, which has been in place for more than 60 years, requires less than 200 pages).

Second, we should remember that compliance costs are just the tip of the iceberg. The video also briefly mentions three other costs.

- The money we send to Washington, which is a direct cost to our pocketbooks and also an indirect cost since the money often is used to finance counterproductive programs that further damage the economy.

- The budgetary burden of the IRS, which is a staggering $12.5 billion. This is the money we spend to employ an army of tax bureaucrats that is larger than the CIA and FBI combined.

- The economic burden of the tax system, which measures the lost economic output from a tax system that penalizes productive behavior.

The way to fix this mess, needless to say, is to junk the entire tax code and start all over.

I’ve been a big proponent of the flat tax, which would mean one low tax rate, no double taxation of savings, and no corrupt loopholes. But I’m also a big fan of national sales tax proposals such as the Fair Tax, assuming we can amend the Constitution so that greedy politicians don’t pull a bait and switch and impose both an income tax and a sales tax.

But the most important thing we need to understand is that bloated government is our main problem. If we had a limited federal government, as our Founding Fathers envisioned, it would be almost impossible to have a bad tax system. But if we continue to move in the direction of becoming a European-style welfare state, it will be impossible to have a good tax system.

Related Tags

Jon Stewart: ‘Tax Expenditures’ = Newspeak

Along with other advocates of limited government, I have criticized the convention of referring to targeted tax breaks as “tax expenditures” or “tax subsidies.” Yes, targeted tax breaks share many characteristics with government spending. But they are not government spending. And if we concede that premise, then someday, some smarmy politician will try to increase taxes while telling us it’s a spending cut.

That someday has come. And in the below video, Jon Stewart is all over it. (Skip ahead to about 5:00.) Stewart’s comments are worth transcribing:

What? “Spending reductions in the tax code”? The tax code isn’t where we spend, it’s where we collect. And tha–ohhhhh. I guess what you said is tax code — code for raising taxes. You managed to talk about a tax hike as a spending reduction. [Laughter.] Can we afford that and the royalty checks you’re going to have to send to George Orwell? That is the weirdest way — just say tax hike.

There ain’t no such thing as a tax expenditure. There ain’t no such thing as a tax subsidy.

Related Tags

This Week in Government Failure

Over at Downsizing the Federal Government, we focused on the following issues this week:

- If there’s this much resistance to a budget haircut, how can we hope to agree on surgery that would actually reduce spending, balance the budget, and avert national bankruptcy?

- Policymakers looking for spending cuts are finally turning an eye toward farm subsidies.

- Despite the budget cuts agreed to this week, total federal outlays will still rise by approximately $177 billion.

- President Obama wants to get reelected, and he will need a strong economy to succeed. Penalizing millionaires won’t help, but partnering with Republicans on corporate tax reforms and spending cuts would boost the economy and his job prospects.

- Spending increased an average $170 billion a year over the last decade. Thus, the $40 billion cut reverses out no more than one-quarter of one year’s worth of the last decade of increases.

- A new Cato video does an excellent job of visualizing the minuscule spending cuts Republicans and Democrats agreed to this week.

Follow Downsizing the Federal Government on Twitter (@DownsizeTheFeds) and connect with us on Facebook.

Related Tags

Why Are Geithner and Bernanke Trying to Panic Financial Markets with Debt Limit Demagoguery?

By taking advantage of “must-pass” pieces of legislation, Republicans have three chances this year to restrain the burden of government. They didn’t do very well with the “CR fight” over appropriated spending for the rest of FY2011, which was their first opportunity. I was hoping for an extra-base hit off the fence, but the GOP was afraid of a government shutdown and negotiated from a position of weakness. As such, the best interpretation is that they eked out an infield single.

The next chance to impose fiscal discipline will be the debt limit. Currently, the federal government “only” has the authority to borrow $14.3 trillion (including bookkeeping entries such as the IOUs in the Social Security Trust Fund). This is a very big number, but America’s gross federal debt will hit that limit soon, perhaps May or June.

Republicans say they will not raise the debt limit unless such legislation is accompanied by meaningful fiscal reforms. The political strategists in the Obama White House understandably want to blunt any GOP effort, so they are claiming that any delay in passing a “clean debt limit” will have catastrophic consequences. Specifically, they are using Treasury Secretary Tim Geithner and Federal Reserve Bank Chairman Ben Bernanke to create fear and uncertainty in financial markets.

