Regular readers of Alt‑M don’t need to be told that yours truly is no fan of the Fed’s gigantic credit footprint. Even before the recent crisis, he lamented both the extent to which the Fed went from merely regulating this nation’s short-term money market to being its short-term money market, and the switch to an abundant reserve or “floor” operating system that made a bigger Fed footprint inevitable.

By the time the Great Recession ended, the Fed’s balance sheet was more than four times as large as it was in mid-2008. And now, thanks to the COVID-19 crisis, it has doubled in size yet again, to just shy of $7.6 trillion.

And Ron Paul is partly responsible for it.

What? Ron Paul, the retired Texas Congressman who was throughout his long career a constant thorn in the Fed’s side? The man who, far from wanting to see the Fed get bigger, led a famous campaign to end it? Yes, that Ron Paul, believe it or not. As paradoxical as it may sound, were it not for one of Paul’s earliest attempts to limit the Fed’s money-creating powers, it might be as much as $1.3 trillion smaller, as of this writing, than it is in fact.

The TGA Balance

Assuming they aren’t already heading my way with a barrel of hot tar and a bag of feathers, Ron Paul’s many admirers will no doubt demand an explanation for what will seem to them a preposterous charge. And an explanation they shall get. They may perhaps find it easier to swallow if they bear in mind something most of them already know, to wit: that even small changes in legislation can have serious, unintended consequences.

But before I take up the story of that small change, and Congressman Paul’s role in it, I must explain how the United States Treasury has contributed to recent growth in the Fed’s balance sheet, to the tune of as much as $1.8 trillion.

Like banks and unlike most of us (so far), the United States Treasury has an account at the Fed, called the “Treasury General Account” (TGA), where it deposits proceeds from taxes and bond sales, and upon which it draws to make government payments, including relief payments. Ordinarily, funds coming into the account roughly suffice to cover disbursements. But during emergencies, like wars, the government may have to pay out funds faster than it can raise them.

To prepare for such occasions, the Treasury can build-up a TGA balance, the size of which will depend on what it judges to be the scale of potential emergency expenditures. After the outbreak of the COVID-19 crisis, and all the uncertainties surrounding it, the Treasury thought it prudent to establish a war chest that at one point amounted to almost $1.8 trillion—a record amount. Because it never had to use most of those funds (by the time the government started doling-out relief funds, revenues from its bond sales were sufficient to cover these payments), the balance never fell much below $1.5 trillion. Today, after newly-appointed Treasury Secretary Janet Yellen decided to start reducing it, it’s still above $1.3 trillion.

It remains for me to explain the connection between the size of the TGA balance and the Fed’s overall size. That connection is actually pretty straightforward: given some overall value of the Fed’s assets and liabilities, every dollar the Treasury puts into the TGA reduces the banks’ combined reserve balances by one dollar. It follows that, whatever level of reserve balances the Fed considers necessary to keep its “abundant reserve” or floor system functioning smoothly and otherwise achieve its macroeconomic objectives, preserving that level requires a Fed balance sheet that’s X dollars bigger for every X dollars in the TGA account. So, when the Treasury stuffed $1.8 trillion into that account, the Fed had to compensate by arranging to add $1.8 trillion more to its portfolio than it might have added otherwise.

