“The FOMC should forget about r* for the moment and focus on … the supermassive black hole at the center of global dollar funding markets.”—Zoltan Poszar, 21 August, 2019.

A few weeks ago, as part of its effort to prevent overnight rates from rising above the Fed’s target range, and especially to avoid dramatic overnight rate spikes like the one that occurred in mid-September, the Fed announced that it would soon begin acquiring assets again. Over the course of the next two quarters, the Fed plans to purchase $60 billion in Treasury securities each month, or a total of somewhere between $250 and $300 billion, adding as many reserves to the banking system. By so doing, it will undo about two-thirds of the balance-sheet unwind that began in October 2017 and ended last September. And many experts expect the Fed to end up acquiring considerably more than $300 billion in new assets.

What the Fed hasn’t been telling anyone is that it doesn’t have to fatten-up to solve the reserve shortage. “If the answer to the problem of overnight interest rate control is more reserves,” Stephen Williamson observed last month,

that can be achieved by reducing the size of the foreign repo pool and the Treasury’s general account, which together currently come to a total of about $672 billion. That’s a lot larger than the $300 billion in T‑bills the Fed plans on purchasing. The size of the foreign repo pool and the Treasury’s general account are purely discretionary, and both were tiny before the financial crisis. None of the communications coming from the Fed have explained what these items are about. Why is it important to the Fed’s goals that foreign entities, including central banks, hold what are essentially reserve accounts at the Fed? How does it help monetary policy that the Treasury carries a large and volatile reserve balance with the Fed? Why can’t foreign central banks park their overnight US dollars elsewhere? Why can’t the Treasury park its accounts with the private sector, as before the financial crisis?

Why can’t they indeed! Besides increasing bank reserves by considerably more than $300 billion, getting the Treasury and foreign central banks to keep their surplus dollars out of the Fed could also significantly reduce fluctuations in reserve supply that make a fat excess reserve cushion appear necessary. That means that, instead of having to buy more assets, the Fed could resume its aborted balance-sheet unwind, shedding a few hundred billion dollars in assets, and possibly a lot more. In short, Williamson’s suggested alternative could prove far more consistent than the Fed’s present plans are with the Fed’s long standing normalization goal of holding “no more securities than necessary to implement monetary policy efficiently and effectively.”

Taking up Williamson’s argument where he left it, I plan to argue that the possibility he raises, far from being so much pie in the sky, is both perfectly sensible and achievable. It will take some cooperation from the Treasury, and perhaps from Congress, and some relatively straightforward reforms, to make it happen. But as those reforms should be welcomed by all of the concerned parties, that cooperation shouldn’t be hard to secure.

I plan to proceed as follows:

- First, I’ll explain why the supply of bank reserves depends not just on the size of the Fed’s balance-sheet but on other factors, including the behavior of the Treasury General Account balance and the Foreign Repo Pool, and how growth in those last factors contributed to the recent reserve shortage.

- Second, I’ll review the histories of the Treasury General Account balance and Foreign Repo Pool, showing how various developments have affected their use over the years, and particularly how crisis-era changes in the Fed’s policies encouraged their growth;

- Third, I’ll draw on those histories to explain how the Fed, with some cooperation from the Treasury, Congress, and foreign central banks, could discourage use of the TGA balance and Foreign Repo Pool, and increase the stock of bank reserves, with the help of relatively minor reforms, and without great cost to any of the parties concerned;

- Finally, I’ll explain how, besides allowing the Fed to operate its present “floor” system with fewer assets than it holds today, the steps I propose would also make it practical for it to switch from the current abundant-reserves system to a still more efficient scarce-reserve “corridor” system.

Doing all this takes lots of words. So rather than put them all into a single post, I’ve divided my essay into two installments. This one will cover the first two points above. The second will cover the rest.

“Factors Absorbing Reserve Funds”

Although the size of the Fed’s balance-sheet is the most obvious determinant of the quantity of bank reserves, it’s far from the only determinant. The quantity of bank reserves also depends on the extent of the Fed’s non-reserve liabilities. As a matter of strict accounting logic, if the size of the Fed’s balance-sheet itself doesn’t change when the sum of the Fed’s non-reserve liabilities goes down, bank reserves go up by the same amount. When the Fed’s non-reserve liabilities go up, bank reserves go down.

