In a note to my last post, I observed that Liberty Street Economics, the blog of Federal Reserve Bank of New York, promised a follow-up to its post addressing the advantages of the Fed’s interest payments on required reserves. The follow up would address the benefits of paying interest on banks’ excess reserves and of thereby establishing a “reserve-abundant regime.”

That follow-up post has since appeared, under the title “Why Pay Interest on Excess Reserve Balances?” As I’d anticipated, it answers the question it poses by outlining some supposed benefits of having banks sit on immense piles of cash, without so much as hinting at the existence of any countervailing costs. As soon as those costs are considered, the supposed benefits turn out to be largely, if not entirely, fictitious.

Real and Pseudo Reserve Economies

According to the post’s authors, Laura Lipscomb and Heather Wiggins (Board of Governors) and Antoine Martin (FRBNY), a major advantage of paying interest on excess reserves (IOER) is that, by ensuring that banks possess “a relatively abundant supply of [excess] reserves,” it “makes the U.S. payment system more efficient.” Besides no longer having to rely “on intraday and overnight credit from the Fed,” the authors explain, banks made flush with reserves “are more willing to relinquish reserves early and are therefore engaging in less economizing and hoarding of reserves, making the payment system more efficient.”

“Less economizing and [less] hoarding”? Usually, when we speak of someone “economizing” on X, we mean that he or she makes do with less of X. To do less economizing of X is therefore to require more of X. So how can banks do “less economizing and hoarding of reserves”? They can’t. They can either economize less and hoard more, or they can economize more and hoard less.

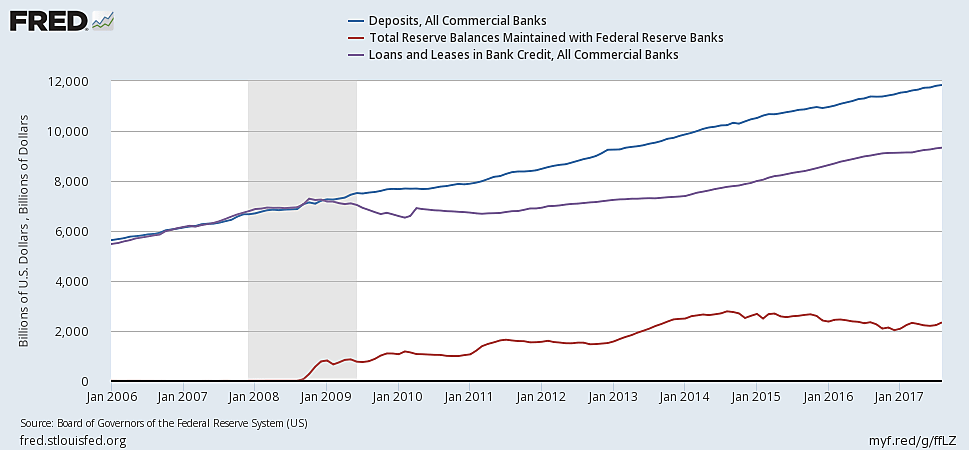

Nor can there be any doubt which of these alternatives IOER encourages. Before that policy was introduced, U.S. banks seldom held more than $2 billion in excess reserves collectively. Today they hold more than $2 trillion. If that isn’t less economizing and more hoarding, I can’t imagine what would qualify. Certainly to claim, as Lipscomb, Martin, and Wiggins do, that it marks an improvement in the efficiency of the payments system, seems on the face of it quite a stretch.

But let’s allow the authors to elaborate:

When reserves are scarce, banks are more reliant on the reserves they receive from other banks to make their own payments than when reserves are more abundant. So reserve scarcity exposes the payment system to a greater risk that a disruption at one bank could spill over and affect the system as a whole. Also, having a larger share of payments settled early reduces the potential consequences of a late day operational disruption.

Furthermore,

the amount of intraday credit the Fed needs to extend to banks to cover daylight overdrafts … is much lower when the supply of reserves is high. … A large supply of reserves gives banks a sizable buffer to make payments throughout the day without needing to wait for the receipt of other payments or relying on daylight credit from the Fed or other counterparties.

