In March, the Federal Open Market Committee (FOMC) signaled it could begin shrinking the Fed’s balance sheet sometime later this year. However, with limited official details about what that means and none forthcoming from last week’s FOMC press release, many questions remain:

- How will the Fed decide exactly when to begin shrinking its balance sheet, and will the move be data or date dependent?

- Once the wind-down begins, how rapidly will the balance sheet shrink and to what new normal level?

- How will the Fed dispose of its assets: by simply refraining from reinvesting the proceeds from maturing securities, passively shrinkage the balance sheet, or by actively disposing of some assets to ensure a smoother path for balance sheet reduction?

- And would asset sales, should they occur, include both mortgage-backed securities (MBS) and Treasuries or would the Fed initially focus on a single asset class?

Back in September 2014, the FOMC released its Policy Normalization Principles and Plans (henceforth “the Framework”), its official statement outlining a three-step normalization strategy, including balance sheet reduction. First, the Fed would raise policy rates[1] to “normal levels.” Second, the Fed would begin to shrink the balance sheet in a “gradual and predictable manner” by ending the reinvestment policy. And third, the wind down would continue until the Fed holds only enough securities to conduct monetary policy “efficiently and effectively” with a portfolio consisting primarily of Treasuries. There is, of course, a caveat that the Fed can deviate from the Framework as economic conditions change. Since December 2015 the Fed has raised policy rates three times, but it has yet to update the Framework to provide further details on the next steps for balance sheet normalization.