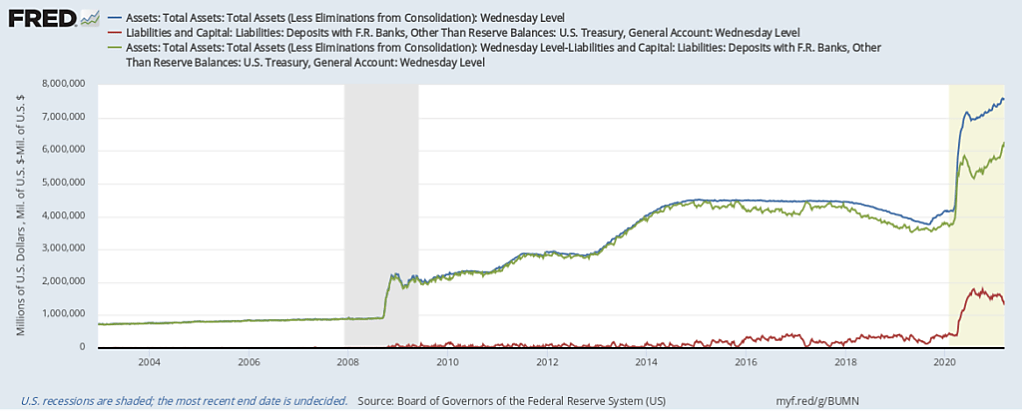

The following FRED chart shows just how much the Treasury’s action mattered. In it, the blue line shows total Fed assets, while the red line shows the TGA balance. The green line, finally, shows what Fed assets would have been, other things equal, had the TGA balance stayed at zero—an admittedly extreme case, but as we’ll see, one that might have been approximated were it not for the small change in legislation I referred to earlier.

And that’s where Ron Paul comes in.

The Fed’s Direct Purchase Authority

In this case the small change in legislation with big unintended consequences consisted of Congress’s 1979 decision to eventually terminate a former Fed privilege known as its “direct purchase” authority (or, alternatively, as the Treasury’s “direct draw” authority). For decades starting during World War II, with occasional interruptions, this authority allowed the Federal Reserve to lend directly to the Treasury, instead of limiting it to open-market security purchases, subject to certain limits and conditions.

As Kenneth Garbade explains in his excellent history of that authority, upon which I draw heavily here, in making the wartime case for it, then Fed Chairman Marriner Eccles observed that that ability would allow the Fed “to aid the Treasury in meeting emergencies which may arise during the war,” by tiding it over for “a period, such as that following the attack at Pearl Harbor.”

Ultimately Congress elected to amend the Federal Reserve Act’s section 14(b), governing its outright security purchases, by temporarily allowing it to buy securities directly from the Treasury up to a limit of $5 billion. In 1947, that power was renewed. On that occasion, Eccles argued that the Fed’s direct purchase authority had

always been used in the past and would be used in the future is simply one of meeting the temporary needs of the Treasury which, if met in other ways, would entail either needless additional costs in managing the public debt or equally needless fluctuation in the securities and money markets for brief periods.

Eccles went on to explain that the direct-purchase authority was “in effect, merely an overdraft privilege with the Reserve banks—a line of available credit for use if needed,” without which “the Treasury would feel obliged to carry much larger cash balances” (my emphasis). The House Banking Committee agreed:

By providing this line of credit the Treasury has a source to which it may turn to obtain funds in a substantial amount on little notice to meet temporary situations and contingencies. With such an emergency source of funds, it is possible for the Treasury to operate with a smaller cash balance than might otherwise be necessary.

Even so, the committee agreed to extend the Fed’s direct purchase authority only until July 1950, when it would consider renewing it again. In fact, the authority, though never made permanent, was routinely reinstated or renewed until 1981, when it was allowed to expire.

One Last Time

In the spring of 1979, the Fed’s direct purchase authority came up for what was to be its final renewal. During hearings that March concerning a proposed renewal bill, the Fed and Treasury both supported renewal, as they’d always done since the war. So did most members of the House Banking Committee’s Subcommittee on Domestic Monetary Policy, including Parren Mitchell, the subcommittee’s chair. But a few voiced doubts.

One reason they did was that, since August 1975, the Treasury could raise funds in as little as two days, albeit at a relatively high interest cost, by issuing “short-term cash management bills.” Another was that new arrangements made it economical for the Treasury to park funds in “Treasury Tax & Loan” (TT&L) accounts at commercial banks, rather than in the TGA, thereby allowing it to keep a large cash balance without complicating the Fed’s monetary policy operations. Fed and Treasury officials replied that this arrangement offered neither the speed nor the flexibility needed to deal with emergencies, including ones that might disrupt credit markets, that the Fed’s direct purchase authority provided. Paul Taylor, the Treasury’s Fiscal Assistant Secretary, testified that

Despite the quick cash-raising techniques developed by Treasury and the related lack of usage of the authority in the past few years, we are still convinced that we need the Fed borrowing authority, which provides for almost instantaneous or “same day” availability of funds in the case of extreme financial emergencies.

