Throughout the coronavirus pandemic, Democratic governors have accused the Trump administration of favoritism in determining how the federal government has allocated medical supplies and aid to the states. Critics claim that the process has been politicized, with the administration assisting Republican states while leaving many Democratic states to fend for themselves. A recent New York Times article outlines concerns that $16 billion in pandemic relief for farmers will be used as another tool by the Trump administration to lock up support from farmers and buy votes in key battleground states.

As the article notes, the federal government distributed $28 billion in trade relief to pay farmers for the negative effects of increased tariffs in 2018 and 2019. Critics allege that the payments were excessive, estimated to be one-and-a-half to 33 times more than farmers lost because of economic damage from the trade war, and are a ploy to maintain support for President Trump among farmers, a group that is favorable to Trump and plays an important role in swing states.

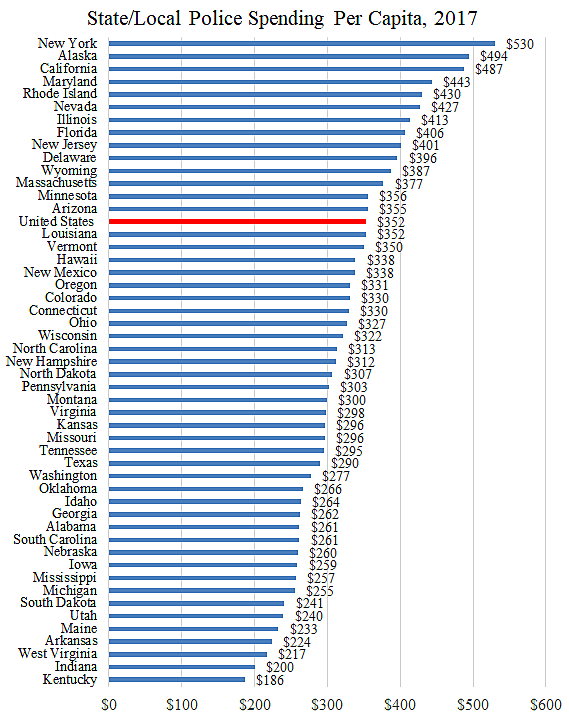

Critics also argue that the trade relief payments were distributed mainly to states favorable to Trump—primarily southern states. A report by the Democratic staff of the Senate agriculture committee found that, in 2019, Georgia, Mississippi, Alabama, Tennessee, and Arkansas received the highest amounts of trade relief in the first round of payments. The concern is that the coronavirus relief will be no different and, so far, of the $500,000 in coronavirus relief distributed to farmers, the important swing state Wisconsin has received the third-highest share.

Because the pandemic aid has yet to be fully disbursed it is too early to know if there will be favoritism. But history suggests that the politicization of disaster relief is nothing new. In the summer issue of Regulation, Steven Horwitz and E. Frank Stephenson summarize the research on how politics has influenced the allocation of disaster aid going back to the New Deal. The findings are clear: relief funds, disaster declarations, and the allocation of medical supplies have frequently been used by presidents and legislators to reward supporters and buy votes.

The distribution of loans and relief during the New Deal is a prime example of how political factors can dictate how funds are steered. Economic historian Gavin Wright explored why western states received a large amount of aid relative to the South, which received a comparatively small amount. He found that the variability of Democratic voting in western states played an important role in influencing where the Roosevelt administration sent funds, implying that the administration sought to buy votes in battleground states while the South was less important because it consistently voted Democratic. Relevant to coronavirus farm relief, additional research also found that New Deal aid to farmers in Alabama counties was positively correlated with Roosevelt’s vote share.

As the federal government’s role in responding to natural disasters has increased, the allocation of Federal Emergency Management Agency (FEMA) spending has also been politicized. Multiple studies have found that presidential disaster declarations, which make regions eligible for FEMA disaster relief, increased in election years and that disaster declarations were more frequent in swing states. States with more representation on subcommittees overseeing FEMA also received more disaster relief. One of the studies, by Thomas Garrett and Russell Sobel, concludes that from 1991 to 1999, “nearly half of all FEMA disaster relief is explained by political influence rather than actual need.”

And separate research of agricultural disaster payments for areas with crop failures, droughts, floods, and other disasters found that states represented on Congressional committees overseeing agriculture and agricultural appropriations received more disaster relief. As much as 30% of agricultural disaster relief is estimated to be based on political influence instead of actual crop losses.

Most relevant to the current pandemic, research found that H1N1 (swine flu) vaccine allocations were politicized. First available in October 2009, doses of the vaccine were distributed by the Department of Health and Human Services which is overseen by the House Committee on Energy and Commerce. A study by Matt Ryan indicates that states received an additional 60,000 doses for each Democratic member the state had on the Committee.

Horwitz and Stephenson summarize the cause of this politicization nicely:

These outcomes are not the product of particular personalities or partisan affiliations, but of the incentives created by the institutional structure of politics. Politicized disaster relief is nothing more than politics as usual.

It is too early to identify whether the Trump administration’s decisions on how to allocate medical supplies, aid, and agricultural relief are truly political. But it should be no surprise if they are. At this point, the politicization of disaster relief is an American tradition.