Finally,

In addition to needing less daylight credit, banks require less overnight credit in the form of discount window loans when reserves are abundant. The relatively abundant reserve environment means that fewer banks are caught short of balances at the end of the day, or at the end of a reserve maintenance period, which can lead to a scramble for funds, a spike in the federal funds rate, and banks occasionally accessing the discount window.

What’s wrong with that? The terminology, for starters. In the absence of IOER, although excess reserves are certainly “scarce” in the sense of being valuable, and therefore unlike salt water to a sailor or sand to a Bedouin, they are not usually “scarce” in the sense of being in short supply. The difference matters because, despite the impression conveyed in the above passages, the “scarcity” of reserves, properly understood, is not a problem with which bankers must cope, like so many farmers coping with a drought. Rather, the degree to which reserves are “scarce” is one normally chosen by the banks themselves. In econ lingo, it is itself the solution to an optimization problem, involving the weighing of private benefits and costs, including the costs of having to rely on occasional intraday and overnight loans.

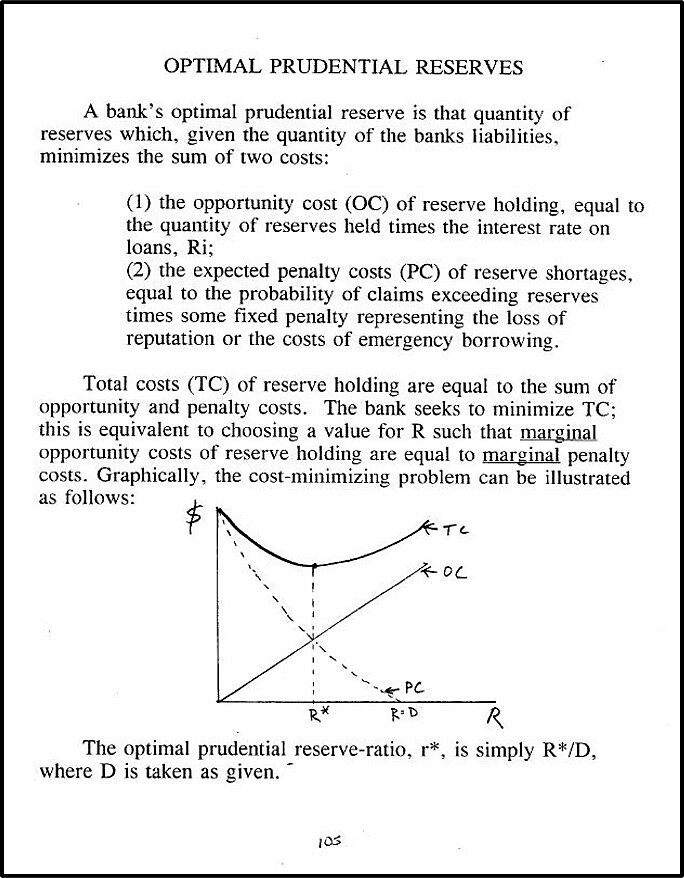

The economics of the problem in question are actually pretty simple — so simple that, over the course of three decades, I taught them to several thousand undergraduates. As it happens, I still have a copy of my class notes. Here is the relevant page:

For “prudential” read “excess,” and never mind the typos. The point is that the mere fact that banks can avoid having to borrow if they hold more reserves hardly suffices to establish that getting them to do so makes either the banks themselves or the public better off.

An Inefficient Reserve Market?

Am I then claiming that, without IOER, the market for bank reserves would be perfectly efficient, with banks holding just the right amount of excess reserves? Not at all. Without IOER, the market for excess reserves might be inefficient for several reasons. It might be so because the Fed doesn’t charge banks the right price for daylight overdrafts or overnight loans. And it might be so because the Fed doesn’t reward them sufficiently for holding excess reserves.

