Another week, another news story about supposedly imploding state-local government budgets. A New York Times headline warns, “With Washington Deadlocked on Aid, States Face Dire Fiscal Crises.”

The story leads with, “Alaska chopped resources for public broadcasting. New York City gutted a nascent composting program that could have kept tons of food waste out of landfills. New Jersey postponed property-tax relief payments.” The piece is built around such anecdotes, which do not seem dire to me.

Senate Republicans are right to resist the additional state bailouts pushed by House Democrats because the states can and should handle their own budget challenges going forward.

The NYT discussion conflates the situations of state and local governments. While state income and sales tax revenues have dipped, local governments raise 72 percent of their tax dollars from property taxes, which are rising. Property tax revenues were up one percent in the second quarter of 2020 from the first quarter.

The estimate of overall state budget gaps mentioned by the NYT is from Moody’s, but that is a high-end number. Tax Foundation summarizes three lower estimates here.

The CBO released new federal revenue projections last week, which may be suggestive of possible state revenue reductions. Just considering the effects of the recession, CBO projects that fiscal 2020 tax revenues will fall a modest 6.4 percent from 2019. GDP is expected to fall just 2.7 percent in fiscal 2020 before starting to rise again. (CBO separately calculates the revenue losses from tax cuts in recent relief bills).

If state tax revenues dropped the same 6.4 percent in calendar 2020, that would be a modest $70 billion reduction from calendar 2019 state tax revenues of $1.09 trillion. Local tax revenues nationwide may not fall at all, as they did not fall in the last recession.

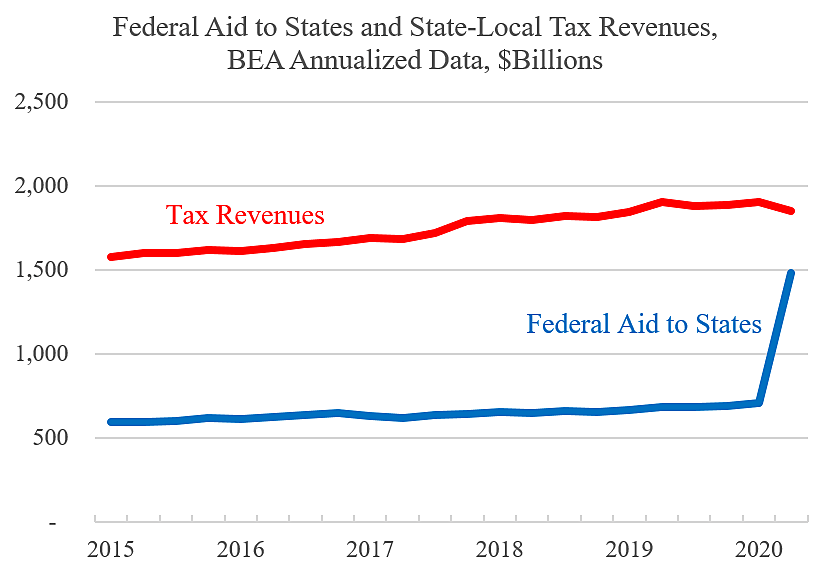

Regular federal aid pays for more than one-quarter of overall state revenues, so a 6.4 percent drop in state tax revenues translates into a smaller percentage drop in overall state revenues. And that is true before recent federal relief bills, which have showered more aid on the states than they have lost in tax revenues. The chart below (based on Table 3.3) shows the small dip in state-local tax revenues in the second quarter of 2020 compared to the large increase in federal aid.

The states face budget challenges, but the situation in most places is not “dire.” State officials can solve budget gaps without further federal aid by tapping rainy day funds, freezing hiring and wages, and improving program efficiencies.

More on this topic here, here, here, and here.

Note: In the chart, I’ve included “capital transfer receipts” in the aid-to-states total.