It is not often I get a chance to latch on to someone as high profile as the President of the United States saying that public schools “draw us together.” But in his appearance at Georgetown University a couple of days ago, President Obama blamed, among other things, people sending their children to private schools for breaking down social cohesion and reducing opportunities for other children.

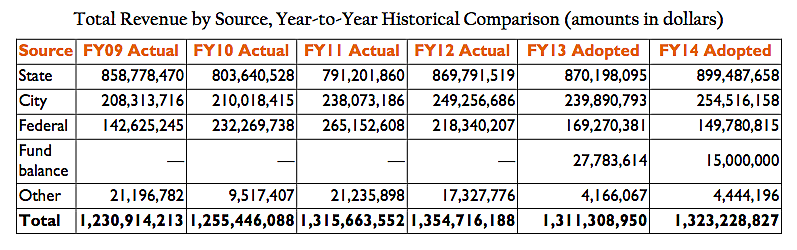

First, let’s get our facts straight: Private schools are not the main way better-off people, or people with high social capital, isolate themselves from poor families. Only 9 percent of school children attend private schools, and as Matt Ladner points out in a great response to the President, that percentage has been dropping over the years. No, the main way the better-off congregate amongst themselves is buying houses in nice places, which translates into access to good school districts. Even the large majority of the mega-rich appear to send their children to public schools, but rather than paying school tuition, their tuition is the far-steeper, far more exclusive price of a house. And let’s not pretend — as the President hinted — that we’ve seen anything close to long-term decreased funding for public schools. Even with a slight dip during the Great Recession, inflation-adjusted, per-pupil spending in public schools has well more than doubled since 1970.

On the deeper point, do we really know that public schools “draw us together,” and more importantly, do so better than private schooling? No, we don’t. That’s the accepted wisdom, but basic history doesn’t necessarily bear it out. Roman Catholics ended up starting their own school system – which at its peak in 1965 enrolled about 12 percent of all students – because the de facto Protestant public schools could not accommodate them. African-Americans, of course, were long legally excluded from public schools, especially white public schools. Similar situations existed for Asians and Mexican-Americans in some parts of the country. And, of course, public schools reflected the communities they served, which were often small and homogeneous. Finally, public schooling forces diverse people into a single system, which has led to seemingly incessant, cohesion-tearing clashes over values, personal identities, and much more.

It is also not the case, as President Obama’s critique implies, that private schools don’t build social capital within communities. As discussed in the book Lost Classroom, Lost Community: Catholic Schools’ Importance in Urban America, Roman Catholic schools — the most numerous of private schools — have often been hubs of their communities, and when they have closed it has contributed to major losses of social capital ultimately resulting in community disintegration and all the ills that go with that. And as I wrote when the latest NAEP exam results in geography, U.S. History, and civics came out a few weeks ago, private schools also appear to do a better job than public schools of inculcating good civic values in their students, including political knowledge and a proclivity to volunteer in one’s community.

Private schooling is not what’s pulling Americans apart, Mr. President. Indeed, it may be a powerful tool for bringing us together.