There are large differences in tax burdens between states. New York and Florida provide a good illustration because their populations are similar. In 2019, state and local governments in New York imposed $192 billion in taxes, which was more than double the $86 billion imposed by governments in Florida.

More evidence on large tax differences comes a study by the District of Columbia. It compares state and local taxes on hypothetical households in the largest city in each state and D.C. The study includes sales, property, individual income, and automobile-related taxes. It does not include federal taxes.

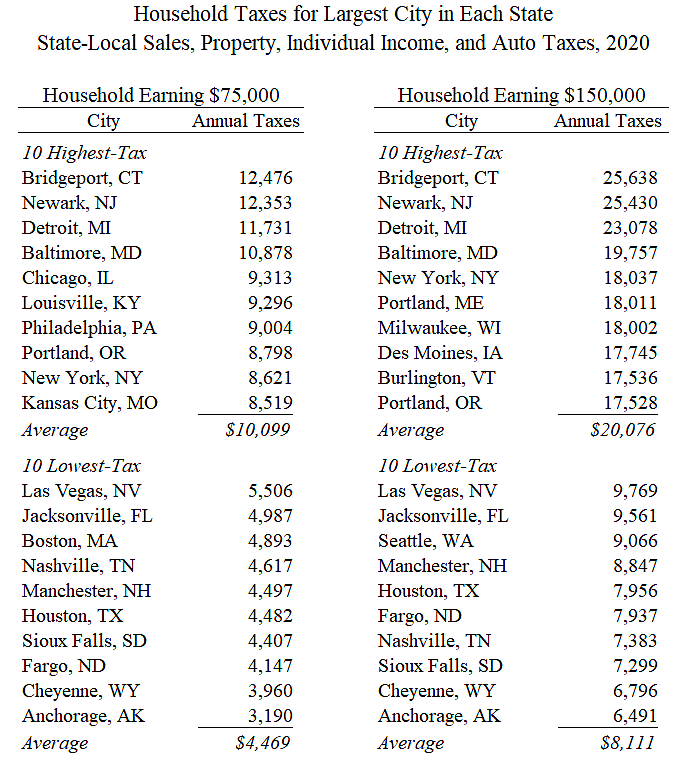

The table below shows the highest- and lowest-tax cities for households earning $75,000 and $150,000. Some observations:

- Residents of high-tax cities could slash their state-local tax bills in half by moving to a low-tax city. Households earning $75,000 could save about $5,600 a year by moving. Households earning $150,000 could save about $12,000 a year by moving.

- Across the 51 cities, the largest tax at the $75,000 level is the property tax, and the largest tax at the $150,000 level is the income tax.

- The property tax was the largest tax at both income levels in Bridgeport, Newark, Detroit, and Baltimore. The study found that Bridgeport, Detroit, Indianapolis, Milwaukee, and Newark had the highest effective property tax rates among the 51 cities.

- Some cities have their own income taxes on top of state income taxes, including Baltimore, Detroit, Newark, New York City, Philadelphia, and Portland (OR).

- A number of the highest-tax cities are known for urban decay. Leaders in those cities should know that high property and income taxes in particular kill investment.

Nine U.S. states do not have individual income taxes: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Cities in these states generally had the lowest overall tax burdens in the study, which suggests that they do not fully make up for the loss in income taxes by raising other taxes.

The D.C. study did not include business taxes, but adding them does not change the pattern greatly. Considering total state-local taxes as a percentage of income, the four lowest-tax states do not have individual income taxes—Alaska, Florida, South Dakota, and Tennessee. New Hampshire was the sixth lowest.

In sum, states without individual income taxes include some of the lowest-tax states in the nation with the leanest governments. If legislators in other states want to improve government efficiencies, repealing the income tax is one way to encourage it.