Setting aside the problem of routinely mispriced Fed credit, which was once very serious but has since been somewhat rectified, many economists, myself included, have long understood that there’s a case for reducing banks’ opportunity cost of reserve holding by paying a positive return on reserves. But that hardly means that banks can’t be overcompensated for their reserve holdings, or that they can’t thereby be encouraged to hold inefficiently large quantities of excess reserves.

The well-known arguments for paying interest on bank reserves are in fact arguments for paying a rate of interest reflecting the true opportunity cost of reserve holding. That means a “Friedman rule” rate not lower but also no higher than market rates on other liquid and risk-free assets.

Furthermore, because the Friedman rule applies to a hypothetical economy free of nominal rigidities and other frictions, even that rate is likely to be too high in practice. In their recently published study devoted to determining an optimal IOER rate in light of real-world frictions, Matthew Conzoneri, Robert Cumby, and Behzad Diba arrive at an optimal steady state tax on excess reserves of 20 to 40 basis points, implying an optimal IOER rate equal to the Friedman rate minus that optimal tax. Allowing for what the authors’ refer to as a “bank lending externality” pushes the optimal IOER rate down even more, and can even make it negative.

Yet almost since IOER was first introduced, in October 2008, the Fed’s practice has been to set its IOER rate above, if not substantially above, corresponding market rates, and to thereby encourage banks, not merely to fine-tune their reserve holdings to equate marginal (social) benefits and costs, but to pile-up as many reserves as the Fed sends their way.

In short, slice and dice it however you like, there is no way to make sense of Liberty Street Economics’ claim that the Fed’s interest payments on excess reserves serve to achieve an optimal quantity of bank reserves, or to otherwise make our payments system more efficient.

There’s No Such Thing as a Free (Liquid) Lunch

But hold on: can’t the Fed produce reserves costlessly? And doesn’t that mean that, even if there are more than enough of them, their presence can’t possibly be wasteful?

No, and no. Even if it didn’t cost a thing for the Fed to increase the nominal quantity of reserves, it costs plenty to get banks to increase their excess reserve holdings, which is what the Fed does by paying interest on excess reserves. Every dollar that banks keep in the form of excess reserves is a dollar they might instead have traded (along with some others) for a security, or lent. (And if you think that banks don’t lend reserves, you need to read this Nick Rowe post.)

As the chart below shows, in the good-old, pre-IOER days, when U.S. commercial banks hardly held any excess reserves, their total loans and leases amounted to about 100 percent of their deposits. Today, in contrast, banks hold excess reserves equal to about 20 percent of their deposits, and loans and leases equal to about 80 percent of their deposits. That change is a truer index of the cost of IOER.

None of this would matter if the Fed acted as an efficient savings-investment intermediary, as commercial banks are able to do, at least in principle. But the Fed isn’t a commercial bank, and it doesn’t employ funds at its disposal the way commercial banks do. It makes loans to other banks, but not to businesses or consumers. And its investments are typically confined to Treasury and some agency securities.

High-Tech Financial Repression

When central banks of less-developed countries impose high reserve requirements on their nations’ banks, for the sake of steering more of their citizens’ savings onto their own balance sheets, and thence to their governments’ coffers, economists call it “financial repression.” And they condemn it.

How come? Because ever since Adam Smith wrote his eloquent chapter (No. 2 of Book 2) on the subject, they’ve understood the crucial role bank lending plays in boosting economic productivity and otherwise spurring growth. In recent decades that understanding has been reinforced by a vast crop of writings on the topic, both theoretical and empirical.

When, on the other hand, the Federal Reserve gets banks to accumulate trillions of dollars in excess reserves, and to thereby fund its acquisition of an equivalent amount of government and mortgage-backed securities (where by “vast” I again refer not just to nominal but to real quantities), Federal Reserve economists call it “making the payments system more efficient”!

Call it what they will, the Fed’s policy is also financially repressive. By diverting savings to the government and its agencies and to whatever endeavors they favor, it denies that much funding to other prospective borrowers, many of whom — and small business owners especially — would employ the funds in question more productively.

