Prior to 2008, the Fed could accelerate or decelerate inflation by expanding or contracting the monetary base and therefore bank reserves with open market operations and/or with repo loans to dealers. Since 2008, however, the Fed has paid interest on excess reserves equal to or even higher than the effective federal funds rate. As a result, the banks are awash with excess reserves that have zero opportunity cost, and the Fed has lost its primary mode of control over the price level and inflation.

Pre-2008

Until 2008, bank reserves earned zero interest. Banks normally held only a tiny inventory of excess reserves to meet withdrawals and adverse clearings, typically well under 0.5% of checkable deposits. The federal funds market efficiently allowed banks with surplus reserves and no immediate borrowing partner to lend them to banks that were short on reserves or were able to expand loans. The fed funds rate that banks charge one another for one-day use of reserves was typically well below the average rate banks got on somewhat risky customer loans that required close supervision, but represented the risk-adjusted opportunity cost to banks of marginal excess reserves.

Under this regime, if the Fed expanded the base and therefore excess reserves, banks would scramble to lend out any excess reserves beyond this small inventory to businesses or consumers who wanted the loans to make purchases they could not otherwise make, thereby driving up prices and at the same time temporarily driving down the fed funds rate.

Similarly, it could decelerate inflation by contracting the base, leaving banks with either precariously small excess reserves or an outright reserve shortfall. As banks contracted loans and thereby deposits to restore their reserves, businesses and consumers would spend less. At the same time, banks would temporarily bid the fed funds rate up.

IOER since 2008

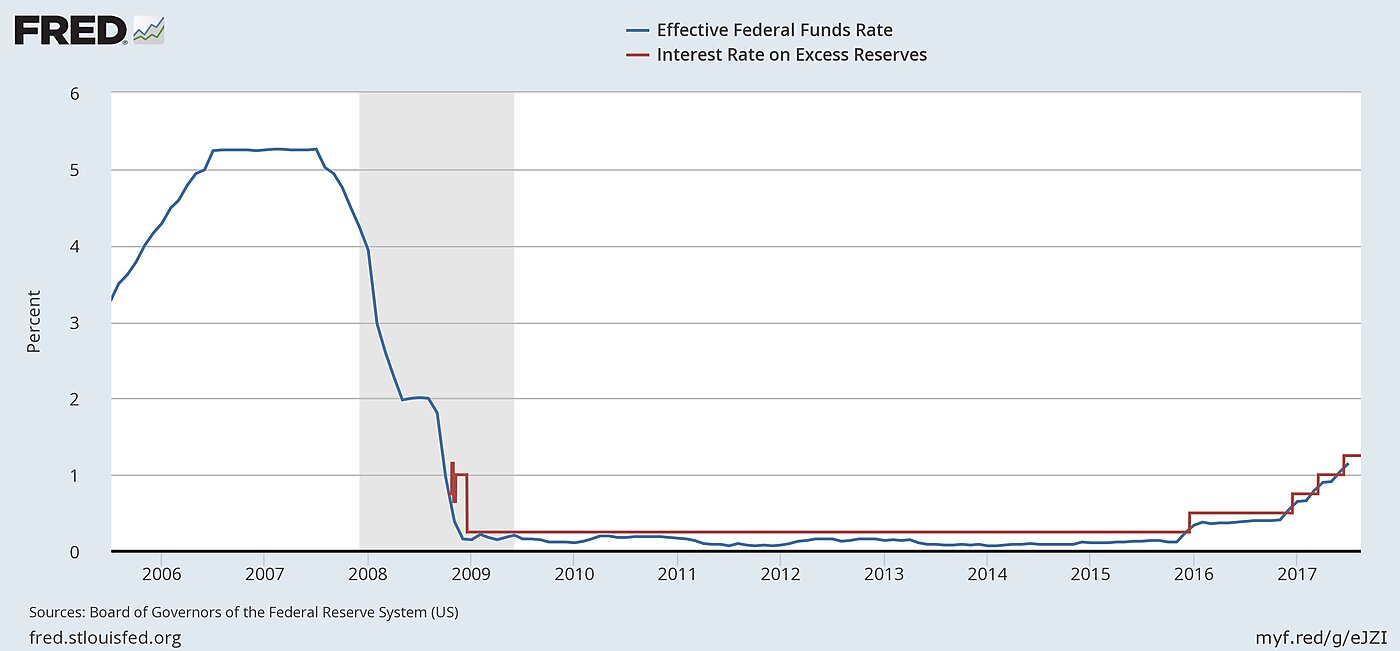

Since October of 2008, however, the Fed has paid interest on excess reserves (IOER) at or slightly above the fed funds rate, as shown in the figure 1 below:

