When President Biden announced that he would unilaterally cancel up to $20,000 of federal student debt for almost everyone holding any, he may have thought his action unstoppable. No one, he might have concluded, would have standing in court to block him. But the legal sailing hasn’t been so smooth, with two courts finding that the plaintiffs had standing, and the U.S. Supreme Court set to hear their cases tomorrow. If the Supreme Court agrees that the plaintiffs have standing, Biden’s declaration is in big trouble, because it’s clearly unconstitutional.

It’s also terrible policy.

Biden’s attempt to forgive student loans is unconstitutional for the simple reason that it was not authorized by Congress and the president has no unilateral authority to spend public tax dollars however he sees fit. Indeed, as an amicus brief submitted by a dozen former high-ranking government officials with “centuries of experience in the constitutional and statutory strictures of U.S. budgetary policy” explains, the power of the purse is among the most jealously guarded prerogatives and one of the Constitution’s most powerful protections against tyranny. As a result, spending statutes must be strictly construed to safeguard the separation of powers and prevent presidents from usurping a role that belongs to Congress alone.

One way to think of it, as Cato shows in its own amicus brief, is if a teenager’s parents went on vacation and gave the teen permission to use the family car for home improvement projects while they were gone. This would clearly permit trips to Home Depot to buy cleaning products, but would obviously not include selling the car to pay for a new addition on the house. But that is precisely what President Biden has done in claiming to find the authority to forgive $400 billion of student loans in an obscure, decades-old federal law enacted to help veterans of the Iraq War.

Simply put, this is a naked power grab and a tax-dollar giveaway that brazenly violates one of the most important constitutional constraints on government power. From a constitutional separation-of-powers standpoint, it should be struck down.

Not only is that essential for the rule of law, it would be good news for taxpayers and future college students from a higher-education policy standpoint.

The price tag for turning loans into grants is likely to be enormous. The Congressional Budget Office’s $400 billion estimate is more than the entire gross domestic product of most countries. Per-taxpayer, based on 2022 federal tax returns, it’s about $2,400.

That’s just the direct cost. There’s also the effect mass cancelation would have on already astronomical college prices. Basically, it would send the message that if debt holders complain enough, a future president will simply wipe out a bunch of their debt. Indeed, how could one not after precedent has been set? Would future debtors feel less deserving than current ones?

This would bode ill for future students because there is powerful evidence that colleges raise prices as students get access to more taxpayer funding—and an expectation of future cancelation would de facto increase how much debt students could take without really incurring debt. As one New York Federal Reserve study found, institutions of higher learning increase their prices 20 to 60 cents for every additional dollar in federal loans students get. And it’s hardly the only study to find an inflationary effect of federal “help.”

