The observation is simply that emergency lending, far from being an end in itself, is but one of many possible means by which a central bank might achieve the ultimate end of avoiding general reductions in lending and spending that might otherwise result in more general business failures — that is, in a recession or depression. For so long as the overall flow of spending remains stable, it must be the case, as a matter of simple logic, that aggregate business receipts do not fall remarkably short of aggregate outlays, and that the flagging incomes of particular firms are matched by the net revenues of others.

From this banal observation two others follow. The first is that central bank emergency lending can be justified only to the extent that it succeeds in keeping overall spending stable. The second is that a central bank that allows the overall volume of spending to collapse has blown it, no matter how much emergency lending it undertakes. Indeed, to the extent that a central bank engages in emergency lending while failing to preserve aggregate spending, it may be guilty of compounding the damage attributable to the collapse of spending itself with that attributable to a misallocation of scarce resources in favor of irresponsibly-managed firms. Thanks to moral hazard, the extent of such misallocation, instead of being proportionate to the actual volume of emergency lending, is augmented by the expectation that such lending will continue to be resorted to in the future.

In a previous post, I took Ben Bernanke’s Fed to task for contributing to the moral hazard problem during the recent crisis. It did this by repeatedly violating Walter Bagehot’s “dictum” (“lend freely at a high interest rate, against good collateral”), especially by extending credit to troubled institutions on collateral that was neither “commonly pledged” nor “easily convertible.” Although Bagehot himself never spoke in such terms, it seems to me that his emergency lending principles are broadly consistent with the overarching goal of preserving overall spending while limiting risk subsidies.

I now turn to consider the bearing of the Fed’s actions on the course of spending. As I have plenty to say on the topic, I plan to divide my observations into two posts, with this one dealing with the period prior to October 2008, and the next addressing developments after that. Still, I don’t want to keep anyone in suspense, so allow me to come right out and state my conclusion: Far from seeing to it that its emergency lending and subsequent large-scale asset purchases served to preserve the flow of aggregate spending, or to revive that flow following its collapse, Bernanke’s Fed went out of its way to make sure that the programs in question did no such thing.

Note that I am choosing my words quite deliberately: the Fed did not merely fail in its efforts to revive the flow of spending. It deliberately prevented such a revival, and by so doing prolonged the Great Recession.

Of course Bernanke and other Fed officials did not see things this way. They viewed the steps they took as ones essential to maintaining control of monetary policy. But what they imagined they were doing, and what they actually did, were two very different things.

What steps? Until the AIG bailout, the Fed made a point of “sterilizing” its emergency lending. Afterwards, finding that it lacked the resources it needed to continue to sterilize its loans and asset purchases, it sought to achieve similar results by alternative means. On September 17, 2008, the Treasury, at the Fed’s request, inaugurated its “Supplementary Financing Program,” whereby it issued additional Treasury bills, the proceeds of which were deposited in a new Fed account created for the purpose. Then, on October 1st, the Board of Governors announced that it would soon begin paying interest on depository institutions’ required and excess reserve balances. The Fed took these steps, which served either to drain reserves from the banking system, or to immobilize excess reserves that remained outstanding, for one reason only, to wit: to make sure that its crisis-related lending and asset purchases did not sponsor any corresponding increase in bank lending.

You need not take my word for it. Here is Bernanke’s own explanation of the Fed’s decision to sterilize its emergency loans:

We were facing what might prove to be a critical question: Could we continue our emergency lending to financial institutions and markets, while at the same time setting short-term interest rates at levels that kept a lid on inflation? Two key elements of our policy framework — lending to ease financial conditions, and setting short-term interest rates — could come into conflict.

When the Fed makes a loan, taking securities or bank loans as collateral, the recipient of the loan deposits the funds in a commercial bank. The bank in turn adds the funds to its reserve account at the Fed. When banks hold substantial reserves, they have little need to borrow from other banks, and so [sic] the interest rate that banks charge each other for short-term loans — the federal funds rate — tends to fall (p. 236).

