Republicans are scrambling to adjust their tax bill to satisfy concerns of lawmakers worried about budget deficits. The Joint Committee on Taxation (JCT) released a report yesterday finding that the government would lose $1 trillion over a decade in revenue even including the dynamic growth effects. Numerous economists (e.g. here and here) have criticized the JCT’s modeling for undercounting the growth benefits.

Still, the JCT’s $1 trillion figure is within the $1.5 trillion that Republicans allotted themselves for the tax bill. So it is surprising that some senators are moving the goalposts and demanding more revenue. But adding triggers or tax increases makes little sense because rising deficits in coming years will be mainly driven by rising spending, not revenue shortfalls—with or without a tax bill.

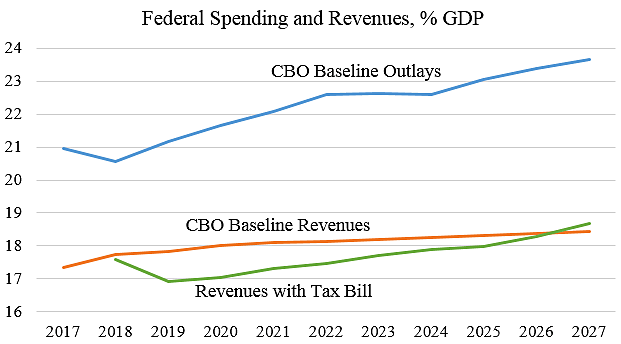

The chart below shows CBO’s baseline projections of spending and revenues as a share of gross domestic product (GDP). Revenues (red line) are set to rise from 17.7 percent of GDP this year to 18.4 percent by 2027, while outlays (blue line) will jump from 20.5 percent to 23.6 percent. Revenues creep upwards partly because of “real bracket creep” as people move into higher tax brackets. The chart clearly shows that deficits will rise because of rapid spending growth.

The green line shows revenues including the JCT’s projected effects of the Senate tax bill. Revenues fall in the short run, then rise as a result of numerous tax breaks expiring, and as the economy expands modestly per the JCT estimate. The Senate bill would add debt in the near term, but by year 10 would begin reducing deficits.

Even with the JCT’s lowballed growth estimates, projections show that spending restraint is the key to deficit reduction. Rather than adding tax increases, deficit worriers in the Senate should work to replace no-growth provisions in the tax bill, such as child credits, with pro-growth provisions, such as further rate cuts. And rather than holding up the tax bill, they should redouble their efforts in the new year to cut discretionary spending and reform entitlement programs.

Note: the green line is rough estimate as the JCT does not breakout dynamic revenue effects from its estimate of spending increases due to a rising interest rate.