A Wall Street Journal news piece this week was titled “U.S. States Face Biggest Cash Crisis Since the Great Depression.” But new data from the U.S. Bureau of Economic Analysis suggest that the Journal headline and story were needless scaremongering. The BEA data (Table 3.3) for the third quarter of 2020 show that aggregate state and local sales, property, and individual income tax revenues are all rising.

Overall state and local tax revenues hit a peak in the first quarter of 2020, fell in the second quarter, and bounced back in the third. Here are the revenue changes from first to second quarter and second to third quarter. Sales and excise taxes fell 11.0 percent then rose 7.3 percent. Property taxes rose 1.1 percent then rose another 1.1 percent. Individual income taxes rose 0.7 percent then rose another 2.0 percent.

The BEA has corporate income tax revenues falling 13.6 percent in the second quarter but don’t provide an estimate for the third quarter. To calculate a figure for overall tax revenues, I’ve assumed that third quarter corporate tax revenues are the same as the second quarter. (Corporate taxes are less than 4 percent of total state and local taxes).

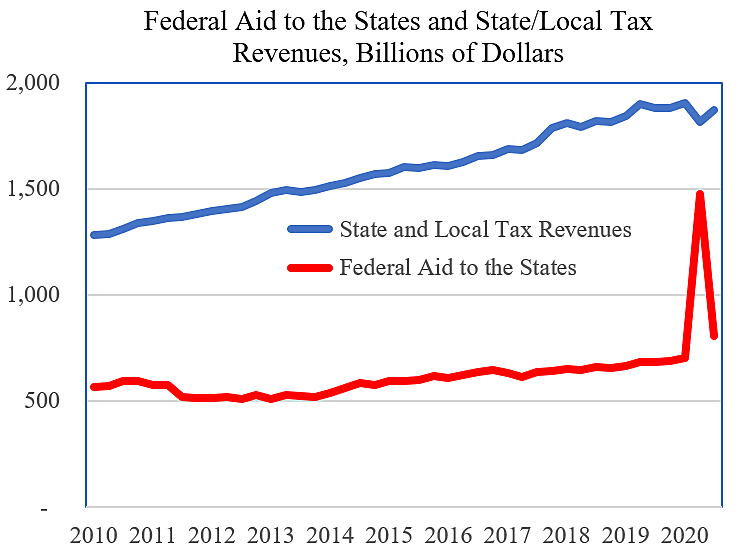

With that assumption, total state and local tax revenues fell 4.7 percent in the second quarter but then rose 3.3 percent in the third quarter, as shown in the chart below. Total tax revenues are still below the peak but headed upward.

The chart also shows BEA data for (current plus capital) federal aid to state and local governments. Since the data is annualized, I’ve divided by four to consider actual dollar changes by quarter. In the second quarter, total state and local tax revenues fell $23 billion but federal aid to states spiked $193 billion, thus vastly overwhelming the tax revenue loss. Federal aid is now falling toward normal levels, but CBO data (p. 34) show that there is still more than $150 billion in emergency state aid for health care and education to be spent in federal fiscal year 2021.

In sum, state and local tax revenues are rising and there is still federal cash in the pipeline. Congress does not need to pass any more emergency state aid.

More on the state and local fiscal situation here and here, and critiques of media stories on the topic here, here, and here.