For that last reason, the Fed’s non-reserve liabilities are listed on the Fed’s H.4.1 statements under the heading, “Factors Absorbing Reserve Funds. If you examine the link, you’ll see that three of the factors that can absorb reserve funds are far more important than the rest. These are (1) currency in circulation, (2) the Fed’s reverse-repurchase agreements (repos) with foreign and official international Fed account holders, and (3) balances in the U.S. Treasury General Account. Henceforth, to save typing, I’ll refer to the last two factors as the FRP (for Foreign Repo Pool) and TGA balance, respectively.

Currency in Circulation

Of the three factors, currency in circulation is both the most familiar and the least subject to Federal Reserve control. It’s familiar because everyone uses currency, and also because most of us understand that when we take currency from a bank teller or cash machine, we’re depriving our banks of a like quantity of reserves. Because the Fed can’t prevent us from getting cash from our banks, any more than it can prevent us from giving cash to them, it has to create or destroy reserves to compensate for changes in the public’s demand for paper money if it wants to keep those changes from causing it to miss its interest-rate target.

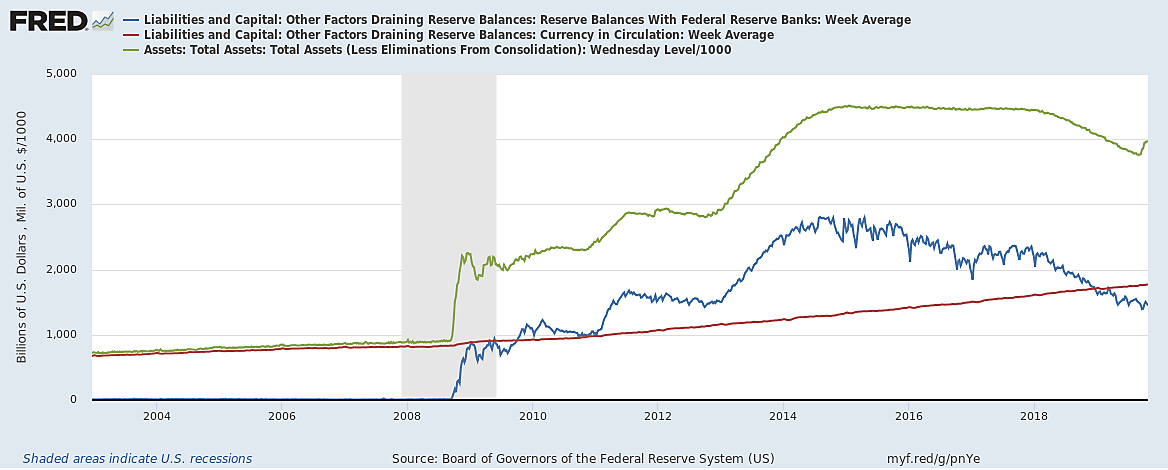

Yet changes in the public’s demand for currency rarely pose any great challenge to the Fed, because, in these post deposit insurance times, the public’s demand for currency is usually quite predictable. In the FRED chart below, tracking the public’s currency holdings, total Fed assets, and bank reserves since 2003, makes clear, that demand tends to grow at a very steady pace—so steady that it’s easy to imagine programing a computer, à la Friedman, to offset them by prompting modest and steady Fed security purchases, adding a small supplement before every Christmas holiday, and subtracting as much come each New Year.

Computer or no computer, the point remains that movements of currency into and out of the banking system haven’t been a cause of large and unpredictable changes in the supply of bank reserves. For that reason, such movements don’t themselves call for banks to be equipped with large excess reserve cushions to guard against occasional reserve shortages. Instead, the Fed has mainly been vexed by unanticipated growth and fluctuations in the TGA balance and FRP.

