I testified to the Senate Finance Committee today regarding taxes and small business. My testimony is posted here.

President Obama plans to raise the top two individual income tax rates. That will not be good for business or the economy. A little more than half of all business income in the United States is reported on individual returns, not corporate returns. Of the business income reported on individual returns, 44 percent is in the top two income tax brackets.

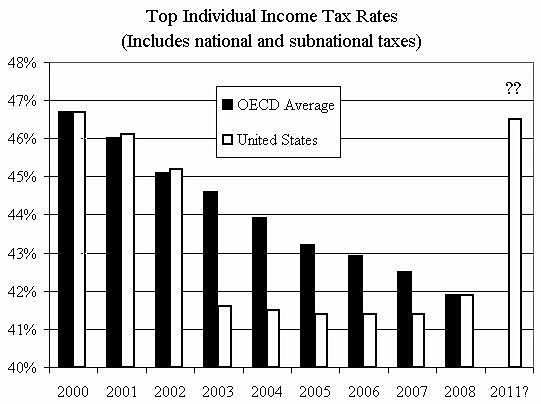

My testimony pointed out that while Congress cut the top individual rate by 5 percentage points this past decade, the average top rate in the 30 OECD countries also fell by 5 percentage points, as shown in the chart below.

If the top federal rate rises to 40 percent next year, the United States will have the ninth highest top individual rate in the OECD, including state-level taxes. We’ve already got the second-highest corporate tax rate in the OECD.

A nation that has been a relative bastion of market capitalism and individual achievement has a tax code that is becoming very hostile to high-earners, entrepreneurs, and businesses of all types.