Bernanke’s account calls for some further elaboration. It is, of course, not lending on the federal funds market per se, but a more general increase in lending, that has the capacity to “raise the lid” on inflation. Bernanke’s concern must, in other words, have been that the Fed’s emergency lending would result, not merely in a reduced federal funds rate, but in a general loosening of credit. Such a loosening was, evidently, not what Bernanke had in mind in claiming that the Fed’s emergency lending was supposed to “ease financial conditions.”

Sterilization, Bernanke goes on to explain, involved

selling a dollar’s worth of Treasury securities from our portfolios for each dollar of our emergency lending. The sales of Treasuries drained reserves from the banking system, offsetting the increase in reserves created by our lending (p. 237).

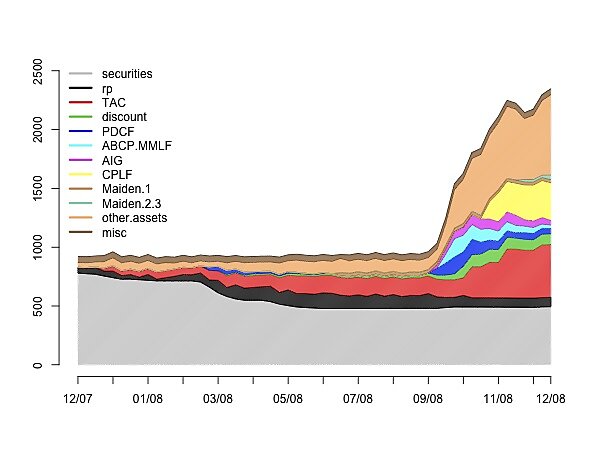

The sterilization shows up in the chart below (reproduced from James Hamilton’s Econbrowser) as a decline in the light-gray field representing the Fed’s holdings of (mostly Treasury) securities, which served to more-or-less perfectly offset its pre-AIG emergency lending.

To understand just how misguided the Fed’s sterilized lending program was, it helps to go back to the event that marked the beginning of the crisis: BNP Paribas’ August 9, 2007 decision to suspend withdrawals from three of its subprime mortgage funds. The French bank’s announcement had banks everywhere scrambling for liquidity. Bernanke’s description of the Fed’s response to that event makes for a revealing comparison with his subsequent defense of sterilized lending:

That morning, I emailed Brian Madigan…to instruct the New York Fed to buy large quantities of Treasury securities on the open market. The cash that the sellers of the securities received from us would end up in banks, meeting the banks’ increased demand for cash. If banks had less need to borrow, the federal funds rate should move back to target and the pressure in short-term funding markets should ease. If all went well, we would withdraw the cash from the system in a day or two.

Walter Bagehot’s lender-of-last-resort concept argues that central banks should stand ready during a panic to lend as needed, which in turn would help stabilize financial institutions and markets. Later that morning, consistent with Bagehot’s advice and my instructions to Brian, the New York Fed injected $24 billion in cash into the financial system (pp. 143–4).

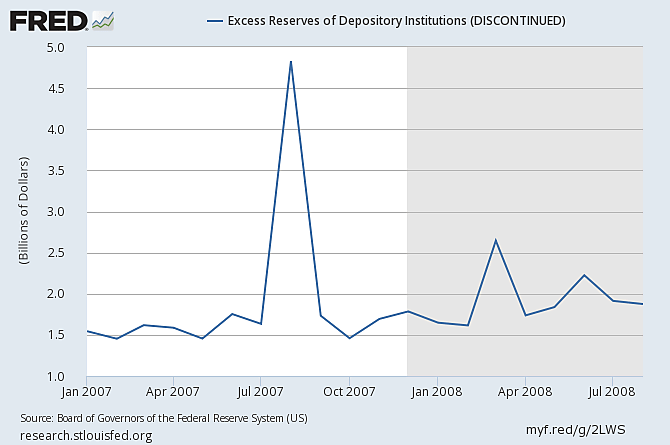

Although Dan Thornton is probably correct in calling the Fed’s response to the BNP Paribas event “anemic,” the point remains that at the time Bernanke understood the Fed’s responsibility as being that of avoiding a general contraction of bank lending by seeing to it that the U.S. banking system as a whole remained well-stocked with reserves, which the Fed made available by means of net open-market asset purchases. A plot of excess reserves during 2007 and the first quarters of 2008 makes the point better than words can:

Notice that the increase in banks’ excess reserves in August 2007 was due to the Fed’s having expanded the monetary base, so as to loosen credit, and not to its having rewarded banks for holding reserves, as it was to begin doing in October 2008. Although paying banks to hold reserves led to very substantial growth in banks’ excess reserve holdings, that policy served not to loosen credit but to tighten it.