The TGA and FRP

Besides granting the Federal Reserve System the authority “to furnish an elastic currency, to afford means of rediscounting commercial paper, [and] to establish a more effective supervision of banking in the United States,” the Federal Reserve Act made the twelve Federal Reserve banks fiscal agents to the U.S. government, allowing them to supplement, if not supplant, various national banks as depositories for government funds. The Treasury’s accounts at each of the twelve Fed banks are consolidated at the end of each day in the Treasury’s New York Fed account, aka the TGA.

If few people have heard of the TGA, still fewer have heard of the Foreign Repo Pool, a decades-old New York Fed program that, until relatively recently, drew little attention even from economists. The program allows foreign central banks and other “Foreign Official Institutions,” or FOIs, including foreign governments and multilateral agencies like the BIS, to deposit money at the Fed and earn interest on it. Although the deposits don’t themselves bear interest, balances in them are swept into the repo pool at the end of each day. In other words, the Fed exchanges some of its securities for them, and repurchases those securities the next morning, returning the cash to the FOIs at a price that allows them some interest. Despite the fancy nature and terminology of the underlying exchanges, the outcome is much as if the FOIs were simply able to keep interest-bearing Fed accounts.

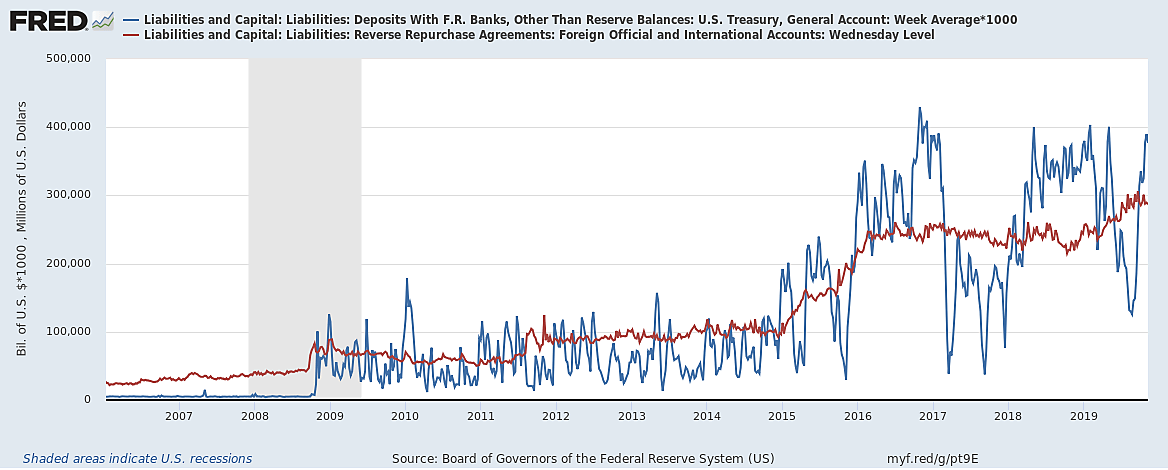

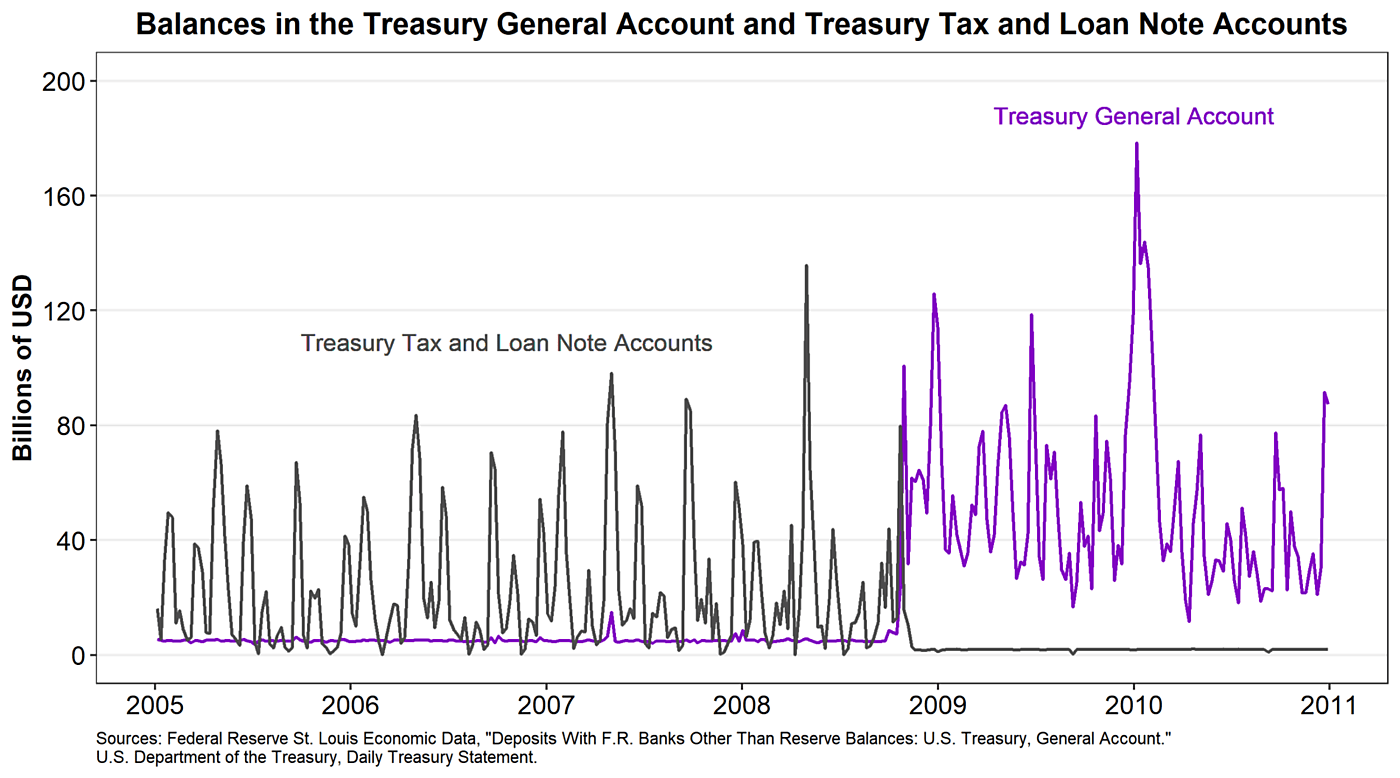

As the next FRED chart shows, both the TGA balance and the FRP have grown substantially since 2008. And both, but the TGA especially, have been relatively volatile:

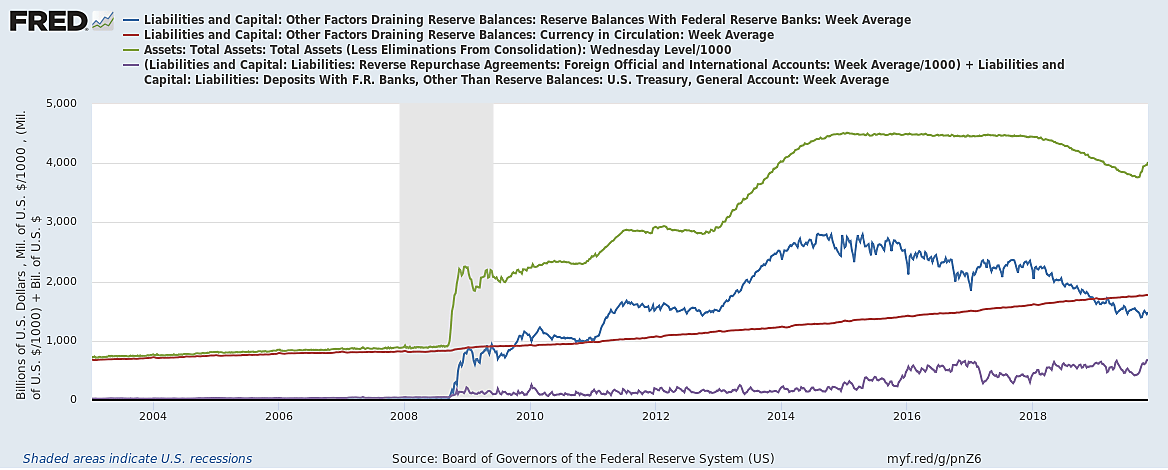

Combining the TGA balance and FRP values in a single series, as is done in the purple line in the next chart, makes it especially easy to see how growth and fluctuations in the combined series contributed to the recent reserve shortage:

As of October 30th, the TGA balance and FRP sum to over $676 billion, representing an equivalent drain on U.S. bank reserves. That’s half again the size of the Fed’s truncated balance-sheet unwind.