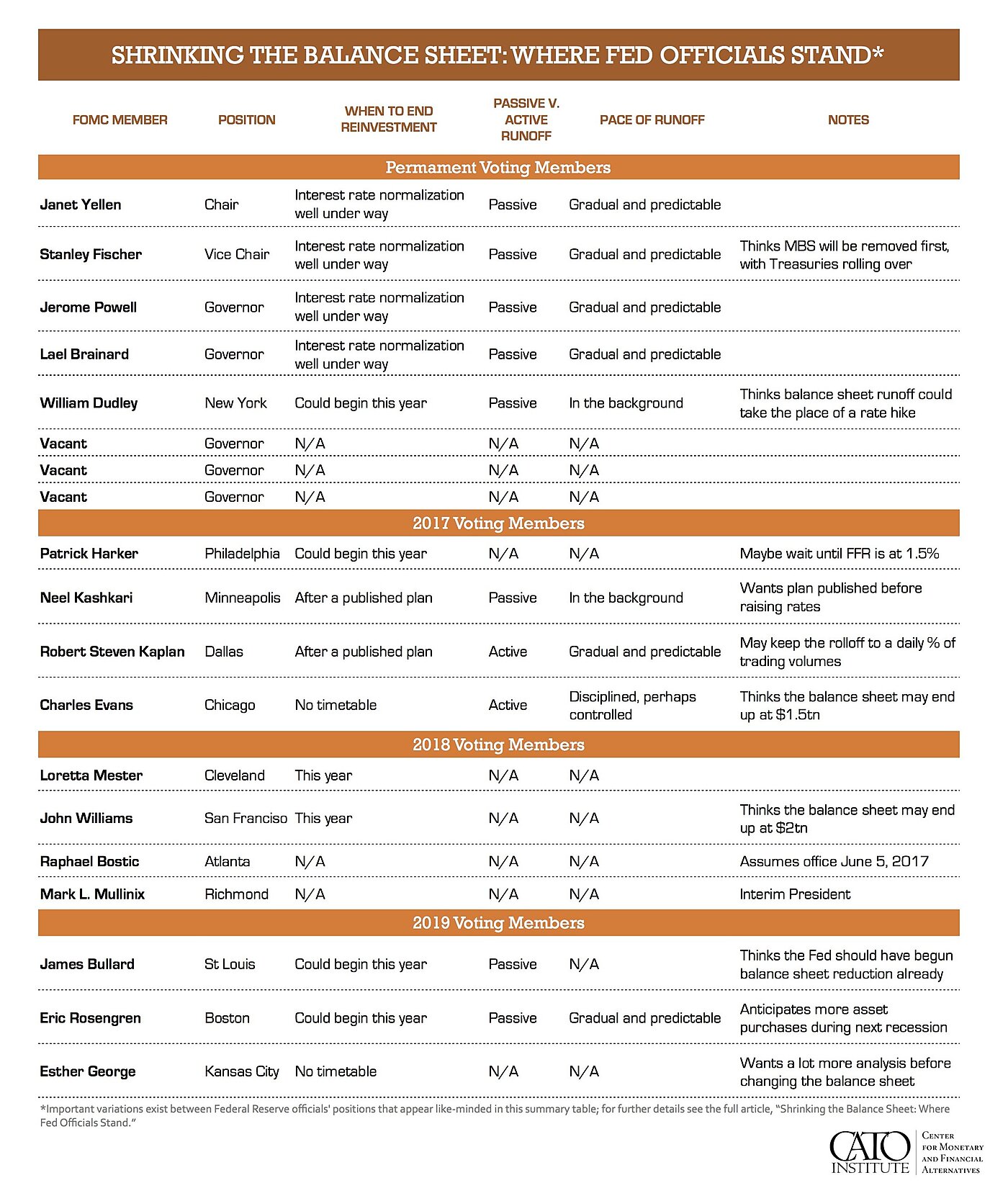

With only the broad principles in the Framework as yet available, more detailed information must be gleaned from elsewhere. Fortunately, nearly every Federal Reserve official has discussed the balance sheet to some extent recently; but while their attention may be uniform, the policy discussion is not. Some officials have said nothing beyond the Framework, while others, particularly those regional bank presidents that do not vote on this year’s FOMC, have offered additional comments about the timing, speed, and ultimate target size associated with reducing the balance sheet. This essay examines the views of FOMC permanent voters first, then regional Fed presidents voting in 2017, followed by non-voting regional presidents.

PERMANENT FOMC VOTING MEMBERS

Federal Reserve Chair Janet Yellen

Chair Yellen has said very little beyond the Framework, and, as the leader of the Fed, keeping to the official talking points is no surprise. In a March speech, Yellen reiterated that the balance sheet would remain elevated until “sometime after” rates rise, though she declined to add specific benchmarks. When asked for additional clarity during the March FOMC press conference she said only that shrinking the balance sheet is not predicated on a pre-specified level for the federal funds rate and that overall monetary policy normalization would be “well under way” before shrinking the balance sheet commenced. George Selgin did not think much of her remarks.

New York Federal Reserve Bank President & FOMC Vice Chairman William Dudley

Dudley, a dove who is a close ally of Chair Yellen, gave a slight preview of the Framework in a May 2014 speech indicating that he wanted to see rates quite a bit higher before the cessation of reinvestments. This was a break from the 2011 Exit Strategy Principles that had called for ending reinvestments first and raising rates secondarily. In that talk, Dudley downplayed the potential adverse consequences of the larger for longer balance sheet approach, believing it prudent to tolerate those risks as the Fed moved off the zero lower bound. Dudley’s preferred order, to raise rates before touching the balance sheet, is, of course, the order now in the Framework.

More recently Dudley discussed balance sheet actions beyond the Framework. In March he mentioned that shrinking the balance sheet and raising interest rates are, “…two different, yet related, ways of removing monetary policy accommodation.” Because ending reinvestments could act similarly to a rate hike, Dudley cautioned, “…when we begin to end reinvestment, we will have to consider the implications for the appropriate short-term interest rate trajectory.” He has also commented on the mechanics of how to shrink the balance sheet, saying he does not see “a strong need to differentiate between mortgages and Treasuries” as the reinvestment policy ends, which he believes might end this year or in early 2018. Nonetheless, the New York Fed’s trading desk has conducted very small MBS sales to test the operational readiness of such transactions.