Figure 1: Effective Fed Funds Rate and IOER

Since 2008, the Fed has more than quadrupled the monetary base though its QE I-III acquisitions of mortgage-backed securities and Treasury securities. These acquisitions were financed mostly through the creation of new excess reserve balances, shown in figure 2 below. Thanks to IOER, however, banks have been in no rush to lend these funds out, and instead are content to just sit on them. The Fed in effect is acting as a huge financial intermediary, borrowing reserve deposits from the banks at interest and lending them back to homeowners as mortgages or to the Treasury by investing in the National Debt.

Figure 2: Excess Reserve Explosion

This intermediation activity on the part of the Fed is not without adverse consequences, but has not in itself been inflationary, since IOER ensures that it is being financed with deposits that are savings instruments at the margin, rather than money per se.

When banks are awash with interest-bearing excess reserves, as they have been since 2008, there is little if any need for a fed funds market, since banks can earn interest simply by depositing surplus reserves with the Fed, and can obtain funds simply by withdrawing these deposits. To the extent there is a fed funds market, the fed funds rate should be essentially equal to the IOER rate. Indeed, the fed funds market has shrunk from over $300 billion in 2007 to barely $50 or $60 billion in recent years.

From late 2008 through November 2015, the IOER rate was only 0.25% and the fed funds rate itself was a little under 0.2%, neither of which is much different than zero -- recall that the FOMC typically moves its fed funds target in multiples of 0.25%, which is therefore its estimate of the smallest perceptible increment to the rate. However, the Fed’s IOER policy in fact made a difference for banks’ willingness to hold reserves, since they could be confident that when market rates rose, IOER would rise with them, so that there never would be an opportunity cost to holding excess reserves. Since late 2015, the IOER and fed funds rate have indeed risen together, to about 1.25% and 1.15% by July of 2017.

Although interest-bearing reserve deposits are themselves not particularly inflationary, the consumer deposits they support are free to drain off as currency. Currency in circulation, which does not pay interest, has almost doubled since 2007, while nominal GDP has only grown by 33.3%. Ultimately the price level must equate the supply and demand for all components of the money supply, including currency. Artificially low interest rates may have temporarily increased the demand for currency, but this situation cannot be expected to continue indefinitely.

Unwinding IOER

Unfortunately, abruptly restoring IOER to zero would potentially be very inflationary, given the Fed’s bloated balance sheet, since it would be equivalent to suddenly quadrupling the base under the pre-2008 regime.

I have no easy solution to this predicament, but recommend that the Fed immediately begin reversing its QE I-III acquisitions until the Base is approximately back to its 2007 level, adjusted for nominal GDP growth to approximately $1130 billion. Treasuries have a very liquid market and can be sold as quickly as the Fed acquired them. Mortgage-backed securities are much less liquid, but at a minimum the Fed should immediately begin allowing them to run down to zero by not reinvesting any interest or return of principal it gets from its mortgage portfolio. As it does this, it can temporarily hold IOER at its present level, thereby gradually creating an opportunity cost to excess reserves as the fed funds rate lifts off above IOER. Then, when it has restored control of the situation, it can lower IOER to zero.

Interest on Required Reserves (IORR)

Interest on Required Reserves, or IORR, is an entirely different matter than IOER. Before 2008, when IORR was zero along with IOER, reserve requirements acted as a modest excise tax on transactions deposits, and therefore gave banks a strong incentive to game them through the introduction of NOW Accounts, Money Market Deposit Accounts, Retail Sweep Accounts, etc. These “near money” de facto transactions accounts have left the concept of M1 narrow money hopelessly muddled.

However, there is no particular reason to have a special excise tax on transactions deposits, aside from the FDIC’s user fee for deposit insurance, since banks already pay income taxes on the income generated by their deposit-creation activities. I would therefore recommend retaining IORR, setting it at say the average of the fed funds rate over the previous two weeks, or slightly lower.

One beneficial but little-noticed provision of Dodd-Frank is that it rolled back the anti-competitive 1932 prohibition of interest on Demand Deposits. Retaining IORR would therefore permit the consolidation of NOW accounts, Money Market Deposit Accounts, and therefore Sweep Accounts into a single interest-bearing Demand Deposit category, thereby greatly simplifying monetary statistics.

__________________

More from Alt-M on Interest on Reserves: