The Senate’s Inflation Reduction Act includes an $80 billion increase in the Internal Revenue Service budget over a decade, which would roughly double the agency’s budget by 2031.

It’s nearly impossible for taxpayers to contact the IRS for timely answers to filing questions, but the Senate bill devotes just $3.2 billion of the new spending to “taxpayer services.” The lion’s share—$46 billion—goes toward jacking up IRS enforcement. The thrust of the bill is against the people, not for the people to understand the code and voluntarily comply.

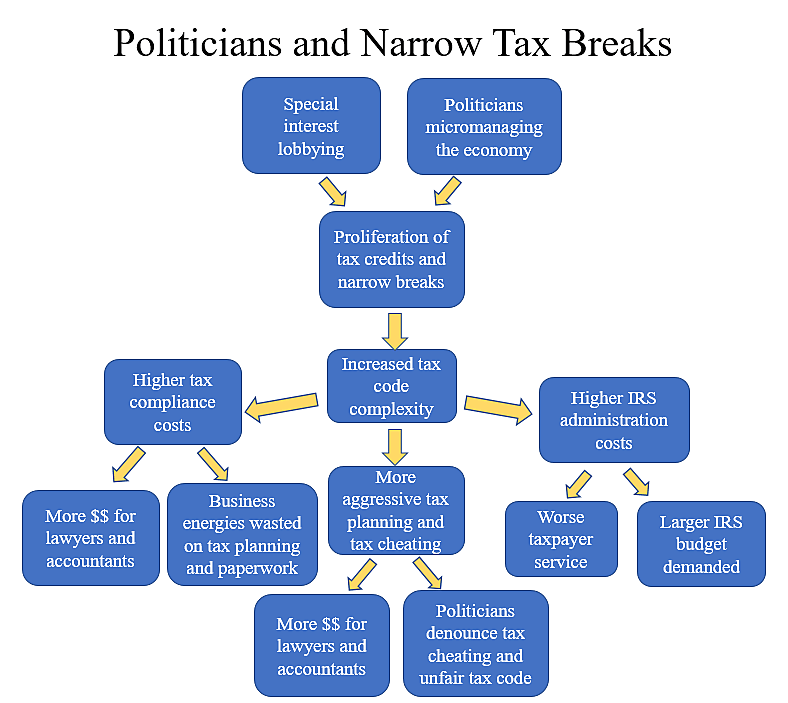

Senators supporting the bill talk about “tax cheats” and “closing tax loopholes.” But this is a huge hypocrisy. The Senate bill itself creates new loopholes and tax breaks, and complicated breaks drive noncompliance with the tax system. The Senate bill would expand a slew of special-interest credits and other breaks within a $370 billion orgy of green subsidies and corporate welfare.

This chart illustrates the relationship between politicians and special-interest tax breaks:

The CBO summary of the Senate bill lists tax credits for electricity produced from renewable resources, solar facilities in low-income communities, carbon oxide sequestration, nuclear power production, sustainable aviation fuel, nonbusiness energy property, residential clean energy, energy efficient homes, clean vehicles, previously-owned clean vehicles, alternative fuel refueling property, advanced energy projects, advanced manufacturing production, small business research, clean electricity production, clean electricity investment, and clean fuel production.

All these clean breaks will make the tax code a mess. IRS administration will be more difficult, and aggressive taxpayers will have more margins to twist the code into gray areas. Battles between taxpayers and the IRS will grow. Law and accounting firms specializing in green breaks will prosper.

The IRS cannot properly administer existing tax credits, let alone all the proposed new and expanded ones. The earned income credit has long suffered from an improper payment rate of more than 20 percent. The low income housing credit has long been riddled with fraud by housing developers, and it is so complex that the IRS hardly bothers to police it. Don’t be surprised if the new green breaks get similarly riddled with tax-filing errors and hijacked by “tax cheats.”

Aside from the lawyers and accountants, politicians will be winners from the Senate bill because they will have more lobby groups to raise money from. Each one of the credits has a lobby group that will work to lock-in and expand the benefits in the coming years. This will strengthen the fundraising power of members on the House and Senate tax committees. The new minimum tax structure will further boost corporate lobbying because it is ripe for carve-outs.

Senate bill supporters don’t seem worried about growing tax-code complexity. They assume the bill makes sense because the $80 billion of IRS funding is supposed to raise $204 billion in government revenues. But that ignores the added costs and loss of civil liberties imposed on individuals and businesses. More aggressive IRS enforcement will mean more paperwork, more lawyer fees, more time wasted on tax planning, more anguish and uncertainty, less privacy, and less personal financial security. Government will win, but society will lose.

Peter Gattuso contributed to this blogpost.