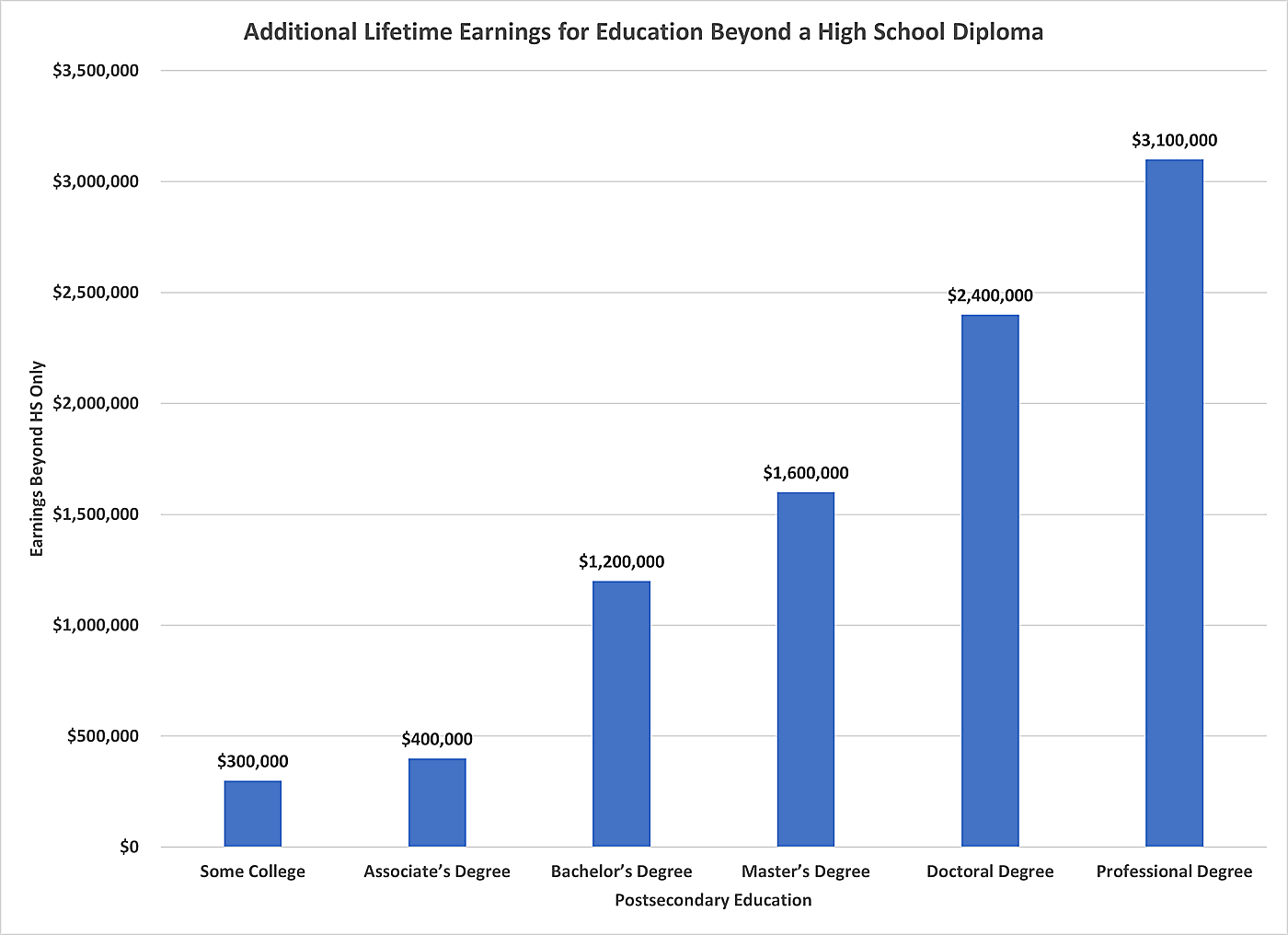

Mass cancelation is also in large part a giveaway to people who least need it: those with undergraduate degrees and beyond. The average person who stops their education with a bachelor’s degree is expected to make roughly $1.2 million more over their lifetime than someone who ends with a high school diploma. Someone who gets a professional degree, such as a doctor or lawyer, will make around $3.1 million more.

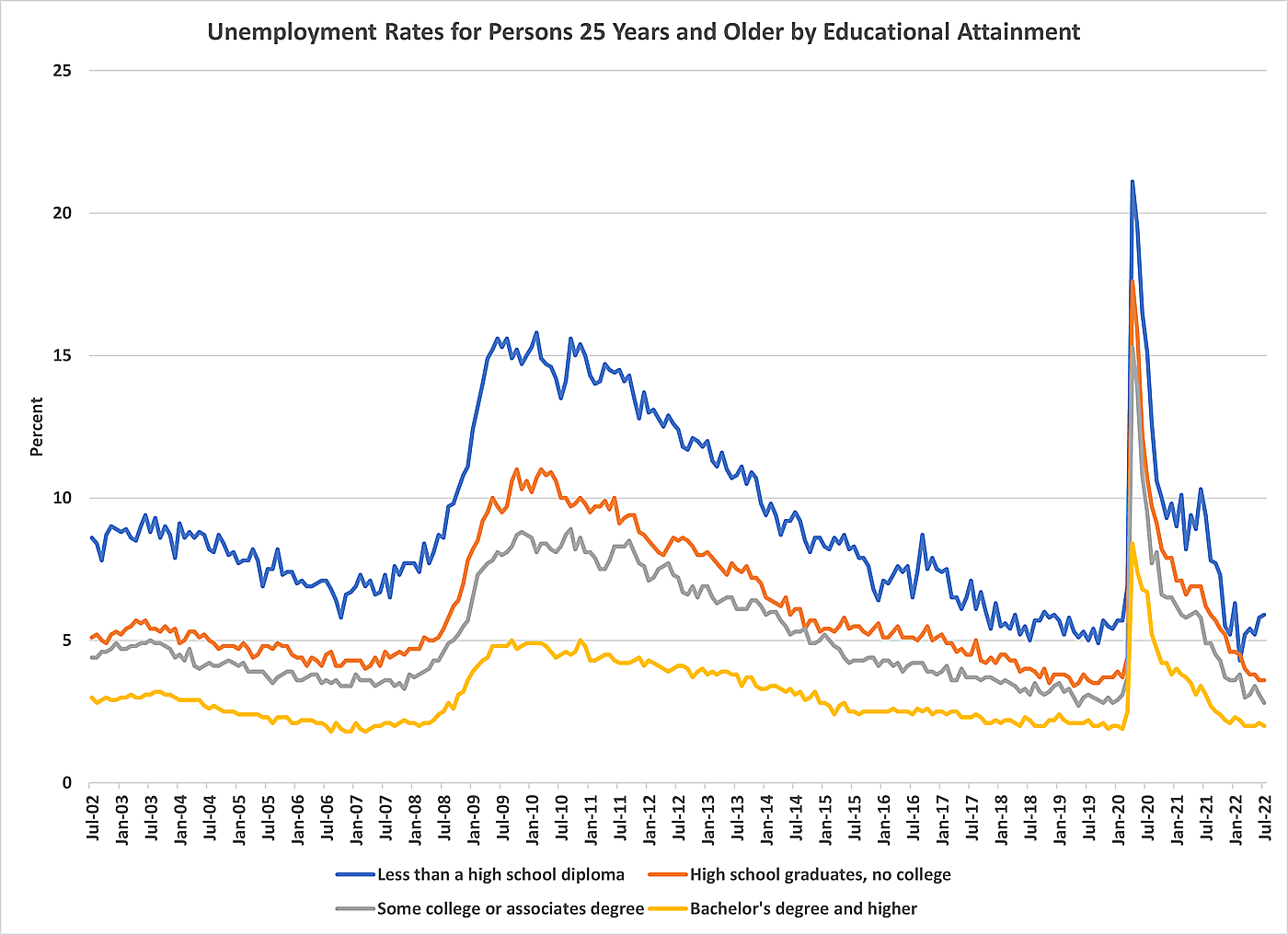

Ironically, given that the asserted justification for mass forgiveness is helping people hurt by COVID-19, college grads tended to fare the best economically under COVID, as they were the most likely to have jobs that could be done remotely. While unemployment for people with just a high school diploma hit 17.6 percent at the height of COVID lockdowns, it was only 8.4 percent for college graduates. Meanwhile, most borrowers report being more or as financially secure after COVID as before.

President Biden’s mass student-debt cancelation deserves to lose in the Supreme Court because it violates the Constitution. But it deserves to lose as a matter of higher-education policy as well.