Just a few days ago, for instance, the Treasury Secretary was fanning the flames of a financial meltdown, as noted by Bloomberg:

“Default would cause a financial crisis potentially more severe than the crisis from which we are only now starting to recover,” Geithner said. “For these reasons, default by the United States is unthinkable.”

The Fed Chairman also tried to pour gasoline on the fire. Here’s a passage from an article in the New York Times earlier this year:

Mr. Bernanke said the debt ceiling should not be used as a negotiating tactic, warning that even the possibility of the United States not being able to pay its creditors could create panic in the debt markets.

There are two problems with these statements from Geithner and Bernanke. First, it is a bit troubling that the Treasury Secretary and Fed Chairman are major players in a political battle. The Treasury Secretary, like the Attorney General, traditionally is supposed to be one of the more serious and non-political people in a President’s cabinet. And the Fed Chairman is supposed to be completely independent, yet Bernanke is becoming a mouthpiece for Obama’s fiscal policy.

But let’s set aside this first concern and focus on the second problem, which is whether Geithner and Bernanke are being honest. Simply stated, does a failure to raise the debt limit mean default? According to a wide range of expert opinion, the answer is no.

Donald Marron, head of the Urban-Brookings Tax Policy Center and former Director of the Congressional Budget Office, explained what actually would happen in an article for CNN Money.

Our monthly bills average about $300 billion, while revenues are about $180 billion. If we hit the debt limit, the federal government would be able to pay only 60 cents of every dollar it should be paying. But even that does not mean that we will default on the public debt. Geithner would then choose which creditors to pay promptly and which to defer. …Geithner would undoubtedly keep making payments on the public debt, rolling over the outstanding principal and paying interest. Interest payments are relatively small, averaging about $20 billion per month, and paying them on time is essential to America’s enviable position in world capital markets.

And here is the analysis of Stan Collender, one of Washington’s elder statesman on budget issues (and definitely not a small-government conservative).

There is so much misinformation and grossly misleading talk about what will happen if the federal debt ceiling isn’t increased that, before any more unnecessary bloodcurdling language is used that increases everyone’s anxiety, it’s worth taking a few steps back from the edge. …if a standoff on raising the debt ceiling lasts for a significant amount of time, the alternatives to borrowing eventually may not be enough to provide the government with the cash it needs to meet its obligations. Even at that point, however, a default wouldn’t be automatic because payments to existing bondholders could be made the priority while payments to others could be delayed for months.

The Economist magazine also is nonplussed by the demagoguery coming from Washington.

Tim Geithner, the treasury secretary, sent Congress a letter on January 6th describing in gory detail the “catastrophic economic consequences” such an event would entail. …Even with no increase in the ceiling, the Treasury can easily service its existing debt; it is free to roll over maturing issues, and tax revenue covers monthly interest payments by a large multiple. But in that case it would have to postpone paying something else: tax refunds, Medicare or Medicaid payments, civil-service salaries, or Social Security (pensions) cheques.

There are countless other experts I could cite, but you get the point. The United States does not default if the debt limit remains at $14.3 trillion. The only exception to that statement is that default is possible if the Treasury Secretary makes a deliberate (and highly political) decision to not pay bondholders. And while Geithner obviously is willing to play politics, even he would be unlikely to take this step since it is generally believed that the Treasury Secretary may be personally liable if there is a default.

The purpose of this post is not to argue that the debt limit should never be raised. That would require an instant 40 percent reduction in the size of government. And while that may be music to my ears (and some people are making that argument), I have zero faith that politicians would let that happen. Instead, my goal is to help fiscal conservatives understand that Geithner and Bernanke are being dishonest and that they should not be afraid to hold firm in their demands for real reform in exchange for a debt limit increase.

Last but not least, with all this talk about the debt limit, it’s worth reminding everyone that deficits and debt are merely symptoms of too much government spending. As this video explains, spending is the disease and debt is merely one of the symptoms.

By the way, the final chance this year to impose spending restraint will be around October 1, when the 2011 fiscal year expires and the 2012 fiscal year begins. But I won’t be holding my breath for anything worthwhile if Republicans screw up on the debt limit just like they failed to achieve much on the CR fight.