Tomorrow is Tax Day, which is the deadline for you to mail or e‑file your 1040 to the IRS.

We should say thanks on Tax Day, but not to the federal politicians who impose $1.6 trillion of income taxes on us and spend that treasure on low-value, damaging, and pork-barrel programs.

Rather, we should thank the entrepreneurs and other high earners who work hard, create jobs, invent new industries, and make a lot of money doing so. Those folks bear most of the costs of all that federal spending.

The harder you work and more value you add, the more the government wallops you under the income tax. The more benefits you generate for society through the marketplace, the larger the share of your earnings the government confiscates.

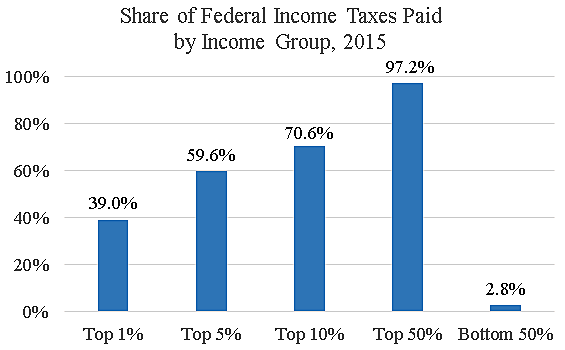

The chart shows that the top-earning 1 percent of households paid 39 percent of all individual income taxes in 2015, while the top 10 percent paid 71 percent. The data is here. Those shares have risen over time, and the new tax law exacerbates the upward skew in burdens.

The data for 2015 also show that average federal income taxes paid as a share of income for the top 1 percent of households was 27 percent, while the average for the other 99 percent of households was 11 percent.

Some people call this “progressive,” but to me it is unproductive and discriminatory. It also weakens political responsibility when the costs of government are borne so narrowly.

So on Tax Day, we should ponder the huge cost of government, while also considering whether it is healthy for democracy when such a small group carries most of the load.