It’s largely owing to the substantial post-crisis growth and volatility of these two relatively obscure Fed liabilities that the Fed has found it necessary to bulk up again, to a size not much smaller than its post-recession record. Yet it was mainly changes to the Fed’s own policies during the Great Financial Crisis that encouraged both the Treasury and foreign entities to park more dollars at the Fed than ever before.

What’s Happened to the TGA?

The post-crisis increase in the Treasury’s TGA account balance, for example, reflects a deliberate decision by the Treasury to favor the Fed over commercial bank depositories, prompted by a change in the Fed’s monetary policy operating system. Understanding how the financial crisis led to this change calls for a quick review of the history of the TGA.

The Early Days

Although the Treasury transferred almost all of its surplus funds from commercial bank depositories to the Fed soon after the passage of the Federal Reserve Act, that change was only temporary. During WWI, the Treasury started keeping the money raised from income and excess profits taxes in commercial banks again, using special “War Loan Deposit Accounts” established for the purpose. Because War Loan Deposit balances earned what now qualifies as a princely interest rate of 2 percent, while the Treasury’s Fed balances earned no interest at all, the Treasury naturally preferred them.

Although the Banking Act of 1933 put an end to interest on all bank demand deposits, including the War Loan Deposits, the War Loan Deposit Accounts managed to survive until 1950—when their name was changed to “Treasury Tax and Loan” or TT&L accounts—and for many years afterwards. Indeed, until 1974, the Treasury tended to keep funds at commercial banks until it needed to disburse them. Only then would it transfer the necessary amounts to the TGA. This policy was partly a result of various services TT&L depositories supplied to the Treasury free of charge. But low market interest rates also helped.

Déjà-Vu

In the mid-1970s, however, rising market interest rates convinced the Treasury to shift most of its excess cash back into the TGA. Although the TGA itself bore no interest, by placing funds in it the Treasury drained reserves from the banking system, compelling the Fed to buy more Treasury securities to make up for the drain, thereby increasing its Treasury remittances.

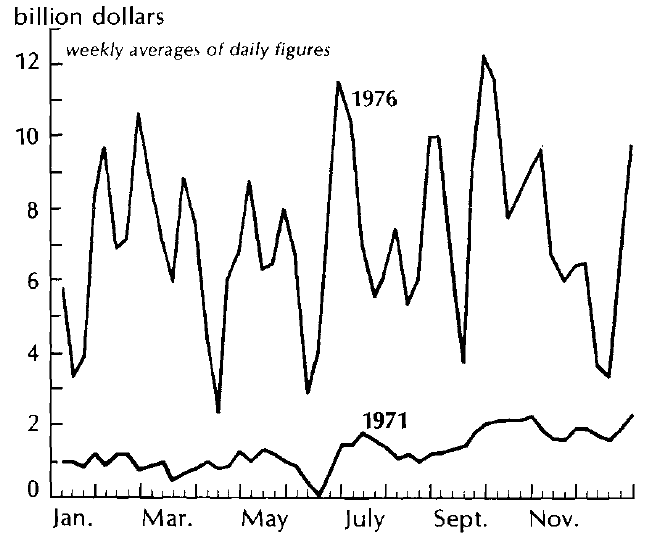

The Treasury’s move confronted the Fed with a situation eerily similar to the present one. Thanks to it, as can be seen from the next chart (from a 1977 Chicago Fed article), not just the size but the volatility of the TGA account rose dramatically. Consequently, as Richard Lang explains, the task of stabilizing the federal funds rate became much more difficult, forcing the Fed to frequently “resort to defensive open-market operations.”

