The Republican tax bill not only cuts taxes, but also increases spending through refundable tax credits. The plan will increase spending directly by increasing child tax credits, and increase spending indirectly by changing low-income provisions that affect spending on the earned income tax credit (EITC).

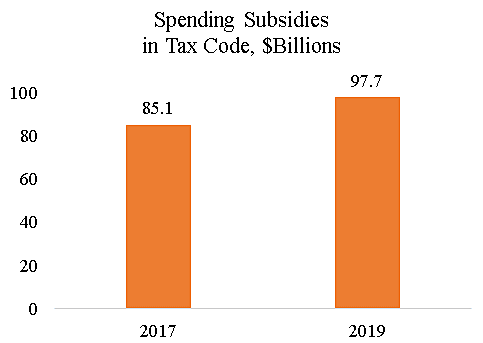

The chart shows estimated fiscal 2017 and 2019 outlays on the EITC, child credit, and American Opportunity Tax Credit (AOTC). The 2019 figure includes a $12.6 billion increase from the GOP tax bill, as estimated by the Joint Committee on Taxation in endnote 2 in here. (I’ve excluded the ACA piece).

Outlays on refundable credits or subsidies will jump from $85.1 billion in 2017 to an estimated $97.7 billion in 2019. This amount is not a “tax cut.” Rather, it represents taxes extracted from other workers and businesses, having all the usual negative effects.

See here for a critique of the EITC.

Current law spending on the EITC, child credit, and AOTC in the budget (Table 26–1).