Federal Reserve Vice Chairman Stanley Fischer

In a February 2016 speech, Fischer said that because the federal funds rate is now adjusted using two new tools, interest on excess reserves (IOER) and overnight reverse repurchases (ON RRP), the Fed can change the size of the balance sheet independently from interest rate policy. At that time, Fischer saw benefits to maintaining a larger balance sheet, remarking that when to “…begin phasing out reinvestment will depend on how economic and financial conditions and the economic outlook evolve.”

In November, Fischer reiterated the Framework position, saying that shrinking the balance sheet would commence when “…the short-term interest rate approaches more normal levels.” However, he also offered a position different from Dudley’s, explicitly stating that the Fed would begin by ending reinvestments on mortgage-backed securities while continuing to roll over Treasuries. Just last month, Fischer said he does not expect significant market disturbances, such as another taper tantrum when reinvestments end, given the muted market responses to Fed officials’ discussions about shrinking the balance sheet, thus far.

Federal Reserve Governor Jerome Powell

Powell said in a recent interview that he wants the Fed “well into the normalization process” before the balance sheet begins to shrink. With rates far from zero, “removing accommodation” by ending reinvestments would then proceed in “a very predictable almost automatic way.”

Federal Reserve Governor Lael Brainard

Though Brainard is widely considered to be the most dovish Federal Reserve official, she voted with the rest of her colleagues to raise interest rates at the March FOMC meeting. She has also signaled a willingness to increase the speed of rate increases provided the new administration makes good on its campaign pledges of expansionary fiscal policy.

Brainard offered more details about the normalization strategy than her colleagues on the Board when she identified two available strategies in a recent speech. The first is the complementarity strategy, in which balance sheet adjustments would be viewed as an independent and thus second tool for conducting monetary policy. As Brainard says, “Under this strategy, both tools would be actively used to help achieve the Committee’s goals…to take advantage of the ways in which the balance sheet might affect certain aspects of the economy or financial markets differently than the short-term rate.” The Fed might deploy the balance sheet to affect term premiums on longer-term securities and use the policy rates to affect money markets. The second option is the subordination strategy, in which the policy rates would remain the primary tool for the Fed’s conduct of monetary policy. Once normalization of short term rates was “well under way” the balance sheet could begin to shrink in a “gradual [and] predictable way.” When reinvestments end, the balance sheet would then shrink on “autopilot.”

Brainard is an advocate of the subordination strategy and supports the automatic process that Powell discussed, though she does maintain that were the economy to be hit with a large adverse shock restarting reinvestments could be prudent in order to preserve traditional policy space in the federal funds rate.

2017 VOTING REGIONAL BANK PRESIDENTS

Minneapolis Federal Reserve Bank President Neel Kashkari

Kashkari made national headlines when he posted an essay explaining his dissent at the March FOMC meeting, where all his colleagues voted for a rate increase. In dissenting, he noted that a 2% inflation target was no reason to raise rates as though 2% was a ceiling . His preferred strategy was for the Fed to publish a detailed plan for shrinking its balance sheet, allow some time to gauge the market reaction, and then continue to use short term rates as the primary policy lever. Kashkari supports Brainard’s subordination strategy when he says, “…we can return to using the federal funds rate as our primary policy tool, with the balance sheet normalization under way in the background.”

Philadelphia Federal Reserve Bank President Patrick Harker

Harker, an engineer by training, has been more precise than his colleagues. In January he said, “When we are at or above 100 basis points — and we are moving toward that — I think it is time to start serious consideration of first stopping reinvestment and then over a period of time unwinding the balance sheet.” In March, Harker said that the right number for interest rates could be 1.5%, but that balance sheet reduction is not going to be dependent on a trigger or a target and that it will also depend on the “momentum” of the economy — a position similar to Chair Yellen’s at the March FOMC press conference. Harker does prefer the “Treasury-heavy” portfolio called for in the Framework, though he is not sure that the Fed should completely get out of the MBS market.

Chicago Federal Reserve Bank President Charles Evans

Evans, who originally gained national prominence when the Fed began to employ Forward Guidance, is one of the more dovish members, believing that only two hikes in 2017 are possible, while, by contrast, Eric Rosengren of Boston is predicting four. When it comes to shrinking the balance sheet, though, Evans is one of the few to comment, not on the timing, but on a new target size. Recently, he estimated a target size for the balance sheet of $1–1.5 trillion, requiring as much as $3 trillion of securities to roll off. That is drastically different from former Federal Reserve Chairman Ben Bernanke’s estimate for a new normal balance sheet of $2.5-$4 trillion. Despite the potential reduction, Evans has yet to say when reinvestments might actually end.

Dallas Federal Reserve Bank President Robert Steven Kaplan

Kaplan has become more vocal on balance sheet action throughout this year. In January, he said that 2017 would be a good year to discuss a “plan of action” to “slim” the balance sheet, but that nothing should actually be done until rates hikes were “further along.” Kaplan echoed those sentiments in February: “…as we make further progress in removing accommodation, I believe we should be turning our attention to a discussion of how we might begin the process of reducing the size of the Federal Reserve balance sheet.”

After the March rates hike, Kaplan went even further, saying that as rates rise the Fed should publish a plan to shrink the balance sheet. He added that he does not want balance sheet normalization to “unduly affect” financial market conditions, suggesting that securities rolling off ought to be kept to a percentage of daily trading volumes in MBS and Treasuries. Such a strategy would require more active management of the balance sheet than the autopilot strategy proposed by Brainard and Powell. For Kaplan, one of the most important considerations as the balance sheet begins to shrink is to “minimize disruption” to markets.

NON-VOTING REGIONAL BANK PRESIDENTS

As mentioned, the most varied opinions about the next move for the balance sheet come from the regional bank presidents who do not have a vote on the FOMC in 2017.

St. Louis Federal Reserve Bank President James Bullard

Bullard is known to be the low dot on the “dot plot,” as he believes the economy is stuck in a low rate regime likely to persist for years. He differs from many of his colleagues in other important ways. For example, Bullard believes that the policy rates are currently at the appropriate levels and that the Fed has, “…delayed a little bit too long in reducing the size of the balance sheet.” While he doesn’t necessarily oppose another hike this year, Bullard thinks the FOMC’s priority should be reducing the balance sheet in an effort to increase the Fed’s ability to react to the next downturn.

San Francisco Federal Reserve Bank President John Williams

Recently, Williams offered perhaps the most comprehensive assessment of the future of the Fed’s balance sheet, with a call for the reinvestment policy to end this year. Like Evans, Williams offered a target, saying that a balance sheet around $2 trillion is likely appropriate, though added that no decision had been made. But, unlike Evans, Williams also offered a timeframe, remarking that getting to a balance sheet that size would likely take 5 years. Williams also believes that with the policy rate and the balance sheet moving contemporaneously, the path of each one will be slower than if they were operating alone, similar to Dudley. He thinks the Fed will raise rates twice more this year, though leaves open the possibility for a third hike if the data support it — a position held by his colleague in Boston.

Boston Federal Reserve Bank President Eric Rosengren

Rosengren is now one of the leading hawks, having announced in a recent speech that he anticipates three more rate hikes this year, likely at every other FOMC meeting. While Dudley and Williams believe shrinking the balance sheet might slow rates hikes, all else equal, and Bullard thinks balance sheet reduction can replace a rates increase, Rosengren believes the path for rate increases is not affected much by gradually shrinking the balance sheet and that the process can begin soon. As identified by Ben Bernanke, Rosengren also differs from his colleagues by being the very rare Fed official to discuss asset sales — though he stopped short of actually advocating them in the speech. However, Rosengren also thinks it is likely that the Fed would resume asset purchases during future recessions, “…unless they are very, very mild.”

Kansas City Federal Reserve Bank President Esther George

George is the most hawkish member on the FOMC, having said that the Fed was behind the curve in raising rates in December 2015, repeatedly voting to trim assest purchases during QE3, and having far and away the most dissenting FOMC votes — now that Jeffrey Lacker has stepped down. And yet, at a recent event George indicated that she did not think that any decision regarding the balance sheet would be made soon. She wants the Fed to spend more time analyzing its path toward normalization, stating that in the meantime the size of the balance sheet is not likely to change. This is a change from her position back in 2014, when she thought it was appropriate to begin shrinking the balance sheet via “passive runoff” before the first rate hike, following the policy articulated in the original 2011 Exit Strategy Principles.