In 1978, Congress, at the Fed’s urging and with the Treasury’s blessing, revived the TT&L program by authorizing a new TT&L “note option.” The option allowed Treasury funds deposited in TT&L accounts to be invested in special depository institution obligations yielding interest at a rate prescribed by the Secretary of the Treasury, which has traditionally been set 25 basis points below the fed funds rate. Because many depositories could earn that much more by investing Treasury funds, they were glad to take part in the new arrangement.

Thanks to this change, the Treasury once again returned most of its money to commercial depositories, reducing both the average TGA balance and its volatility. Ultimately the Treasury settled on a TGA balance target of just $5 billion for most of the year, and a $7 billion target for peak tax flow periods. By sticking close to these targets, the Treasury made it unnecessary for the Fed to hustle to compensate for changes to the TGA balance.

The 1978 episode is important because it shows how, with Congress’s aid, the Fed and the Treasury can come up with efficient solutions to Treasury cash management that help the Fed to maintain a lean balance-sheet.

Rising Rates: A New Challenge

Unfortunately, that post-1978 arrangement didn’t last. Its shortcomings first became evident some years prior to the Great Financial Crisis. Although at first the Treasury’s rule for setting the TT&L note rate made that rate roughly consistent with prevailing money market rates, by 1999 the TT&L rate had fallen well below those rates. In response, the Treasury proposed basing its TT&L rate formula on overnight repo rates rather than the fed funds rate, but investment depositories successfully opposed that plan. As an alternative, in 2002, the Treasury introduced a temporary “Term Investment Option” (TIO) that allowed depositories to bid for Treasury term deposits. As anticipated, the resulting auction-determined rates were considerably higher than the rate on TT&L note deposits. Consequently, the option was made permanent. Thereafter the Treasury kept a considerable portion of its surplus cash in TIO deposits.

Still, the Treasury struggled to keep its promise to maintain a low and stable TGA balance. Despite the TIO, TGA balances continued to be a low-cost option. Treasury officials also worried about the heavy concentration of both TIO and TT&L balances in a small number of depository institutions and the risk that concentration posed. Although in 2007 there were close to a thousand investment depositories (of the 9000 or so that served as tax recipients), roughly half of all TIO balances were held by just two of them. TT&L balances could be even more concentrated, with a single depository holding half of them at times.

Such concentrations raised concerns not just about risk, but about the investment programs’ limited capacity. As the GAO reported in 2007, were any of the larger depository institutions to withdraw from the program, the programs’ “capacity would fall far below that needed to accept the total amount of funds that Treasury needs to invest during peak tax collection dates,” leaving it no choice but to place funds in the TGA, allowing its balance there to rise above target. The Treasury managed nonetheless to keep its pledge to assist the Fed “in maintaining the stability of financial markets by reducing uncertainty about the supply of reserves in the banking system and simplifying the Fed’s implementation of monetary policy.” Treasury officials were willing, in other words, to take some risks and sacrifice some revenue for the Fed’s sake. This fact should be kept in mind in considering the reforms I propose in the second half of this post.

The Effect of Interest on Reserves

So matters stood in October 2008, when the Fed switched to a “floor” operating system by starting to pay interest on bank reserves while flooding the banking system with them. Under the new system, overnight interest rates would, in theory at least, no longer vary with modest changes to the total quantity of bank reserves. Instead, they would depend on the rate paid on those reserves. Consequently, the Fed no longer had to worry either about the total size of the TGA balance or how much that balance fluctuated. The way was thus clear for the Treasury to once again shift funds to the TGA, without posing problems for the Fed.*

And the Treasury leapt at the chance. Here, from one of Bill Nelson’s excellent BPI posts, is a chart showing how dramatically things changed:

The Treasury’s quick response reflected not just the Fed’s indifference to changes in the TGA balance but the fact that, by paying interest on bank reserves, the Fed made it more economical than ever for the Treasury to put money in the TGA: because the interest rate it could earn on TT&L note accounts was less than the rate the Fed paid on bank reserves, and whatever the Fed paid the banks came straight out of its Treasury remittances, the Treasury actually lost money by leaving funds at commercial banks. Because interest on reserves also reduced the net return on the TIO, it, too, became less attractive.

