A Wall Street Journal op-ed last week by liberal billionaire Tom Steyer complained that the proposed Republican tax cut “overwhelming helps the wealthy.” He said that the American people will be furious “if they see a bill passed that hands out filet mignon to the wealthy while leaving them struggling over scraps.”

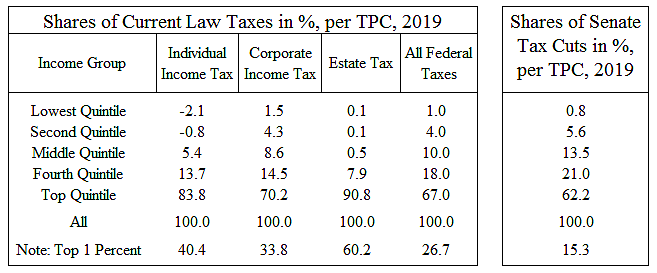

Steyer’s op-ed had more rhetoric than data, but he did cite a Tax Policy Center (TPC) analysis of the Senate bill. So let’s look at the TPC data. The table below summarizes the Senate tax cuts for 2019 and compares them to current-law taxes.

Looking at the block on the right, TPC finds that 62.2 percent of the tax cuts would go to the highest quintile, or fifth of U.S. households, and 15.3 percent would go the top 1 percent. Just 13.5 percent of the cuts would go the middle quintile. Does that mean filet mignon for the top and scraps for the middle?

No, it does not. We need context. We need to know how much tax those groups are currently paying, but TPC does not show that in its analysis of the Senate plan. You have to dig through TPC’s website to find it here. TPC’s estimates of current law taxes for 2019 are below in the block on the left. “All Federal Taxes” includes the taxes shown plus payroll and excise taxes.

Without any tax cut, the top quintile will pay 67.0 percent of all federal taxes in 2019, and the top 1 percent will pay 26.7 percent. Since the tax cut shares for those groups are less than that, the cuts will make federal taxation more progressive. If the Senate bill were passed, the top quintile of higher earners would pay an even larger share of the overall federal tax burden. That would undercut the growth potential of tax reform and make our excessively progressive tax code even more so.

What about the middle quintile? TPC estimates that under current law the group will pay 5.4 percent of individual income taxes, 8.6 percent of corporate taxes, and 10.0 percent of all federal taxes in 2019. Yet this group would receive 13.5 percent of the Senate tax cuts. Thus, middle earners would gain a disproportionately large share of the tax cuts under the Senate plan.

So which group is dining on fillet mignon? It is the overgrown federal government because—with or without a tax cut—spending is projected to soar in coming years. Federal spending is one fifth of gross domestic product and rising, and unfortunately that quintile receives solid bipartisan support.

Data Notes

Citing TPC, Steyer says, “Sixty-two percent of the benefits from the Senate bill’s tax cuts flow to the top 1% of earners.” Bernie Sanders used that statistic on TV yesterday.

That figure is for 2027 when nearly all the individual tax changes are scheduled to have expired in the Senate bill, so it is kind of meaningless. For one thing, it is 62 percent of a small overall revenue loss number. TPC finds that the 2027 tax cuts would reduce revenues by 0.2 percent of income, or just one-sixth the amount that revenues would be reduced in 2019.

The corporate tax rate cut would be the main cut in place in 2027, and TPC assumes that higher earners would receive most of those benefits. But other economists dispute that view, arguing that corporate tax cuts would benefit workers across the income spectrum, as discussed by the CEA.

Finally, most of the estimated static revenue losses from the corporate rate cut in 2027 would offset by corporate tax increases that year, as shown in this Joint Tax Committee report.