Cleveland Federal Reserve Bank President Loretta Mester

In three recent speeches Mester has shown an increasing comfort level with shrinking the balance sheet this year. She wants to end reinvestments in 2017 and believes this move is consistent with the Framework, putting the Fed on a path towards a balance sheet consisting primarily of Treasuries. And just yesterday, Mester supported her colleagues’ notion to announce a plan for balance sheet reduction, which will take “several years,” as well as a return to using the federal funds rate as the “main tool” for monetary policy. Mester added that the balance sheet will eventually be “considerably smaller than it is today.”

WHAT’S NEXT

How Federal Reserve officials view the balance sheet will change as new data come in. There are also potential shifts at the Fed via new personnel. With the retirement of Governor Tarullo in April, President Trump can appoint three new Fed Governors. Additionally, Rafael Bostic will assume leadership of the Atlanta Fed in early June and sit on the FOMC next year while the Richmond Fed is continuing its search for Jeffrey Lacker’s successor, who will have a vote in 2018 as well.

Whoever comes to the Fed and however the views of those already there change, the important questions about the balance sheet will remain. These questions can be grouped into four buckets: Timing, Mechanics, Interest Rates and the Endgame.

On timing, the most important question is when the reinvestment policy ends. There is a growing chorus suggesting that 2017 will see the end of the reinvestment policy, as laid out in the Framework. However, many officials condition their balance sheet remarks as data dependent. It is unknown how much the data would need to soften to move a Fed official’s view away from Mester’s position and towards George’s.

The mechanics of the balance sheet wind down are extremely uncertain. Will the Federal Reserve simply allow for passive shrinking when securities mature, or will they actively manage the process and shrink the balance sheet on a smoother path, perhaps limited by trading volume ratios as Kaplan suggested? These questions require clear answers in the kind of public, detailed plan called for by Kashkari and Kaplan. Another mechanical issue to address is distinguishing between Treasuries and other securities. Is that distinction less important, as Dudley has implied, or will the Fed start by paring back its MBS holdings, as Fischer has suggested?

Related to the mechanics is how shrinking the balance sheet will affect the path of interest rates. Will the Fed adopt the subordination strategy advocated by Brainard? Or will the balance sheet runoff tighten financial market conditions such that the paths for rates hikes and shrinking the balance sheet could be slower together, as Dudley and Williams have considered? Or could ending reinvestments be a substitute for a rates hike, as Bullard prefers?

And lastly, what is the Fed’s endgame when it comes to balance sheet normalization; what is the proper size? Many Fed officials have noted an elevated demand for currency, compared to what existed before the crisis, but only a few have offered specifics as to the balance sheet’s final size. Will the balance sheet stay quite large, something Ben Bernanke advocates, or will it pare down to $2 trillion, as Williams suggests, or even beyond that to $1.5 trillion, as Evans estimates?

As most officials concede, the Federal Reserve is about to take actions with which it has virtually no experience. Providing further details on how and when they will normalize the balance sheet would go a long way to reducing uncertainty. But even then, it will remain critical to track where Fed officials stand on this issue and how those views evolve with the data.

______________

[1] The Framework discusses, “…steps to raise the federal funds rate and other short-term interest rates to more normal levels…” That language, however, is ambiguous as the federal funds market has shrunk dramatically in a financial system awash in reserves. Consequently, interest rate policy is now conducted using two new policy rates to create a federal funds rate target “range:” the interest paid on excess reserves (IOER) creates the target ceiling while the overnight reverse repurchase (ON RRP) rate creates the target floor. Both rates are set administratively by the Fed. For further reading on the Fed’s new monetary control mechanism using IOER and ON-RRP for a federal funds rate range, see “A Monetary Policy Primer, Part 9: Monetary Control, Now” by George Selgin.