In contrast to the Fed’s actions in August 2007, its subsequent turn to sterilized lending had it, not buying, but selling Treasury securities, with the aim of preventing its emergency lending from resulting in any overall increase in the supply of bank reserves. Financial conditions were thus “eased,” not generally, but for particular institutions and their creditors. For the rest, credit was actually tightened. Because it serves to redistribute credit rather than to alter its overall availability, sterilized lending is properly regarded, as Marvin Goodfriend insists, as an exercise in fiscal policy rather than one in monetary policy in the strict sense of the term. The principal beneficiaries of this fiscal policy were the creditors of the aided institutions, while the losers were those prospective borrowers who were denied credit because the Fed had directed the reserves that might have supported lending to them elsewhere.

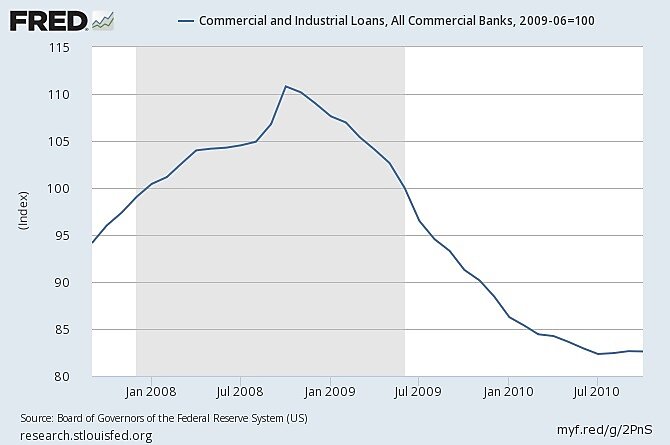

Between December 2007 and September 2008, the Fed sold over $300 billion in Treasury securities, withdrawing a like amount of reserves from the banking system, or just enough to make up for reserves it created through its emergency lending, chiefly through its Term Auction Facility. Bank lending suffered, because available reserves, instead of being augmented to accommodate the increased demand for liquidity that normally accompanied worsening economic conditions, were instead withdrawn from relatively well-capitalized institutions while being supplied to ones that were more likely to be capital-constrained.

After mid 2008, commercial and industrial bank loans, having peaked as borrowers drew on existing lines of credit, went into sharp decline:*

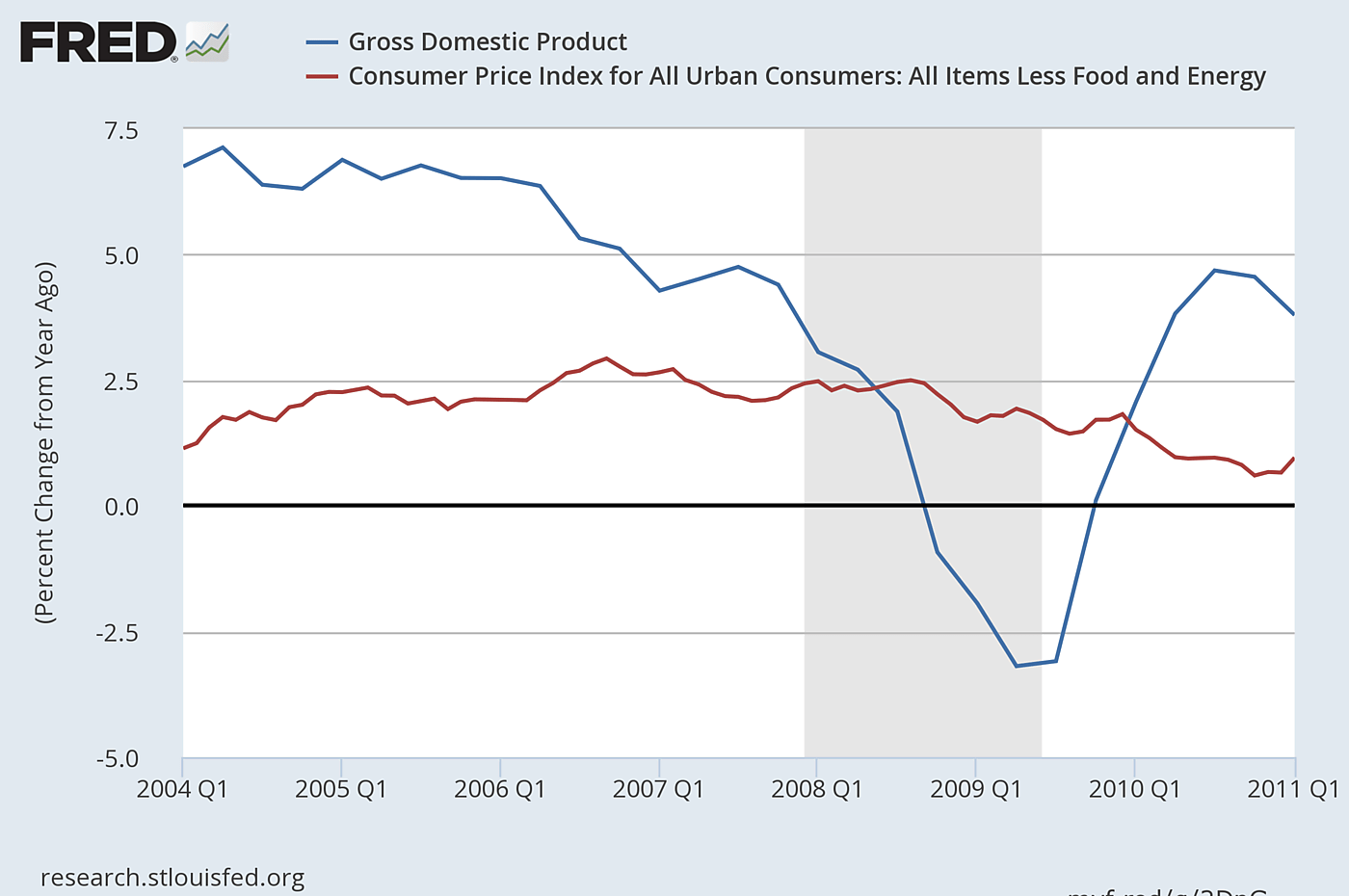

The reduced lending contributed to an equally precipitous decline in overall spending, as measured by nominal GDP:

What was the FOMC thinking? It isn’t the case that it was blind to what was happening to bank lending, or to the fact that the economy was contracting. “In a particularly worrisome development,” Bernanke writes concerning the situation as of August, 2008,

our quarterly survey of bank loan officers had revealed that banks were tightening the terms of their loans, especially loans to households, very sharply. The staff maintained its view, first laid out in April, that the economy was either in or would soon enter recession (p. 238).

In fact, as the NBER subsequently determined, the Great Recession began back in December 2007. Yet even with the benefit of hindsight Bernanke insists that sterilization was called for, because it alone allowed the Fed “to make loans as needed while keeping short-term interest rates where we wanted them” (ibid.). In particular, the Fed wanted to keep the federal funds rate at 2 percent, where it had been since April.

But why 2 percent, rather than 1 percent, or (for that matter) zero percent? According to Bernanke, the Fed determined to keep its rate target unchanged owing to concerns about inflation. In early August the Fed’s economists were predicting a core CPI inflation rate of 2.5 percent (which was also the rate over the course of the proceeding year) — high enough to cause one FOMC hawk, Richard Fisher, to actually favor raising the federal funds target rate. According to Bernanke, the FOMC

could not completely dismiss inflation concerns. Oil prices had fallen to $120 per barrel from their record high of $145 in July. However, staff economists still saw inflation running at an uncomfortable 3–1/2 percent in the second half of the year. Even excluding volatile food and energy prices, the staff expected inflation to pick up around 2–1/2 percent, more than most FOMC members thought was acceptable (p. 238).

In retrospect it is all too clear that the hawks were mistaken, and that the FOMC ought to have paid less attention to inflation (and to headline inflation especially), and more attention to NGDP and other measures of total spending. Scott Sumner and other Market Monetarists have harped on this for some time, so I won’t bother to repeat their arguments.

But there’s a more fundamental point I think worth emphasizing, which is that conceiving of monetary stability as a matter of stability of total spending, or aggregate demand, or NGDP — call it whatever you like — makes nonsense of any supposed “conflict” between maintaining an appropriate monetary policy stance (“setting short-term interest rates”) and keeping the financial system liquid (“eas[ing] financial conditions”), for the connection between a sufficiently liquid financial system and a stable flow of spending is (or ought to be) obvious in a way that the connection between a sufficiently liquid financial system and, say, a stable rate of inflation, is not. Had the Fed acted to preserve overall liquidity in the financial system, instead of letting would-be borrowers go begging for the sake of bailing-out troubled firms, overall spending might never have collapsed.

Please do not misunderstand me: I am not claiming that the Great Recession was entirely due to the Fed’s failure to maintain a steady flow of overall spending during 2008. I am not pretending that by doing so it could somehow have erased all the losses and prevented all the failures connected to the subprime bust, let alone prevented the bust itself. Nor do I mean to deny that easy money contributed to the boom that led to the bust. I am saying that, whatever part the Fed played in the boom, it also deepened the bust by keeping money excessively tight throughout much of 2008. There is no economic law that says that central banks must err only on the side of loose money, or only on the side of tight money. They can, and do, err both ways.

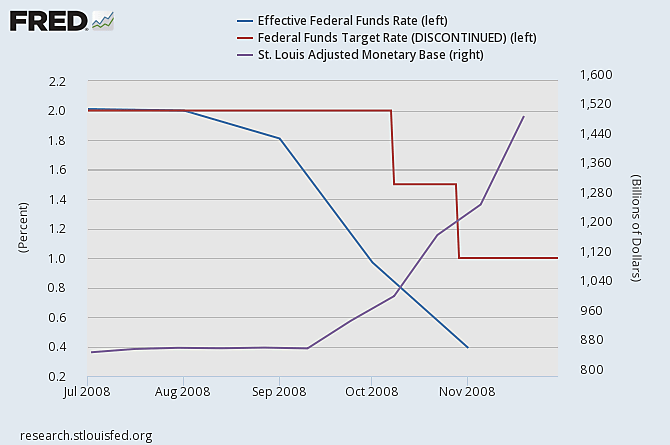

Just as a rising tide lifts all boats, a collapse in aggregate spending depresses all markets, including the market for overnight funds. The collapse was therefore bound eventually to undermine the Fed’s 2 percent funds target, and (as the chart below suggests) would have done so even if the Fed had continued to sterilize its emergency lending. The irony of this is that, by attempting, by hook and by crook, to hold the federal funds rate at 2 percent, the FOMC, far from succeeding in keeping interest rates a safe distance from their zero lower bound, propelled them in that direction. As any fan of Knut Wicksell will tell you, this outcome was, according to that great economist, inevitable once the “natural” funds rate fell below the Fed’s target.

With its September 2008 rescue of AIG, the Fed exhausted its capacity to sterilize its emergency loans. Yet instead of giving up its goal of keeping the fed funds rate pegged at 2 percent, and allowing its emergency asset acquisitions to assist a revival of bank lending in what was by then a downward-spiraling economy, the Fed remained determined to keep a lid on credit. It found a new means for doing so in the permission Congress had given it two years earlier, for reasons quite unrelated to the crisis, to pay banks interest on their excess reserves. I plan to discuss the consequences of that fateful discovery in another post.

***

P.S.: In a post he published yesterday, David Beckworth offers some further evidence of the Fed’s having engaged in what he calls “passive tightening.”

______________________

*I have corrected the graph after having originally published an erroneous one.