According to a recent working paper by Brian Chen, Samuel Hanson, and Jeremy Stein, all of Harvard, overall bank lending to small businesses has yet to fully recover the ground it lost in 2008, and has hardly recovered at all at the top 4 banks. The evidence suggests, furthermore, that this sustained decline, which may have played a part in “the weak productivity growth in the decade since the crises,” reflects “a systematic and sustained supply-side shift.” Although Chen, Hanson, and Stein don’t investigate the cause of the shift, and don’t mention IOER as a possible culprit, it is certainly a likely suspect. Among other things it’s well-known that the biggest banks have also been among the chief accumulators of excess reserves.

But surely, you may be thinking, there’s a difference between forcing banks to hold more reserves, as some less-enlightened central banks have done, and rewarding them for doing so. There is, but it doesn’t make the Fed’s policy much less financially repressive. The difference is that, instead of imposing a “reserve tax” on banks and their depositors, the Fed’s above-market IOER rate grants them a subsidy proportional to the difference between the actual IOER rate and its optimal counterpart. Although the subsidy serves to somewhat enhance rather than to reduce the attractiveness of bank deposits, that slight gain is more than offset by the diversion of deposited savings to less productive uses.

Who, then, foots the bill for the subsidy? Taxpayers do. That becomes evident once one considers that the Fed, being a relatively inefficient intermediary, can afford to pay above-market rates on banks’ reserves only by either (1) sacrificing some of the revenue it would ordinarily remit to the Treasury or (2) taking extraordinary risks in order to earn more revenue than usual. As Deborah Lucas explained at a recent Shadow Open Market Committee meeting, the Fed has taken the latter course by using bank reserves, which are short-term assets, to fund longer-term Treasuries and MBS. “There is,” she adds, “no free lunch from that transaction.” Instead, the Fed’s extra earnings reflect increased risk, which

ultimately falls on taxpayers, who serve as (conscripted) equity holders for any risky government investment. When the budget treats cash flows generated from a market risk premium as revenues but does not recognize an offsetting cost, it is arguably equivalent to levying a hidden tax that confiscates the risk premium to pay for additional spending.

Off Balance

In fairness to the authors of the Liberty Street Economics post, they never actually claim to be offering an objective assessment of the the Fed’s practice of paying interest on banks’ excess reserves. Instead, they state their intent is to review some “potential benefits” of that practice. So perhaps it is unfair of me to suggest that their review is misleading.

But I don’t think so. First of all, when economists refer to a policy’s “benefits,” they often mean its net benefits. So when that’s not what they mean, they should be clear about it, by at least noting that the policy also has costs that they have chosen not to consider. They should also make it clear that, because they are considering only the benefit side of a full cost-beneft reckoning, their assessment should not be understood as implying that the policy is a good idea. Instead of taking such precautions, Lipscomb, Martin, and Wiggens make it all too easy for readers of their article to assume that the “benefits” it describes do in fact suffice to justify the Fed’s IOER policy.

Yet all is not lost, for our authors can easily make up for any misunderstanding their post may have caused. To do so, they need only publish a companion piece, which they could call “Why Not Pay Interest on Excess Reserve Balances?,” addressing all the disadvantages of paying interest on banks’ excess reserves, and especially of paying it at above-market rates. The piece should of course address the drag on productive investments that comes from stuffing banks with reserves they don’t need. But it needn’t stop there. It could also point out how above-market IOER undermines monetary control, and how (by severing balance-sheet management from monetary control) it makes it all too easy for the Fed to play the part of a fiscal fairy godmother. Needless to say, the essay should studiously avoid even a whisper concerning any potential benefits to be expected from the policy.

I should think that a month would be more than enough time for three experts to prepare the essay in question. So let’s give them a deadline: November 1st. If they come through, we can all celebrate the general gain in understanding to which their two-part assessment is bound to contribute. And if not, we will still have learned something, to wit: that the Fed’s own assessments of the merits of its policies are best taken with a grain of salt.