Today is Tax Day. Federal tax returns are due to the Internal Revenue Service with a postmark before midnight. The Congressional Budget Office (CBO) projects that the federal government will collect $3.2 trillion in revenue this year.

Revenue comes from five main sources:

- Individual Income Taxes ($1.5 trillion). The largest source of federal revenues, individual income taxes are imposed on labor and capital income, with statutory rates that vary from 10 to 39.6 percent.

- Payroll Taxes ($1.1 trillion). These taxes finance Social Security and Medicare. Employees and employers split the 15.3 percent tax assessed on wages, but economists agree that the entire burden ultimately lands on workers in the form of lower wages.

- Corporate Income Taxes ($328 billion). These taxes are assessed on the worldwide earnings of corporations.

- Excise Taxes ($96 billion). Excise taxes are consumption taxes on specific goods. At the federal level, excise taxes are charged on such things as gasoline and tanning salons.

- Other ($206 billion). This category includes the remaining sources of federal revenue like federal tariffs and the death tax.

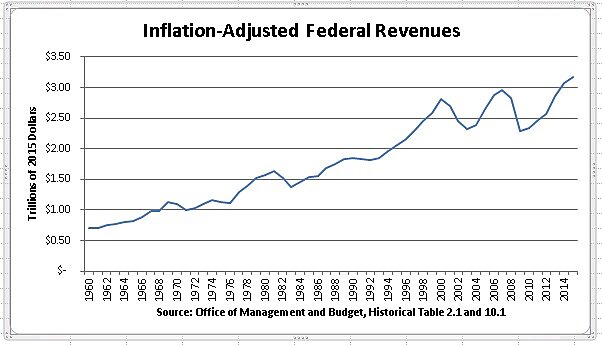

The amount of money collected by the federal government ebbs and flows depending on economic growth, but the overall trend is upwards. Federal revenue decreased in 2008 and 2009 due to the Great Recession, but has since rebounded strongly for two reasons. First, the return of economic growth increases revenue collection. Second, the federal government has passed several large tax increases since 2010. In 2015, the federal government will collect the largest amount of revenue in its history, even after adjusting for inflation.

Where does all this money go?

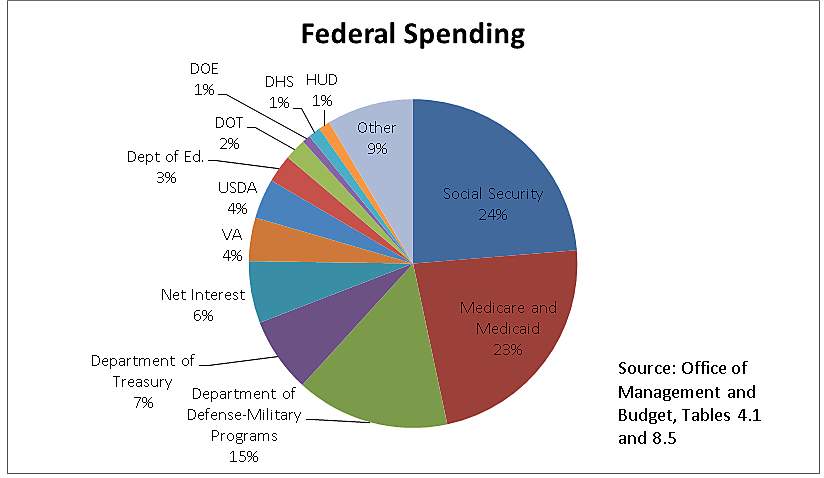

The bulk of federal spending goes to Social Security, Medicare and Medicaid, and defense. These three categories compromise 62 percent of all federal spending in 2015.

The three giant “entitlement” programs are the areas of the budget that are expected to put immense pressure on federal spending over the long term. Without reforms, the CBO estimates that Social Security, Medicare, and Medicaid will represent 60 percent of the increase in federal spending over the next ten years. Net interest is not far behind. It is responsible for 24 percent of the increase in spending over the same time period.

Despite this record intake, federal spending will still outpace revenues by almost $500 billion this year. The government does not have a revenue problem, it has an overspending problem.

Note: All data refers to federal fiscal years, not calendar years. Data for fiscal year 2015 is based on estimates.