As dramatic as the post-October 2008 increase in TGA usage was, a still more dramatic change came in 2015 when the Treasury decided to keep a minimum TGA balance of $150 billion, and even more at certain times of the year. The idea was that, in the event of another financial disaster, the Treasury would always have enough cash there to cover a week’s worth of government payments. Once again, the Fed didn’t mind: when the Treasury made its decision, depository institutions were sitting on over $2.5 trillion in excess reserves. Consequently, having the Treasury drain a “mere” $140 billion or so from that total wasn’t expected to make any difference.

What’s Happened to the FRP?

The Foreign Repo Pool story is in many respects similar to the TGA story. Before it switched to a floor system, the Fed, recognizing how overuse of the FRP, like overuse of the TGA, could complicate the task of keeping interest rates on target, prevented the pool’s investors from making substantial changes to their deposits without advance notice and permission. The Fed also set the FRP rate somewhat below its overnight rate target, and hence below private-market Treasury-secured repo rates, which in those days cleaved to the Fed’s target. Consequently, FOIs wishing to have plenty of dollars on hand were generally better off either doing repos with commercial banks or just buying and holding U.S. Treasury securities.

Once again, things changed in 2008. Lehman’s failure that fall led to a sharp increase in perceived counterparty risk. Because the Fed itself was considered perfectly safe, FOIs became more inclined to put dollars in it rather than in private banks. The collapse of the fed funds market, itself initially a consequence of heightened fears but ultimately a result of the Fed’s decision to start paying interest on reserves, may also have caused the Fed to revise its FRP rate formula in a manner that made the FRP more attractive. Finally, since its switch to a floor system meant that sudden changes in the size of the FRP pool ceased to complicate the Fed’s rate-setting efforts, the Fed appears to have been willing to temporarily relax its FRP deposit limits so as to accommodate FOI’s desire for a safer dollar haven.

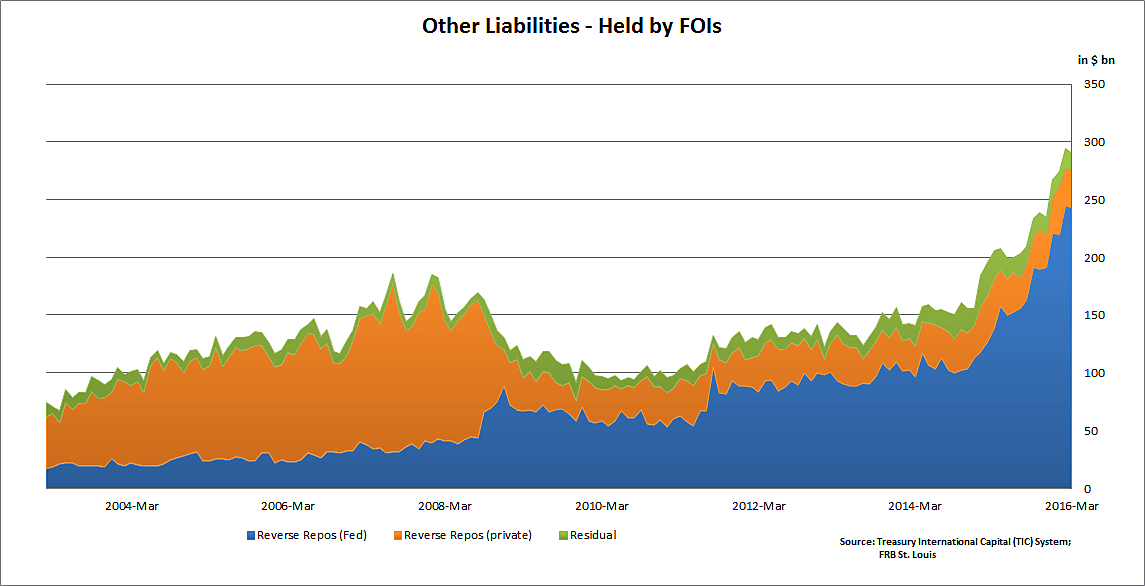

The result of these developments, as one can see in the chart below (copied from an excellent Concentrated Ambiguity post), was a substantial jump in the FRP, matched by an equally substantial drop in private repo lending, which fell to roughly a quarter of its previous level.