Fed Governor Charles Partee in turn testified that

If a market were disrupted, it might be very difficult to consummate the transaction. If the market were already disrupted because there had been an earthquake because the San Andreas Fault had broken up and down California, or if war had been declared, or if some major event of that kind had occurred, you might find the market would not be functioning very well. If the Treasury needed money at that time, they couldn’t get it whereas they could get it by this emergency if they could borrow for a day or 2 from the Federal Reserve.

Circumventing the Debt Ceiling

Such arguments were all well and good. But they didn’t address a third concern that became salient just after the hearing just referred to—one that Congress’s deficit hawks found especially troubling. This was that the Treasury had for a second time taken advantage of the Fed’s direct purchase authority to borrow from it, not to deal with a war or other emergency, but as a way to keep on paying its bills despite an impending reduction in the debt ceiling.

As The New York Times explained on March 31, 1979, a temporary debt ceiling of $798 billion was scheduled to revert, after midnight, to what had been its “permanent” level of just $400 billion. As part of its effort to avoid breaching the ceiling before Congress could raise the ceiling again, the Treasury took advantage of the Fed’s direct purchase authority to borrow $3 billion from the Fed. To do so, it

first redeemed $3 billion of securities from the Exchange Stabilization Fund, which is utilized to buy foreign currencies to bolster the dollar. This lowered the national debt by that amount, enabling the Treasury to arrange a loan from the Federal Reserve. Such loans are included under the $798 billion ceiling.

One of the hawks who severely disapproved of this maneuver was Ron Paul, who served on the House Banking Committee. Dissenting from the majority opinion on the latest proposed renewal bill, H.R. 3404, Paul observed that there was no longer any “war emergency” to justify the continuation of the Fed’s direct purchase authority.

In recent years…the Treasury has been using the authority, not to finance a war, but to make end runs around Congress and the law. The last time the authority was used, March 31, 1979, it was for the purpose of circumventing the expiration of the debt limit, which happened to occur on March 31, 1979. The time immediately before that…also happened to be the date the temporary debt limit expired. Starting as a war power, the authority has become a device that is used by the Treasury to ignore Congress and the law.

Paul went on to suggest that, especially following the establishment of interest-bearing TT&L accounts, there was no reason why the Treasury couldn’t “keep greater amounts of cash on hand, and thus eliminate any necessity for the draw [Fed direct purchase] authority.”

Despite Paul’s objections, the Committee voted 34 to 2 in favor of H.R. 3404, Paul’s being one of the dissenting votes; and the measure Paul considered “ill advised and unwise” became law on June 8, 1979. But while he may have lost the battle, Paul won the war, for although H.R. 3404 extended the Fed’s direct purchase authority for another two years, it also provided that, once those two years were up, the authority would lapse once and for all, and the Fed would only be allowed to buy Treasury securities in the open market. Nor have there been any attempts to revive it. And that’s one reason why it is so fat today.

Not Paul’s Fault

But lest anyone should conclude that Ron Paul is the best thing that ever happened to the Fed, or that I really think we should blame him for his inadvertent contribution to the Fed’s gigantic credit footprint, I’d better set the record straight: the arguments Paul made back in 1979 were not irresponsible at the time. The Treasury really could have stocked-up on TT&L balances then with little cost, just as it stocks up on TGA balances now; and I’ve argued that Congress should take steps that would allow it to do the same today. What Paul couldn’t have anticipated was the Fed’s October 2008 decision to begin paying interest on bank reserves. That decision once again made it profitable for the Treasury to favor TGA balances over TT&L balances. So while the Treasury did indeed make up for losing access to direct Fed funding, as Paul expected it to do, it did so by adding not to its TT&L but to its TGA balance. Besides being paved with good intentions, the road to unfortunate unintended consequences can have all sorts of surprise turns.

But hindsight is 20/20; and in retrospect it seems pretty clear that we’d all—critics of a fat Fed included—be better off today if, instead of being abolished, the Fed’s direct purchase authority, or something like it, were still in place.

As for the Fed’s past abuse of that authority, H.R. 3404 itself included a provision that would probably have sufficed to prevent or at least significantly limit it. The provision will sound familiar to anyone familiar with the Fed’s 13(3) lending authority. It authorized the Fed to lend directly to the Treasury only “[i]n unusual and exigent circumstances and when authorized for renewable periods not to exceed thirty days, by the Board of Governors of the Federal Reserve System pursuant to an affirmative vote of not less than five members.”