In 2020, many reporters and analysts portrayed state and local governments as facing doom-and-gloom with falling revenues and slashed services. I didn’t buy the grim narrative. I argued that budget gaps would not be as large as claimed, that states had rainy day funds they could tap, and that belt tightening, if needed, would be beneficial. (See here, here, here, here, and here).

It turns out that the doom-and-gloom crowd was wrong. State and local government tax revenues dipped just 3 percent in the second quarter of 2020, and then quickly rebounded. By the third quarter of 2021, tax revenues were up 15 percent from the dip.

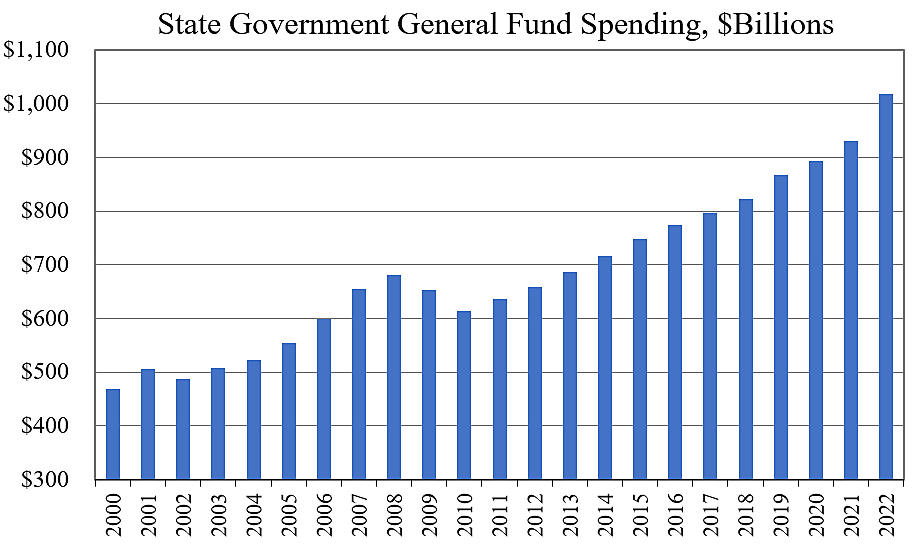

The National Association of State Budget Officers recently reported on general fund budgets across the 50 states. Enacted spending for fiscal 2022 is up 9.3 percent over the prior year, which follows increases of 4.3 percent in 2021 and 4.0 percent in 2020. General fund budgets generally exclude federal pandemic aid, but do include state-funded pandemic spending. Fiscal years generally run July to June.

As NASBO data shows in the chart below, state spending has grown steadily for a decade. Today, many state (and local) governments are flush with cash from rising tax revenues and lavish federal aid during the crisis. The danger is that states—feeling wealthy—rashly launch new programs that are low value and unaffordable in the long run. David Boaz noted the pressure to spend in Maryland, and the Los Angeles Times reports that “gushing” tax revenues are inducing California’s governor to broadly expand subsidy and benefit programs.

What should states do with their full coffers? They should restrain spending and use the extra budget room to eliminate the most damaging parts of their tax systems, such as high corporate tax rates. Such reforms would support long-term growth and prosperity. Other good uses for state surpluses include reducing debt loads and boosting rainy day funds.

In coming months, most states will be crafting their fiscal 2023 budgets, and we will see the prudent or spendthrift choices that state leaders make. Cato’s fiscal team will be keeping track and scoring the governors for our next Fiscal Report Card to be released this Fall.