The same chart shows a further jump in FRP in 2015 when, according to Zoltan Pozsar, in anticipation of the Fed’s first post-crisis rate hike, Fed officials removed the limits on FRP growth altogether, this time to deliberately encourage FOIs (and the Bank of Japan in particular) to shift funds from commercial banks to its own higher-yield facility. By doing so they hoped both to place more upward pressure on overnight rates and to ease an apparent collateral shortage by encouraging foreign central banks to substitute Fed repos for some of their Treasury bill holdings.

According to the aforementioned Concentrated Ambiguity post, regulatory developments, including the U.S. implementation of Basel III, also contributed to increased FRP investments, by altering various private-market repo rates in a manner which, given the Fed’s FRP rate formula, increased the FRP yield relative to that on comparable dollar assets. Estimates made shortly after the Fed’s December 2015 rate hike put the FRP rate at somewhere between 33 and 35 basis points, as compared to the Fed’s domestic ON-RRP rate of 25 points and the 26 basis points that one-month Treasury bills were yielding.

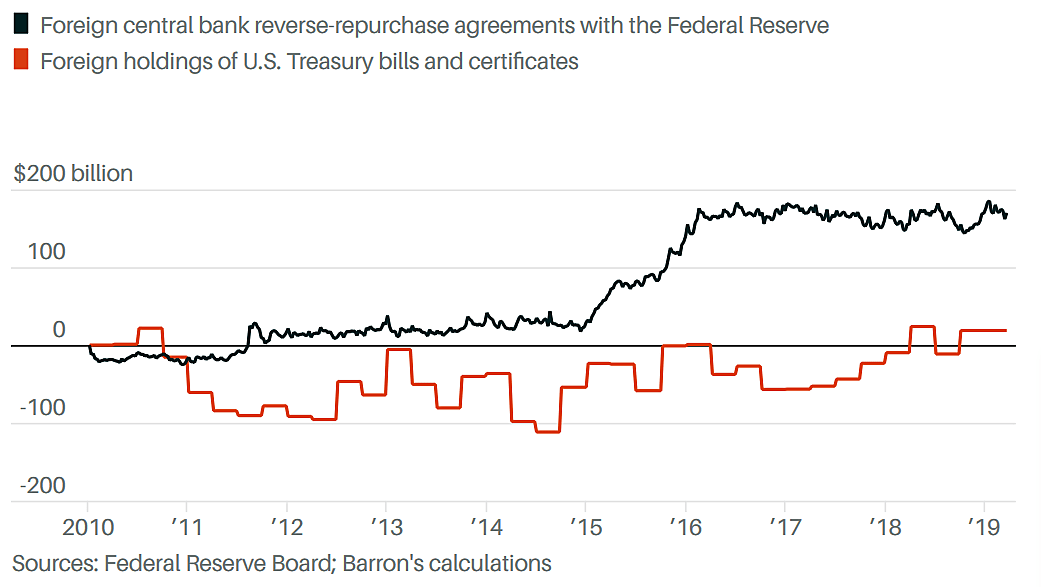

The following chart, from an excellent March 2019 Barron’s Article by Matthew Klein, illustrates how FOI dollar investments responded to these changes:

More recent developments, including the prospect of a trade war and the Treasury yield curve’s (now reversed) inversion (for which the Fed once again deserves some blame) only served to reinforce FOIs’ fondness for the FRP. According to Poszar, these changes encouraged central banks to weaken their currencies by dumping them for dollars, and to place those dollars into the RTP instead of buying up Treasuries as they would have done in the past. The uncapped FRP has thus come to resemble a “supermassive black hole at the center of global dollar funding markets…sucking in reserves.” And the longer it stays uncapped, Poszar says, “the uglier things can get.”

(End of Part 1. For Part 2, click here)

___________________

*Indeed, the Fed would have welcomed growth in the TGA even before it began paying interest on reserves because it was concerned that its emergency lending would cause the fed funds rate to fall below its target. For that reason, in mid-September 2008 it cooperated with Treasury to establish a “Supplementary Financing Program” for the express purpose of draining reserves from the banking system. The program was phased-out after the Fed’s switch to a floor system, which rendered it unnecessary.